Ilmenite Market Outlook:

Ilmenite Market size was valued at USD 11.28 billion in 2025 and is expected to reach USD 19.27 billion by 2035, registering around 5.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ilmenite is assessed at USD 11.84 billion.

The growth of this industry is majorly driven by the increasing demand for titanium in sectors such as aerospace, defense, power generation, chemical processing, and medical devices. According to a report published by WIPO in February 2023, around 80% of global titanium production is sourced from ilmenite. This shows the utility of the mineral being one of the best natural resources in the production of such valuable products.

The demand in the ilmenite market is also increasing due to the heavy usage of titanium in creating expensive and aesthetic products such as jewelry, watches, and eyeglass frames. This further contributes to creating a new era of application for the mineral sand. This subsequently inflated the trade of titanium across the world. According to a 2022 OEC report, the global trade worth of titanium in the same year was USD 6.3 billion. The report further states that the amount is gradually increasing every year, as it grew by 41.8% during 2021-2022. Such increment is pushing companies to introduce new extraction methods and resources such as ilmenite to curate maximum output, availing sufficient supply.

Key Ilmenite Market Insights Summary:

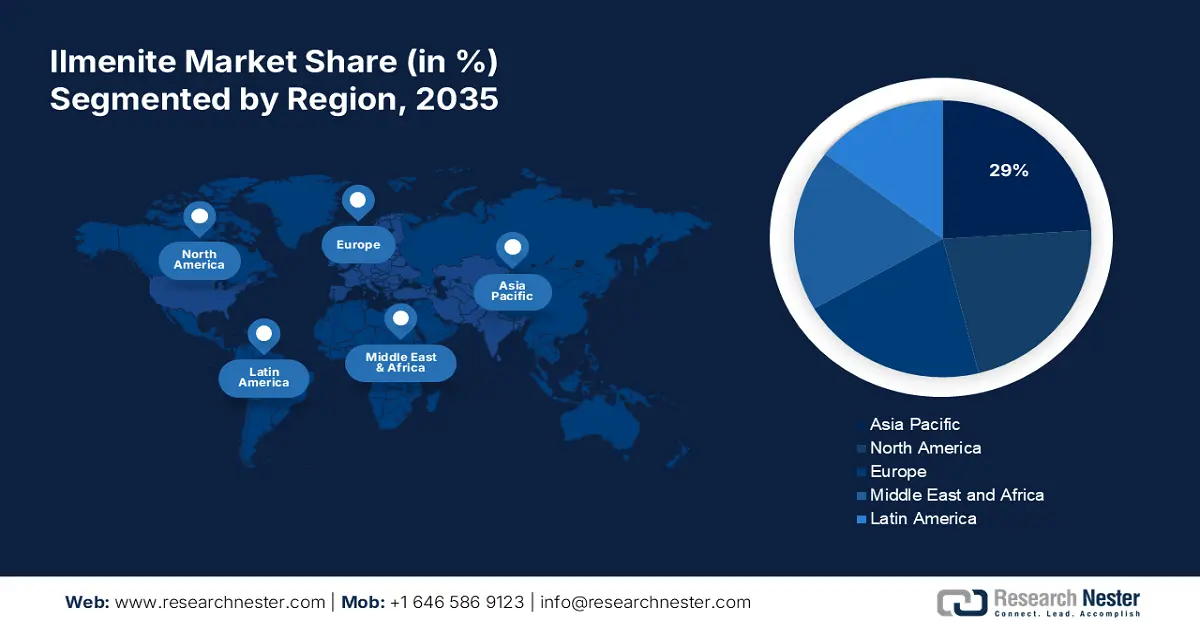

Regional Highlights:

- Asia Pacific's 29% share in the Ilmenite Market is fueled by the expanding production line of titanium and the demand for titanium dioxide in infrastructure and industries, ensuring dominance through 2035.

- North America's ilmenite market anticipates strong growth by 2035, fueled by investment in technologically advanced processing plants for efficient titanium-based product production.

Segment Insights:

- The Titanium Dioxide Production segment is projected to capture around 99.1% market share by 2035, driven by growing demand for TiO2 in emerging industries like paints, coatings, construction, and automotive.

Key Growth Trends:

- Growing industrial usage of TiO2

- Usage in clean energy generation

Major Challenges:

- Volatility in price and availability

- Restrictions due to environmental impact

- Key Players: Akzonostrum, Base Resources Limited, Bluejay Mining Plc, Cristal, Eramet, Exxaro Resources, Iluka Resources, Kenmare Resources, Rio Tinto, Sierra Rutile Limited, Toho Titanium Co., Ltd, Trimex Sands, Tronox Limited, V.V. Mineral, Yunnan Dahutong Titanium Industry Co., Ltd..

Global Ilmenite Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.28 billion

- 2026 Market Size: USD 11.84 billion

- Projected Market Size: USD 19.27 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (29% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Australia, India, United States, Canada

- Emerging Countries: China, India, Brazil, Mexico, Vietnam

Last updated on : 14 August, 2025

Ilmenite Market Growth Drivers and Challenges:

Growth Drivers

- Growing industrial usage of TiO2: The ilmenite market acts as the primary source of titanium dioxide that serves a variety of applications such as pigments for paints, coatings, plastics, and paper. The growing demand for industrial use of this element has inflated the need for heavy mineral sands including ilmenite. According to a USGS report published in January 2024, the total production of TiO2 in the U.S. was accounted to be worth USD 3 billion in 2023. The report further states that the volume of TiO2 pigment produced in the same year was estimated to be 920,000 tons. This marks evidence of the heightened demand for ilmenite.

- Usage in clean energy generation: The shifting preference for clean electricity sources including geothermal, solar, and wind power requires a massive amount of titanium to build the infrastructure. According to a report published by the World Bank in 2020, wind and geothermal will account for 64% of the total titanium demand from energy technologies. This has further inflated the surge in the ilmenite market. Features such as lightweight, high-strength, and corrosion-resistant have increased the application of titanium in EV energy storage. Thus, the requirement for reliable and sufficient titanium ore such as ilmenite has also enlarged.

Challenges

- Volatility in price and availability: Titanium is one of the most expensive metals, curated from ilmenite. This can create an economic barrier between optimum usage and affordability, impacting the growth in the ilmenite market. In addition, the price of ilmenite may fluctuate due to changes in the demand for the TiO2 pigment industry, which can limit the consumer base of this sector. Such downturns may further affect global trading and pricing strategies.

- Restrictions due to environmental impact: Mining heavy mineral sands such as ilmenite can present significant harm to the environment. This may also result in habitat destruction, water contamination, and high energy consumption. Thus, the regulatory framework built to maintain sustainability may create pressure on companies to mitigate these issues. This can create supply disruptions or additional production expenses, preventing investors from participating in the ilmenite market.

Ilmenite Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 11.28 billion |

|

Forecast Year Market Size (2035) |

USD 19.27 billion |

|

Regional Scope |

|

Ilmenite Market Segmentation:

Application (Titanium dioxide production, Titanium metal production, Welding electrodes, Others)

In terms of applications, the titanium dioxide production segment is anticipated to capture around 99.1% ilmenite market share by the end of 2035. The growing demand for TiO2 in emerging industries including paints and coatings, construction, and automotive has driven massive growth in this segment. The ongoing developments in producing high-performance TiO2 from ilmenite such as smelting and magnetic separation are propelling future innovation in this sector. According to the report published by WIPO in 2023, the number of patents registered to describe the production of Ti02 from ilmenite during 2002-2022 accounted to be 459. The report also introduced the chloride and sulfate process, providing 60% and 40% of the global TiO2 respectively.

Type (Natural Ilmenite, Synthetic Ilmenite)

Based on the type, the natural ilmenite segment is projected to capture a significant share of the ilmenite market during the forecast period. Being the foundational raw material for high-value titanium products, this segment has become one of the most preferable choices for titanium exporters. The large reservoir of mineral sands around the world has inflated the reach of this segment. Many companies are engaging in mining high-intensity natural resources of ilmenite. For instance, in September 2024, Allup Silica started the initial stages of PFS engineering design for its recently acquired McLaren Mineral Sands Project in Western Australia. The company is now planning to launch a Q4 2024 drilling program to investigate the potential of the project for expansion and 400,000tpa ilmenite production in its 20-year lifespan.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Type |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ilmenite Market Regional Analysis:

APAC Market Statistics

Asia Pacific industry is anticipated to hold largest revenue share of 29% by 2035, due to its expanding production line of titanium. The large suppliers of ilmenite from Australia, China, and India are playing a pivotal role as the backbone of its growth. For instance, in March 2024, PYX Resources received its license to export ilmenite from the Investment and One-Integrated Services Department. This will further create a massive chain of exports to various external regions, making the Asia Pacific landscape full of opportunities for generating great revenue. The ongoing development in the infrastructure and industries has boosted the demand for titanium dioxide. This further helps the region to foster a huge domestic consumer base.

India is one of the largest exporters of ilmenite to supply the regions such as North America and Europe. Such a leading position in the ilmenite market helps the country to create new business opportunities for domestic and foreign titanium production houses. In November 2024, IREL collaborated with UKTMP JSC Kazakhstan to establish a joint venture, IREUK Titanium Limited. The new JVC will take responsibility for producing Ti slags in India, by using UKTMP JSC’s technology and IREL’s large reservoir of ilmenite.

China is one of the leading producers of TiO2 to supply its growing automotive, chemical, and construction industries. This further creates a surge for raw materials, inflating the demand in the ilmenite market. The country is now focusing on securing new channels of natural resources to offer consumers high-quality titanium products. For instance, in September 2023, Lanka Mineral Sands Limited exported 60,000 metric tons of ilmenite to China. This deal is evidence of the country’s government making efforts to build a good relationship with Sri Lanka SOE to continue such shipments.

North America Market Analysis

North America is expected to become one of the biggest consumers of the ilmenite market during the forecast period, 2026-2035. The region is equipped with technologically advanced processing plants, which ensures efficient production of titanium-based products to support its growing industries. These plants are the evidence of investment to serve both the domestic and international landscapes with high-quality titanium dioxide pigment and titanium metal. For instance, in July 2023, American Titanium Metal, LLC invested USD 867.8 million in Fayetteville to manufacture aerospace-grade titanium under Project Aero. This has further enlarged the demand for titanium ores including ilmenite.

The U.S. is creating great investment opportunities for businesses by gaining traction in its domestic ilmenite market. This is attracting the focus of foreign investors to contribute to the country’s growth in this sector. For instance, in November 2023, Appian acquired the construction-ready mineral sand asset in Virginia from Iluka Resources. The strategic investment will help the company to produce high-grade mineral sands including ilmenite, capturing the large domestic consumer base of the U.S. landscape.

Canada has the potential to create a good supply-demand chain for the ilmenite market due to the presence of raw material reservoirs such as Quebec. This is creating an opportunity for global leaders to solidify their position in this region. For instance, in January 2021, Rio Tinto inaugurated the region’s first scandium oxide plant in Quebec, Canada. The RTFT plant utilizes an innovative process of extracting high-quality scandium oxide from the waste of TiO2 production.

Key Ilmenite Market Players:

- Akzonostrum

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Base Resources Limited

- Bluejay Mining Plc

- Cristal

- Eramet

- Exxaro Resources

- Iluka Resources

- Kenmare Resources

- Rio Tinto

- Sierra Rutile Limited

- Trimex Sands

- Tronox Limited

- V.V. Mineral

- Yunnan Dahutong Titanium Industry Co., Ltd.

- Energy Fuels Inc.

Heavy titanium usage in manufacturing solar panels and wind turbines has been proven to enhance the efficiency of energy generation. This has created a new genre of consumer base for the ilmenite market. This has also created a scope for global leaders to reduce their footprint and contribute to promoting the adoption of clean energy. Many companies are now focusing on decarbonizing their plants to reduce the environmental impact of production, increasing their potential for compliance. For instance, in August 2024, Wärtsilä signed an agreement with QIT Madagascar Minerals S.A (QMM) to increase Rio Tinto’s assets in microgrids. The collaboration aims to reduce the emissions and cost of production by enabling renewable energy in their ilmenite mineral sands mine in Madagascar. Such key players include:

Recent Developments

- In July 2024, Rio Tinto collaborated with Aymium to build a joint venture, Évolys Québec Inc. to introduce an alternative for anthracite, a metallurgical biocarbon product to reduce emissions. The new biocarbon will help the ilmenite smelting processes at Tinto’s metallurgical complex in Sorel-Tracy.

- In April 2024, Energy Fuels acquired Base Resources to establish its position in critical mineral production. The company aims to leverage the Toliara project in Madagascar to globalize its REE supply as a byproduct of ilmenite and zircon production at a low incremental cost.

- Report ID: 6736

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ilmenite Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.