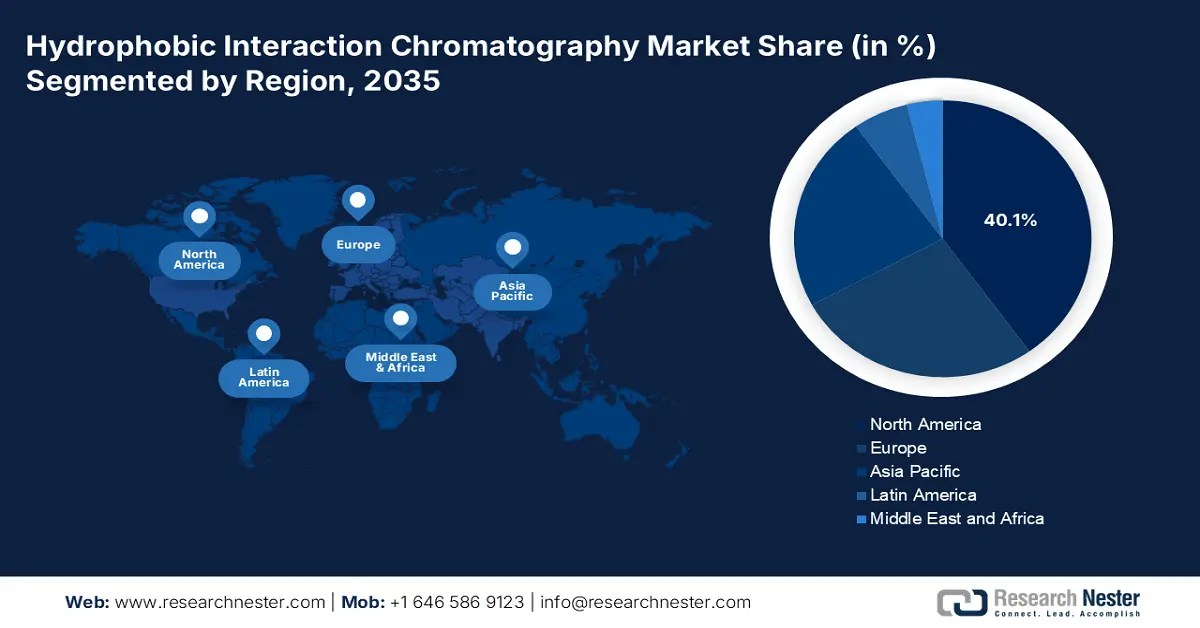

Hydrophobic Interaction Chromatography Market - Regional Analysis

North America Market Insights

North America is anticipated to capture the highest share of 40.1% in the global hydrophobic interaction chromatography market by the end of 2035. The continuous R&D investments from its biopharmaceutical industry and strict regulatory control over medicinal quality and purity are the foundational pillars of the region’s proprietorship in this sector. The high concentration of leading pharma and biotech companies, advanced research infrastructure, and large-scale GMP biologics manufacturing facilities are also benefiting the landscape with greater capital influx. Exemplifying the same, Novartis allocated USD 1.1 billion to establish a biomedical research center in San Diego in April 2025, according to its 5-year U.S.-based production expansion plan.

The U.S. augments the hydrophobic interaction chromatography market with regional dominance, which is backed by its growing capacity in biopharmaceutical innovation and production. Being a home to globally leading pharma giants, research institutions, and contract manufacturing organizations (CMOs), the country has garnered a lucrative demand base for this sector. Testifying to the same, a 2024 report from the Pharmaceutical Research and Manufacturers of America unveiled that the companies based in the U.S. contributed to 55% of the worldwide investment in biopharmaceutical R&D.

Canada is emerging steadily in the hydrophobic interaction chromatography market in support of a growing capital influx in life sciences research. The country’s emphasis on innovation is increasingly improving, which is further complemented by government-backed initiatives to expand biomanufacturing capabilities. This is ultimately driving the adoption of HIC across the nation. As evidence, in July 2025, the Ministries of Industry, Health, and Economic Development in Canada collectively sanctioned a $1.3 billion grant to more than 9,700 researchers and research projects across the nation.

APAC Market Insights

Asia Pacific is poised to become the fastest-growing region in the hydrophobic interaction chromatography market during the analyzed tenure. Rapid expansion in the biopharmaceutical and biotechnology industries across emerging economies, such as China, India, Japan, and South Korea, is the major propeller behind the region’s progress in this sector. Moreover, increasing investments in biologics manufacturing and R&D, coupled with the rising healthcare expenditure and government-backed funding, are driving demand for HIC commodities. Additionally, the region’s leveraging capacity in contractual research and manufacturing services for the pharmaceutical industry is consolidating a favorable landscape for this business category.

China is a leading manufacturer in the Asia Pacific hydrophobic interaction chromatography market, owing to its strong emphasis on clinical trials and massive government support. Further, the country’s focus is highly concentrated on advancing biologics production and increasing adoption of cutting-edge purification technologies boosted demand for HIC resins and systems. Additionally, the amplifying network of contract manufacturing organizations (CMOs) and research institutions is accelerating the integration of HIC in the maximum volume of downstream processing.

India, with an ambitious goal to become the global hub of biomanufacturing, is emerging as a prominent contributor to the Asia Pacific hydrophobic interaction chromatography market. The country’s augmentation in this sector is primarily driven by its expanding biotechnology and pharmaceutical industries. According to a 2023 PIB report, India ranked 3rd in the APAC biotechnology industry. It also highlighted the collaborative call from the country and the U.S. administrations to extend the existing partnerships to advanced biotechnology and biomanufacturing, and enhance biosafety and biosecurity innovation, practices, and norms.

Country-wise Trade of Vaccines, Blood, Antisera, Toxins, and Cultures (2023)

|

Country |

Export Value (Million) |

Import Value (Million) |

|

China |

$1,030 |

$17,700 |

|

Japan |

$2,522 |

$13,921 |

|

Chinese Taipei |

$52.7 |

$311 |

Source: OEC

Europe Market Insights

Europe is predicted to maintain a strong position in the global hydrophobic interaction chromatography market over the timeline between 2026 and 2035. The region’s steady progress in this field is fueled by its advanced biopharma and academic research ecosystem. Besides, the stringent regulatory standards for biologics production are also propelling demand in this landscape. Developed countries, including Germany, the UK, and Switzerland, are home to several globally leading pharma companies and contract development and manufacturing organizations (CDMOs) that rely on high-performance HIC technology. This portrays the presence of a sustainable consumer base for this sector in Europe.

The UK contributes remarkably to the regional propagation of the hydrophobic interaction chromatography market. It is empowered by a strong life sciences industry and commitment to extensive biopharmaceutical innovation. Besides, with a high concentration of biotech firms, academic research institutions, and CDMOs, the UK is fostering a lucrative ecosystem for both domestic and foreign pioneers in this sector. The country's emphasis on advanced purification methods, including HIC, is further supported by ongoing investments in R&D and a regulatory framework that promotes high standards in drug manufacturing.

Germany leads the European hydrophobic interaction chromatography market, owing to its robust pharma and biotech industries. Evidencing the same, in June 2023, WuXi Biologics extended its manufacturing capacity from 12,000L to 24,000L on a 30,000 square metre facility situated in Germany. The sterile filling and freeze-drying plant at Chempark Leverkusen, with an annual capacity of approximately ten million doses, now consists of a second variable filling line. The country also has a strong emphasis on precision manufacturing, which makes it an attractive landscape for pioneers who are seeking to conduct profitable business in this category.

Country-wise Trade of Biologics (Vaccine for Human Use) (2023)

|

Country |

Export Value (Million) |

Import Value (Million) |

|

Belgium |

$15,300 |

$13,200 |

|

Switzerland |

$276 |

$343 |

|

Ireland |

$12,300 |

$943 |

Source: OEC