Hydrogenation Catalyst Market - Growth Drivers and Challenges

Growth Drivers

- Catalytic innovation and efficiency gains: Innovations in catalytic hydrogenation processes have resulted in notable efficiency improvements, with state-of-the-art catalysts demonstrating enhancements in production efficiency. The Hydrogen Production Technologies subprogram of the U.S. Department of Energy, FY 2023 and 2024, received at least annual funding of USD 15 million to develop catalytic innovations and efficiency improvements in clean hydrogen production. The 36 projects that receive funding amount to $1.1 billion (of which approximately 470 million is at the federal level), devoted to the development of new-generation electrolysers, new materials, and new routes. These activities are meant to decrease the price of Hydrogen to USD 2 per kilo by 2026 and to USD 1 per kilo by 2031, and improve the performance and life of the catalysts. These developments improve reaction selectivity and prolong the lifespan of catalysts, thereby lowering operational costs and boosting throughput for chemical manufacturers. Consequently, enhanced hydrogenation catalyst technologies are increasingly sought after, particularly in industries that encounter intense competition and stringent regulatory standards.

- Surge in bio-based chemical production: The worldwide increase in the production of bio-based chemicals is driving a heightened demand for hydrogenation catalysts, which are vital for the conversion of biomass into valuable products such as fuels, bioplastics, and specialty chemicals. For example, the catalytic hydrogenation of bio-oil and intermediates made by the biomass is essential in the production of bio-based products, e.g., fuels, bioplastics, and specialty chemicals. Hydrogenation has been proven to be efficient in upgrading lignin and other biomass components, as representative catalytic systems such as Ru/C have conversion rates of up to 77% with a monomer yield of 30.6%. Hydrogenation catalysts are crucial for the refinement of fatty acids and other renewable feedstocks, facilitating their efficient transformation into sustainable materials. This trend signifies a larger movement towards circular and green economies, establishing hydrogenation catalysts as a fundamental component in the shift from fossil-based to renewable chemical production systems.

- Policy and regulatory push to decarbonization: Climate policies and decarbonization requirements of industries supported by the government are accelerating the need for advanced hydrogenation catalysts. In the U.S., the Infrastructure Investment and Jobs Act (IIJA) provides USD 9.5 billion to fund clean hydrogen development, USD 1 billion towards electrolysis research and development, and half a billion to hydrogen made and recycled. These investments are meant to reduce the cost of hydrogen production and improve the catalyst performance, especially in the heavy industries such as refining, ammonia, and steel, where hydrogenation reactions are crucial. In addition, the DOE Hydrogen Shot initiative aims at reducing the cost of clean hydrogen to less than 1/kg in 2031, stimulating the need to use more efficient and durable catalysts. Such regulatory incentives are not only transforming the industrial activities but also strengthening hydrogenation catalysts as the key instruments in the comprehension of national and global climate objectives.

1. Import & Export Trends

Supported catalysts with nickel or its compound imports by country, 2023

|

Country |

Import Value (USD '000) |

Quantity (kg) |

|

South Korea |

148,363.47 |

9,930,600 |

|

China |

148,088.07 |

5,171,540 |

|

United States |

128,807.46 |

9,910,500 |

|

Germany |

97,100.07 |

5,837,280 |

|

Philippines |

94,510.80 |

643,886 |

|

Indonesia |

56,780.96 |

2,784,880 |

|

Canada |

51,816.99 |

3,515,070 |

|

India |

50,151.37 |

N/A |

|

Japan |

46,652.29 |

2,534,920 |

Source: worldbank.org

Supported catalysts with nickel or its compound exports by country, 2023

|

Country |

Exports (USD ’000) |

Quantity (Kg) |

|

United States |

466,351.85 |

26,126,500 |

|

European Union |

476,996.48 |

22,147,600 |

|

Denmark |

320,163.16 |

12,712,400 |

|

France |

212,949.33 |

12,789,600 |

|

Germany |

195,771.91 |

12,862,200 |

|

Japan |

97,785.34 |

7,696,560 |

|

China |

96,836.24 |

5,738,640 |

|

India |

73,921.68 |

5,397,450 |

|

Saudi Arabia |

60,913.42 |

3,168,850 |

Source: worldbank.org

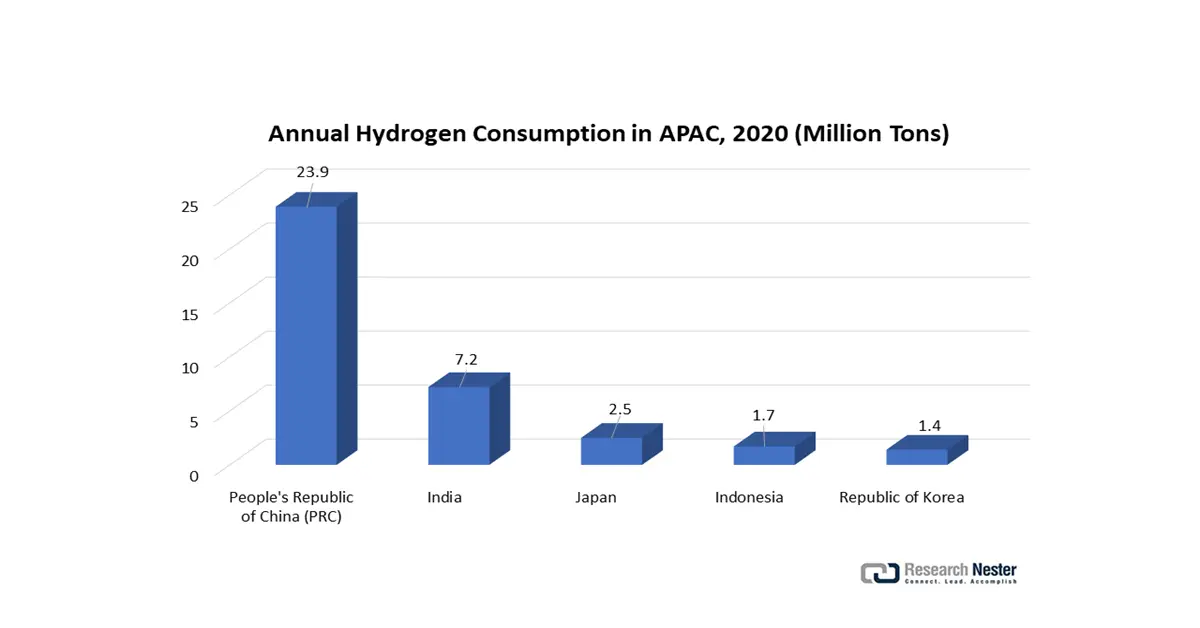

2. Rising Hydrogen Consumption as a Catalyst for Hydrogenation Market Growth

Growing demand for hydrogen in refining processes, petrochemicals, edible oils, and specialty chemicals boosts the need for catalysts that can enhance reaction rates, selectivity, and energy efficiency. In particular, the transition toward cleaner fuels and sustainable chemical production is increasing hydrogen use in desulfurization, biofuel upgrading, and green chemistry applications, thereby creating stronger demand for advanced hydrogenation catalysts. As hydrogen consumption rises across diverse sectors, the catalyst market expands in tandem, reflecting its dependency on hydrogen utilization trends.

Source: adb.org

Challenges

- Complex and varied regulatory landscapes across regions: Manufacturers encounter challenges in managing varying regulatory requirements across different jurisdictions. For example, the REACH regulations in the European Union mandate rigorous chemical registration and testing, while the Ministry of Ecology and Environment in China implements distinct safety standards and approval procedures. Such disparities cause companies to have region-specific compliance teams, pay high costs to test and certify, and they have to modify production processes to be in line with local environmental and safety regulations. This disintegration causes delays in the introduction of products to the hydrogenation catalyst market, diminished economies of scale, and uncertainty in investment planning for international manufacturers, particularly when regulations change rapidly or are inconsistently applied at international boundaries.

- Trade barriers and import/export restrictions: Tariffs, quotas, and non-tariff barriers, often presented as measures for environmental or safety protection, are hindering the international trade of hydrogenation catalysts. These regulatory challenges elevate costs, restrict hydrogenation catalyst market entry, and disrupt supply chains, posing difficulties for manufacturers aiming to expand operations and satisfy the rising demand for sustainable chemical production globally. For example, importation of key raw materials such as platinum and nickel can drive up the cost of production, and exportation of some catalyst formulations may restrict market access. Similarly, there are the lead times caused by customs and failure to meet uneven documentation requirements, which make just-in-time production of catalysts more hazardous and less competitive in world markets for small and mid-sized manufacturers.

Hydrogenation Catalyst Market Size and Forecast:

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 3.9 billion |

|

Forecast Year Market Size (2035) |

USD 6.7 billion |

|

Regional Scope |

|