IGA Nephropathy Treatment Market Outlook:

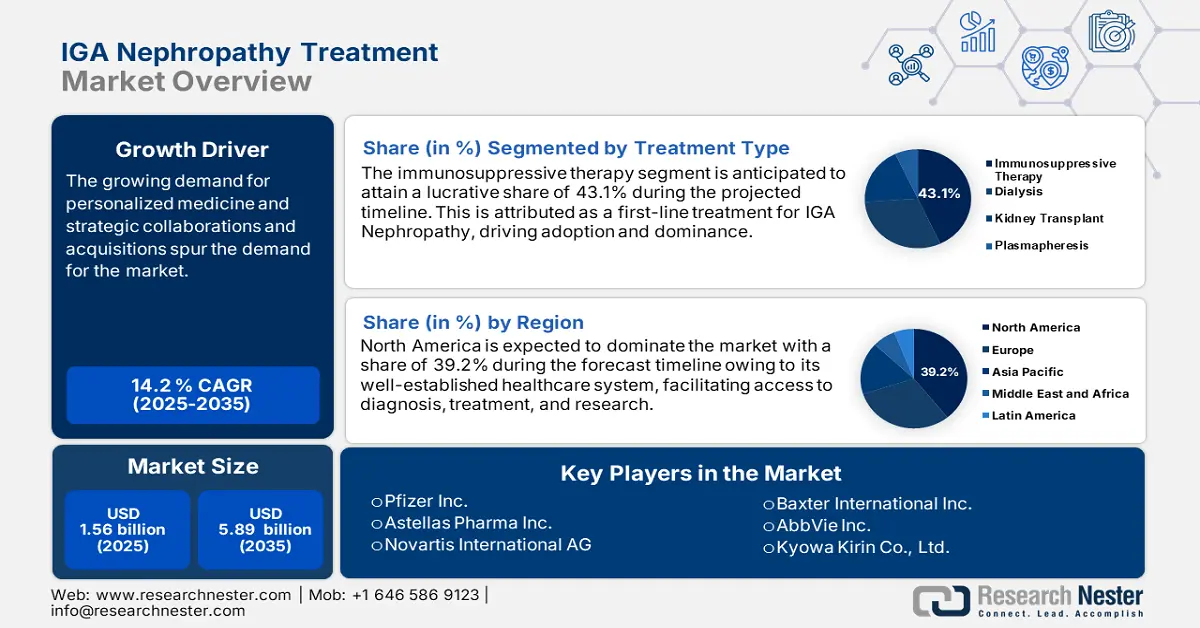

IGA Nephropathy Treatment Market size was over USD 1.56 billion in 2025 and is projected to reach USD 5.89 billion by 2035, witnessing around 14.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of IGA nephropathy treatment is evaluated at USD 1.76 billion.

The factor that is contributing to the growth in the market is the high incidence of its cases globally which raises the demand for its effective treatments. For instance, in May 2024, it was revealed that according to the estimates by the Centers for Disease Control and Prevention in 2023, chronic kidney diseases in the U.S. are common among adults aged 65 years or older (34%), compared to the age range 45–64 years (12%) and 18–44 years (6%). Amongst women, it is 14% more common than men with 12%. In addition, it is significantly more prevalent among non-Hispanic Black adults (20%) than among non-Hispanic Asian adults (14%).

Furthermore, prospects to the patients are also being given in medical research and new therapies such as biologics and targeted treatments, which are therefore resulting in growth in this market. The growth of clinical trials along with new drug approvals is contributing to this trend since improved outcomes result in better disease management. For instance, in November 2023, Boehringer Ingelheim stated that it reported positive 14-week Phase II data for its novel selective aldosterone synthase inhibitor, BI 690517. It presented a marked decrease in albuminuria, an indicator of kidney damage, by as much as 39.5%.

Moreover, individualized forms of treatment and more spending on healthcare across the globe will, in turn, drive the IGA nephropathy treatment market higher and open new doors for pharmaceutical companies and patients. For instance, in August 2020, Renalytix AI plc announced a collaboration with AstraZeneca. The first phase of the partnership applied KidneyIntelX, an artificial intelligence-enabled in vitro diagnostic platform, to investigate further enhancing the prognosis for patients suffering from CKD and its complications. These novel treatments deliver more efficacy and are less harmful thus, creates a plethora of opportunities for market expansion.

Key IGA Nephropathy Treatment Market Insights Summary:

Regional Highlights:

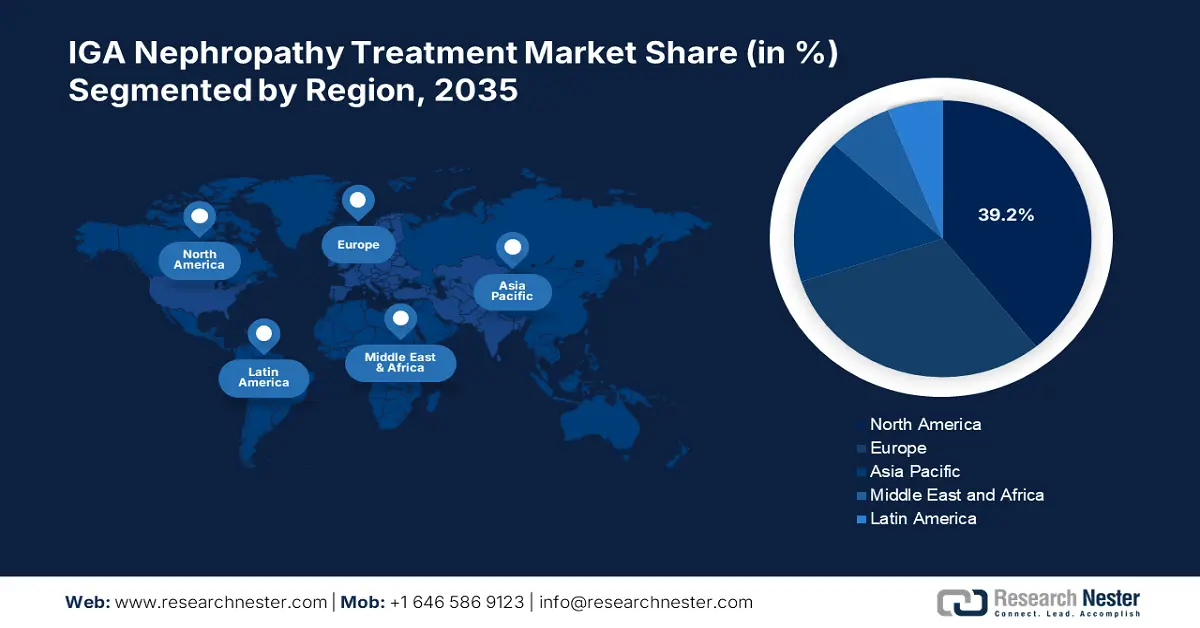

- North America commands a 39.2% share in the IGA Nephropathy Treatment Market, attributed to increased disease awareness and advanced diagnostic methods, driving significant growth by 2035.

- The Asia Pacific IGA nephropathy treatment market is anticipated to achieve lucrative growth through 2035, driven by rising incidence of immune-related kidney conditions and minimally invasive procedures.

Segment Insights:

- The Adult segment is anticipated to dominate the market share by 2035, driven by the more aggressive disease course in adults requiring efficient therapeutic modalities and sophisticated multifaceted management strategies.

- The Immunosuppressive Therapy segment of the IGA Nephropathy Treatment Market is projected to hold a 43.1% share by 2035, driven by the widespread use of corticosteroids and tacrolimus to treat moderate to severe cases and prevent kidney damage.

Key Growth Trends:

- Government and private sector investments

- Rising healthcare expenditures

Major Challenges:

- Late diagnosis or misdiagnosis

- Complexity in disease management

- Key Players: Pfizer Inc., Johnson Johnson Services, Inc., Baxter International Inc., Fresenius Medical Care AG Co. KGaA, AbbVie Inc., and more.

Global IGA Nephropathy Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.56 billion

- 2026 Market Size: USD 1.76 billion

- Projected Market Size: USD 5.89 billion by 2035

- Growth Forecasts: 14.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.2% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

IGA Nephropathy Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Government and private sector investments: A significant driver in the IGA nephropathy treatment market is the investment that comes from the government as well as from the private sector. It mainly focuses on bringing more research into biologics as well as targeted treatments at an accelerating rate. This further leads to clinical trials, advancement in regulatory support, opening the healthcare segment to under-serviced markets, and increasing access. For instance, in August 2024, Sofinnova Partners announced a USD 3.1 million seed investment in an innovative, preclinical-stage biotech company named Nephris.

- Rising healthcare expenditures: A growth driver for the IGA nephropathy treatment market is the elevating expenses towards improving healthcare infrastructure and services. For instance, in December 2024, according to the Centers for Medicare and Medicaid, U.S. healthcare spending increased 7.5% in 2023, for an estimated USD 4.9 trillion and USD 14,570 per person. As a percentage of the nation's GDP, health spending rose to 17.6%. Such initiatives promote specialty care with better patient outcomes and research into effective management strategies for diseases. Thus, improvement of health care budgets leads to greater availability and lowers the cost-effectiveness of IGA nephropathy drugs.

Challenges

- Late diagnosis or misdiagnosis: The issues that pose challenges in the IGA nephropathy treatment market are late diagnosis and misdiagnosis. It denies timely intervention, thereby resulting in poorer patient outcomes and complicating the effect of disease management appropriately. Apart from this, under-diagnosis is also because of a lack of proper awareness amongst health professionals, and because of these diagnostic issues, patients cannot get treatment in the very initial stages hampering the overall market growth.

- Complexity in disease management: The IGA nephropathy treatment market shows very challenging progress on account of complications of disease management. Thus, renal function may vary between very rapid loss and reasonably stable even for many years, and such a natural course of disease tends to test the standardized treatment. In addition to small-scale applications of effective treatments due to the potentially toxic side effects of modern drugs, patients may require exceptionally individualized specific care. Hence, healthcare providers have difficulty optimizing the outcome of the patient in clinical practice.

IGA Nephropathy Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

14.2% |

|

Base Year Market Size (2025) |

USD 1.56 billion |

|

Forecast Year Market Size (2035) |

USD 5.89 billion |

|

Regional Scope |

|

IGA Nephropathy Treatment Market Segmentation:

Treatment Type (Immunosuppressive Therapy, Plasmapheresis, Kidney Transplant, Dialysis)

The immunosuppressive therapy segment is set to capture over 43.1% IGA nephropathy treatment market share by 2035. Corticosteroids and other immunosuppressants are used mainly to treat inflammatory reactions of moderate to severe IGA nephropathy to prevent worsening of the kidney damage. For instance, in November 2020, Lupin announced the launch of tacrolimus capsules (calcineurin inhibitors immunosuppressants) in 0.5 mg, 1 mg, and 5 mg strengths. It is approved by the US FDA for its alliance partner Concord Biotech. This drug is effective with use upon transplanting a different organ onto patients to impair their organism to resist its body against its organ.

Patient Type (Adult, Pediatric)

The adult segment is anticipated to dominate the IGA nephropathy treatment market by 2035. This demographic category generally has an aggressive clinical disease course, making it necessary to have efficient therapeutic modalities. For instance, in September 2023, the U.S. FDA approved Boehringer Ingelheim, Eli Lilly, and Company's Jardiance tablets in 10mg dosage form for reducing sustained eGFR decline and the risk of developing end-stage kidney disease and cardiovascular death. Approval added to the treatment options for more than 35 million adults in the U.S. who have a chronic condition named chronic kidney disease. Adults are also primarily present with a more complex comorbidity profile that requires more sophisticated multifaceted management strategies.

Our in-depth analysis of the global IGA nephropathy treatment market includes the following segments:

|

Treatment Type |

|

|

Disease Severity |

|

|

Patient Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

IGA Nephropathy Treatment Market Regional Analysis:

North America Market Statistics

North America IGA nephropathy treatment market is anticipated to capture revenue share of over 39.2% by 2035. Early detection and prompt treatment are facilitated by the disease's increased awareness and the availability of sophisticated diagnostic methods in the region fosters market growth. Furthermore, combination therapies aim to increase treatment efficacy by overcoming resistance mechanisms. These trends demonstrate that the market is dynamic and ever-changing.

In the U.S. IGA nephropathy treatment market is expanding its footprints through strategic collaborations and mergers. For instance, in August 2023, Novartis announced that it has agreed to pay up to USD 3.5 billion to acquire U.S. biotech company Chinook Therapeutics to expand its late-stage drug development lineup. Under the terms of the agreement, shareholders of Seattle-based Chinook will receive USD 3.2 billion in cash in addition to a contingent value right worth up to USD 300 million. Thus, such agreements bolster the market growth.

Canada market is rapidly growing due to a robust and supportive regulatory framework that pushes the market growth. For instance, in October 2022, Bayer Inc. announced that Health Canada approved finerenone, under the brand name KERENDIA, as an adjuvant to standard-of-care therapy in adults with chronic kidney disease and type 2 diabetes. This approval helped reduce the risk of end-stage kidney disease and a sustained decline in estimated glomerular filtration rate, cardiovascular death, and non-fatal myocardial infarction.

Asia Pacific Market Analysis

The IGA nephropathy treatment market in Asia Pacific is gaining traction and is expected to witness lucrative growth during the forecast timeline i.e. 2025-2035. The primary growth driver is the increasing incidence of immune system-mediated, abnormalities of kidney function, environmental factors, infectious agents, and genetic predispositions. In addition, minimally invasive procedures such as laparoscopic and robotic-assisted surgery have reduced the risks and recovery time of open surgeries thus boosting the market demand.

India IGA nephropathy treatment market is growing substantially owing to the increasing government expenditures on improving healthcare services and its ecosystem. For instance, in October 2024, it was published by the Press Information Bureau, GHE, in per capita, has increased three-fold from Rs. 1,108 during 2014-15 to Rs. 3,169 during 2021-22 due to the investments in the health sector. In addition, the health spending of the government has gone up by 16.6% between 2019-20 and 2020-21. In a nutshell, health expenditure increased sharply from 2020-21 to 2021-22, by 37%.

China IGA nephropathy treatment market is growing at a steady pace attributable to its strong research and development activities and ecosystem. For instance, in January 2025, according to the findings of the Phase 3 clinical study NefIgArd amongst the China population, NEFECON prevents a 66% decline in kidney function and delays the start of dialysis or kidney transplantation by 12.8 years. Because of its unique mechanism of action and therapeutic advantages, NEFECON has been recommended extensively in China by numerous credible treatment guidelines.

Key IGA Nephropathy Treatment Market Players:

- Novartis International AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Merck Co., Inc.

- Pfizer Inc.

- Johnson Johnson Services, Inc.

- Baxter International Inc.

- Fresenius Medical Care AG Co. KGaA

- AbbVie Inc.

- Bristol-Myers Squibb Company

- HoffmannLa Roche Ltd.

To create state-of-the-art diagnostic solutions, established players in the IGA nephropathy treatment market, primarily are revolutionizing the landscape through innovations and breakthroughs. For instance, in October 2024, Purespring raised USD 105 million to advance gene therapy for kidney disease. A series B funding round advanced a phase 1/2 trial of its experimental treatment in IgA nephropathy.

Here's the list of some key players:

Recent Developments

- In August 2024, Novartis received fast-track approval from the FDA for the first and only complement inhibitor, Fabhalta (iptacopan). It is used for reducing proteinuria in primary IgA Nephropathy (IgAN).

- In November 2023, Everest Medicines announced that South Korea's Ministry of Food and Drug Safety (MFDS) accepted a new drug application to review Nefecon for adults with primary IgAN.

- Report ID: 7074

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

IGA Nephropathy Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.