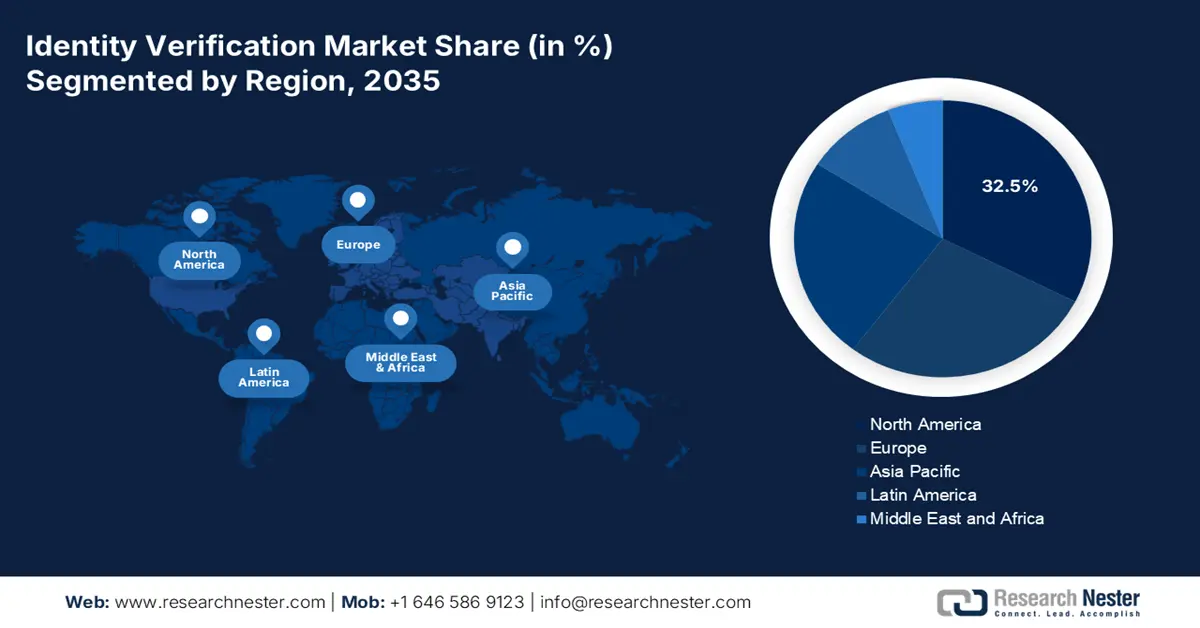

Identity Verification Market - Regional Analysis

North America Market Insights

North America dominates the market and is expected to hold a 32.5% revenue share by 2035. The market is driven by robust regulatory enforcement, high digital service adoption, and significant investment in cybersecurity. The U.S. Financial Crimes Enforcement Network mandates robust Customer Due Diligence rules compelling financial sector adoption. The digitalization of public services, exemplified by platforms such as Login.gov, expands the demand. The region is defined by the rapid integration of AI and biometric technologies to counter advanced fraud, such as synthetic identity theft, cited by the U.S. Federal Reserve. High cybersecurity spending, with the Cybersecurity and Infrastructure Security Agency (CISA) budget consistently increasing, directly funds identity-centric security frameworks, such as zero-trust architecture.

The U.S. identity verification market is defined by the regulatory-driven consolidation of standards and a strategic federal pivot to password less, phishing-resistant authentication. According to the Bureau of Justice Statistics in October 2023, nearly 23.9 million people in the U.S. who are aged above 16 have experienced identity theft. Further in 2021, people experiencing identity theft were 1 in 5-person demanding for a strong market. On the other hand, the scale of the digital public services creates a massive standardized verification ecosystem, while the public-private fraud intelligence sharing coordinated by the U.S. Treasury intensifies the demand for the real time interoperable solutions to combat threats such as synthetic identity fraud that the Federal Reserve notes is a top financial crime.

Identity Theft Victimization Outcomes

|

Metric |

Statistic |

Details |

|

Time to Resolve Financial/Credit Issues |

56% spent 1 day or less |

Majority handled problems rapidly |

|

Reported to Law Enforcement |

7% |

Low reporting rate among victims |

|

Contacted Credit Card/Bank |

67% |

Primary action taken by victims |

|

Average Direct Financial Loss (All Victims) |

USD 880 |

Overall mean across types |

|

New Account Misuse Loss |

USD 3,430 |

Highest average losses |

|

Bank Account Misuse Loss |

USD 670 |

Moderate financial impact |

|

Credit Card Misuse Loss |

USD 620 |

Lowest among specified types |

Source: BJS October 2023

Canada’s identity verification market is shaped by the coordinated federal-provincial digital IS+D alignment and privacy-led innovation. The report from Statistics Canada in March 2025 has indicated that as the technology advances, the reported crime also rises, reflecting 48,900 cybercrime violations in 2023, including identity theft and identity fraud. The federal Digital Ambition 2022 and the significant funding to expand the sign-in Canada service aim to create a seamless, secure access gateway for federal programs, driving the demand for compatible verification solutions. This federal initiative actively seeks interoperability with the leading provincial digital ID systems, such as the BC Services Card and Ontario Digital ID, boosting the unified national landscape. This rise in cybercrime directly validates the market need for robust, government-led digital identity frameworks now being implemented to protect citizens and services.

APAC Market Insights

The Asia Pacific is the fastest-growing identity verification market and is poised to grow at a CAGR of 18.8% during the forecast period 2026 to 2035. The market growth is fueled by the three primary drivers, such as the massive government digital identity initiatives, a rapidly expanding digital finance ecosystem, and the need to combat a significant rise in advanced cyber fraud. Countries such as India, with its Aadhaar biometric ID system, have created a foundational digital infrastructure that private sector verification services can leverage for secure, low-friction onboarding. Similarly, national initiatives such as China’s real name verification laws and Japan's My Number Card system mandate robust identity checks, directly creating market demand. The regional trend is moving towards mobile first biometric centric solutions and cloud-based platforms that can serve diverse populations with varying levels of formal documentation.

China’s identity verification market is defined by the state mandated real name verification policies and integration with the national digital governance systems. A recent report from the GLEIF in February 2025 announced that the first Chinese Qualified vLEI is the China Financial Certification Authority within the verifiable legal entity identifier ecosystem. The CFCA is established by the People’s Bank of China and is an authoritative electronic certification body approved by the national information security administration. vLEI is a new form of organizational identity and addresses the urgent global need for digitized, automated authentication and verification for both organizations and individuals. The market trend involves moving beyond basic checks to AI-powered live detection to combat sophisticated fraud.

Recent Development in China

|

Company/Initiative |

Year-Month |

Key Development |

Details |

|

Zetrix |

October 2024 |

Launched Chinese Digital IDs on ZCert |

First-of-its-kind app for overseas authentication of Chinese nationals' official IDs via Xinghuo BIF blockchain, enabling seamless eKYC. |

|

Keesing Technologies |

June 2023 |

Expanded into China via Resonant Ltd. partnership |

Brought DocumentChecker and AuthentiScan solutions to Chinese law enforcement, border control, and government for e-ID verification. |

|

China (RealDID) |

July 2025 |

Expanded RealDID blockchain system to Hong Kong |

Enables mainland citizens secure, privacy-friendly access to Hong Kong digital services using blockchain-based identities. |

Source: Zetrix, Keesing Technologies, Blockchain Council

In India, the identity verification market is built upon the foundational Aadhaar biometric digital identity systems, which enables low cost, scalable electronic know your customer. Regulated by the unique identification authority of India, Aadhaar-based authentication is extensively used by banks, telecom operators, and government services for instant verification, creating a massive standardized ecosystem. The primary market driver is the push for financial inclusion and digital service delivery, with the verification solutions needing to serve a vast, diverse population often new to formal banking. The report from IBEF in April 2025 shows that the total number of Aadhaar authentications processed grew from 2,707 crore in 2024 to 2025, reflecting the immense and growing reliance on this centralized verification infrastructure.

Europe Market Insights

Europe’s identity verification market is fundamentally a regulatory-driven ecosystem with the EU’s eIDAS 2.0 regulation acting as its primary growth catalyst. This legislation mandates that all member states provide citizens and businesses with a secure interoperable digital identity wallet, creating a continent-wide standardized demand for compliant verification solutions that can interface with the government-issued credentials. The growth is concentrated in highly regulated verticals; for example, the financial services sector relies on the tools for robust Anti Money Laundering and Know Your Customer checks, while the emerging European Health Data Space will require robust patient identification to facilitate secure cross-border access to medical records.

The UK market operates within a post Brexit regulatory framework and is primarily driven by the government's digital transformation and financial services compliance. The key catalyst is the UK Digital Identity and Attributes Trust Framework established by the Department for Science, Innovation, and Technology, which sets standards for providers to enable the use of digital identities across the economy. The report from the CIFAS in December 2024 has shown that identity fraud is surging in the UK and is estimated that £1.8 billion cost of identity fraud is registered each year, and it is the major type of cases filed to the Cifas National Fraud Database by its 750 plus industry members, reaching 64% of filings in 2023 with 237,000 cases on identity fraud recorded. This data highlights the rising demand for identity verification services.

The Germany market is defined by a high trust in official documents and is being reshaped by the implementation of the EU’s eIDAS 2.0 regulation. The cornerstone of the national ecosystem is the national ID card with its online eID function, which has seen growing adoption for accessing both public and private services. In September 2025, IDnow, which is a leading identity verification platform provider, and Docusign the Intelligent Agreement Management company, announced the launch of a new joint solution enabling customers to comply with the Anti Money Laundering law in Germany via secure and automated identity verification and e-signatures that are powered by the electronic ID in the country. This partnership highlights a key market trend where private-sector platforms are rapidly integrating with and building upon the government digital identity infrastructure to offer a seamless, compliant user journey.