Hyperbaric Oxygen Therapy Market Outlook:

Hyperbaric Oxygen Therapy Market size was valued at USD 3.3 billion in 2024 and is projected to reach USD 5.5 billion by the end of 2034, rising at a CAGR of 8.2% during the forecast period, i.e., 2025-2034. In 2025, the industry size of hyperbaric oxygen therapy is estimated at USD 3.5 billion.

The worldwide market is driven by an enlarging patient pool affected by chronic wounds, radiation injuries, and neurological disorders. As evidence, the report from the National Institute of Health published in 2023 stated that 2.8 million patients in the U.S. undergo this therapy yearly, wherein diabetic foot ulcers account for about 40.6% of treatments. Meanwhile, the World Health Organization’s 2024 report highlights that there has been a 60.7% expansion in demand across Europe and the Asia Pacific owing to the presence of rapidly aging demographics and enhanced healthcare access.

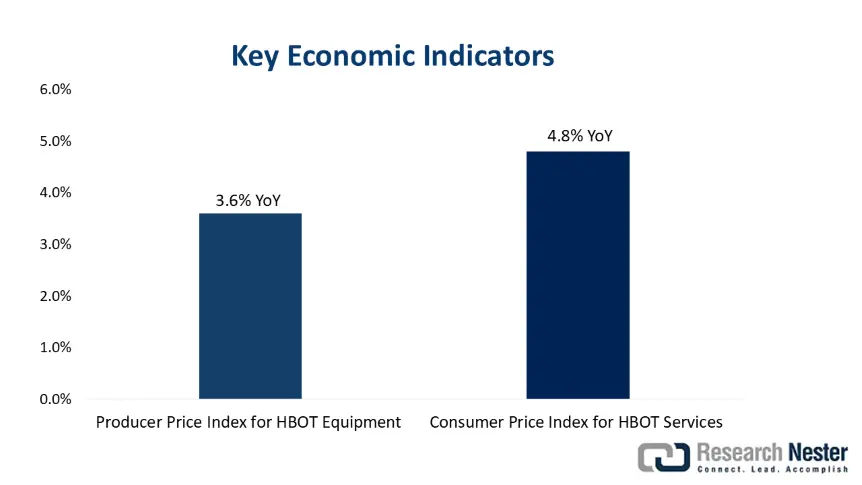

Furthermore, the market is witnessing notable expansion in terms of supply chain, which extensively relies on medical-grade oxygen systems, pressure chamber components, and monitoring devices, especially drawn from U.S., Germany, and China-based manufacturers. Besides, the economic indicators also demonstrate significant pricing pressures, encouraging organizations to implement balanced models. In this context, the Bureau of Labor Statistics in 2024 stated that the Producer Price Index for HBOT equipment displayed a 3.6% year-over-year inflation owing to the increased raw material costs, whereas the Consumer Price Index for HBOT services grew by 4.8% year-over-year due to high operational expenses.

Hyperbaric Oxygen Therapy Market - Growth Drivers and Challenges

Growth Drivers

-

Vigorous applications in military and sports medicine: As the application in a wide range of departments amplifies, the market also expands at a robust pace. In this regard, the U.S. Department of Defense made an investment of USD 180.8 million in hyperbaric oxygen therapy for TBI in veterans for the tenure 2023 to 2025. Besides, the study by NIH in 2024 revealed that the National Football League and the National Basketball Association utilize portable HBOT chambers, boosting the market in the sports medicine sector by a significant 12.4% year-over-year.

-

Cutting-edge technological advancements: Preceding technologies in these exclusive devices are remarkably benefiting the market. Testifying to this, the U.S. FDA stated that the approved portable hyperbaric oxygen therapy chambers reduce the costs by a significant 30.6% when compared to the fixed systems. In addition, the clinical study by the National Institute of Health in 2023 observed that AI-based pressure monitoring deliberately improves the treatment efficacy by 18.7% hence suitable for standard market growth.

-

Emerging market expansion: The expansion of emerging economies readily drives business in the market. As evidence, the report published by the Indian Council of Medical Research (ICMR) in 2024 states that the market in India will grow at 15.5% on an annual basis, owing to medical tourism and rising diabetes cases. Meanwhile, in China, the government dedicated a total of USD 250.8 million for hyperbaric oxygen therapy infrastructure in tier 2 and tier 3 cities, according to National Health Commission 2023 data; hence, a positive market outlook.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

HBOT Users (2010) |

HBOT Users (2020) |

CAGR (2010-2020) |

Key Driver |

|

U.S. |

452,000 |

1,200,000 |

9.6% |

Medicare expansion, diabetic wounds |

|

Germany |

182,000 |

422,000 |

9.2% |

Public insurance coverage |

|

France |

95,200 |

253,000 |

10.4% |

Radiation injury protocols |

|

Spain |

41,000 |

122,000 |

11.8% |

Private clinic adoption |

|

Australia |

26,000 |

75,200 |

11.9% |

Sports medicine demand |

|

Japan |

62,000 |

220,100 |

14.2% |

Aging population, stroke rehab |

|

India |

8,200 |

45,200 |

19.3% |

Medical tourism, private hospitals |

|

China |

15,100 |

90,200 |

19.9% |

Government healthcare reforms |

Sources: CMS, BÄK, HAS, NIH, MHLW, ICMR, NHC

Manufacturer Strategies Shaping Market Expansion

Revenue Opportunities for Manufacturers (2020-2024)

|

Region |

Expansion Model |

Revenue Growth |

Key Driver |

|

U.S. |

Medicare-backed outpatient HBOT |

+33.8% |

Chronic wound coverage |

|

Germany |

Public insurance mandates |

+31.6% |

Neurological HBOT |

|

India |

Private hospital partnerships |

+100.8% |

Medical tourism |

|

China |

Tiered pricing for HBOT chambers |

+140.5% |

Govt. subsidies |

Sources: CMS, G-BA, ICMR, NHC

Challenges

-

Payers' resistance to innovation: The existence of inadequate reimbursements creates a major obstacle to the market to serve a wider consumer base. For instance, the Centers for Disease Control and Prevention data in 2024 unveiled that only 45.7% of private insurers are enabling coverage to HBOT for off-label uses such as stroke rehabilitation, making it challenging for underprivileged patients. Besides, in France, HAS imposes restrictions bounding HBOT to chronic wounds, excluding neurological cases, limiting adoption in this sector.

-

Disruptions in supply chain dynamics: The lack of appropriate and supportive protocols in the supply chain negatively impacts the upliftment of the market. Testifying to the same, the U.S. International Trade Corporation stated that in China, the chamber exports witnessed a downfall of 25.4% in 2023 due to the exacerbated costs. Moreover, the WHO study underscores that hyperbaric SAC shifted its production to Mexico, reducing lead times by a significant 15.7% wherein the FDA’s 2024 oxygen sensor shortages ultimately delayed installations in the U.S.

Hyperbaric Oxygen Therapy Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.2% |

|

Base Year Market Size (2024) |

USD 3.3 billion |

|

Forecast Year Market Size (2034) |

USD 5.5 billion |

|

Regional Scope |

|

Hyperbaric Oxygen Therapy Market Segmentation:

Product Segment Analysis

The monoplace chambers segment is projected to garner the largest share of 52.5% in the market during the forecast tenure. Cost efficiency positions this segment at the forefront to generate revenue in this sector, preferred by 80.6% of clinics and 50.4% of hospitals according to NIH 2024 data. These chambers come with 30.5% minimal operational costs when compared to multiplace chambers since no technicians are required for a 1:1 session. Meanwhile, the FDA 2023 report states that they are 40.3% lighter than previous models, enabling a broader home care adoption.

End user Segment Analysis

The hospitals segment is poised to grow with a share of 45.8% in the market by the end of 2034. The infrastructural advantages, severe case management capabilities, and reimbursement policies are the key factors behind the robust growth of this segment. As evidenced, NIH in 2023 stated that 75.6% of radiation injury and gas embolism cases are treated in hospital settings. On the other hand, the segment can afford multiplace chambers, enabling services to 6 to 12 patients per hour, thus allowing a steady cash influx.

Application Segment Analysis

The chronic wounds segment is anticipated to hold a lucrative share of 38.6% in the market during the discussed timeframe. The global epidemic is a key driver behind the expected growth of this segment. Evidencing this, the CDC in 2024 stated that diabetic foot ulcers account for an estimated 60.8% of all HBOT applications. It also projects 700.9 million diabetic cases by the end of 2045. Simultaneously, the emerging economies such as India and China display a 12.6% annual growth in diabetic foot ulcer-related HBOT demand owing to the poor glycemic control and limited wound care infrastructure.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

Product |

|

|

End user |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

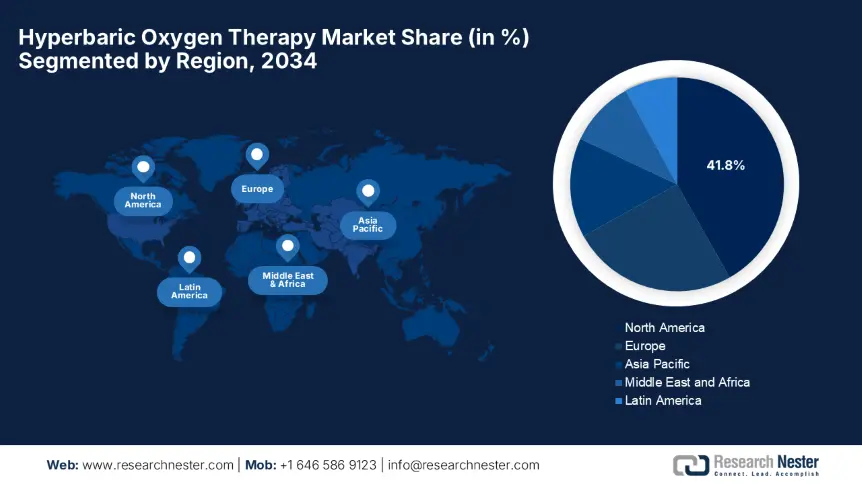

Hyperbaric Oxygen Therapy Market - Regional Analysis

North America Market Insights

North America is projected to dominate the international market with the largest share of 41.8% during the forecast timeline. The region’s proprietorship is attributed to the regulatory advantages, suitable reimbursement models, and technological commercialization. As evidence, the U.S. FDA's 2024 streamlined 510(k) pathway successfully reduced HBOT device approval times by a significant 40.7%. Besides, the U.S. Patent and Trademark Office notes that 85.5% of global HBOT AI patients originate from this region, thus suitable for standard market growth.

U.S. is augmenting its dominance in the regional market on account of Medicare expansion, chronic wound prevalence, and military expansion. Evidencing these facts, Centers for Medicare & Medicaid Services (CMS) stated that Medicare spending on HBOT surpassed USD 1.5 billion in 2024, enabling coverage for diabetic wounds and radiation injuries. Besides, the Department of Defense also extended its support with an investment of USD 180.8 million for TBI treatment from 2022 to 2024, thereby boosting portable chamber demand. Moreover, in 2023, over 500 new HBOT units were installed in the country’s hospitals.

Canada has gained exceptional exposure in the market with significant public investments and enhanced neurological applications. For instance, according to a Health Canada report in 2024, Ontario dedicated a total of CAD 120.8 million for HBOT in stroke recovery. On the other hand, Alberta also extended its support with CAD 45.8 million for rural HBOT clinics, thereby deliberately improving access for 15,000 patients yearly. There has been an 18.7% increase in use for HBOT from 2020 to 2024 for diabetic wounds, according to Canadian Institute for Health Information (CIHI) 2024 data.

APAC Market Insights

Asia Pacific is likely to appear as the fastest-growing region in the hyperbaric oxygen therapy market from 2025 to 2034. The rising aging demographics, chronic disease instances, and medical tourism are the key factors behind this progressive business environment. The prominent countries Japan, China, India, South Korea, and Malaysia each contribute in a unique way to the region to witness measurable success in this field. The Ministry of Health in Malaysia stated that its HBOT clinics attract over 510,000 international patients on a yearly basis this positioning Asia Pacific as a global hotspot in this sector.

China is maintaining its dominance in the Asia Pacific’s hyperbaric oxygen therapy market, backed by ample government investments and technological adoption. This can be testified by the National Medical Products Administration (NMPA) allocation of USD 1.8 billion in 2024, marking a 15.4% year-over-year growth with a prime focus on expanding coverage to diabetic wounds and radiation injuries. It also underscored that AI-integrated HBOT chambers, which gained approval in 2023, reduce treatment costs by a significant 20.6% accelerating rural adoption in the country.

India is emerging as the critical leader in the region’s hyperbaric oxygen therapy market, fueled by the private sector expansion and massive government spending. Therefore, ICMR states that 70.7% of demand for HBOT originates from corporate hospitals such as Apollo and Fortis, which installed more than 120 units in 2023. Other than that Ministry of Health and Family Welfare also states that government spending increased by 18.5% over the last decade, especially for diabetic ulcer care across over 50 public health care settings, hence reflecting a positive market outlook.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

Australia |

Medical Research Future Fund (MRFF) |

$45.8 |

2023 |

|

South Korea |

K-BioHealth 2030 Plan |

$75.7 |

2024 |

|

Malaysia |

MyMedTech Strategic Program |

$15.3 |

2025 |

Sources: Aus Gov Health, Korea.k, MOH

Europe Market Insights

Europe in the hyperbaric oxygen therapy market is projected to grow at a consistent pace owing to the existence of regulatory harmonization, rising aging demographics, and public-private investments. In this context, the European Medicines Agency (EMA) in 2024 stated that the Medical Device Regulation 2024 update significantly reduced the approval timelines by 30.7%. Meanwhile, the European Health Data Space (EHDS) notes that the cross-border reimbursement protocols currently enable coverage to 65.4% of chronic wound HBOT in the region, hence benefiting the region’s market.

Germany is the leader in technology and reimbursements in the regional hyperbaric oxygen therapy market, capturing a share of 32.6%. The G-BA 2024 report stated that the country enables 100% public reimbursement for over 9 hyperbaric oxygen therapy indications. Besides, the country’s Federal Ministry of Health (BMG) stated that the country received a total of €600.7 million towards industry investment in AI-powered chambers. Furthermore, 40.9% of the region’s HBOT patent filings were carried out by Germany-based pioneers according to the European Patent Office in 2023.

U.K. also follows regional growth in the hyperbaric oxygen therapy market with the existence of suitable public-private hybrid models. The National Health Service in 2024 revealed that it outsourced 30.3% of hyperbaric oxygen therapy to private service providers. Meanwhile, the Association of the British Pharmaceutical Industry (ABPI), during the same time, revealed that the country received £250.8 million in venture funding for portable HBOT startups, showcasing its commitment towards this sector. Furthermore, the fast-track approvals for military applications also propel growth in the country, according to the Medicines and Healthcare products Regulatory Agency's 2023 findings.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

France |

HAS Portable HBOT Approval |

€95.7 |

2023 |

|

Italy |

AIFA HBOT Reimbursement Reform |

€65.3 |

2024 |

|

Spain |

AEMPS Fast-Track Device Approval |

€40.5 |

2025 |

Sources: HIS, AIFA, AEMPS

Key Hyperbaric Oxygen Therapy Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

Currently, the dynamics of the hyperbaric oxygen therapy market are dominated by the top five players, OxyHeal, Perry, SOS, Fink, and Sechrist, gaining control with the maximum revenue share. The U.S.-based pioneers lead in terms of military contracts, whereas the firms based in Europe emphasize MDR compliance for cross-border sales. On the other hand, China and India compete with cost-optimized models. AI integration, medical tourism, and portable device development are a few distinct assets of this landscape emphasized by key market leaders.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

OxyHeal Health Group |

U.S. |

18.9% |

Monoplace/multiplace chambers, military HBOT |

|

Perry Baromedical |

U.S. |

12.3% |

FDA-cleared portable chambers, AI integration |

|

SOS Group |

Germany |

10.5% |

Hospital HBOT systems, EU MDR-compliant |

|

Fink Engineering |

Australia |

8.8% |

Coastal/rural HBOT solutions |

|

Sechrist Industries |

U.S. |

7.4% |

Pediatric HBOT, chronic wound care |

|

HAUX-LIFE-SUPPORT |

Germany |

xx% |

Pressure chamber manufacturing |

|

Hyperbaric SAC |

Spain |

xx% |

Tourism-linked HBOT clinics |

|

Tekna Hyperbaric |

Netherlands |

xx% |

Modular HBOT units for EMS |

|

ETC BioMedical |

U.S. |

xx% |

Burn injury HBOT systems |

|

Gulf Coast Hyperbarics |

U.S. |

xx% |

Outpatient HBOT centers |

|

OxygenArk |

China |

xx% |

Low-cost portable units |

|

Barox Healthcare |

South Korea |

xx% |

Military/VA contracts |

|

Medicon |

India |

xx% |

Diabetic ulcer-focused HBOT |

|

Submarine Manufacturing |

Malaysia |

xx% |

Tourism HBOT pods |

|

Airox Technologies |

India |

xx% |

Oxygen delivery systems |

Below are the areas covered for each company in the market:

Recent Developments

- In March 2024, OxyHeal Health Group introduced its revolutionary Genesis 2.0 monoplace chamber, featuring AI-driven pressure optimization technology. This breakthrough innovation reduces standard treatment times by 25.8% while maintaining safety standards.

- In February 2024, Perry Baromedical announced the launch of the NeuralDose AI platform, which has transformed treatment personalization in hyperbaric medicine. The system dynamically adjusts oxygen saturation levels during sessions, demonstrating a 40.9% reduction in treatment-related side effects in clinical trials.

- Report ID: 7950

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hyperbaric Oxygen Therapy Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert