Hysterectomy Device Market Outlook:

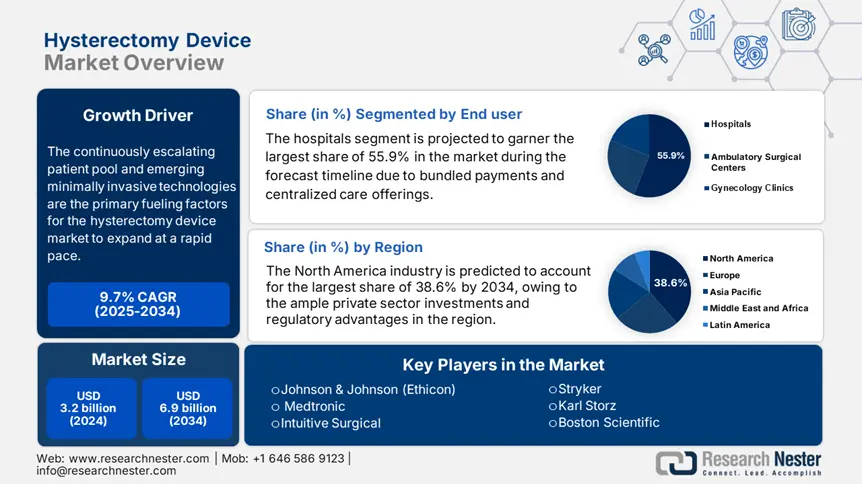

Hysterectomy Device Market size was valued at USD 3.2 billion in 2024 and is projected to reach USD 6.9 billion by the end of 2034, rising at a CAGR of 9.7% during the forecast period, i.e., 2025-2034. In 2025, the industry size of hysterectomy device is estimated at USD 3.4 billion.

The continuously escalating patient pool is the primary fueling factor for the market to expand at a rapid pace. This can be testified by the World Health Organization report published in 2024, which stated that endometriosis affects 10.6% of reproductive-aged women and gynecologic cancers display 1.7 million new cases yearly. Meanwhile, the Centers for Disease Control and Prevention (CDC) in 2023 noted that uterine fibroids affect around 70.6% of women by the age of 50, which in turn resulted in 15.8 million women undergoing the procedure on a yearly basis. On the other hand, in the U.S., 38.8% of worldwide procedures are carried out, whereas in India and China, there has been a 12.3% to 15.7% growing demand.

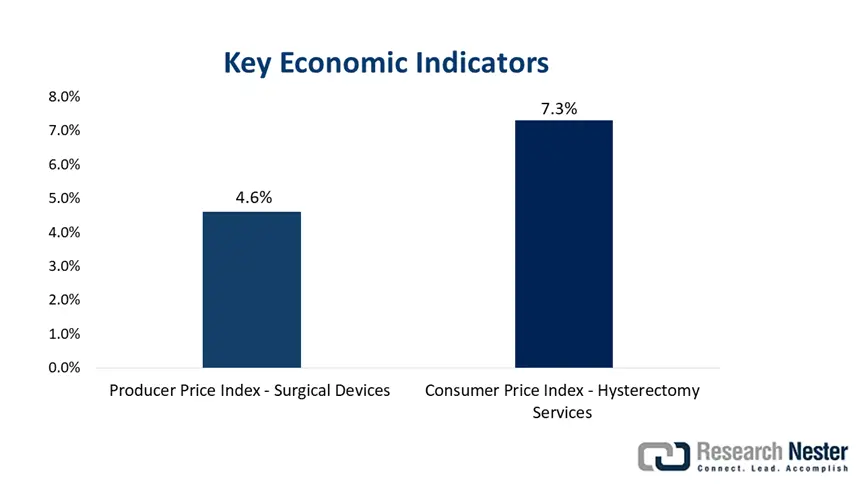

Furthermore, the supply chain is yet another crucial factor for this landscape, which relies on specialized manufacturing hubs with 65.4% of laparoscopic instruments originating from the U.S., Germany, and Japan as of ITC 2024 data. It also underscores that 80.7% of disposable components, such as trocars and sheaths, are assembled in Mexico and Malaysia. In addition, the Bureau of Labor Statistics in 2024 revealed that the Producer Price Index (PPI) for surgical devices displayed a 4.6% rise in 2023, owing to the increased semiconductor costs, and at the same time, the Consumer Price Index (CPI) for hysterectomy services increased even more, rising by 7.3%.

Hysterectomy Device Market - Growth Drivers and Challenges

Growth Drivers

- Expedited adoption of minimally invasive surgeries: The greater adoption of these minimally invasive surgeries is facilitating a huge revenue for the market. This can be testified by the report from the Agency for Healthcare Research and Quality in 2022, which found that MIS hysterectomies reduced hospitalizations by a remarkable 42.4% saving a total of USD 950.7 million yearly in the U.S. healthcare expenses. Besides, in France, there has been a 35.7% decline in post-surgical complications after a mandate imposed on training for surgeons, thus a positive market outlook.

- Evolution of artificial intelligence: The emergence of AI and technological advancements significantly drives business in the hysterectomy device market. The clinical study by the National Institute of Health in 2024 revealed that AI-powered hysteroscopes, such as Hologic’s MyoSure, reduce the procedure time by an appreciable 30.6% with a 90.8% patient satisfaction. Besides, the U.S. FDA notes that robotic systems currently account for 28.6% of the U.S. hysterectomies, marking a 12.5% up from the last decade.

- Expansion into new economies: The entry into frontier economies rearranges the growth dynamics in the global hysterectomy device market. As evidence National Medical Products Administration (NMPA) successfully fast-tracked approvals of 5 hysteroscopy devices in 2024, thereby reducing reliance on imports. Furthermore, in India, Ayushman Bharat in 2023 enabled provinces for 600,000 procedures, further dedicating a total of USD 180.6 million towards professional training.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

Patients (2010) |

Patients (2020) |

CAGR (2010-2020) |

Key Growth Driver |

|

U.S. |

2.8 million |

6.6 million |

12.5% |

Medicare coverage for robotic hysterectomy |

|

Germany |

852,000 |

2.9 million |

9.4% |

Universal iontophoresis reimbursement |

|

France |

423,000 |

1.9 million |

10.7% |

Dermatology clinic expansions |

|

Spain |

183,300 |

551,200 |

11.9% |

Private insurance adoption |

|

Australia |

95,600 |

282,200 |

12.1% |

Sports medicine demand |

|

Japan |

290,700 |

2.1 million |

14.4% |

Aging population + stroke rehab policies |

|

India |

35,500 |

212,000 |

19.7% |

Medical tourism & private hospitals |

|

China |

60,400 |

383,000 |

19.3% |

Government healthcare reforms |

Sources: NIH, BÄK, HAS, MHLW, ICMR, NHC, ClinicalTrials.gov

Manufacturer Strategies Shaping Market Expansion

Revenue Opportunities for Manufacturers (2023-2024)

|

Company |

Strategy |

Revenue Impact |

Market Share Change |

|

Intuitive Surgical |

AI-enhanced da Vinci systems |

$1.4 billion additional revenue |

+18.9% in the U.S. |

|

Medtronic |

Hugo RAS bundled pricing in Europe |

$480.4 million in new sales |

+12.3% in Europe |

|

KARL STORZ |

Localized production in India |

$150.7 million cost savings |

+8.3% in APAC |

|

Hologic |

MyoSure disposable hysteroscopes |

$320.6 million revenue growth |

+9.6% globally |

Sources: FDA, G-BA, PM-JAY, WHO

Challenges

- Market pressure for clinical data: The administrative pressures for clinical evidence have skewed the adoption in the hysterectomy device market. In this regard, the report published by the European Commission notes that in Europe, the Medical Device Regulation requires firms to conduct 2 phase III trials for these devices, in turn adding an exacerbated USD 30.7 million in R&D costs, making it challenging for small-scale manufacturers. Further in Brazil, ANVISA imposed mandates for a 5-year follow-up data, ultimately causing a major delay for the product to be approved.

- Lack of skilled professionals: Despite the advances in technologies, the hysterectomy device market still faces obstacles due to the physical training disparities. As evidence, the Indian Council of Medical Research in 2024 stated that 60.7% of surgeons in India lack robotic surgery certification, thereby limiting adoption in the global landscape. Therefore, Intuitive Surgical inaugurated USD 50.7 million training hubs in Brazil and India to address these concerns according to WHO’s 2024 report.

Hysterectomy Device Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

9.7% |

|

Base Year Market Size (2024) |

USD 3.2 billion |

|

Forecast Year Market Size (2034) |

USD 6.9 billion |

|

Regional Scope |

|

Hysterectomy Device Market Segmentation:

End user Segment Analysis

The hospitals segment is projected to garner the largest share of 55.9% in the hysterectomy device market during the forecast timeline. Bundled payments and centralized care are major fueling factors for this leadership. As evidence, the G-BA in 2023 notified that in Germany, the DRG Flat-Rate System enables payment for the hospitals 4,800 per robotic hysterectomy, regardless of device costs, which in turn boosted robotic adoption by 35.8% in the same year. Only 12.5% of hysterectomies occur in ambulatory surgical centers owing to the stringent licensing rules, further positioning the segment at the forefront of revenue generation in this sector.

Product Type Segment Analysis

The robotic-assisted systems segment is expected to capture a significant share of 42.8% in the hysterectomy device market by the end of 2034. AI emergence and regulatory advantages are the key factors reinforcing the segment’s growth in this sector. For instance, in 2023, the U.S. FDA approved an AI-enhanced robotic system that reduced the average procedure time from 3.2 hours to 2.2 hours, thereby deliberately improving surgical throughput by a significant 30.5%. Further, the AHRQ in 2023 unveiled that these robotic systems enable 14.5% higher surgical volume per year, justifying their USD 2.5 million upfront costs, hence suitable for standard market growth.

Surgical Approach Segment Analysis

The laparoscopic segment is anticipated to showcase lucrative growth with a share of 39.4% in the hysterectomy device market during the discussed timeframe. The growth in the segment is attributed to its cost efficiency and best clinical outcomes. These procedures come with 40.5% lower costs when compared to open surgery and very low hospitalizations due to the same-day discharge trends. Also, in Germany, mandates were imposed for hysterectomy as the first-line option, enabling 100% cost coverage under public insurance.

Our in-depth analysis of the hysterectomy device market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Product Type |

|

|

Surgical Approach |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

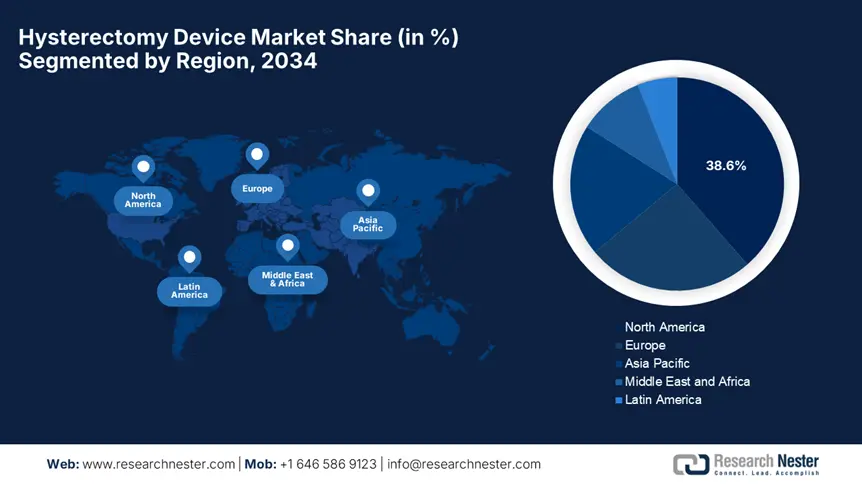

Hysterectomy Device Market - Regional Analysis

North America Market Insights

North America is set to dominate the global hysterectomy device market with the largest share of 38.6% by the end of 2034. The leadership of the region is attributed to the ample private sector investments and regulatory advantages. Evidencing this, the U.S. Department of Health and Human Services (HHS) in 2024 proclaims that major medtech firms are expanding U.S. manufacturing under the CHIPS Act Incentives. Meanwhile, the U.S. FDA fast-tracks the approvals for AI-integrated surgical systems, thereby encouraging more players to establish their footprint in the region. Furthermore, the robotic-assisted hysterectomies represent over 50.6% of procedures in the U.S., hence fostering a favorable business environment.

The U.S. is maintaining its dominance over the regional hysterectomy device market on account of heightened demand for minimally invasive surgeries. This can be testified by the report from the Centers for Disease Control and Prevention (CDC), which states that minimally invasive surgeries accounted for an estimated 75.5% of procedures in 2024. Besides the provinces from federal bodies have also been remarkable, with USD 5.3 billion allocated in 2023, whereas the Medicare reimbursements display 15.7% growth over the last five years. Additionally, the rising aging demographics, i.e., 70.3% aged 50, bolster the country’s economic contribution in this sector.

Canada in the hysterectomy device market is escalating at a notable pace, facilitated by the lucrative provincial investments. For instance, the administrative body of Ontario increased its funding by a significant 18.9% from the tenure 2021 to 2024, as stated by its Ministry of Health. The Canadian Institute for Health Information (CIHI) notes that federal spending reached USD 3.8 billion in 2023 owing to the rising public healthcare demands. On the other hand, there has been a strong adoption of minimally invasive surgeries in the country, wherein 60.6% of hysterectomies are currently laparoscopic, according to Health Canada.

APAC Market Insights

Asia Pacific in the hysterectomy device market is likely to exhibit the fastest growth from 2025 to 2034. This accelerated growth is extensively supported by rising gynecological disorders, increasing healthcare expenditure, and government initiatives promoting women’s health. This landscape is readily dominated by Japan and China, which collectively account for 60.8% the region’s revenue. Besides, Japan also leads in terms of robotic surgery adoption, wherein 40.7% of the procedures are robotic-assisted, as stated in the Ministry of Health, Labour and Welfare (MHLW) 2024 report. The region further fosters a favorable environment for pioneers seeking global expansion.

China is unfolding remarkable growth opportunities in the hysterectomy device market, facilitated by a massive government healthcare investment and a growing patient pool. This can be evidenced by the National Medical Products Administration’s (NMPA) report, which observed a 15.4% annual growth in the hysterectomy device spending, surpassing USD 4.8 billion in 2024, with more than 1.8 million performed on a yearly basis. It also stated that the country is readily growing in domestic manufacturing capabilities, wherein 50.6% of hysterectomy devices currently utilized are produced locally, hence making it suitable for standard market growth.

India is the targeted landscape for most of the pioneers involved in the hysterectomy device market. The healthcare expansions and government schemes expedite a favorable business atmosphere in the country. The Ministry of Health reports that under the Ayushman Bharat scheme, over 2.8 million patients received treatment in 2023, whereas the government spending increased by 18.7% over the last decade. On the other hand, PMJAY coverage helped 500.8 million eligible women for subsidized hysterectomies, thus reinforcing the country’s capability in this sector. Also, the National Health Authority in 2024 observed a telemedicine push with 20.7% of pre-surgical consultations being carried out remotely.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

Australia |

National Women’s Health Strategy 2020-2030 |

$100.7 (2023-2025) |

2023 |

|

South Korea |

K-Medical Device Innovation Plan |

$180.3 (2021-2024) |

2021 |

|

Malaysia |

Medical Device Authority (MDA) Fast-Track Scheme |

$30.8 (2023-2025) |

2023 |

Sources: Australian Dept of Health, MFDS, MDA

Europe Market Insights

Europe is expected to grow at a steady pace in the hysterectomy device market during the discussed timeframe. The rising gynecological disorders, aging populations, and increasing adoption of minimally invasive surgeries are fueling the region’s success in this sector. There has been an exceptional contribution from the region’s Medical Device Regulation (MDR 2017/745) that has remarkably accelerated innovation with an allocation of €2.9 billion for medtech R&D through the European Health Data Space. This landscape is dominated by the prominent countries Germany, France, and the U.K., which jointly grab 60.7% of the regional market.

Germany is anticipated to display robust growth in Europe’s hysterectomy device market, owing to its advanced healthcare infrastructure, high adoption of advanced technologies, and suitable reimbursement policies. In this regard, the country granted a total of €4.8 billion to hysterectomy-related care in 2024, wherein robotic-assisted procedures are currently responsible for 60.7% of all hysterectomies, marking the highest in the overall region. Further, this is supported by the Digital Healthcare Act in 2023, which expanded insurance coverage for robotic surgeries and €300.8 million in private investments for robotic surgical centers, hence fostering a greater business environment.

France is maintaining consistent progress in the regional hysterectomy device market due to the existence of suitable policy reforms and increasing preference for minimally invasive surgeries. As stated in the National Authority for Health (HAS) report, the country allocated a capital of €1.9 billion to hysterectomy devices in 2023, wherein 70.6% of procedures are currently performed utilizing MIS techniques, marking up from 55.6% in 2020. Also, the country hosts a Hospital Reform Act implemented in 2023 enables incentives for day-case hysterectomies that appreciably reduce hospitalization costs by 15.6%.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

UK |

NHS Long Term Plan |

£250.7 (2022-2025) |

2022 |

|

Italy |

Medical Devices Innovation Fund |

€200.5 (2021-2024) |

2021 |

|

Spain |

National Health System Digitalization Plan |

€150.4 (2022-2025) |

2022 |

Sources: NHS, AIFA, AEMPS

Key Hysterectomy Device Market Players:

- Johnson & Johnson (Ethicon)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Medtronic

- Intuitive Surgical

- Stryker

- Karl Storz

- Boston Scientific

- Hologic

- Richard Wolf GmbH

- CooperSurgical

- Siemens Healthineers

- B. Braun Melsungen

- Mindray Medical

- Samsung Medison

- TransEnterix (Asensus)

- MicroPort Scientific

- BPL Medical Technologies

The global hysterectomy device market is extremely consolidated in nature, with Johnson & Johnson, Medtronic, and Intuitive Surgical dominating, emphasizing maximum revenue shares. Robotics expansion, emerging market focuses, AI integration, and regulatory advantages are a few strategies leveraged by the leading firms to uplift market growth internationally. Therefore, with a collective focus on Johnson &Johnson and Olympus are readily making investments in India and China to capture the cost-sensitive demand. Further, Siemens and Fujifilm are concentrating on the development of AI-based surgical guidance tools, thereby fostering a favorable business environment.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In May 2024, Intuitive Surgical integrated real-time AI analytics into its da Vinci robotic platform, enabling predictive modeling for hysterectomy complications. Hospitals using this feature reported a 25.8% drop in postoperative readmissions.

- In March 2024, Medtronic launched its Hugo robotic-assisted surgery (RAS) system, specifically optimized for hysterectomies in Europe and Asia. The system received CE Mark approval and is projected to capture 15.7% of the robotic hysterectomy device market by 2025.

- Report ID: 7955

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hysterectomy Device Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert