Idiopathic Pulmonary Fibrosis Treatment Market Outlook:

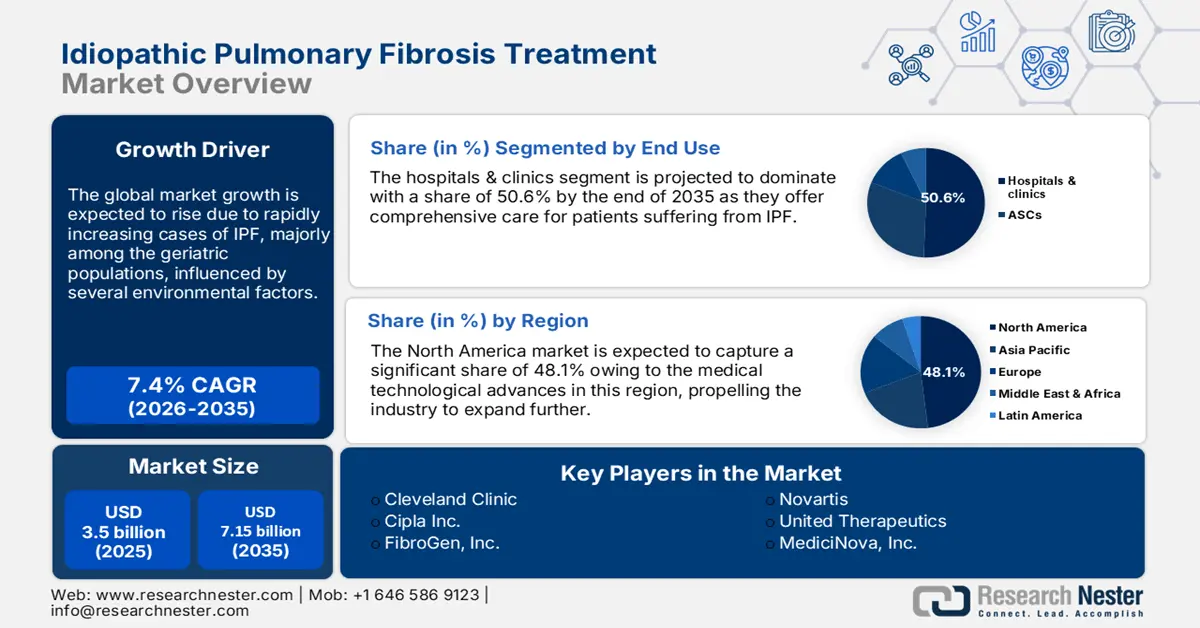

Idiopathic Pulmonary Fibrosis Treatment Market size was valued at USD 3.5 billion in 2025 and is expected to reach USD 7.15 billion by 2035, registering around 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of idiopathic pulmonary fibrosis treatment is assessed at USD 3.73 billion.

The market is expanding rapidly due to advancements in drug development, a growing prevalence of IPF, and increased awareness about the disease among healthcare providers. With ongoing research efforts focused on improving therapeutic efficacy and reducing side effects of current treatment, the IPF treatment market is expected to witness significant expansion in the upcoming years.

As per an article posted by the America Lung Association, dated October 2024, IPF is the most common type of pulmonary fibrosis, with nearly 25ooo new cases diagnosed each year. Most of the cases start showing symptoms between the ages of 50 and 70 years old. The article further states that even though the disease is more common among men, the number of IPF cases in women is on a significant rise. The development of combination therapies, integrating antifibrotic agents with immunomodulators is expected to gain traction. The shift toward personalized medicine, leveraging genetic and biomarker-based approaches to tailor treatment is a trend witnessed in the idiopathic pulmonary fibrosis treatment market.

Key Idiopathic Pulmonary Fibrosis Treatment Market Insights Summary:

Regional Highlights:

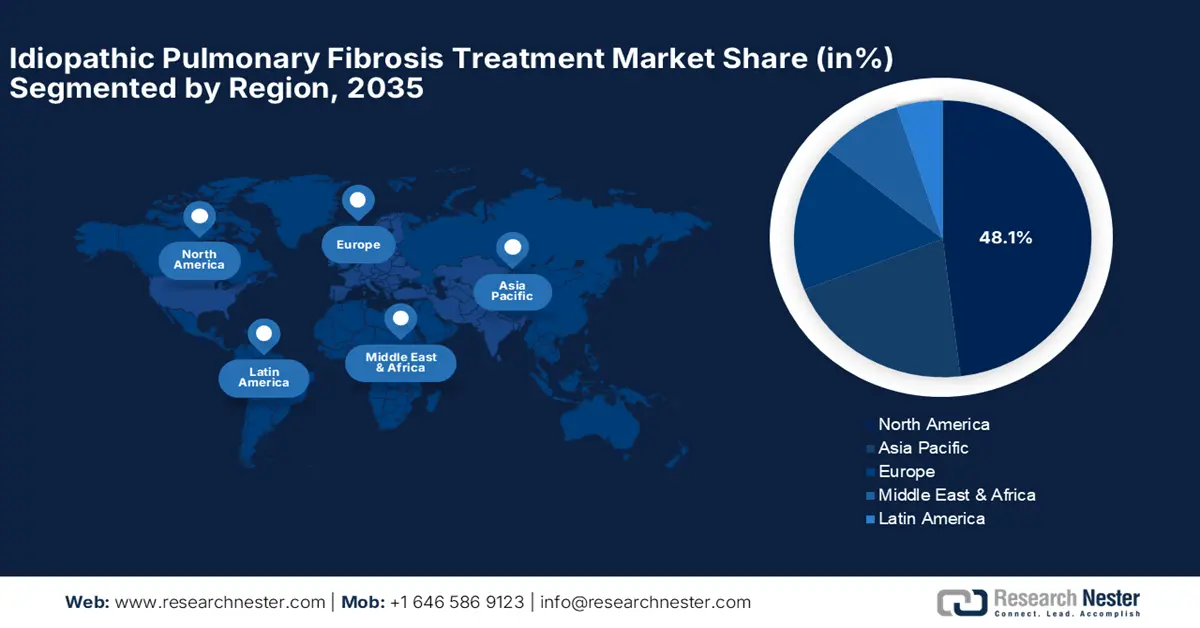

- North America dominates the Idiopathic Pulmonary Fibrosis Treatment Market with a 48.1% share, driven by advanced healthcare infrastructure and significant R&D investments, ensuring robust growth through 2026–2035.

Segment Insights:

- The Oral segment is anticipated to hold a significant share by 2035, propelled by its convenience and better adherence for chronic care.

- The Hospitals and Clinics segment of the Idiopathic Pulmonary Fibrosis Treatment Market is forecasted to achieve over 50.6% share by 2035, driven by their capability in managing complex IPF therapies.

Key Growth Trends:

- Increasing focus on R&D in novel therapeutic options

- Strategic partnerships driving market expansion

Major Challenges:

- High treatment cost

- Setbacks in clinical trial findings

- Key Players: Cipla Inc., FibroGen, Inc., Galapagos NV, Liminal BioSciences Inc..

Global Idiopathic Pulmonary Fibrosis Treatment Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.5 billion

- 2026 Market Size: USD 3.73 billion

- Projected Market Size: USD 7.15 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (48.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, Singapore

Last updated on : 14 August, 2025

Idiopathic Pulmonary Fibrosis Treatment Market Growth Drivers and Challenges:

Growth Drivers

- Increasing focus on R&D in novel therapeutic options: Companies in the idiopathic pulmonary fibrosis treatment market are investing significantly in developing innovative drugs, including antifibrotic therapies and biologics, to address the complexities. This commitment to R&D is further fueled by government funding, allowing more targeted and effective treatment options. The rise in clinical trials exploring new drug candidates and combinations is also indicative of positive outcomes as firms aim to expand their treatment portfolios. For instance, as per a report by NLM, published in March 2022, a clinical trial was conducted based on Inhaled pirfenidone solution (AP01) for IPF, showcasing progress in the field.

- Strategic partnerships driving market expansion: Distribution rights agreements among key companies are a notable growth driver in the IPF treatment market. These partnerships allow firms to share resources and navigate complex markets more efficiently. For instance, in May 2024, Ferrer announced the expansion of its existing distribution agreement with United Therapeutics Corporation, to reinforce its focus on pulmonary vascular and interstitial lung diseases. The two companies have signed an agreement for the distribution rights for two new potential indications of the molecule, IPF and PPF.

Challenges

-

High treatment cost: The high cost associated with existing IPF therapies can be prohibitively high, limiting access for patients, especially in regions with less robust healthcare infrastructure. Current antifibrotic therapies such as nintedanib and pirfenidone can exceed thousands of dollars per month, placing a heavy financial burden on patients and healthcare systems alike. This, thus creates a further challenge for the companies participating in the idiopathic pulmonary fibrosis treatment market growth.

-

Setbacks in clinical trial findings: These have significantly impacted the development of IPF therapies, disappointing stakeholders, including researchers and patients seeking new treatment options. The unpredictability of clinical outcomes complicates the landscape of drug developers further. In June 2023, FibroGen, Inc. announced topline outcomes from its Phase 3 ZEPHYRUS-1 trial evaluating the safety and efficacy of pamrevlumab in patients with IPF. The treatment revealed serious adverse effects in 28.2% of patients in the group. Hence, the Phase 3 clinical trial was discontinued immediately.

Idiopathic Pulmonary Fibrosis Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 3.5 billion |

|

Forecast Year Market Size (2035) |

USD 7.15 billion |

|

Regional Scope |

|

Idiopathic Pulmonary Fibrosis Treatment Market Segmentation:

Route of Administration (Oral, Parenteral)

Based on the route of administration, the oral segment is projected to register a significant share in the idiopathic pulmonary fibrosis treatment market during the forecast period. This is due to its convenience, ease of use, and patient preference. Oral medications are widely used as they allow patients to manage their condition with less frequent hospital visits compared to injectable options. Additionally, oral therapies support better adherence, which is crucial in managing a chronic condition like IPF, where long-term treatment is necessary to slow disease progression. In October 2023, Bristol Mayers Squibb received U.S. FDA approval for a potential first-in-class, oral medication for people living with IPF and PPF.

End use (Hospitals and Clinics, Ambulatory Surgical Centers (ASCs), Homecare Settings)

Based on end use, hospitals and clinics segment is set to capture IPF treatment market share of over 50.6% by 2035. Hospitals play a critical part in supervising acute exacerbations of IPF and offer intensive care throughout disease progression. Meanwhile, specialty clinics offer personalized care approaches, including advanced treatments such as antifibrotic drugs and several emerging gene therapies. These healthcare facilities have the necessary resources and trained medical staff to administer complex therapies and ensure patients receive optimal care.

Our in-depth analysis of the global market includes the following segments:

|

Treatment Type |

|

|

Route of Administration |

|

|

Age Group |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Idiopathic Pulmonary Fibrosis Treatment Market Regional Analysis:

North America Market Analysis

North America industry is expected to account for largest revenue share of 48.1% by 2035. It is majorly driven by the advanced top-quality healthcare infrastructure and significant R&D investments. The region benefits from robust government support, encouraging the development and commercialization of new IPF treatments. Collaborations between research institutions and pharmaceutical companies are expected to further bolster the market growth.

The U.S. market is expanding vastly with a high demand for advanced IPF therapies due to the relatively high prevalence of disease. The FDA’s Orphan Drug Act also encourages pharmaceutical companies to invest in IPF treatments by offering incentives for developing rare disease therapies. In May 2022, Sandoz announced the US launch of its generic pirfenidone to treat patients with IPF in the country.

Canada IPF treatment market is growing steadily majorly due to improved diagnostic capabilities. However, access to advanced therapies can be limited by cost barriers, the country’s healthcare system sometimes restricts coverage for high-cost treatments. Patient advocacy groups are advocating for more inclusive coverage and encouraging participation in clinical trials to improve the availability of IPF treatments in Canada.

APAC Market Statistics

The idiopathic pulmonary fibrosis treatment market in the APAC is expected to witness substantial growth, driven by rising respiratory disease prevalence, improving healthcare infrastructure, and increasing IPF awareness. Government support for rare disease research and expanding healthcare spending also contribute to this market’s potential. Companies are focusing on R&D in this region to cater to the growing demand for effective IPF therapies.

India market for idiopathic pulmonary fibrosis treatment is still emerging, with growth fueled by increasing awareness and better diagnostic capabilities. However, limited access to advanced therapies remains a challenge, and treatment often involves general antifibrotic and symptomatic management rather than targeted IPF-specific drugs. The local government’s further push for rare disease funding may foster further research, potentially improving the accessibility of IPF treatments in the country.

China represents a growing segment in the idiopathic pulmonary fibrosis treatment market with significant potential due to its large population and increasing incidence of respiratory diseases. The country’s healthcare reforms are focused on increasing access to innovative treatments. The China government and pharmaceutical companies are increasingly investing in clinical research and international collaborations to enhance IPF drug availability.

Key Idiopathic Pulmonary Fibrosis Treatment Market Players:

- Boehringer Ingelheim International GmbH

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Bumrungrad International Hospital

- Cedars-Sinai

- Cleveland Clinic

- Bristol-Myers Squibb Company

- Cipla Inc.

- FibroGen, Inc.

- Galapagos NV

- Liminal BioSciences Inc.

- MediciNova, Inc.

- Novartis AG

- United Therapeutics

The companies participating in the idiopathic pulmonary fibrosis treatment market are expanding through R&D investments in new therapies, partnerships to accelerate drug discovery, and acquisitions to enhance their treatment portfolios. Many firms are also focusing on geographic expansion, particularly in emerging markets, to increase accessibility. Regulatory engagement, such as securing orphan drug status, is a key strategy to streamline approvals, while digital patient tools for patient monitoring are becoming integral to improving treatment adherence and personalized care. In September 2024, Boehringer Ingelheim released a statement that its study of nerandomilast, FIBRONEER-IPF, effectively met its primary endpoint, encouraging plans for a new drug request for IPF treatment.

Recent Developments

- In August 2024, Reviva Pharmaceuticals Holdings, Inc. announced that the U.S. Patent and Trademark Office (USPTO) has granted U.S. Patent 12053477 covering the use of brilaroxazine for the treatment of IPF.

- In December 2023, Boehringer Ingelheim launched Nintedanib, an antifibrotic medication for the treatment of IPF, in Algeria. Additionally, it is the only IPF treatment approved by the Ministry of Health of Algeria.

- Report ID: 6636

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Idiopathic Pulmonary Fibrosis Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.