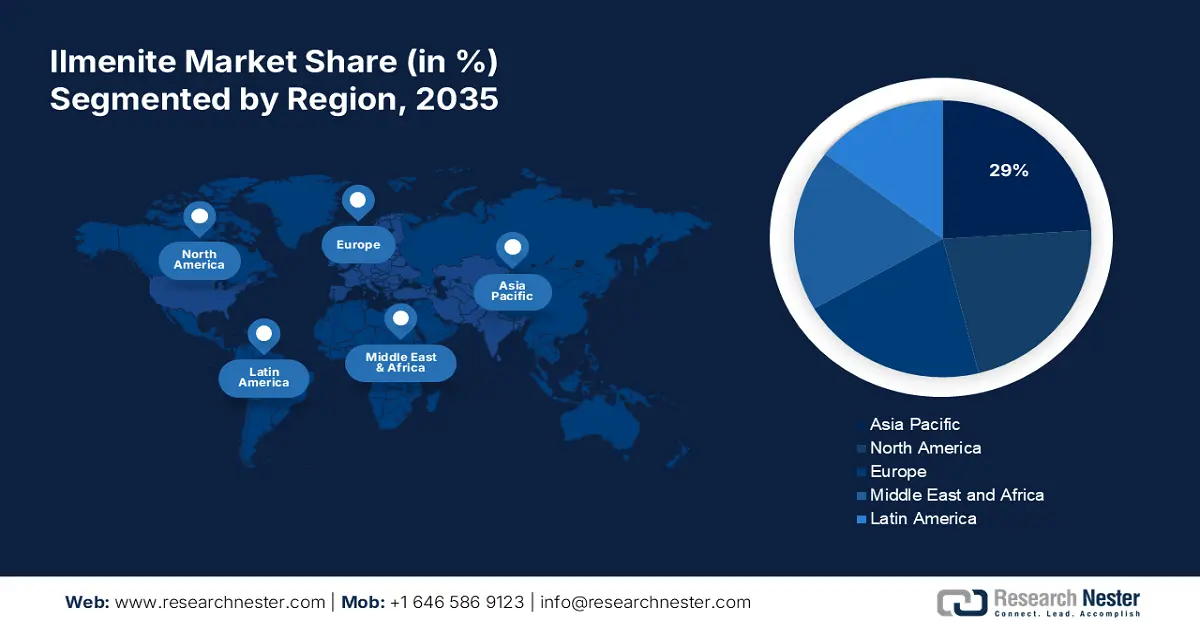

Ilmenite Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is anticipated to hold largest revenue share of 29% by 2035, due to its expanding production line of titanium. The large suppliers of ilmenite from Australia, China, and India are playing a pivotal role as the backbone of its growth. For instance, in March 2024, PYX Resources received its license to export ilmenite from the Investment and One-Integrated Services Department. This will further create a massive chain of exports to various external regions, making the Asia Pacific landscape full of opportunities for generating great revenue. The ongoing development in the infrastructure and industries has boosted the demand for titanium dioxide. This further helps the region to foster a huge domestic consumer base.

India is one of the largest exporters of ilmenite to supply the regions such as North America and Europe. Such a leading position in the ilmenite market helps the country to create new business opportunities for domestic and foreign titanium production houses. In November 2024, IREL collaborated with UKTMP JSC Kazakhstan to establish a joint venture, IREUK Titanium Limited. The new JVC will take responsibility for producing Ti slags in India, by using UKTMP JSC’s technology and IREL’s large reservoir of ilmenite.

China is one of the leading producers of TiO2 to supply its growing automotive, chemical, and construction industries. This further creates a surge for raw materials, inflating the demand in the ilmenite market. The country is now focusing on securing new channels of natural resources to offer consumers high-quality titanium products. For instance, in September 2023, Lanka Mineral Sands Limited exported 60,000 metric tons of ilmenite to China. This deal is evidence of the country’s government making efforts to build a good relationship with Sri Lanka SOE to continue such shipments.

North America Market Analysis

North America is expected to become one of the biggest consumers of the ilmenite market during the forecast period, 2026-2035. The region is equipped with technologically advanced processing plants, which ensures efficient production of titanium-based products to support its growing industries. These plants are the evidence of investment to serve both the domestic and international landscapes with high-quality titanium dioxide pigment and titanium metal. For instance, in July 2023, American Titanium Metal, LLC invested USD 867.8 million in Fayetteville to manufacture aerospace-grade titanium under Project Aero. This has further enlarged the demand for titanium ores including ilmenite.

The U.S. is creating great investment opportunities for businesses by gaining traction in its domestic ilmenite market. This is attracting the focus of foreign investors to contribute to the country’s growth in this sector. For instance, in November 2023, Appian acquired the construction-ready mineral sand asset in Virginia from Iluka Resources. The strategic investment will help the company to produce high-grade mineral sands including ilmenite, capturing the large domestic consumer base of the U.S. landscape.

Canada has the potential to create a good supply-demand chain for the ilmenite market due to the presence of raw material reservoirs such as Quebec. This is creating an opportunity for global leaders to solidify their position in this region. For instance, in January 2021, Rio Tinto inaugurated the region’s first scandium oxide plant in Quebec, Canada. The RTFT plant utilizes an innovative process of extracting high-quality scandium oxide from the waste of TiO2 production.