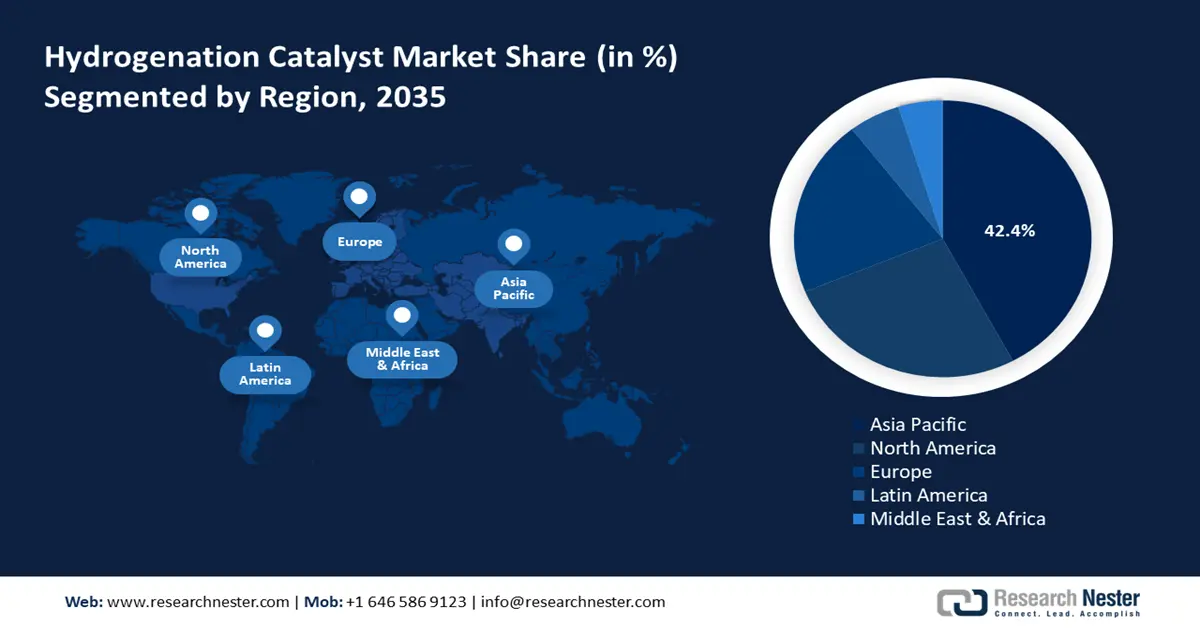

Hydrogenation Catalyst Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to dominate the hydrogenation catalyst market with the largest revenue share of 42.4% over the forecast years from 2026 to 2035, owing to swift industrial expansion, heightened chemical manufacturing activities, and strong governmental initiatives aimed at promoting sustainable chemical production. As per the report on Global Hydrogen Review 2024 by the International Energy Agency, the Asia Pacific region contributes more than 40% of the global production capacity of hydrogen, showing that there are significant regional investments in hydrogen technologies, such as catalysts. In addition, the report of Asian Development Bank stated that half of the world demand of industrial hydrogen is in the Asia and Pacific region, and it has a huge potential of producing clean hydrogen, which makes hydrogen a key factor in decarbonization of hard-to-abate industrial processes, including oil refining, chemical production, iron and steel production, and the use of heat produced in high temperature.

Furthermore, the region is leading the world in terms of investment in hydrogen, with 73% of the total hydrogen investments being in the region in the year 2020. This influx of investment is promoting improvements in catalyst technology in hydrogenation, which is needed in the production and use of hydrogen efficiently. The developments are significant in fulfilling the increasing need for sustainable chemical processes and the shift towards the low-carbon economy of the Asia Pacific region.

The hydrogenation catalyst market in China is predicted to dominate the Asia Pacific region with a significant revenue share over the forecast period by 2035, owing to a robust growth in the petrochemical and chemical production industries. China is the largest hydrogen manufacturer in the world, producing around 25 million tons every year, which constitutes a quarter of the world's production. The China Hydrogen Alliance estimates that by 2030, national demand will go up to 35 million tons and 60 million tons by 2050. The industry will have a market value of RMB 1 trillion (USD 157 billion) in 2025, supported by robust state support. In addition, in 2025, China targets 200,00 tonnes of green hydrogen, through its Green Hydrogen Energy Plan. The China Hydrogen Alliance also aims to have 80 GW of electrolyzer capacity by the year 2030.

Moreover, China encouraged the use of hydrogen-fuelled vehicles, and a target of 50,000 hydrogen vehicles on the streets was set as of 2025. Such aggressive goals are inspiring the quest for advancing hydrogenation catalysts, particularly nickel or precious metal-based systems that operate efficiently in both green hydrogen and industrial applications such as refining, chemical processing, and energy storage.

India’s market is anticipated to grow with the fastest CAGR during the projected years from 2026 to 2035, attributed to the government initiatives such as the National Hydrogen Mission and Chemical Industry development programs targeted at fostering sustainable manufacturing. The present hydrogen consumption in India is roughly estimated as 6 million metric tons per annum (mmtpa), with oil refining industries consuming approximately 3 mmtpa and ammonia production consuming approximately 2.5 mmtpa. Demand is likely to be 12 mmtpa by 2030, and Hydrogen prices are expected to be USD 2-2.5 per kilogram. This rising demand is likely to see a dynamic growth in the hydrogenation catalysts, particularly in greater efficiency, durability, and cost-effectiveness in the large-scale refining, fertilizer, and chemical manufacturing industries.

Furthermore, in January 2023, the National Green Hydrogen Mission was approved by India with an outlay of USD 2.5 billion (₹19,744 crore) for the production of 5 million metric tons of green hydrogen per year by 2030. The program is expected to minimize the importation of fossil fuel by USD 12 billion, attract more than USD 100 billion in investments, and reduce 50 million metric tons of CO2 per year. This massive shift is likely to spur high demand for hydrogenation catalysts in the process of refining, fertilizers, and clean energy. Such growth prospects are straining the need to have stronger hydrogenation catalysts, particularly nickel and precious metal-based, to sustain scaled clean hydrogen generation, increased reaction efficiencies, and stability in a variety of industrial environments.

North America Market Insights

North American hydrogenation catalyst market is projected to grow steadily over the forecast years, with a revenue share of 26.5%, owing to the high demand in such industries as petrochemicals, food processing, and pharmaceuticals. These industries use a lot of hydrogenation catalysts to produce refined fuels, oils, and other chemicals. For example, Prairie Energy Partners will build a USD 5.56 billion decarbonized refinery in Oklahoma with both blue and green hydrogen as the process heating medium and fuel feeds with an objective of reducing 95 percent of GHG emissions. The plant will also have a hydrogen complex that has CCS, which will substitute the heating process that uses natural gas with hydrogen-oxygen combustion. This is a massive hydrogen integration that directly serves the market as a result of the expansion in clean fuel refining technologies. The rising push for sustainable, bio-based feedstocks and stringent environmental regulations is driving market growth. For instance, the EPA has suggested a 5.61 billion-gallon by 2026, and 7.50 (5.86 billion gallons) in 2027. This is a direct increase in the demand for hydrotreating units and hydrogenation catalysts in the production of renewable diesel. Additionally, major corporations like BASF, Johnson Matthey, and Clariant are leading the pack in offering innovative catalyst solutions within the region.

U.S. market is likely to lead the North American region with the largest revenue share by 2035, attributed to the high demand in each of the oil refining, food processing, and automotive industries. The U.S Department of Energy targets to minimize the cost of hydrogen production to remove 2 per kilogram in 2026 and 1 per kilogram in 2031 with reduced electrolyzer and fuel cell costs. These cuts will lead to an increase in hydrogen consumption in refining and chemicals; this will result in a greater need for hydrogenation catalysts and will drive the growth of the U.S. catalyst industry. Besides this, the development of biofuels in the U.S. is also affected by renewable energy projects and government support of cleaner technology. In 2023, the U.S. biofuel production capacity was 23.8 billion gallons per year, with renewable diesel and biodiesel on top of 3.9 and 2.9 billion gallons, respectively. The policies, such as the Renewable Fuel Standard and programs such as the Sustainable Aviation Fuel Grand Challenge, help in growth. This growth increases the need for hydrogenation catalysts that are essential to transform bio-based feeds into high-quality fuels. Furthermore, the future market trends are likely to be influenced by the demand for renewable diesel, sustainable fuel, and the efficiency of catalysts. The major participants like Haldor Topsoe, BASF, and W. R. Grace are taking the initiative to continuously innovate to keep the lead in the market.

The market in Canada is expected to grow at a steady rate during the projected years, driven by the increased demand in the chemical, pharmaceutical, and food industries. In the evolution of the hydrogenation industry in the country, Natural Resources Canada states that there is a growing trend of biofuels and a general shift in the direction of sustainability. Since 2020, Canada has had over 80 low-carbon hydrogen production projects online, which amount to an estimated CAD 100 billion in investment potential. By 2024, 13 functioning low-carbon hydrogen plants will be present on the territory of the country, generating more than 3,000 tonnes of hydrogen per year. The emerging hydrogen output environment is also directly related to the need to produce hydrogenation catalysts in Canada that are required in the refining and renewable fuel processes that utilize hydrogen as a major feedstock. Furthermore, Canada's objective to eliminate its greenhouse gases and to produce more renewable energy is driving the use of new technologies to improve the process of hydrogenation.

Europe Market Insights

By 2035, the European market is expected to account for around 20.7% of the global market revenue, fueled by robust industrial demand and advancing environmental regulations in major European economies. The UK and Germany are significant contributors to this hydrogenation catalyst market, bolstered by substantial government backing and advancements in green chemistry. The 2021 Hydrogen Strategy by the UK government places a bold goal of 10 GW of low-carbon hydrogen production capacity by 2030, in a bid to create a sufficient quantity of hydrogen to serve more than 3 million households every year. The latter strategy is the basis of the increase in investments in hydrogen production technologies, such as electrolytic and hydrogen-enabled through CCUS. This growing emphasis on green hydrogen is also accompanied by an augmented interest in enhanced hydrogenation catalysts, which are required to generate renewable fuels, chemicals, and special products, and thus, promote innovation and growth of the UK hydrogenation catalyst market.

Furthermore, Germany was the second-biggest global exporter of Reaction and Catalytic Products, as in 2023 it exported its products valued at USD 4.46 billion, sharing 16.6% market share of the global market. Germany also imported these products in large volumes, USD 4.4 billion, with the largest share of the market in the world at 16.4%. The high level of trade is an indicator of a strong industrial base in Germany and the increasing demand for hydrogenation catalysts due to the rising number of chemical and refining industries. The large level of exports and imports provides evidence of the important part played by Germany in the manufacture, development, and usage of advanced hydrogenation catalysts to sustain the growth in the market.