Hyperscale Data Center Market Outlook:

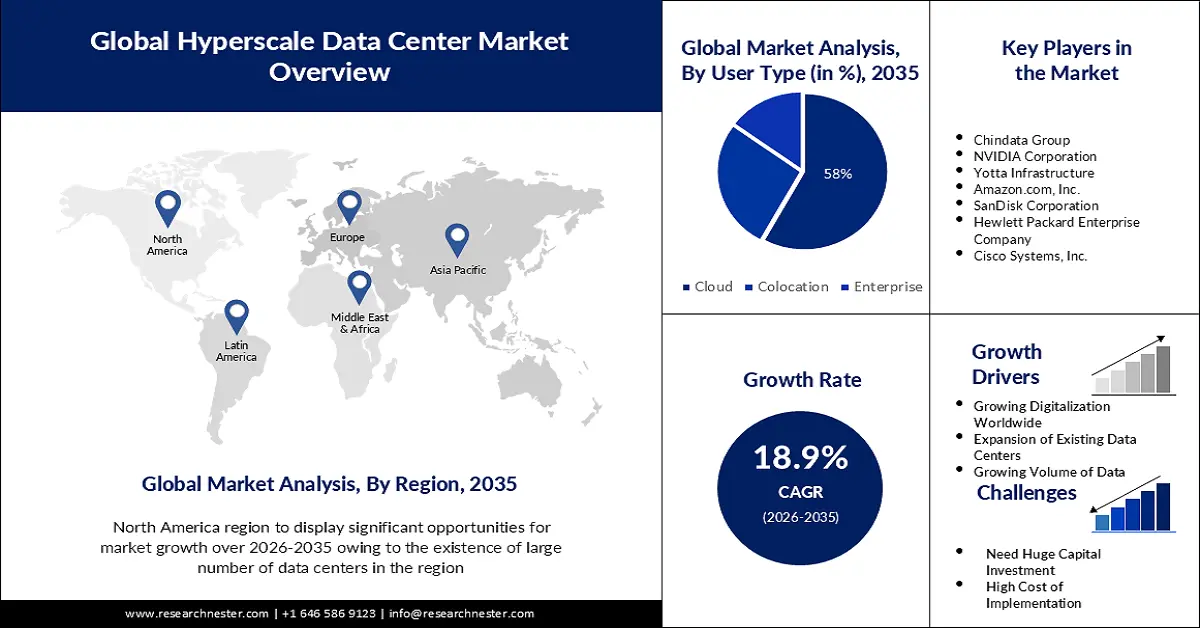

Hyperscale Data Center Market size was over USD 43.75 billion in 2025 and is anticipated to cross USD 247.06 billion by 2035, growing at more than 18.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hyperscale data center is assessed at USD 51.19 billion.

The growth of the market can be attributed to the growing volume of digital businesses worldwide owing to augmenting investment in digital transformation together with the rising need for data centers to enhance productivity, reduce operational costs and increase customer experiences. For instance, as per estimations, the direct digital transformation investment is anticipated to hit nearly USD 7 trillion with a CAGR of 18% from 2020 to 2023 as companies have been strategizing & investing to become future enterprises that are digital at scale.

Furthermore, factors that are believed to fuel the market growth of hyperscale data centers include the unprecedented growth in storage demand, driven by the increasing amount of video-intensive content, collaboration, multi-generational investments, and many other digital transformation applications together with developing infrastructure that is scalable and can maintain a high level of security. For instance, Broadcom Inc., the market leader in hyperscale video storage connectivity, in October 2022 announced the expansion of its silicon, software, and hardware storage connectivity products with enhanced performance, capabilities, and power. This expanded product portfolio is intended to aid hyperscale data centers to manage and maintain the storage connectivity they need to deliver video storage at scale. Additionally, the growing demand for hyperscale data centers over enterprise data centers by large companies owing to its economies of scale and custom engineering is predicted to present the potential for market expansion over the projected period.

Key Hyperscale Data Center Market Insights Summary:

Regional Highlights:

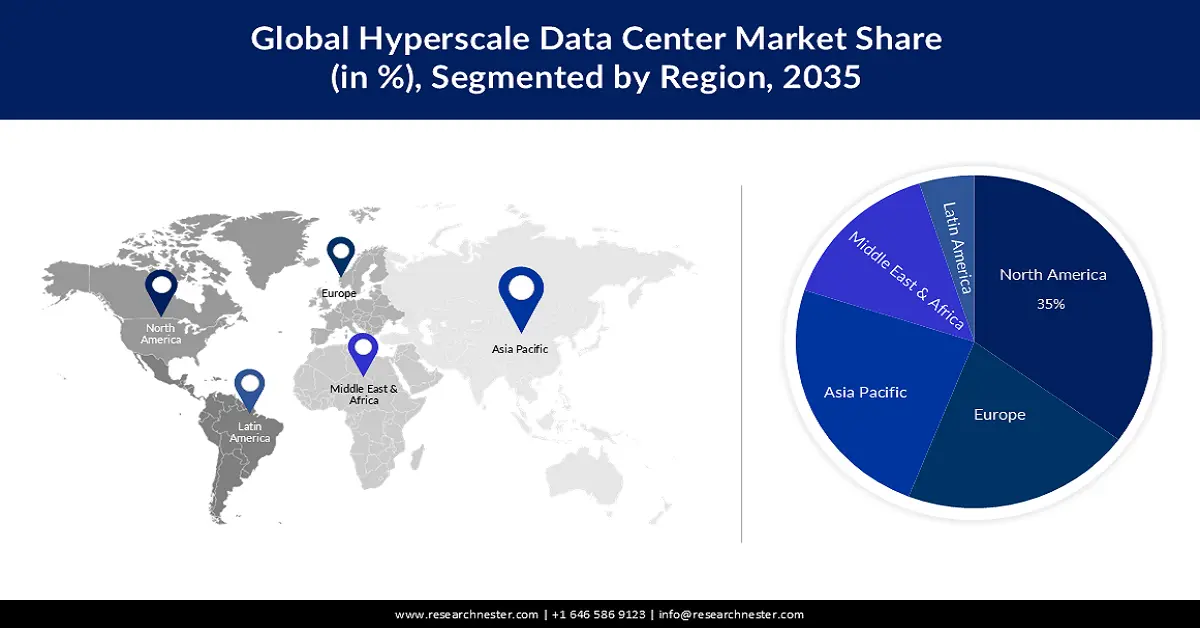

- The North America hyperscale data center market is projected to capture a 35% share by 2035, driven by growing digitalization and large data center footprints.

- The Asia Pacific market is expected to secure a 24% share by 2035, driven by the growing base of big data-producing companies.

Segment Insights:

- The cloud user type segment in the hyperscale data center market is projected to hold a 58% share by 2035, driven by rising growth in cloud computing and increased cloud spending worldwide.

- The server solution segment in the hyperscale data center market is forecasted to secure a 46% share by 2035, driven by digital businesses focusing on optimized workload management.

Key Growth Trends:

- Increasing Demand & Utilization of Hyperscale Data Centers

- Radically Increasing Volume of Data

Major Challenges:

- Requirement of huge capital investment

- High Cost of Implementation

Key Players: Chindata Group, NVIDIA Corporation, Yotta Infrastructure, Amazon.com, Inc., SanDisk Corporation, Hewlett Packard Enterprise Company, Cisco Systems, Inc., Telefonaktiebolaget LM Ericsson, Intel Corporation, Broadcom, Inc., Cavium, Inc., Nlyte Software Limited.

Global Hyperscale Data Center Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 43.75 billion

- 2026 Market Size: USD 51.19 billion

- Projected Market Size: USD 247.06 billion by 2035

- Growth Forecasts: 18.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, Singapore

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 11 September, 2025

Hyperscale Data Center Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing Demand & Utilization of Hyperscale Data Centers – which are massive business-critical facilities designed to efficiently support robust, scalable applications and can support thousands of individual servers that operate via high-speed internet connectivity. The increasing number of companies associated with big data production are favoring the development of such data centers which is why there is an increase in the number of hyperscale data centers worldwide. For instance, in 2021, the number of large

-

data centers operated by hyperscale providers rose to over 700.

- Radically Increasing Volume of Data – and the development of data-driven technologies such as artificial intelligence (AI), machine learning (ML), IoT, blockchain, and metaverse are anticipated to boost the growth of the hyperscale data center market worldwide. It is observed that approximately 2.5 quintillion bytes of data are generated worldwide every day.

- Growing IT & Telecom Industry and the Expanding Data Centre Industry – is responsible for the rapid growth of the hyperscale data center market over the period of time. The data center industry was found to reach a valuation of around USD 1.2 billion in 2021, a 216% rise from USD 385 million in 2014.

-

Rise in the Use of Big Data Technologies - and an increasing number of big data-producing companies who are responsible for the evolution of hyperscale data centers as they have the ability to share the processing load and quickly add or remove servers or other resources as needed to meet capacity demands are propelling the market growth. As per recent data, more than 24% of companies use big data analytics worldwide.

Challenges

-

Requirement of huge capital investment – As hyperscale data centers support thousands of servers, they tend to be much larger than the facility size of the average data center. Moreover, it also requires a number of specialized high-density server racks to accommodate more components, like power suppliers and hard drives, with enough space for engineers to swap them out and customize them as needed. With so much equipment to support, hyperscale facilities need a massive amount of power. Furthermore, the ability to customize and swap out components which are key to the flexibility of hyperscale facilities and equipment needs a commitment to personalized configuration. All these requirements to build a hyperscale data center are expensive, time-consuming, hampering the market growth.

- High Cost of Implementation

- Heavy Reliability on Automation Tools

Hyperscale Data Center Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

18.9% |

|

Base Year Market Size (2025) |

USD 43.75 billion |

|

Forecast Year Market Size (2035) |

USD 247.06 billion |

|

Regional Scope |

|

Hyperscale Data Center Market Segmentation:

User Type Segment Analysis

The global hyperscale data center market is segmented and analyzed for demand and supply by user type into cloud, colocation, and enterprise. Out of the three types of users hyperscale data centers, the cloud segment is estimated to gain the largest market share of about 58% in the year 2035. The growth of the segment can be attributed to the rising growth in the field of cloud computing as it facilitates data backup, disaster recovery, software development and testing, big data analytics, and many other advantages to large and small enterprises worldwide. For instance, it was observed that cloud computing spending rose by 35% year-over-year in 2021. The spending in 2020 was recorded to be around USD 140 billion whereas it reached around USD 191.5 billion in 2021. Moreover, over 50% of enterprises are expected to use industry cloud platforms to accelerate their business initiatives by 2027. Hence, all these factors are anticipated to boost the segment growth in the upcoming years.

Solution Segment Analysis

The global hyperscale data center market is also segmented and analyzed for demand and supply by solution into software, storage, and server. Amongst these three segments, the server segment is expected to garner a significant share of around 46% in the year 2035, owing to the increasing focus placed by digital businesses on achieving optimized workload management with speed, agility, and security without having to deal with the challenges of training, integration and deployment, support, and maintenance. This, as a result, is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Solution |

|

|

By User Type |

|

|

By Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hyperscale Data Center Market Regional Analysis:

North American Market Insights

The market share of hyperscale data centers in North America, amongst the market in all the other regions, is projected to be the largest with a share of about 35% by the end of 2035. The growth of the market can be attributed majorly to the growing digitalization in the region as well as the strong existence of companies with the broadest data center footprint together with the increasing investment in advanced technologies in the North American region. It was found that over 50% of the world's hyperscale data centers were located in the U.S. in 2021. Moreover, the base of many large bid-data producing companies, including Microsoft, Amazon, Google, IBM, and Meta along with their expanding facilities of cloud provision is further expected to boost the market growth.

APAC Market Insights

The Asia Pacific hyperscale data center market is estimated to be the second largest, registering a share of about 24% by the end of 2035. The growth of the market can be attributed majorly to the growing base of big data-producing companies in the region together with the rising need to store, manage and process these vast volumes of data. As per research, it was found that in 2021, China was the next biggest contributor to hyperscale data center capacity after the US across the globe, and accounted for nearly 15% of the overall hyperscale data centers operated in that year.

Europe Market Insights

Further, the market in Europe, amongst the market in all the other regions, is projected to hold a majority of the share by the end of 2035. The increasing investment in the field of technology as well as the growing development of IT infrastructure to promote digital transformation and growth of the region besides the rise in the number of data centers is estimated to boost the regional market growth in the upcoming years.

Hyperscale Data Center Market Players:

- Chindata Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- NVIDIA Corporation

- Yotta Infrastructure

- Amazon.com, Inc.

- SanDisk Corporation

- Hewlett Packard Enterprise Company

- Cisco Systems, Inc.

- Telefonaktiebolaget LM Ericsson

- Intel Corporation

- Broadcom, Inc.

- Cavium, Inc.

- Nlyte Software Limited

Recent Developments

- A subsidiary of Chindata Group and a leading data center provider across Malaysia, India, and Thailand, the Bridge Data Centres (BDC) together with ByteDance announced the opening of BDC’s first phase hyperscale data center (MY06) in Sedenak, Johor, Malaysia.

- NVIDIA Corporation, a technology company known for designing and manufacturing graphics processing units (GPUs) announced about NVIDIA Spectrum-4. It is the next generation of its Ethernet platform which enables the extreme networking performance and robust security needed for data center infrastructure at scale.

- Report ID: 4912

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hyperscale Data Center Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.