Global Identity Verification Market TOC

- Market Definition

- Definition

- Market Segmentation

- Assumptions and Acronyms

- Research Methodology

- Research Process

- Primary Research

- Secondary Research

- Executive Summary – Global Identity Verification Market

- Market Dynamics

- Market Drivers

- Market Trends

- Key Market Opportunities

- Major Roadblocks for the Market Growth

- Regulatory and Standards Landscape

- Industry Risk Analysis

- Impact of COVID-19 on the Identity Verification Market

- Assessment on the Demand of Identity Verification

- Competitive Landscape

- Market Share Analysis, 2020

- Competitive Benchmarking

- Company Profiles

- Experian plc

- Mastercard International Incorporated

- Equifax, Inc.

- Mitek Systems, Inc.

- LexisNexis Risk Solutions Group

- Acuant, Inc.

- Onfido, Liquid Inc.

- Intellicheck, Inc.

- IDEMIA

- Product Feature Analysis

- Competitive Positioning

- Global Identity Verification Market 2020-2030

- Market Overview

- By Value (USD Million)

- Global Identity Verification Market – Segmentation Analysis 2020-2030

- Component Type

- Solutions, 2020-2030F (USD Million)

- Document Verification, 2020-2030F (USD Million)

- Identity Authentication, 2020-2030F (USD Million)

- Digital Identity Verification, 2020-2030F (USD Million)

- AML Screening and Monitoring, 2020-2030F (USD Million)

- Business Verification, 2020-2030F (USD Million)

- Others, 2020-2030F (USD Million)

- Services, 2020-2030F (USD Million)

- Professional Services, 2020-2030F (USD Million)

- Managed Services, 2020-2030F (USD Million)

- Solutions, 2020-2030F (USD Million)

- Verification Type

- Knowledge-Based Authentication, 2020-2030F (USD Million)

- SMS-Based Two Factor Authentication, 2020-2030F (USD Million)

- IC Chip-Based Authentication, 2020-2030F (USD Million)

- Database Solutions, 2020-2030F (USD Million)

- AL/ML-Based Authentication, 2020-2030F (USD Million)

- Biometric Authentication, 2020-2030F (USD Million)

- Others, 2020-2030F (USD Million)

- Deployment Type

- Cloud, 2020-2030F (USD Million)

- On-Premise, 2020-2030F (USD Million)

- Organization Size Type

- Small & Medium Enterprises, 2020-2030F (USD Million)

- Large Enterprises, 2020-2030F (USD Million)

- End-User Industry Type

- BFSI, 2020-2030F (USD Million)

- Government & Defense, 2020-2030F (USD Million)

- Retail, 2020-2030F (USD Million)

- Healthcare, 2020-2030F (USD Million)

- IT & Telecom, 2020-2030F (USD Million)

- Entertaining & Gaming, 2020-2030F (USD Million)

- Transportation, Logistics, & Mobility, 2020-2030F (USD Million)

- Energy & Utility, 2020-2030F (USD Million)

- Hospitality, 2020-2030F (USD Million)

- Others, 2020-2030F (USD Million)

- Region

- North America, 2020-2030F (USD Million)

- Europe, 2020-2030F (USD Million)

- Asia Pacific, 2020-2030F (USD Million)

- Latin America, 2020-2030F (USD Million)

- Middle East & Africa, 2020-2030F (USD Million)

- Cross Analysis of Identity Verification End-User Industry w.r.t. Verification Type, 2020

- Component Type

- North America Identity Verification Market

- Market Overview

- Market Value (USD Million)

- Market Segmentation by:

- Component Type

- Solutions, 2020-2030F (USD Million)

- Document Verification, 2020-2030F (USD Million)

- Identity Authentication, 2020-2030F (USD Million)

- Digital Identity Verification, 2020-2030F (USD Million)

- AML Screening and Monitoring, 2020-2030F (USD Million)

- Business Verification, 2020-2030F (USD Million)

- Others, 2020-2030F (USD Million)

- Services, 2020-2030F (USD Million)

- Professional Services, 2020-2030F (USD Million)

- Managed Services, 2020-2030F (USD Million)

- Solutions, 2020-2030F (USD Million)

- Verification Type

- Knowledge-Based Authentication, 2020-2030F (USD Million)

- SMS-Based Two Factor Authentication, 2020-2030F (USD Million)

- IC Chip-Based Authentication, 2020-2030F (USD Million)

- Database Solutions, 2020-2030F (USD Million)

- AL/ML-Based Authentication, 2020-2030F (USD Million)

- Biometric Authentication, 2020-2030F (USD Million)

- Others, 2020-2030F (USD Million)

- Deployment Type

- Cloud, 2020-2030F (USD Million)

- On-Premise, 2020-2030F (USD Million)

- Organization Size Type

- Small & Medium Enterprises, 2020-2030F (USD Million)

- Large Enterprises, 2020-2030F (USD Million)

- End-User Industry Type

- BFSI, 2020-2030F (USD Million)

- Government & Defense, 2020-2030F (USD Million)

- Retail, 2020-2030F (USD Million)

- Healthcare, 2020-2030F (USD Million)

- IT & Telecom, 2020-2030F (USD Million)

- Entertaining & Gaming, 2020-2030F (USD Million)

- Transportation, Logistics, & Mobility, 2020-2030F (USD Million)

- Energy & Utility, 2020-2030F (USD Million)

- Hospitality, 2020-2030F (USD Million)

- Others, 2020-2030F (USD Million)

- Country

- United States

- Canada

- Component Type

- Europe Identity Verification Market

- Market Overview

- Market Value (USD Million)

- Market Segmentation by:

- Component Type

- Verification Type

- Deployment Type

- Organization Size Type

- End-User Industry Type

- Country

- United Kingdom

- Germany

- Italy

- France

- Spain

- Russia

- Netherlands

- Rest of Europe

- Asia Pacific Identity Verification Market

- Market Overview

- Market Value (USD Million)

- Market Segmentation by:

- Component Type

- Verification Type

- Deployment Type

- Organization Size Type

- End-User Industry Type

- Country

- China

- India

- Japan

- South Korea

- Australia

- Rest of Asia Pacific

- Latin America Identity Verification Market

- Market Overview

- Market Value (USD Million)

- Market Segmentation by:

- Component Type

- Verification Type

- Deployment Type

- Organization Size Type

- End-User Industry Type

- Country

- Brazil

- Argentina

- Mexico

- Rest of Latin America

- Middle East & Africa Identity Verification Market

- Market Overview

- Market Value (USD Million)

- Market Segmentation by:

- Component Type

- Verification Type

- Deployment Type

- Organization Size Type

- End-User Industry Type

- Country

- GCC

- Israel

- South Africa

- Rest of Middle East & Africa

- Analyst Review

Identity Verification Market Outlook:

Identity Verification Market size was valued at USD 14.7 billion in 2025 and is projected to reach USD 64.3 billion by the end of 2035, rising at a CAGR of 15.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of identity verification is evaluated at USD 17.1 billion.

The market is driven mainly by the sustained growth in identity-enabled fraud affecting financial institutions, healthcare systems, and public sector programs. According to the Federal Trade Commission March 2025, identity-related fraud accounted for nearly 1.1 million reports in 2023, representing the largest category of consumer fraud in the U.S., with the reported losses across the fraud and identity misuse combined. Business facing exposure is significant. The FBI Internet Crime Complaint Center reported that the business email compromise and identity-driven account takeover schemes generated USD 2.9 billion in losses in 2024, heavily impacting banks, insurers, payroll processors, and government contractors. These figures are driving enterprises to embed stronger identity verification controls across onboarding account access and transaction authorization workflows to meet operational risk thresholds and regulatory expectations.

From a regulatory and compliance standpoint, public institutions are directly influencing enterprise adoption. The National Institute of Standards and Technology continues to mandate higher identity levels under the NIST SP 800-63, which is referenced across federal procurement, financial services compliance, and healthcare identity programs. Additionally, the U.S. Government Accountability Office data in March 2024 reported that the identity verification gaps are a contributor to improper payments, estimating USD 236 billion in improper federal payments in 2023, with identity weaknesses cited across unemployment insurance, Medicare, and disaster relief programs. On the healthcare side, the CMS links the patient misidentification to claim errors and fraud exposure, reinforcing payer and provider demand for stronger identity controls.

Key Identity Verification Market Insights Summary:

Regional Highlights:

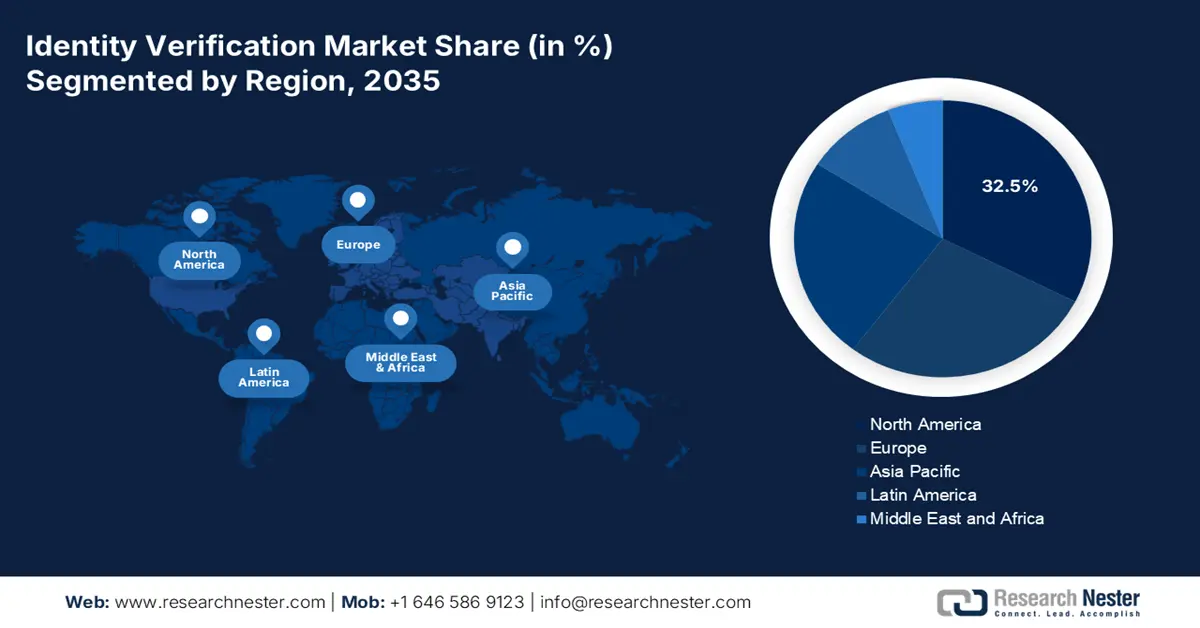

- North America is projected to command a 32.5% revenue share by 2035 in the identity verification market, underpinned by stringent regulatory enforcement and escalating cybersecurity investment.

- Asia Pacific is anticipated to expand at a CAGR of 18.8% during 2026–2035, accelerated by large-scale government digital identity programs and the rapid proliferation of digital financial ecosystems.

Segment Insights:

- Within the identity verification market, the Solutions segment is forecast to secure a dominant 72.7% share by 2035, supported by escalating demand for advanced algorithmic platforms to counter increasingly sophisticated fraud techniques.

- The Cloud deployment mode leads the segment outlook over 2026–2035, benefitting from widespread adoption driven by scalability advantages and continuous cloud modernization initiatives.

Key Growth Trends:

- Government digitalization and secure public service delivery

- Modernization of government IT and legacy system upgrades

Major Challenges:

- Stringent and evolving global regulation

- Significant R&D & initial capital investment

Key Players: Jumio, ID.me, Onfido,GBG, TransUnion, Experian, LexisNexis Risk Solutions, Daon.

Global Identity Verification Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 14.7 billion

- 2026 Market Size: USD 17.1 billion

- Projected Market Size: USD 64.3 billion by 2035

- Growth Forecasts: 15.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (32.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: South Korea, Singapore, Brazil, United Arab Emirates

Last updated on : 2 January, 2026

Identity Verification Market - Growth Drivers and Challenges

Growth Drivers

- Government digitalization and secure public service delivery: Governments worldwide are driving the demand by digitizing citizen services requiring robust remote identity proofing. The report from the GSA August 2023 indicates that the Login.gov platform has over 70 million users and is accessing federal services, mandating secure identity verification. The technology modernization fund, which funds federal IT upgrades, has allocated hundreds of millions to project modernization, citizen-facing digital services, and cybersecurity, where identity assurance is foundational. This public sector investment creates a blueprint and demand for similar B2B solutions in adjacent sectors like finance and healthcare, which must interact with government-verified identities. The shift establishes a digital identity not as a feature but as the vital public infrastructure.

- Modernization of government IT and legacy system upgrades: Direct government spending on the IT modernization is a tangible, high-value demand driver in the identity verification market. The federal initiatives, such as the Cybersecurity and Infrastructure Security Agency’s Secure Cloud Business Applications project, provide funding and frameworks for agencies to migrate to a secure cloud environment with identity and access management as a core component. The spending data reflects this. An analysis of USA Spending shows a obligations for IT software and professional IT services related to identity management saw consistent YoY growth as agencies executed the modernization plans. This public investment reduces risks and validates the technologies for private sector adoption.

- Rising government spending on fraud prevention and digital trust: Public sector budgets are directly expanding the demand for identity verification via fraud prevention programs. The data from the Committee for a Responsible Federal Budget in September 2024 has indicated that the improper payments spiked at USD 281 billion in 2021, pushing agencies to invest in identity controls across benefits, healthcare, and procurement. The programs tied to unemployment insurance, Medicare, and disaster relief have mandated stronger identity checks. Similar spending patterns are visible in Europe via national digital identity and anti-fraud initiatives aligned with public finance accountability. Further, the vendors serving the B2B clients increasingly align their offerings to government assurance requirements, enabling the downstream enterprise adoption via a regulated supply chain contractor ecosystem.

Total Reported Improper Payments Estimates

|

Year |

Total Improper Payments (USD billion) |

|

2019 |

174.8 |

|

2020 |

206.4 |

|

2021 |

281.4 |

|

2022 |

247.0 |

|

2023 |

235.8 |

Source: CRFB September 2024

Challenges

- Stringent and evolving global regulation: New participants must traverse the complicated web of laws, such as GDPR, eIDAS, and sector-specific KYC/AML norms. Compliance is costly and non-negotiable. Top players in the market, such as GBG, invest heavily in global compliance teams. For example, the eIDAS regulation in the EU creates a standardized framework, but building solutions that comply requires a significant legal overhead, a major barrier for startups without dedicated resources.

- Significant R&D & initial capital investment: Developing a competitive, accurate core engine demands a massive upfront investment in AI training, data security certifications, and global testing. Thales, a leader in biometrics, invests billions in R&D annually. Companies estimate that the spending on AI-powered fraud detection and identity verification will exceed a billion globally, highlighting the capital-intensive nature of simply keeping pace with innovation.

Identity Verification Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

15.9% |

|

Base Year Market Size (2025) |

USD 14.7 billion |

|

Forecast Year Market Size (2035) |

USD 64.3 billion |

|

Regional Scope |

|

Identity Verification Market Segmentation:

Component Segment Analysis

Within the component segment, solutions are dominating and is expected to hold the market share of 72.7% by 2035. The segment comprises the core software platform and technologies that perform the actual verification. This includes AI-powered tools for document authenticity checks, biometric analysis data validation, and risk scoring engines. The demand for these integrated solutions far outstrips that for standalone professional or managed services as businesses seek to own and automate their customer onboarding and continuous authentication processes. The growth of this segment is directly related to the advancement of fraud, as deepfakes and forged documents become more common, the market demands more advanced algorithmic solutions. The government procurement data provides a clear metric for this demand. The AI and machine learning algorithms at the heart of these solutions are becoming a critical public infrastructure, much like digital utilities, for securing the modern economy.

Deployment Mode Segment Analysis

The cloud is leading the deployment mode segment and is driven by its superior scalability, cost efficiency, and rapid deployment capabilities. It allows businesses to access advanced verification tools via API without any major upfront infrastructure investment, making it ideal for the dynamic market needs and global operations that require continuous updates to combat fraud. The key indicator of this trend is the U.S. government's adoption, for instance, of the technology modernization fund, which allocated funding for cloud migration projects, with identity and access management being the priority. The report from the Fed RAMP in September 2025 has indicated that over 350 cloud services had completed FedRAMP in 13 years reflects the pace and scale of government-approved cloud adoption, which directly affects cloud-based identity verification vendors seeking federal and public-sector contracts.

Organization Size Segment Analysis

Under the organization size segment, the large enterprises are leading and accounting to hold the largest share of the market revenue. These organizations have complex compliance requirements, extensive customer bases, and significant fraud risk that necessitate robust enterprise-grade identity verification solutions. They invest in these systems to meet the strict regulatory mandates, secure high-value transactions, and protect their brand reputation from synthetic identity fraud and data breaches. Their scale allows for dedicated cybersecurity budgets and the integration of verification into complex legacy systems. A statistical reflection on cybersecurity indicates that the foundational element for identity systems comes from the U.S. Cybersecurity and Infrastructure Security Agency. Further, identity and access management is the top investment to defend against ransomware and unauthorized access.

Our in-depth analysis of the identity verification market includes the following segments:

|

Segment |

Subsegments |

|

Component |

|

|

Type |

|

|

Deployment Mode |

|

|

Organization Size |

|

|

Vertical |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Identity Verification Market - Regional Analysis

North America Market Insights

North America dominates the market and is expected to hold a 32.5% revenue share by 2035. The market is driven by robust regulatory enforcement, high digital service adoption, and significant investment in cybersecurity. The U.S. Financial Crimes Enforcement Network mandates robust Customer Due Diligence rules compelling financial sector adoption. The digitalization of public services, exemplified by platforms such as Login.gov, expands the demand. The region is defined by the rapid integration of AI and biometric technologies to counter advanced fraud, such as synthetic identity theft, cited by the U.S. Federal Reserve. High cybersecurity spending, with the Cybersecurity and Infrastructure Security Agency (CISA) budget consistently increasing, directly funds identity-centric security frameworks, such as zero-trust architecture.

The U.S. identity verification market is defined by the regulatory-driven consolidation of standards and a strategic federal pivot to password less, phishing-resistant authentication. According to the Bureau of Justice Statistics in October 2023, nearly 23.9 million people in the U.S. who are aged above 16 have experienced identity theft. Further in 2021, people experiencing identity theft were 1 in 5-person demanding for a strong market. On the other hand, the scale of the digital public services creates a massive standardized verification ecosystem, while the public-private fraud intelligence sharing coordinated by the U.S. Treasury intensifies the demand for the real time interoperable solutions to combat threats such as synthetic identity fraud that the Federal Reserve notes is a top financial crime.

Identity Theft Victimization Outcomes

|

Metric |

Statistic |

Details |

|

Time to Resolve Financial/Credit Issues |

56% spent 1 day or less |

Majority handled problems rapidly |

|

Reported to Law Enforcement |

7% |

Low reporting rate among victims |

|

Contacted Credit Card/Bank |

67% |

Primary action taken by victims |

|

Average Direct Financial Loss (All Victims) |

USD 880 |

Overall mean across types |

|

New Account Misuse Loss |

USD 3,430 |

Highest average losses |

|

Bank Account Misuse Loss |

USD 670 |

Moderate financial impact |

|

Credit Card Misuse Loss |

USD 620 |

Lowest among specified types |

Source: BJS October 2023

Canada’s identity verification market is shaped by the coordinated federal-provincial digital IS+D alignment and privacy-led innovation. The report from Statistics Canada in March 2025 has indicated that as the technology advances, the reported crime also rises, reflecting 48,900 cybercrime violations in 2023, including identity theft and identity fraud. The federal Digital Ambition 2022 and the significant funding to expand the sign-in Canada service aim to create a seamless, secure access gateway for federal programs, driving the demand for compatible verification solutions. This federal initiative actively seeks interoperability with the leading provincial digital ID systems, such as the BC Services Card and Ontario Digital ID, boosting the unified national landscape. This rise in cybercrime directly validates the market need for robust, government-led digital identity frameworks now being implemented to protect citizens and services.

APAC Market Insights

The Asia Pacific is the fastest-growing identity verification market and is poised to grow at a CAGR of 18.8% during the forecast period 2026 to 2035. The market growth is fueled by the three primary drivers, such as the massive government digital identity initiatives, a rapidly expanding digital finance ecosystem, and the need to combat a significant rise in advanced cyber fraud. Countries such as India, with its Aadhaar biometric ID system, have created a foundational digital infrastructure that private sector verification services can leverage for secure, low-friction onboarding. Similarly, national initiatives such as China’s real name verification laws and Japan's My Number Card system mandate robust identity checks, directly creating market demand. The regional trend is moving towards mobile first biometric centric solutions and cloud-based platforms that can serve diverse populations with varying levels of formal documentation.

China’s identity verification market is defined by the state mandated real name verification policies and integration with the national digital governance systems. A recent report from the GLEIF in February 2025 announced that the first Chinese Qualified vLEI is the China Financial Certification Authority within the verifiable legal entity identifier ecosystem. The CFCA is established by the People’s Bank of China and is an authoritative electronic certification body approved by the national information security administration. vLEI is a new form of organizational identity and addresses the urgent global need for digitized, automated authentication and verification for both organizations and individuals. The market trend involves moving beyond basic checks to AI-powered live detection to combat sophisticated fraud.

Recent Development in China

|

Company/Initiative |

Year-Month |

Key Development |

Details |

|

Zetrix |

October 2024 |

Launched Chinese Digital IDs on ZCert |

First-of-its-kind app for overseas authentication of Chinese nationals' official IDs via Xinghuo BIF blockchain, enabling seamless eKYC. |

|

Keesing Technologies |

June 2023 |

Expanded into China via Resonant Ltd. partnership |

Brought DocumentChecker and AuthentiScan solutions to Chinese law enforcement, border control, and government for e-ID verification. |

|

China (RealDID) |

July 2025 |

Expanded RealDID blockchain system to Hong Kong |

Enables mainland citizens secure, privacy-friendly access to Hong Kong digital services using blockchain-based identities. |

Source: Zetrix, Keesing Technologies, Blockchain Council

In India, the identity verification market is built upon the foundational Aadhaar biometric digital identity systems, which enables low cost, scalable electronic know your customer. Regulated by the unique identification authority of India, Aadhaar-based authentication is extensively used by banks, telecom operators, and government services for instant verification, creating a massive standardized ecosystem. The primary market driver is the push for financial inclusion and digital service delivery, with the verification solutions needing to serve a vast, diverse population often new to formal banking. The report from IBEF in April 2025 shows that the total number of Aadhaar authentications processed grew from 2,707 crore in 2024 to 2025, reflecting the immense and growing reliance on this centralized verification infrastructure.

Europe Market Insights

Europe’s identity verification market is fundamentally a regulatory-driven ecosystem with the EU’s eIDAS 2.0 regulation acting as its primary growth catalyst. This legislation mandates that all member states provide citizens and businesses with a secure interoperable digital identity wallet, creating a continent-wide standardized demand for compliant verification solutions that can interface with the government-issued credentials. The growth is concentrated in highly regulated verticals; for example, the financial services sector relies on the tools for robust Anti Money Laundering and Know Your Customer checks, while the emerging European Health Data Space will require robust patient identification to facilitate secure cross-border access to medical records.

The UK market operates within a post Brexit regulatory framework and is primarily driven by the government's digital transformation and financial services compliance. The key catalyst is the UK Digital Identity and Attributes Trust Framework established by the Department for Science, Innovation, and Technology, which sets standards for providers to enable the use of digital identities across the economy. The report from the CIFAS in December 2024 has shown that identity fraud is surging in the UK and is estimated that £1.8 billion cost of identity fraud is registered each year, and it is the major type of cases filed to the Cifas National Fraud Database by its 750 plus industry members, reaching 64% of filings in 2023 with 237,000 cases on identity fraud recorded. This data highlights the rising demand for identity verification services.

The Germany market is defined by a high trust in official documents and is being reshaped by the implementation of the EU’s eIDAS 2.0 regulation. The cornerstone of the national ecosystem is the national ID card with its online eID function, which has seen growing adoption for accessing both public and private services. In September 2025, IDnow, which is a leading identity verification platform provider, and Docusign the Intelligent Agreement Management company, announced the launch of a new joint solution enabling customers to comply with the Anti Money Laundering law in Germany via secure and automated identity verification and e-signatures that are powered by the electronic ID in the country. This partnership highlights a key market trend where private-sector platforms are rapidly integrating with and building upon the government digital identity infrastructure to offer a seamless, compliant user journey.

Key Identity Verification Market Players:

- Jumio (U.S.)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ID.me (U.S.)

- Onfido (UK)

- GBG (UK)

- Thales (France)

- IDnow (Germany)

- Veriff (Estonia)

- TransUnion (U.S.)

- Experian (U.S.)

- LexisNexis Risk Solutions (U.S.)

- Mitek Systems (U.S.)

- Trulioo (Canada)

- Shufti Pro (United Kingdom)

- AU10TIX (Israel)

- Daon (U.S.)

- Samsung SDS (South Korea)

- Panasonic (Japan)

- Australia Post (Australia)

- Signzy (India)

- Synamedia (Malaysia)

- Jumio is a pioneer in the market and is providing an end-to-end platform that seamlessly integrates Know Your Customer compliant ID verification with the automated Anti Money laundering screening and monitoring. This convergence is vital for the regulated industries as it allows businesses to fulfill major compliance requirements within a single AI-powered workflow.

- ID.me is dominating the market with its unique verify once digital wallet model, which is transforming how citizens access online services. This advancement ensures secure reusable credentials for both public and private sector services, eliminating the need for repetitive verification. Further, ID.me has become an integral part of enabling compliance with federal mandates for the EPCS. The company has enrolled over 135 million members into its digital wallet in 2024.

- Onfido advances the identity verification market by offering flexible AI-powered solutions that allow businesses to balance fraud prevention with a smooth customer experience. This advancement ensures that identity verification can be precisely customized to a company’s risk appetite using a hybrid of AI and human experts to analyze the identity documents and facial biometrics.

- GBG makes significant advances in the identity verification market via its electronic ID verification solutions that leverage vast global reference data to confirm identities without requiring document uploads. This advancement ensures a dramatically faster and less intrusive customer onboarding process while maintaining strict regulatory compliance. The company has earned a revenue of £282.7 million in 2025.

- Thales shapes the foundational infrastructure of the market via its leadership in providing secure government-grade digital identity solutions and data protection systems. This advancement ensures trust at a national and enterprise scale by securing the entire digital identity value chain from credential issuance to verification. Thales ensures the security of sensitive data across the expanding IoT, providing multi-factor authentication and encryption solutions.

Here is a list of key players operating in the global market:

The global identity verification market is intensely competitive and fragmented, featuring a mix of specialized pure play vendors, established credit bureaus, data aggregators, and large technology security conglomerates. Key strategic initiatives include aggressive consolidation via mergers and acquisitions to broaden the technology stacks and the geographic reach, heavy investment in AI and biometrics to combat advanced fraud, and a focus on achieving compliance across diverse global regulations such as GDPR and AML directives. For example, in December 2025, ID-Pal announced its acquisition of Know Your Business (KYB) specialists NorthRow. The partnerships with financial institutions, tech platforms, and government digital ID schemes are also vital for scaling and integration. The competitive edge increasingly hinges on balancing robust security, seamless user experience, and privacy by design principles.

Corporate Landscape of the Identity Verification Market:

Recent Developments

- In October 2025, Jumio, the leading provider of AI-powered identity intelligence anchored in biometric authentication, automation, and data-driven insights, announced the launch of selfie.DONE, a new solution that delivers on the company’s vision for true reusable identity.

- In October 2025, Regula has launched its brand-new Regula IDV Platform. This ready-to-use orchestration solution is designed to replace fragmented identity verification and management systems with a single, unified workflow.

- In April 2025, AuthBridge, India’s leading provider of background screening and due diligence solutions, launched the largest AI-powered platform suite for identity verification, unveiled at the prestigious GCC Summit & Awards 2025 in Hyderabad.

- Report ID: 3713

- Published Date: Jan 02, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Identity Verification Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.