Hygiene Packaging Market Outlook:

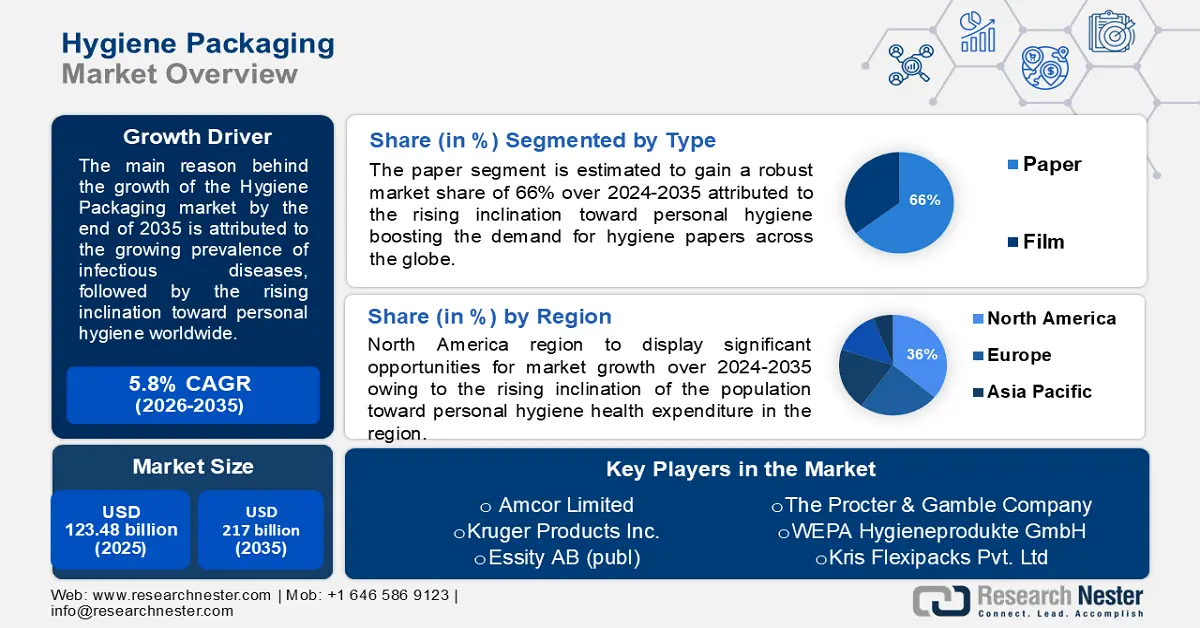

Hygiene Packaging Market size was valued at USD 123.48 billion in 2025 and is set to exceed USD 217 billion by 2035, registering over 5.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hygiene packaging is estimated at USD 129.93 billion.

The growth of the market can be attributed to the growing prevalence of infectious diseases, followed by the rising inclination toward personal hygiene among people throughout the world. For instance, it was estimated that in the United States, around 3.5 million people visited the emergency department with parasitic and infectious diseases in 2018. Further, the growing consumption of packaged products where hygiene packaging is being used to protect the product from any kind of damage or contamination is another significant factor that is estimated to accelerate the growth of the market over the forecast period.

In addition to these, factors that are believed to fuel the market growth of hygiene packaging include the rise in the demand for antibacterial hygiene packaging products to meet better life expectancy, along with the soaring growth in the packaging sector. For instance, packaging is one of India's fastest-growing industries, with around a 28% annual rate of expansion. Besides this, the surge in the collaboration between major key players to discover more sustainable alternatives in the array of packaging is also anticipated to present positive opportunities for the growth of the global hygiene packaging market in the coming years. Additionally, escalating demand and sales of sanitizer, napkins, diapers and other personal hygiene products are further expected to hike the growth of the market over the forecast period. As of 2020, around 270 million Americans were observed to be using soap and the number is estimated to reach nearly 280 million by 2024. Hence, all these factors are estimated to boost the growth of the market over the forecast period.

Key Hygiene Packaging Market Insights Summary:

Regional Highlights:

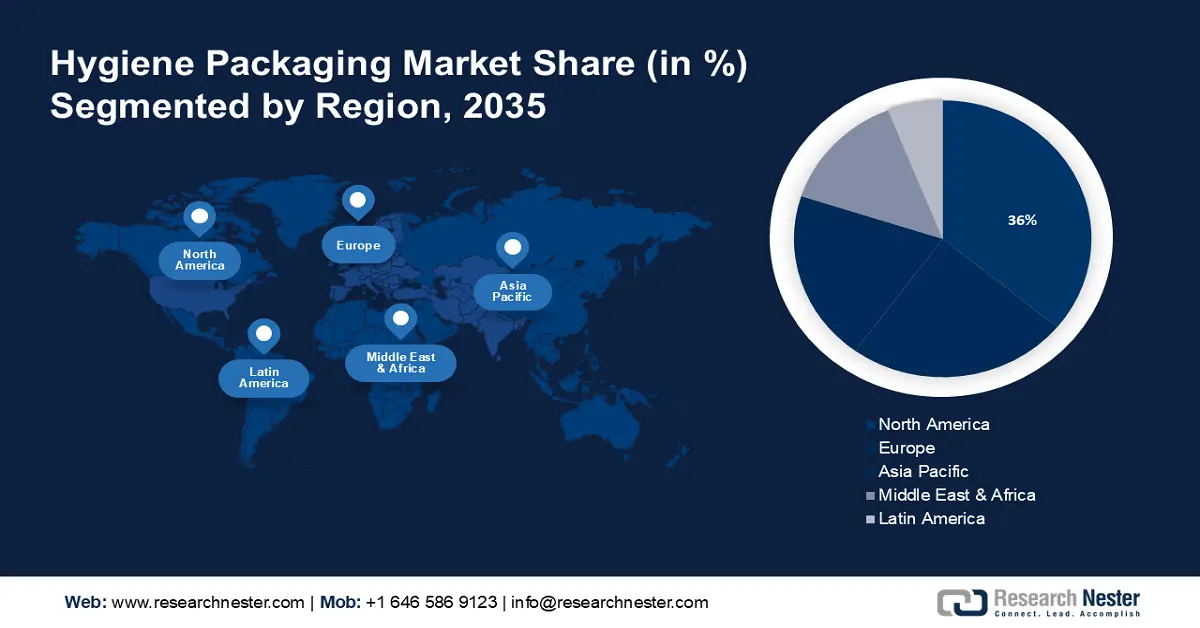

- North America hygiene packaging market will secure around 36% share by 2035, driven by growing personal hygiene awareness, high health expenditure, and advanced hygiene packaging manufacturing facilities.

- Europe market will achieve notable growth during the forecast timeline, driven by increasing hygiene awareness, growing population, and rising demand for feminine and incontinence products.

Segment Insights:

- The paper segment in the hygiene packaging market is projected to experience noteworthy growth over 2026-2035, driven by rising personal hygiene awareness and global population growth.

- The food & beverages segment in the hygiene packaging market is expected to secure a significant share by 2035, driven by the increasing consumption of convenience and ready-to-eat food.

Key Growth Trends:

- Exponential Growth in the Inclination Toward Sanitization

- Growing Prevalence of Infectious Disease

Major Challenges:

- Negative Impact on the Environment

- Presence of Alternative Products

Key Players: Amcor Limited, Kruger Products Inc., Essity AB (publ), The Procter & Gamble Company, WEPA Hygieneprodukte GmbH, Kris Flexipacks Pvt. Ltd, KIMBERLY-CLARK CORPORATION, Amerplast Ltd, Georgia-Pacific LLC, Soffass S.p.A.

Global Hygiene Packaging Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 123.48 billion

- 2026 Market Size: USD 129.93 billion

- Projected Market Size: USD 217 billion by 2035

- Growth Forecasts: 5.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Russia, Indonesia

Last updated on : 10 September, 2025

Hygiene Packaging Market Growth Drivers and Challenges:

Growth Drivers

-

Exponential Growth in the Inclination Toward Sanitization - A report by the World Health Organization demonstrated that 54% of the people across the globe, summing up to 4.2 billion, utilized safely managed sanitation services in 2020. Sanitization is important since it is associated with the safe disposal of human waste. It can be further described as the process that makes places free from infection, diseases, dirt, and others. In recent years, as of the break out of COVID-19, the process of sanitization became very popular. Hence, the higher demand for products necessary for sanitization is estimated to flourish the growth of the market over the forecast period.

-

Growing Prevalence of Infectious Disease - As per the report published by the Centers for Disease Control and Prevention, in 2019, the count of tuberculosis cases reached 8,916 in the United States. Whereas, salmonella cases touched off at 58,371.

-

Increasing Awareness of Food Safety - The World Health Organization states that in every 10 people, 1 of them dies as of the consumption of contaminated food, while the annual rate of such deaths is projected by about 420,000 across the globe.

-

Higher Export and Import Volume of Medicines - For instance, the total sales generated from the globally exported drugs were anticipated to be nearly USD 370 billion in 2018. Additionally, pharmaceutical products were recognized as the world’s 6th highly traded products.

-

Significant Increment in E-Commerce Sales - As of 2021, the worldwide E-commerce sales volume was valued at about USD 5 trillion. Furthermore, more than 20 million E-commerce sites were noticed to be functioning in 2022 throughout the world.

Challenges

- Negative Impact on the Environment - Several hygiene packaging materials consist of plastic polymer. Increasing usage of hygiene products may negatively influence the environment by generating a large amount of packaging waste. Such packaging waste may contain some specific kinds of toxicological and eco-toxicological properties, that can negatively affect the environment. Hence, this factor is anticipated to hinder the growth of the market during the projected time frame.

- Presence of Alternative Products

- Disrupted Supply Chain as of COVID-19

Hygiene Packaging Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.8% |

|

Base Year Market Size (2025) |

USD 123.48 billion |

|

Forecast Year Market Size (2035) |

USD 217 billion |

|

Regional Scope |

|

Hygiene Packaging Market Segmentation:

Type Segment Analysis

The global hygiene packaging market is segmented and analyzed for demand and supply by type into film, paper, and others. Out of these three types of segments, the paper segment is projected to witness noteworthy growth over the forecast period. The growth of the segment can be attributed to the rising inclination toward personal hygiene boosting the demand for hygiene papers across the globe. For instance, the total consumption of tissue paper worldwide was estimated to be around 40 million tons in 2021 and is projected to reach approximately 50 million tons by 2032. There are numerous uses for tissue and hygiene paper products, which are available in a vast variety. The primary function of tissue paper is to enhance people's standard of living, and good packaging preserves its worth. Moreover, the worldwide surge in population is another significant factor that is projected to accelerate the growth of the segment throughout the projected time frame.

End-user Segment Analysis

The global hygiene packaging market is also segmented and analyzed for demand and supply by end-user into food and beverages, personal care & cosmetics, pharmaceutical, home care & toiletries, and others. Amongst these segments, the food & beverages segment is expected to garner a significant share. Evolving lifestyle has led to a shift in the eating habits of people. This, as a result, has increased the consumption of convenience food that includes processed food, finger food, frozen food, ready-to-eat food, packaged beverages, and so on across the globe. For instance, in 2020, around 5.40 million people in the United Kingdom consumed chilled or frozen ready-to-eat meals at least once on weekly basis. Therefore, this factor is anticipated to create numerous opportunities for the growth of the segment in the coming years.

Our in-depth analysis of the global market includes the following segments:

|

By Type |

|

|

By End-Use |

|

|

By Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hygiene Packaging Market Regional Analysis:

North American Market Insights

The North America hygiene packaging market, amongst the market in all the other regions, is projected to hold the largest market share by the end of 2035. The growth of the market can be attributed majorly to the rising inclination of the population toward personal hygiene that includes using of deodorant to cover up the smell from body, and the constantly increasing health expenditure. For instance, the health expenditure in the United States was estimated to hit approximately 11,000 U. S. dollars per capita in 2019. In addition, there has been rising use of Further, the presence of advanced technology-based hygiene packaging manufacturing units is also anticipated to contribute to the market’s growth in the region. In addition, to this, the surging demand for toilet tissue paper is also anticipated to boost the market’s growth during the forecast period.

Europe Market Insights

Furthermore, the European hygiene packaging market is also estimated to display notable market growth by the end of 2035. The growth of the market can be attributed to the dynamically increasing awareness regarding personal hygiene and health, coupled with the growing population which is anticipated to boost the growth of the market during the coming years in the region. Besides this, the escalating demand for feminine care products such as sanitary pads, and adult incontinence products is another major factor that is anticipated to propel the growth of the market throughout the forecast period.

Hygiene Packaging Market Players:

- Amcor Limited

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kruger Products Inc.

- Essity AB (publ)

- The Procter & Gamble Company

- WEPA Hygieneprodukte GmbH

- Kris Flexipacks Pvt. Ltd

- KIMBERLY-CLARK CORPORATION

- Amerplast Ltd

- Georgia-Pacific LLC

- Soffass S.p.A.

Recent Developments

-

Essity AB (publ) conducted a health survey by recognizing the upcoming largest threats to well-being. Since, poor hygiene standards were a major concern for global health threats, hence, to identify these threats, Essity Ab and other health companies conducted Global Hygiene and Health Survey 2022.

-

Amcor Limited to introduce sustainable packaging, High Shield Laminates, for pharmaceuticals. This method of packaging is low in carbon, easy to recycle, and capable of supporting companies’ agendas of recyclability.

- Report ID: 4657

- Published Date: Sep 10, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hygiene Packaging Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.