Hydrogenation Catalyst Market Outlook:

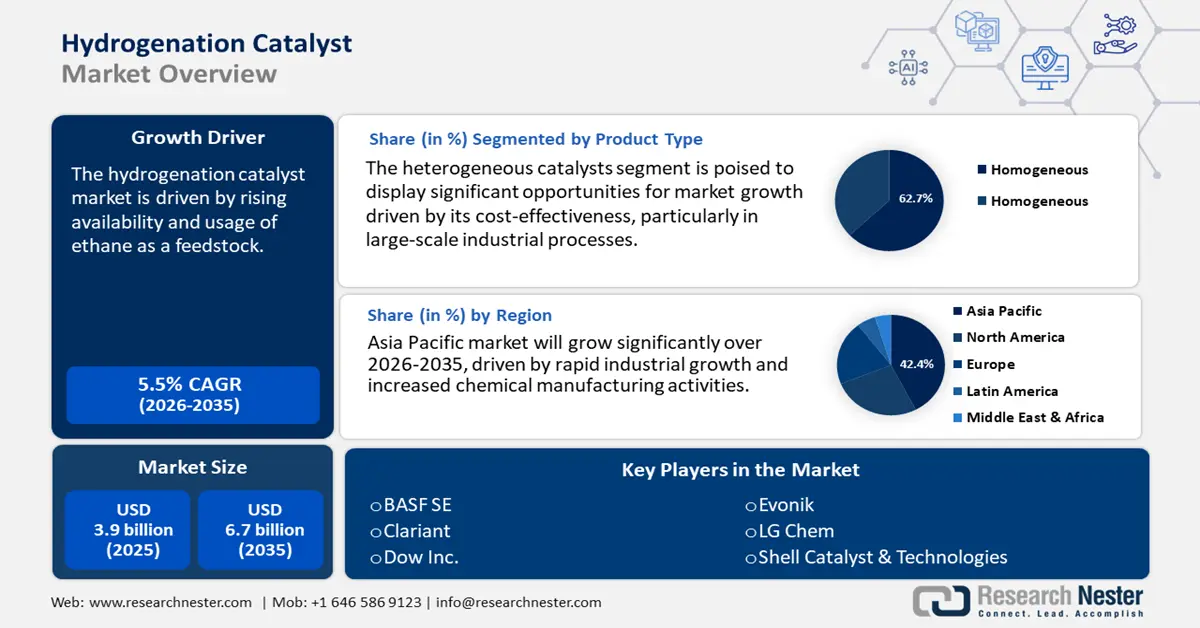

Hydrogenation Catalyst Market size was valued at USD 3.9 billion in 2025 and is projected to reach USD 6.7 billion by the end of 2035, rising at a CAGR of 5.5% during the forecast period 2026-2035. In 2026, the industry size of hydrogenation catalysts is evaluated at USD 4.3 billion.

The global hydrogenation catalyst market is anticipated to witness significant growth over the forecast years, primarily driven by increased regulatory requirements for ultra-low sulfur fuels. Adherence to the International Maritime Organization's (IMO) 2020 sulfur cap and similar national regulations has necessitated refineries around the world to upgrade their hydro processing units, thereby greatly increasing the demand for high-performance hydrogenation catalysts. Furthermore, the vessels that will navigate the Mediterranean Sea Emission Control Area (ECA) must use marine fuel with not more than 0.10% mass by mass (m/m) of sulfur, which is a substantive reduction of the 0.50% cap of marine fuel used in the global waters. These new sulfur limits are coming into effect after amendments to MARPOL Annex VI to the Marine Environment Protection Committee (MEPC), with implementation commencing on 1 May 2025 in the Mediterranean and other areas to be implemented in the years to come, such as the Canadian Arctic Waters and the Norwegian Sea.

Additionally, the U.S. Energy Information Administration (EIA) expects the global refining capacity to increase continuously up to 2028, with 2.6 to 4.9 million barrels per day of new capacity. This growth is mainly focused in Asia-Pacific, particularly India and China, and in the Middle East. This expansion is indicative of continued investments in terms of building to respond to increasing demand, even as there is uncertainty in the schedule of project completion. These advancements are driving the requirement for sophisticated catalyst technologies that can function effectively under strict emission control standards, which further facilitates the hydrogenation catalyst market growth.

In response to global trade fluctuations and geopolitical uncertainties, the hydrogenation catalyst market is adapting by localizing its production infrastructure. In February 2024, imports of nickel into the U.S. were USD 168.75 million, a slight increase from the long-term average of USD 163.77 million imports on a monthly basis since 1989. This stable nickel importation rate is an indication of the increased demand for nickel-based hydrogenation catalysts as a result of the continued increase in the number of catalyst applications in different chemical and industrial reactions. According to the December 2024 Producer Price Index (PPI) report by the Bureau of Labor Statistics, the price index of the chemical manufacturing industry has increased with a 6.2% increase in the price index in comparison to the past year. This trend in increasing prices of chemicals and other related products is similar to the increased demand for hydrogenation catalysts.

The trend of the PPI shows that the cost of production and the market growth of hydrogenation catalysts may increase due to the ongoing growth of investments in the refineries. The Directorate on Technology, Innovation and Partnerships (TIP) of the U.S. National Science Foundation has funded more than USD 1.4 billion in swifter technologies in the fiscal years 2022-2024, as a method to enhance innovation in a region and the development of the workforce and translation of technologies. The investment has funded over 1,200 startups and killed many breakthrough projects throughout the major technological fronts, including advanced catalyst technologies. These are strategic investment activities that underscore the role of NSF in enhancing the competitiveness of the U.S. in the areas of critical technology. Trade agreements with the European Union also entail standardized catalyst specifications, which facilitate smoother export processes and enhance global hydrogenation catalyst market integration.