Ibuprofen Market Outlook:

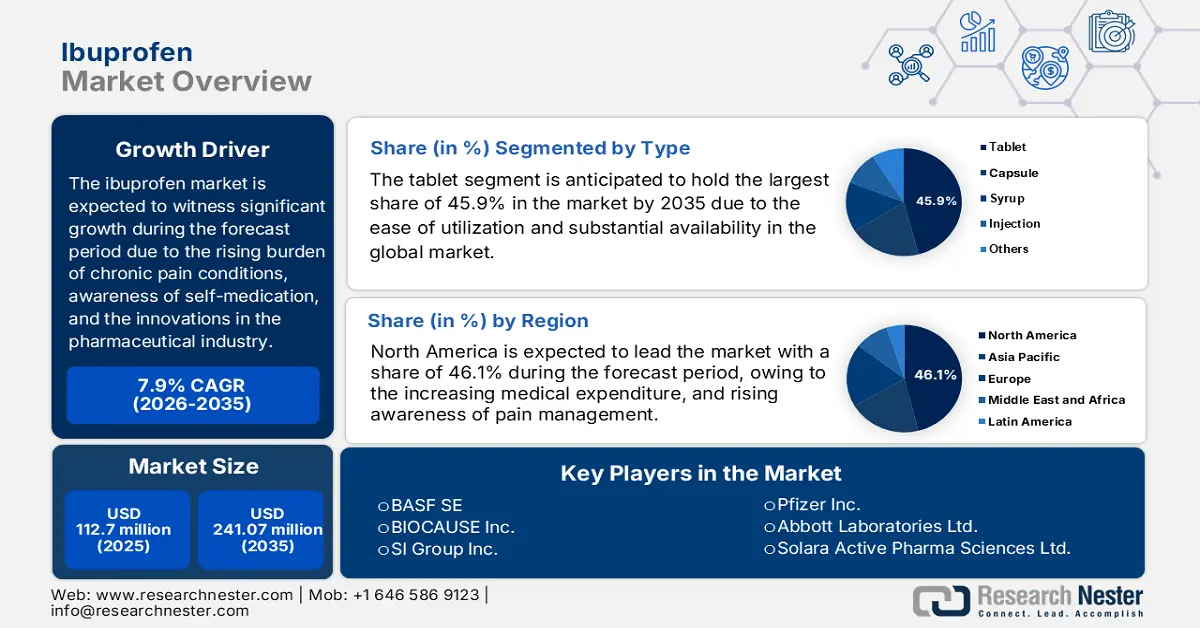

Ibuprofen Market size was valued at USD 112.7 million in 2025 and is likely to cross USD 241.07 million by 2035, expanding at more than 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ibuprofen is assessed at USD 120.71 million.

The proven efficacy of this element as an appropriate solution for numerous concerns is driving growth in the market. The immense utilization of ibuprofen as a non-steroidal anti-inflammatory drug (NSAID) for pain management, fever reduction, and inflammation management is the key factor fueling growth in this sector. Moreover, its broad application across various sectors such as headache, muscle pain, and menstrual cramps inflates the demand for such therapeutics. Additionally, the increasing healthcare spending and expanding pharmaceutical industry are pushing the public healthcare associations to invest in availing effective treatments.

The rising prevalence of musculoskeletal conditions is an exceptional driver for the market as the drug is widely used for pain and inflammation relief. In this regard, according to a WHO study in July 2022, approximately 1.7 billion people across the world suffer from musculoskeletal conditions, which is becoming the leading contributor of disability, with lower back pain being the top cause in 160 countries. This growing health burden is expected to boost the demand for effective NSAIDs such as ibuprofen in the global market, further inspiring pharmaceutical leaders to introduce more effective for solidify their positions in the competitive landscape of this sector.

Key Ibuprofen Market Market Insights Summary:

Regional Highlights:

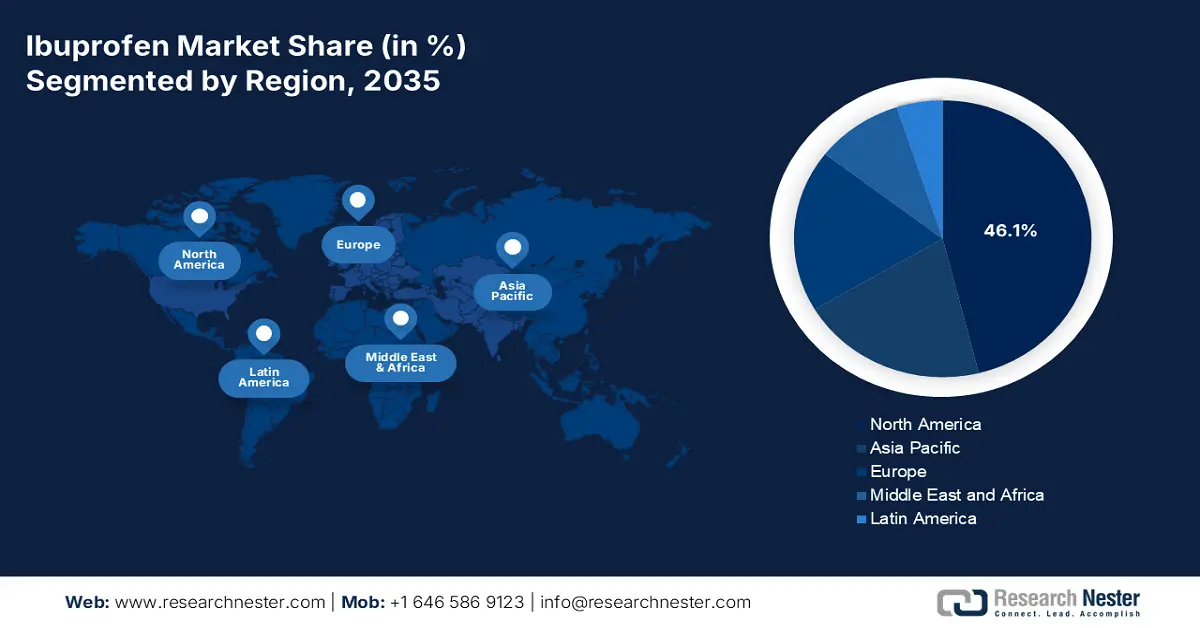

- North America commands a 46.1% share in the Ibuprofen Market, driven by increased medical expenditure and expansion strategies by biopharmaceutical companies, supporting strong growth prospects through 2035.

- The Ibuprofen Market in Asia Pacific is projected to see the fastest growth through 2026–2035, driven by increased healthcare disbursement and affordable manufacturing in India and China.

Segment Insights:

- The tablet Segment is anticipated to capture 45.9% market share by 2035, driven by its ease of administration, wide consumer base, and effectiveness in managing conditions like headaches and arthritis.

- The Rheumatoid Arthritis and Osteoarthritis segment is anticipated to achieve a significant share by 2035, fueled by increasing demand for advanced medications to treat these chronic conditions.

Key Growth Trends:

- Wide range of applications

- Self-medication trends

Major Challenges:

- Stringent regulatory approvals

- Highly competitive demographics

Key Players: BASF SE, BIOCAUSE Inc., SI Group Inc., Pfizer Inc., Abbott Laboratories Ltd., Solara Active Pharma Sciences Ltd..

Global Ibuprofen Market Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 112.7 million

- 2026 Market Size: USD 120.71 million

- Projected Market Size: USD 241.07 million by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, India, Japan

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 12 August, 2025

Ibuprofen Market Growth Drivers and Challenges:

Growth Drivers

- Wide range of applications: One of the primary drivers for the ibuprofen market is the wide range of applications of ibuprofen for different sorts of chronic pain management conditions. The effectiveness of products from this element leads pharmaceutical firms to undergo various clinical trials for approval. For instance, in July 2023, Granules India Limited received the U.S. FDA approval for its Advil dual-action tablets combining acetaminophen and ibuprofen, which is bioequivalent to GlaxoSmithKline’s branded version and will be marketed through Granules Consumer Health. Thus, positively impacting the market on a wider scope with regulatory support.

- Self-medication trends: Another significant driver for the market is the growing awareness of self-medication and substantial accessibility to OTC drugs in developing countries. The proactive digital health initiatives and pharmacist consultations have encouraged consumers to adopt easily accessible pain relievers. In February 2023, Univar Solutions Brasil Ltda announced a distribution agreement with SI Group for ibuprofen API to support pharmaceutical burden in Brazil with access to advanced specialty ingredients. This inspires healthcare professionals to prescribe more ibuprofen therapies, thereby augmenting market expansion.

Challenges

- Stringent regulatory approvals: One of the major challenges witnessed by the global ibuprofen market is navigating through strict regulatory frameworks across different countries. The governing bodies enforce robust safety standards, ensuring proper drug efficacy and labelling measures. Any delays or failures in obtaining necessary approvals may limit the expansion of this sector. Moreover, the increasing scrutiny around drug recalls and adverse effects may surpass the limited budget of resource-constrained firms, restricting product exposure across the healthcare industry.

- Highly competitive demographics: Despite having limited adverse reaction cases, growth in the market can be hindered due to competition with affordable alternatives. With numerous manufacturers producing similar formulations, profit-making is shrinking, particularly in price-sensitive markets, limiting industry penetration. One of the hurdles for this sector to capture the optimum consumer base in the industry due that lower procurement costs for the over-the-counter drugs further impacts market expansion.

Ibuprofen Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 112.7 million |

|

Forecast Year Market Size (2035) |

USD 241.07 million |

|

Regional Scope |

|

Ibuprofen Market Segmentation:

Type (Tablet, Capsule, Syrup, Injection)

Based on type, the tablet segment is expected to garner the highest share of 45.9% in the ibuprofen market by the end of 2035. The tablet works as an excellent indicator for pain management in headaches, rheumatoid arthritis, osteoarthritis, and other conditions. The segment’s dominance is attributable to the ease of utilization, accessibility, and a large consumer base. As of August 2024, the NLM report ibuprofen is available in different formulations, out of which tablets are the widely preferred for their ease of administration, with adult pain relief doses for adults ranging from 200 to 400 mg every 4 to 6 hours, with a maximum limit of 1200 mg unless guided by a physician. Thus, this denotes a positive outlook for market development.

Application (Rheumatoid Arthritis and Osteoarthritis, Cancer, Pain/Fever, Dysmenorrhea, Inflammatory Diseases, Headache)

Based on application, the rheumatoid arthritis and osteoarthritis segment is anticipated to account for a significant share of the ibuprofen market during the forecast period. This segment is plagued by the growing need for advanced medications to cure such medical conditions. In this regard, according to the May 2024 NLM article, review of 70 studies comprising 28,000 individuals, the osteoarthritis symptoms were relieved in 55 out of 100 people who took anti-inflammatory painkillers, with a high improvement rate compared to 38 out of 100 who did not utilize NSAIDs. Thus, these factors are expected to widen the segment’s growth with such positive outcomes.

Our in-depth analysis of the global market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Ibuprofen Market Regional Analysis:

North America Market Analysis

The North America ibuprofen market is poised to capture the largest share of 46.1% during the forecast period. The dominance of the region is attributable to the increased medical expenditure with a focus on pain management strategies. Moreover, the region is augmenting such growth due to the expansion strategies boasted by the biopharmaceutical companies. For instance, in May 2023, Cumberland Pharmaceuticals Inc. inaugurated a new corporate office, enhancing its service to its international consumer base, and as located near Vanderbilt University Medical Center, it fosters continued collaboration. Such milestones will strengthen the position of the region in the life sciences sector, providing lucrative growth opportunities.

The U.S. has become the hub for global leaders in the market due to its wide consumer base and excellent distribution channels. The country presents an ideal opportunity for international players to expand their business by establishing their footprint in the country with the support of the governing bodies. In August 2021, Alkem Laboratories Limited launched Ibuprofen and Famotidine tablets (800 mg/26.6 mg) in the U.S., followed by the U.S. FDA clearance for the drugs. Such launch activities are anticipated to grow at a rapid pace during the forecast period, supporting the U.S. as the global hub for the market.

Canada is steadily consolidating its position in the ibuprofen market with proactive government initiatives and subsidiary policies. The concerning growth in cough, cold, arthritis, and osteoarthritis is pushing the country to promote available treatment options and preventive programs. For instance, in September 2023, Health Canada reported that there is a shortage of ibuprofen and acetaminophen to reduce pediatric pain and fever. It further stated that the country increased its production to 13.9 million units, and over 4.4 million units of medication were imported from foreign countries. This is evidence for a wider scope, further inspiring players in this sector to expand their manufacturing capabilities to meet the growing demand.

APAC Market Statistics

Asia Pacific is expected to demonstrate the fastest growth in the ibuprofen market with its strong capacity in biotechnology and research activities in drug development. The region is augmenting such growth due to the increased healthcare disbursement and the awareness of the exceptional benefits offered by ibuprofen for pain management. Moreover, the presence of affordable manufacturing facilities in India and China is taking the lead in the sector. Thus, the growth in this region is further carried forward with the efforts of regional players who are researching to bring innovations in this field.

India is propagating the regional market with its strong pharmaceutical development and expansion. The country is accumulating the resources to leverage the accessibility of generic non-steroidal anti-inflammatory drugs. The support from the regulatory frameworks is also a key factor fueling growth in this sector. For instance, in January 2025, Strides Pharma Science Limited notified that its subsidiary, Strides Pharma Global Pte. Limited received the U.S. FDA clearance for Acetaminophen and Ibuprofen Tablets, 125 mg /250 mg (OTC), offering a dual-action pain relief option. In addition, the rising burden of painful conditions in medical facilities across the country is fueling this sector to expand more.

China is one of the biggest suppliers of the market, which is emerging as a great distribution source for this region. The key factors fueling growth in China market comprise a well-established healthcare infrastructure, export activities, and a supportive regulatory landscape due to the huge demand for drugs. In April 2025, IOL Chemicals and Pharmaceuticals Limited announced that it received approval from China’s Center for Drug Evaluation under the NMPA for its product, ibuprofen, for relieving pain, reducing inflammation, and lowering fever. The country is also aiming to introduce more affordable solutions through huge production, offering a favorable business environment for both domestic and international leaders.

Key Ibuprofen Market Players:

- BASF SE

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BIOCAUSE Inc.

- SI Group Inc.

- Pfizer Inc.

- Abbott Laboratories Ltd.

- Solara Active Pharma Sciences Ltd.

- Ѕhаndоng Хіnhuа Рhаrmасеutісаl Со.Ltd.

- ІОL Сhеmісаlѕ and Рhаrmасеutісаl Ltd.

- Zydus Lifesciences Limited

- Endo International plc

- Par Pharmaceutical, Inc

- Granules India Limited

- Univar Solutions Brasil Ltda

- Cumberland Pharmaceuticals Inc.

- Alkem Laboratories Limited

- Strides Pharma Science Limited

- Sun Pharmaceutical Industries Limited

- Bain Capital

The competitive demographic of the ibuprofen market is inspiring global leaders to allocate their financial and research resources to innovate more effective solutions. They are investing extensive efforts to promote the adoption of these therapeutics in pain management. Moreover, the heightened support from the regulatory frameworks is drawing the focus of other pharmaceutical firms, enlarging the boundaries of this sector. In September 2024, Sun Pharmaceutical Industries Limited, with Medical Limited, notified that it received U.S. FDA Fast Track designation for MM-II for the treatment of osteoarthritis knee pain. Such factors significantly contribute to market progression in the forecast period.

Some of the key players in the market include:

Recent Developments

- In February 2025, Zydus Lifesciences Limited announced the U.S. FDA final approval for manufacturing Ibuprofen and Famotidine tablets, 800 mg/26.6 mg. It is indicated for rheumatoid arthritis and osteoarthritis, and to lower the risk of developing upper gastrointestinal ulcers.

- In March 2024, Endo International plc notified that its operational firm, Par Pharmaceutical, Inc., launched ibuprofen-famotidine 800 mg/26.6 mg tablets, for rheumatoid arthritis and osteoarthritis, and is an alternative version of Amgen's DUEXIS.

- Report ID: 7590

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Ibuprofen Market Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.