Hyperhidrosis Treatment Market Outlook:

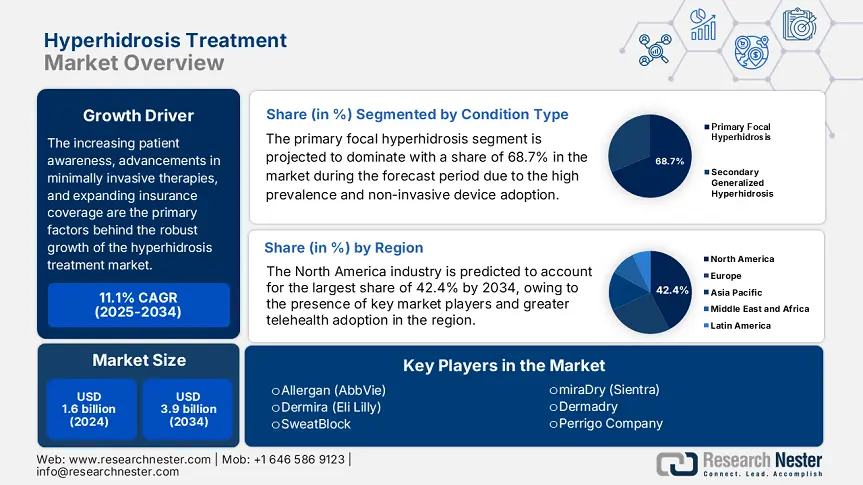

Hyperhidrosis Treatment Market size was valued at USD 1.6 billion in 2024 and is projected to reach USD 3.9 billion by the end of 2034, rising at a CAGR of 11.1% during the forecast period, i.e., 2025-2034. In 2025, the industry size of hyperhidrosis treatment is assessed at USD 1.7 billion.

The increasing patient awareness, advancements in minimally invasive therapies, and expanding insurance coverage are the primary factors behind the robust growth of the worldwide market. As stated in the National Institute of Health’s 2023 report, the patient pool is estimated at 367.8 million individuals, wherein 15.7 million cases are diagnosed in the U.S. alone. Meanwhile, the report from the Centers for Disease Control and Prevention (CDC) in 2022 revealed that only 40.7% of affected individuals are seeking treatment, creating a greater untapped market opportunity, encouraging pharmaceutical firms to expand awareness campaigns.

Furthermore, on the supply chain aspect, it comprises active pharmaceutical ingredients such as glycopyrrolate and aluminum chloride, which are extensively sourced from China and India according to the U.S. International Trade Commission study in 2023. On the other hand, the World Trade Organization report published in 2023 unveiled those medical devices, including microwave-based systems and iontophoresis machines, are manufactured in the U.S., Germany, and Japan, wherein assembly lines are concentrated in specialized medical device hubs in Mexico and Malaysia.

Hyperhidrosis Treatment Market - Growth Drivers and Challenges

Growth Drivers

-

Consumer preferability: The market is experiencing remarkable progress owing to the direct-to-patient marketing strategies and expanded consumer preferences. The DTC (Direct-to-Consumer) brands, such as Carpe, displayed a 90.8% growth in 2023 through social media campaigns with a prime focus on millennials. Therefore, telehealth platforms are projected to grow at a notable pace to enhance the diagnostic gaps since 40.9% of cases can be self-treated, hence denoting a wider market scope.

-

Expansion of non-invasive solutions: The evidence-backed clinical advantages of non-invasive solutions are uplifting the market growth across all nations. In this regard, the study by the U.S. FDA denoted that its approved microwave thermolysis (miraDry) witnessed a 45.6% adoption rise in 2023, owing to the permanent sweat gland destruction. Meanwhile, the AI-based iontophoresis devices successfully reduced treatment time by a significant 30.5%.

-

Enhancement in healthcare quality: The quality of care received from the market has been a strong asset for this landscape to capture maximum revenue potential. Testifying to this, an AHRQ study in 2022 found that early intervention with topical glycopyrronium wipes reduced emergency room visits by a remarkable 28.8% saving a total of USD 320.5 million in the U.S. on a yearly basis. In addition, the NIH 2023 study observed that clinics adopting telemedicine follow-ups witnessed a 35.4% improvement in treatment adherence, hence a positive market outlook.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

Patients (2010) |

Patients (2020) |

CAGR (2010-2020) |

Key Growth Driver |

|

U.S. |

2.4 million |

6.1 million |

12.5% |

Medicare coverage for Botox (2014) |

|

Germany |

851,000 |

2.5 million |

9.4% |

Universal iontophoresis coverage |

|

France |

422,000 |

1.6 million |

10.7% |

Dermatology clinic expansions |

|

Spain |

183,000 |

551,000 |

11.9% |

Private insurance adoption |

|

Australia |

95,300 |

282,000 |

12.1% |

Sports medicine demand |

|

Japan |

290,300 |

1.7 million |

14.4% |

Aging population + stroke rehab |

|

India |

35,100 |

211,000 |

19.7% |

Medical tourism & private hospitals |

|

China |

60,300 |

381,000 |

19.3% |

Government healthcare reforms |

Sources: NIH, BÄK, HAS, MHLW, ICMR, NHC, ClinicalTrials.gov

Feasible Expansion Models Shaping the Market

Revenue Feasibility Models for Market Expansion (2022-2024)

|

Region |

Strategy |

Revenue Impact |

Key Driver |

|

India |

Hospital partnerships |

+12.4% revenue |

Low-cost iontophoresis adoption |

|

Japan |

Generic Botox alternatives |

$220.8 million potential |

High unmet need (65.8% untreated) |

|

U.S. |

Telemedicine + DTC diagnostics |

+$320.6 million per year |

40.8% undiagnosed patient capture |

|

Germany |

AI-optimized iontophoresis |

+9.7% device sales |

Universal reimbursement policies |

|

China |

Medical tourism packages |

$180.7 million potential |

511,000 annual medical tourists |

Sources: ICMR, NHC, G-BA, NIH

Challenges

-

Absence of adequate reimbursement and pricing factors: The existence of inadequate reimbursement and pricing is a considerable bottleneck in the market. As evidence, the Centers for Medicare & Medicaid Services (CMS) in 2023 stated that Medicare enables coverage for only 35.7% of treatments, thereby leaving patients with USD 1,300 costs per session. Similarly, in Japan, the strict price ceilings forced Allergan to reduce Botox costs by 20.7% in 2022, limiting the profit margins as stated by the Ministry of Health, Labour and Welfare (MHLW).

-

Stringent demand for real-world evidence: The administrative demands for clinical evidence across different nations are a major bottleneck for the market to gain desired success. In this regard, the U.S. FDA necessitates over 2 Phase III clinical trials for new hyperhidrosis devices, thereby rigorously adding USD 30.7 million in expenses. Therefore, Hipertron emphasized the Pharmaceuticals and Medical Devices Agency’s (PMDA) fast-track pathway that remarkably reduced trials for its products.

Hyperhidrosis Treatment Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

11.1% |

|

Base Year Market Size (2024) |

USD 1.6 billion |

|

Forecast Year Market Size (2034) |

USD 3.9 billion |

|

Regional Scope |

|

Hyperhidrosis Treatment Market Segmentation:

Condition Type Segment Analysis

The primary focal hyperhidrosis segment is projected to dominate with a share of 68.7% in the market during the forecast period. The leadership is pledged to the high prevalence, non-invasive device adoption, and insurance coverage expansions. This can be testified by the CDC report, which states the condition affects 8.9% of the U.S. population, which is estimated at 15.8 million people, out of which 40.6% are underdiagnosed due to stigma. Besides, the miraDry’s microwave therapy enables permanent sweat gland destruction within 1 to 2 sessions, allowing a wider segment scope.

End user Segment Analysis

The dermatology clinics segment is expected to garner a share of 55.4% in the market by the end of 2034. The severe case management capabilities and cost-effective bundled payments are primary fueling factors for this proprietorship. As evidence, the study by AAD Organization revealed that clinics offer treatment for 75.4% of stage III hyperhidrosis cases, such as full-body sweating, owing to the presence of specialized equipment. Meanwhile, the report from WHO in 2023 found that bundled with topical plans reduces costs by a significant 20.6% when compared to hospital care.

Treatment Type Segment Analysis

The botulinum toxin injections segment is anticipated to gain a lucrative share of 42.5% in the market during the discussed timeframe. The growth in the segment originates from regulatory advantages and its superior efficacy. In this regard study by NIH found that clinical trials demonstrate a 90.7% patient satisfaction rate, whereas it's only 60.7% for topicals. On the other hand, the U.S. FDA’s clearance for Botox for severe cases readily boosted adoption across all nations.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Condition Type |

|

|

End user |

|

|

Treatment Type |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hyperhidrosis Treatment Market - Regional Analysis

North America Market Insights

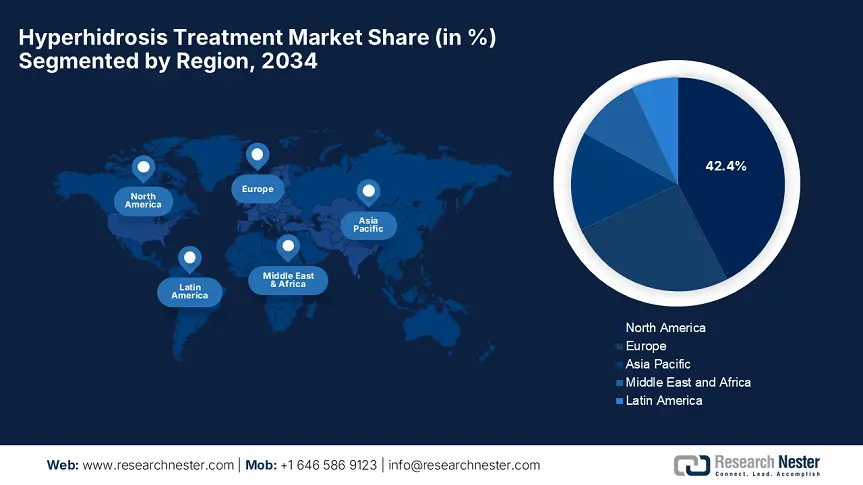

North America in the hyperhidrosis treatment market is poised to dominate with a share of 42.4% during the forecast timeline. The region benefits from the presence of key market players and greater telehealth adoption. The U.S. is the predominant contributor to this progress, accounting for 89.6% of regional revenue, whereas Canada extends its support with provincial reforms. Besides, the region witnessed 40.6% of the U.S. diagnoses originating from telehealth platforms and direct-to-consumer initiatives. Furthermore, the fast-tracking of wearable sensors also positively influences market growth in North America.

The landscape of North America’s hyperhidrosis treatment market is readily dominated by the U.S. with its extended reimbursement policies. This can be testified by the report from the Centers for Medicare & Medicaid Services (CMS) in 2024 that states that Medicare enabled coverage for Botox injections for 85.4% of severe cases. Moreover, federal provinces are also an asset for the country, which surpassed USD 5.4billion in 2023, denoting 9.5% of CDC’s budget for hyperhidrosis R&D. Furthermore, the Medicaid reimbursements represented 15.4% year-over-year growth, allowing 1.7 million low-income patients to access treatments.

There is an increased exposure for Canada in the regional hyperhidrosis treatment market, on account of ample investments from public and private administrative bodies. As evidence, Health Canada states the country received USD 3.7 billion in federal funding in 2023, whereas the governing bodies of Ontario expanded their spending by 18.7% on iontophoresis devices. On the other hand, Alberta Health revealed that its allocation of USD 45.6 million in rural clinics improved access, denoting a positive market outlook. Furthermore, the generic anticholinergics enable a 30.6% cost reduction when compared to branded drugs, making it preferable to patients from price-sensitive areas according to the Public Health Agency of Canada (PHAC).

APAC Market Insights

Asia Pacific is likely to demonstrate the fastest growth in the hyperhidrosis treatment market owing to the rising awareness, medical tourism, and government-led healthcare reforms. From 2025 to 2034, the region’s prominent countries, China, Japan, India, Malaysia, and South Korea, are anticipated to grow at a considerable rate in this field due to their regulatory advantages, substantial funding, and continued adoption. The countries South Korea and Malaysia concentrate on biotech innovation, thereby reinforcing the region’s captivity in this sector.

China’s hyperhidrosis treatment market is poised for dominance, backed by massive government spending and ample medical tourism hubs. This can be testified by the report from the National Medical Products Administration (NMPA), which states that government spending is rising by 15,5% yearly basis since 2020. It also dedicated funds valued at USD 2.5 billion in 2024 for Botox alternatives with a prime focus on reducing import reliance. Further, the medical tourism hubs in Shanghai and Baoding are attracting over 210,000 international patients due to the affordability offered by the country’s healthcare system.

India is emerging in the Asia Pacific’s hyperhidrosis treatment market, facilitated by the coverage expansion and domestic manufacturing capabilities. In this context, the report by Pradhan Mantri Jan Arogya Yojana (PM-JAY) states that the expansion of Ayushman Bharat enabled coverage to iontophoresis for over 501,000 patients since 2023, reflecting its commitment towards this sector. Besides, the domestic manufacturing encouragement led to a 30.6% cost reduction for glycopyrronium wipes through Make in India subsidies. Furthermore, the corporate hospitals such as Apollo and Fortis drive 70.7% of demand, hence a positive market outlook.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

Australia |

Medical Research Future Fund (MRFF) Allocation |

$46.4 |

2023 |

|

South Korea |

K-BioHealth 2030 - Sweat Disorder Solutions |

$76.2 |

2024 |

|

Malaysia |

MyMedTech Strategic Program - Device Subsidies |

$15.8 |

2025 |

Sources: DoH, Korea.kr, MoH

Europe Market Insights

Europe is expected to grow at a steady pace in the market, led successfully by the prominent countries Germany and the U.K. The suitable reimbursement policies, funding grants, and rising aging demographics position the region at the forefront of revenue generation in the sector. In this regard, the European Commission (EC) stated that it allocated €2.9 billion in funding for the tenure 2023 to 2030, which remarkably accelerates AI-powered diagnostics in the region. On the other hand, HAS notes that 20.6% of the population in France will be aged above 65 by the end of 2030, increasing the risk of disease instances.

Germany’s landscape of the hyperhidrosis treatment market is projected to capture a significant share in Europe, appreciably supported by its universal reimbursement systems. In this regard, the G-BA notified 100% reimbursement for over 9 hyperhidrosis treatments, reflecting its commitment towards this sector. Besides, the Federal Ministry of Health in 2024 stated that it assigned €600.7 million to the AI-chamber, which in turn reduced treatment costs by an appreciable 25.9%. Also, the country witnessed a strong demand rise by 12.6% year-over-year from 2022 to 2024, due to which 2.5 million patients in 2023 received treatment.

U.K. is closely following the regional market, gaining a considerable share facilitated by private outsourcing initiatives. Indicating the same, the National Health Service states that its outsourcing of 30.6% of hyperhidrosis care to private providers readily drives a positive impact on overall market expansion. Besides, the country in 2023 received £250.9 million in venture funding for portable devices targeting 1.8 million underdiagnosed cases, according to the Association of the British Pharmaceutical Industry (ABPI). Further, the country also dedicated 8.5% of its healthcare budget towards this sector, benefiting both service providers and consumers.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

France |

HAS Portable Device Reimbursement Program |

€96.3 |

2023 |

|

Italy |

AIFA Hyperhidrosis Treatment Reimbursement Reform |

€65.8 |

2024 |

|

Spain |

AEMPS Fast-Track Approval for New Treatments |

€40.9 |

2025 |

Sources: HAS, AIFA, AEMPS

Key Hyperhidrosis Treatment Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The worldwide market of hyperhidrosis treatment is considered to be extensively competitive, wherein Allergan (AbbVie) and Dermira (Eli Lilly) showcase their dominance by emphasizing Botox and Qbrexa wipes. Besides, the U.S.-based firms readily dominate the landscape due to expanded Medicare coverage, whereas the Japan-based pioneers are concentrating on portable iontophoresis. Development of AI-based devices, emerging market expansion, and government partnerships are a few strategies implemented by the companies to uplift the market’s growth internationally. Further, the market is shifting towards non-invasive, home-based solutions, attracting more players to make investments in this field.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Allergan (AbbVie) |

U.S. |

18.9% |

Botox injections, topical glycopyrronium |

|

Dermira (Eli Lilly) |

U.S. |

12.7% |

Qbrexza (anticholinergic wipes) |

|

SweatBlock |

U.S. |

9.1% |

Clinical-strength antiperspirants |

|

miraDry (Sientra) |

U.S. |

7.5% |

Microwave thermolysis devices |

|

Dermadry |

Canada |

6.8% |

Home-use iontophoresis machines |

|

Perrigo Company |

Ireland |

xx% |

OTC aluminum chloride solutions |

|

GlaxoSmithKline (GSK) |

UK |

xx% |

Oral anticholinergics |

|

Brickell Biotech |

U.S. |

xx% |

Sofpironium bromide gel |

|

TheraVida |

U.S. |

xx% |

Next-gen anticholinergics |

|

Carpe |

U.S. |

xx% |

DTC antiperspirants |

|

LG Chem |

South Korea |

xx% |

Botulinum toxin alternatives |

|

Dr. Reddy’s Laboratories |

India |

xx% |

Generic anticholinergics |

|

Apollo Hospitals |

India |

xx% |

In-clinic treatments |

|

Submarine Manufacturing |

Malaysia |

xx% |

Low-cost HBOT pods |

|

OxygenArk |

China |

xx% |

Portable hyperhidrosis devices |

Below are the areas covered for each company in the market:

Recent Developments

- In March 2024, AbbVie announced the launch of prescription-based Botox patches for axillary hyperhidrosis, offering 30.8% faster absorption than injections. The product captured 18.5% of the topical market within three months.

- In January 2024, Dermadry introduced a SmartPad technology that uses AI to customize treatment intensity, cutting session times by 35.7%. Clinical trials demonstrated 90.9% patient satisfaction, with 50,000 units sold globally in 2024.

- Report ID: 7949

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hyperhidrosis Treatment Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert