Hydropower Market Outlook:

Hydropower Market size was over USD 274.54 billion in 2025 and is anticipated to cross USD 426.35 billion by 2035, witnessing more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydropower is estimated at USD 285.66 billion.

The market growth is driven by increasing demand for renewable energy. As public awareness about environmental issues and greenhouse gas emissions grows, so does the demand for renewable energy sources. Hydropower is one of the most dependable and cost-effective renewable energy sources, making it an appealing option for energy providers and governments trying to lower their environmental impact. For instance, according to the U.S. E.I.A (Energy Information Administration), renewable energy accounted for about 12.4% of total energy consumed in the U.S. in 2021.

In addition, growing government interest in clean energy sources will impel the market revenue. Numerous countries throughout the globe have put laws and incentives in place to encourage the use of sources of clean energy such as hydropower. Some governments, for instance, provide tax benefits or subsidies for the building of new hydropower facilities, whereas others have set renewable power objectives that include hydropower. Additionally, the growing number of awareness campaigns focusing on the benefits of clean energy is predicted to boost the market growth.

Key Hydropower Market Insights Summary:

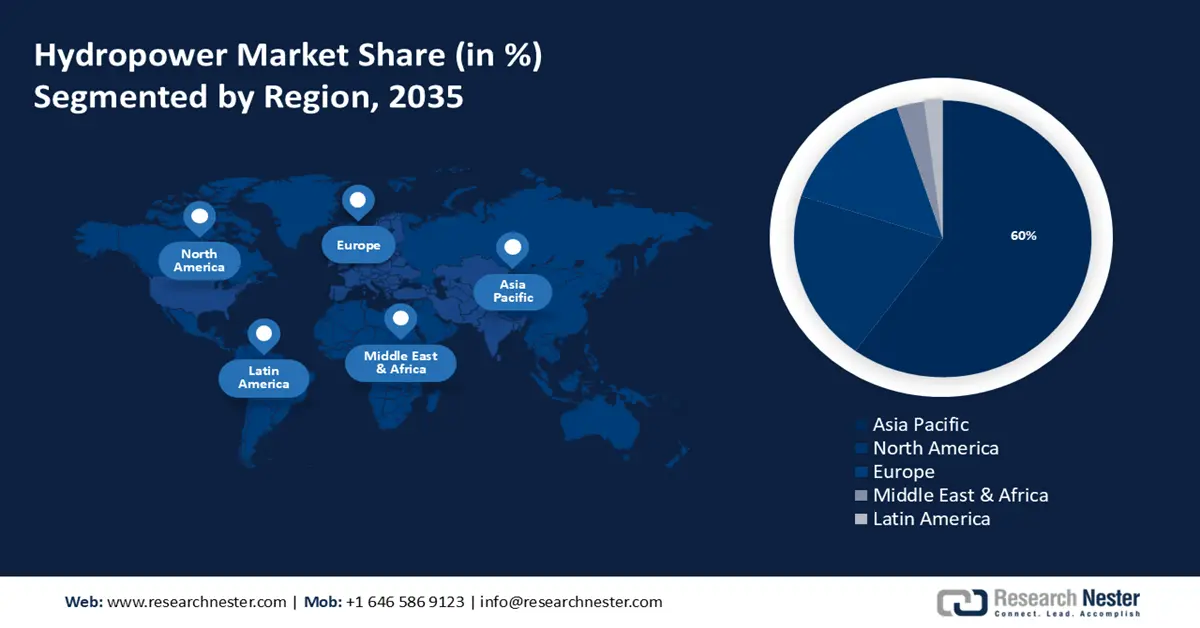

Regional Highlights:

- Asia Pacific hydropower market will dominate over 60% share by 2035, driven by the presence of China, the largest producer of hydroelectricity in the world.

- North America market will capture a 20% share by 2035, driven by a lengthy history of hydropower production and high installed capacity in the US and Canada.

Segment Insights:

- The large hydropower segment in the hydropower market is anticipated to achieve a 52% share by 2035, influenced by massive energy generation capacity and cost savings.

- The infrastructure segment in the hydropower market is anticipated to hold a 45% share by 2035, propelled by high costs of construction activities such as excavation, drilling, and dam building.

Key Growth Trends:

- Rising Global Energy Needs

- Rising Demand for Alternative Source of Energy

Major Challenges:

- Environmental and Social Consequences

- High Capital Investment

Key Players: GE Group, Siemens AG, Bharat Heavy Electricals Limited, Voith GmbH & Co. KGaA, ANDRITZ AG, ALSTOM Holdings, The Vattenfall Group, Gilbert Gilkes & Gordon Ltd., HYDROCHINA International Engineering Co., Ltd., JSC RusHydro.

Global Hydropower Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 274.54 billion

- 2026 Market Size: USD 285.66 billion

- Projected Market Size: USD 426.35 billion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (60% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Brazil, Canada, United States, Russia

- Emerging Countries: China, India, Brazil, Mexico, Indonesia

Last updated on : 8 September, 2025

Hydropower Market Growth Drivers and Challenges:

Growth Drivers

- Rising Global Energy Needs –As per the expected data, the world population is expected to reach 9.8 Billion by the end of 2050, energy needs are rising globally. Hydropower is a dependable form of energy that can deliver a consistent supply of electricity even when other energy sources are disrupted. As a result, it is an appealing alternative for countries seeking to improve their energy security.

- Rising Demand for Alternative Source of Energy– Hydropower may be utilized to preserve energy by preserving water uphill (as in dams) when energy demand is low and discharging it to create electricity when demand is high. This can assist to solve the periodic nature of other alternative power sources such as wind and solar, rendering hydropower as an essential component of power systems. For instance, hydropower systems generated over 4400 TWh of energy in 2020 globally.

- Increasing Reliance on Clean Energy Sources –With rising global warming and focus on sustainable development by governments globally, hydropower has been a strong pillar in supporting the clean energy transition. In fact, hydropower units produce more electricity than other form of renewable energy (except nuclear) such as wind and solar combined. Furthermore, the other source of energy based on fossil fuels emits large amount of carbon dioxide, that is further expected to boost the growth of the market. According to the International Energy Agency, coal accounted for more than 40 percent of the overall growth in the global carbon dioxide emissions in the year 2021.

- Boost to the Economy – Hydropower projects are often major projects that require intensive capital and human effort to be completed. Such projects often attract investment from many sources, as well as provide employment to many people who help in its construction and upkeep. Hence, they provide jobs and investment opportunities to the people. According to the estimates, nearly USD 2000 to 5000 million is required to build a dam that can serve many purposes.

- Increasing Need for Cheaper Cost of Energy: Hydropower generation rates have been falling in recent years as a result of technical advances, efficiency gains, and economies of scale. It has allowed hydropower to become an affordable source of energy. Moreover, in terms of upkeep and operations, hydropower is cheaper than other sources of electricity. Although expenses are bound to be there in any huge energy producing facility, the long-term nature of hydropower plants makes expenses bearable by reducing huge one-time expenses and spreading them over a longer spam of time. Hydropower does not get affected by changes in fuel prices and hence remains stable in terms of power generation costs. As per the International Hydrogen Association, the world’s average cost of electricity from hydrogen projects in the year 2018 accounted to only USD 0.047 per Kwh.

Challenges

- Environmental and Social Consequences: Major hydropower projects can have considerable ecological as well as social consequences, such as community displacement, biodiversity loss, and ecosystem disturbance. These effects may be reduced by diligent project design and administration, yet they may also increase the cost and complexities of hydropower projects. Therefore, it is anticipated to restrain the growth of the global hydropower market in the upcoming years.

- High Capital Investment

- Geographically Limited as it Requires Large Water Bodies to Be Constructed

Hydropower Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 274.54 billion |

|

Forecast Year Market Size (2035) |

USD 426.35 billion |

|

Regional Scope |

|

Hydropower Market Segmentation:

Capacity Segment Analysis

The large hydropower segment is predicted to dominate around 52% market share by 2035. Large hydropower projects often need major financial investment and take longer to complete than smaller projects, and they have the potential to generate massive amounts of energy and offer substantial cost savings. Small hydropower projects, on the other hand, are frequently more adaptable and may be built faster, although they may have limited capability and may not be suited for all places. For instance, most large projects are government owned, since they require a significant investment to be built, along with the proper management of communities and environments impacted by such projects. For instance, the Three Gorges Dam in China is the largest hydroelectric plant in the world, with a capacity of over 2200 MWh.

Components Segment Analysis

The infrastructure segment is expected to hold 45% revenue share by the year 2035. The majority of the expense of a hydropower project is often spent on expensive construction activities such as excavation work, drilling, and dam & powerplant building. Moreover, the major costs include electromechanical gear, which includes turbines, generators, and other support equipment. Since, many of these parts and equipment are tailor-made to be case-specific, they can be quite expensive, thus they cannot be mass produced. As the size of the projects increase, the total cost of construction can go down. For very large-scale projects, the cost per kilowatt can be as low as 800-900 USD/kW and can go as high as 9000-11000 USD/kW for smaller sized projects.

Our in-depth analysis of the global market includes the following segments:

|

By Capacity |

|

|

By Components |

|

|

By End User |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydropower Market Regional Analysis:

APAC Market Insights

The market share of hydropower in Asia Pacific is predicted to cross 60% by the end of 2035. The market growth is propelled by presence of China, the largest producer of hydroelectricity in the world. For instance, China produces more than 850 billion kilowatt hours of energy every year. The second major player in the region is India, which produces about 120 billion kilowatt hours of energy every year. India is also aiming to bolster its share in the market in the coming years. The third major player is Pakistan, with many hydroelectric plants running in the country. The region is currently aiming to meet its sustainability as well as energy objectives, with a steady growth in population as well as rise in living standards.

North American Market Insights

The North American hydropower market is estimated to hold 20% share by 2035. With over 100 GW of installed capacity, the US has the biggest hydropower market in North America. The country has a lengthy history of hydropower production, with several current facilities originating from the early twentieth century. The hydropower market in the United States is dominated by large-scale plants, which account for more than 90% of installed capacity. With over 80 GW of generation capacity, Canada is another key hydropower market in North America. Moreover, Canada, such as the United States, has a long history of hydropower production and has numerous large-scale facilities. Yet, there is a large quantity of small and medium-sized hydropower in Canada, particularly in rural and off-grid regions.

Europe Market Insights

The market in Europe is set to observe significant growth till 2035. Several of Europe's extant hydroelectric plants date back to the early twentieth century, revealing how the region has a lengthy history of hydropower development. As part of its aim to decrease greenhouse gas emissions and promote energy security, the European Union (EU) is aggressively pushing the growth of clean energy sources, including hydropower. The EU has set a target of 32% renewable energy by 2030, and hydroelectricity is likely to play a critical role in meeting this aim.

Hydropower Market Players:

- GE Group

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- Bharat Heavy Electricals Limited

- Voith GmbH & Co. KGaA

- ANDRITZ AG

- ALSTOM Holdings

- The Vattenfall Group

- Gilbert Gilkes & Gordon Ltd.

- HYDROCHINA International Engineering Co., Ltd.

- JSC RusHydro

Recent Developments

-

GE Group announced that they have chosen to renovate two hydropower units at Pakistan's Mangla Hydropower Project.

-

Siemens AG was chosen as the exclusive solution provider for the completely electric Woodfibre LNG project in British Columbia, Canada, near Squamish

- Report ID: 3284

- Published Date: Sep 08, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydropower Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.