Hydrostatic Transmission Market Outlook:

Hydrostatic Transmission Market size was valued at USD 5.73 billion in 2025 and is expected to reach USD 9.6 billion by 2035, expanding at around 5.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrostatic transmission is evaluated at USD 6 billion.

The hydrostatic transmission market has received considerable attention over the past decade in several industries such as agricultural, construction, and automotive industries due to its inherent advantages such as smooth operation, high efficiency, and variable speed control provision. For instance, in December 2024, Eaton released an automated manual transmission, Advantor designed for commercial vehicles with internal combustion engines (ICEs). Advantor AMTs leverage Eaton's long history of innovation and reliability in automated transmission technology. As industries will continue to focus on sustainability and operational efficiency, there is much room for hydrostatic transmissions to grow not only in existing applications but also in new markets.

Moreover, with the population of the world growing, there is an ever-growing need for more houses, commercial buildings, and infrastructure development. In addition, the urbanization trend has increased demand for major metropolitan construction projects such as the building of skyscrapers, bridges, and highways demand for heavy equipment and machinery. For instance, according to a 2019 report from the Brattle Group, the competitive transmission projects have saved costs at an estimated 20% to 30%. In addition, to strengthen transmission infrastructure in the U.S., in 2022 MISO approved 18 new high-voltage transmission lines (mostly in the Great Lakes area), for an estimated investment of USD 10.3 billion in the grid.

Key Hydrostatic Transmission Market Insights Summary:

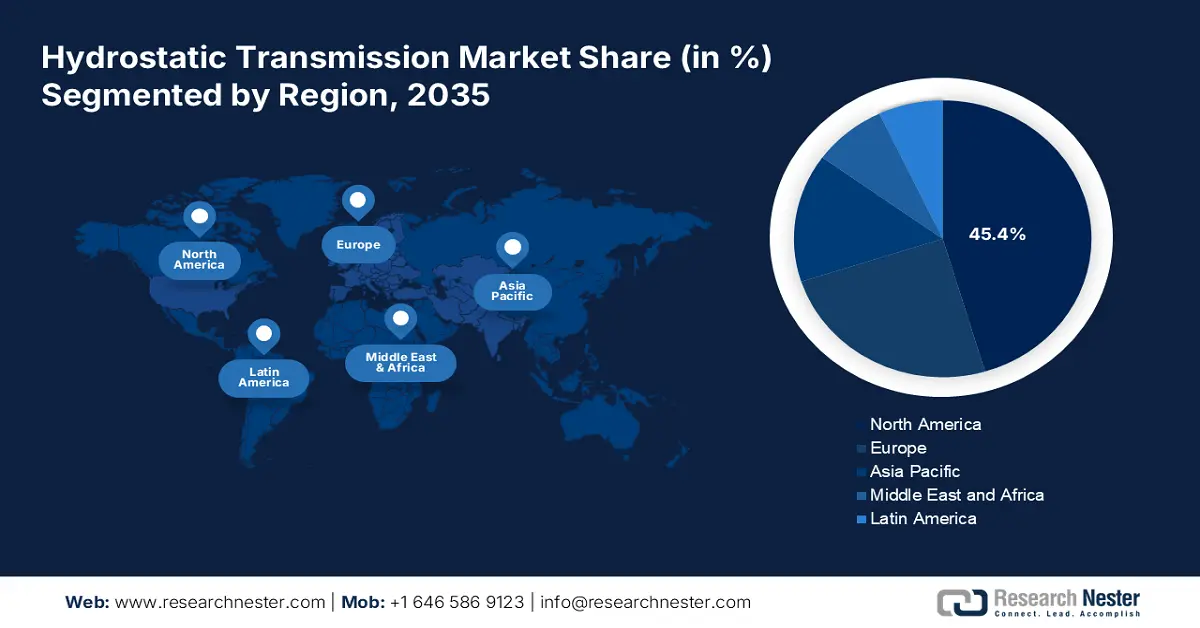

Regional Highlights:

- North America dominates the Hydrostatic Transmission Market with a 45.4% share, driven by the growing demand for heavy equipment due to the region’s large population and increasing urbanization, fueling robust growth through 2035.

Segment Insights:

- The Construction & Mining segment is set to capture a major market share by 2035, attributed to the increasing complexity and scale of projects requiring advanced machinery.

- The Heavy-duty Hydrostatic Transmission segment of the Hydrostatic Transmission Market is projected to maintain a 49.40% share by 2035, fueled by growing demand for high-performance machines in extreme conditions.

Key Growth Trends:

- Rising automation in industries

- Growth of electric vehicles

Major Challenges:

- Temperature sensitivity

- High initial costs

- Key Players: Parker Hannifin Corporation, Dana Incorporated, Komatsu America Corporation, Total Energies SE, Shell pic.

Global Hydrostatic Transmission Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 5.73 billion

- 2026 Market Size: USD 6 billion

- Projected Market Size: USD 9.6 billion by 2035

- Growth Forecasts: 5.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (45.4% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: United States, China, Germany, Japan, India

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 13 August, 2025

Hydrostatic Transmission Market Growth Drivers and Challenges:

Growth Drivers

- Rising automation in industries: The hydrostatic transmission market has provided the necessary adaptability and responsiveness in automated environments for the equipment to accomplish tasks accurately and with reliability. In addition, the implementation of digital technologies in HST systems improves performance monitoring and predictive maintenance capabilities, which drives innovation and adoption in modern machinery design. For instance, in September 2023, Traxen and Eaton announced a worldwide partnership to market, distribute, service, and support the installation of Eaton's state-of-the-art iQ-Cruise system. This technology determined the best fuel-efficient driving style for Class 8 commercial vehicles in real-time using artificial intelligence (AI), sophisticated algorithms, GPS, and high-definition 3D maps.

- Growth of electric vehicles: Growth in electric vehicles is emerging as a vital driver for the hydrostatic transmission market, since it increases the emphasis put on efficient power management in the hybrid and fully electric drivetrains. To optimize performance with maximum energy efficiency in vehicles, hydrostatic transmissions have a compelling offer based on precise control of torque and speed, vital in improving responsiveness and range. For instance, in April 2024, Amsted Automotive utilized its experience in electro-mechanical torque management to design clutch systems for electric vehicle development that can increase efficiency up to 10%. It is implemented on two-speed transmission in an EVs drivetrain. Such implementations can provide better performance improvements as well as enhance their driving range.

Challenges

- Temperature sensitivity: A significant challenge within the hydrostatic transmission market is its impact on hydraulic fluid viscosity and system performance. Hydrostatic transmissions rely on hydraulic fluids to transmit power efficiently, however, fluctuations in operating temperatures can alter the fluid's properties, leading to reduced efficiency and potential system failures. Maintaining optimal temperature ranges is critical for ensuring reliable operation and longevity of these systems. Therefore, manufacturers are compelled to put additional investment in advanced thermal management solutions and robust design practices against the effects of temperature variations, which may otherwise confuse system integration and rise to operational costs.

- High initial costs: However, a significant hurdle that the hydrostatic transmission market presents, mainly because of the sophistication that is required for design as well as manufacturing. Hydrostatic systems entail complexity, requiring special material and precision engineering. They are likely to be costlier to produce than traditional mechanical transmission systems. This makes their adoption difficult for some industries, especially those sensitive to price, despite their ultimate operational advantages. Because of this, the manufacturers need to present effectively the value proposition of hydrostatic transmissions while looking at possible ways to reduce cost with economies of scale and technology.

Hydrostatic Transmission Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.3% |

|

Base Year Market Size (2025) |

USD 5.73 billion |

|

Forecast Year Market Size (2035) |

USD 9.6 billion |

|

Regional Scope |

|

Hydrostatic Transmission Market Segmentation:

Capacity (Heavy-duty, Medium-duty, Light-duty)

Heavy-duty segment is poised to capture hydrostatic transmission market share of around 49.4% by the end of 2035, owing to an ascending demand for high-performance machines in segments where machines are often forced to work under extreme operating conditions with excessive loads, requiring high torque management.

For instance, in January 2023, Dana Incorporated announced to introduce a hydrostatic driveline for telehandler applications lifting to 12,000 pounds and a Spicer 312 dropbox for high-power hydrostatic motors. The transmission is available in combination with the field-proven Spicer 222 front and rear heavy-duty axles. The ability of these systems to provide smooth power delivery and precise control further solidifies their position as essential components in heavy-duty machinery.

End user (Construction & Mining, Logistics & Transport, Agriculture, Others)

Based on end user, the construction & mining segment is expected to garner the major share in the hydrostatic transmission market by the end of 2035. The growth is mainly driven by the growing complexity and scale of projects that require advanced machinery capable of handling challenging environments. Increased demand of automation in the construction and mining fields also requires efficient power train solutions that can accommodate new ideas in machine designs.

For instance, in April 2024, Kubota UK launched its first telehandler, KTH4815-2, for construction and associated industries, such as material handling. It can reach a maximum lift height of 4.8m and a maximum lift capacity of 1.5 tonnes. It meets EN15000 certification included in the standard specification. This alignment with industry needs puts hydrostatic transmission systems as vital sector more productive and efficient in operations.

Our in-depth analysis of the global market includes the following segments:

|

Capacity |

|

|

Operation Type |

|

|

End user |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrostatic Transmission Market Regional Analysis:

North America Market Statistics

North America in hydrostatic transmission market is expected to hold over 45.4% revenue share by the end of 2035, owing to the region's growing demand for heavy equipment. The region has a large population and is becoming increasingly urbanized, thus increasing demand for construction and mining equipment. In addition, the region has a significant agricultural industry, which fuels demand for agricultural machinery.

Canada hydrostatic transmission market is witnessing substantial growth owing to the expanding infrastructure in hydrostatic transmission systems. For instance, in July 2024, Allison Transmission has partnered with Element Technical Services to deploy Allison's FracTran in Canada for the first time. FracTran entered production last year and represents an incremental growth opportunity of USD 100 million dollars in annual revenue. The unique and always evolving demands of the hydraulic fracturing industry require that there be a transmission for such powerful performance, particularly in the tough operating conditions here in Canada.

The U.S. hydrostatic transmission market is expanding significantly not within the country but also globally. It is solidifying its position and market competition by importing and exporting parts of power transmission equipment to facilitate the growth of hydrostatic transmission across various industries. According to the data published by the Observatory of Economic Complexity that in year 2022, the U.S. exported worth USD 1.59 billion and imported USD 2.24 billion of parts of power transmission.

Europe Market Analysis

The Europe hydrostatic transmission market has been striving to lower carbon emissions. This set of ambitious goals has prompted the focus on clean energy solutions, from hydrostatic transmissions in sectors. In addition, the region has comprehended that hydrostatic transmissions are superior to traditional mechanical transmissions and they provide better performance, greater efficiency, and improved reliability. Thus, the requirement for a reliable hydrostatic transmission system is gaining significant importance.

Germany hydrostatic transmission market is exploding its ecosystem with investment opportunities through promoting the utilization of renewable resources including wind and solar power. For instance, in February 2024, Hitachi Energy announced a significant investment of USD 32 million, to expand and modernize its power transformer manufacturing facility in Bad Honnef, Germany. This strategic investment is planned for completion by 2026, bolstering the company's global presence while addressing the escalating demand for power transformers amidst the rapid energy transition happening in Europe.

The U.K. landscape for hydrostatic transmission market is experiencing robust growth by making significant investments towards sustainability. For instance, in September 2024, UKIB announced to make an investment in new subsea HVDC cable factory to be developed by XLCC in Scotland. The funding comprises an initial USD 20.7 with an option to invest a further USD 69.6 million on specific development and funding milestones being achieved by XLCC. This investment demonstrates the Bank's commitment to working with private investors to support the Government's Clean Energy Mission to make the UK a clean energy superpower and accelerate to net zero.

Key Hydrostatic Transmission Market Players:

- Eaton

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Parker Hannifin Corporation

- Dana Incorporated

- Komatsu America Corporation

- Total Energies SE

- Shell pic

- Robert Bosch GmbH

- Tuff Torq Corporation

The strategy of key market players in hydrostatic transmission market involves partnerships, acquisitions, expansion of the product portfolio, and a focus on sustainable solutions. For instance, in July 2022, Parker Aerospace, Lockheed Martin, and DUST Identity collaborated in August 2022. The collaboration focuses on the integration of digital engineering and technology. Implementation in the F-35 Horizontal Tail Electro-Hydrostatic Actuator for Lockheed Martin will commence. The core aim revolves around traceability, authenticity, and integrity of the supply chain.

Here's the list of some key players:

Recent Developments

- In June 2024, JLG introduced the new Sky Trak 8042 telehandler. It features lightweight design, hydrostatic transmission, advanced control system, electric-over-hydraulic joystick, and data at-a-glance.

- In March 2022, John Deere's offered a new electric variable transmission for the electrification of farm implements. The new EVT was made available on all 410-horsepower 8 Series tractors, including 8R, 8RT, and 8RX models.

- Report ID: 6885

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrostatic Transmission Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.