Hydrogenation Catalyst Market Outlook:

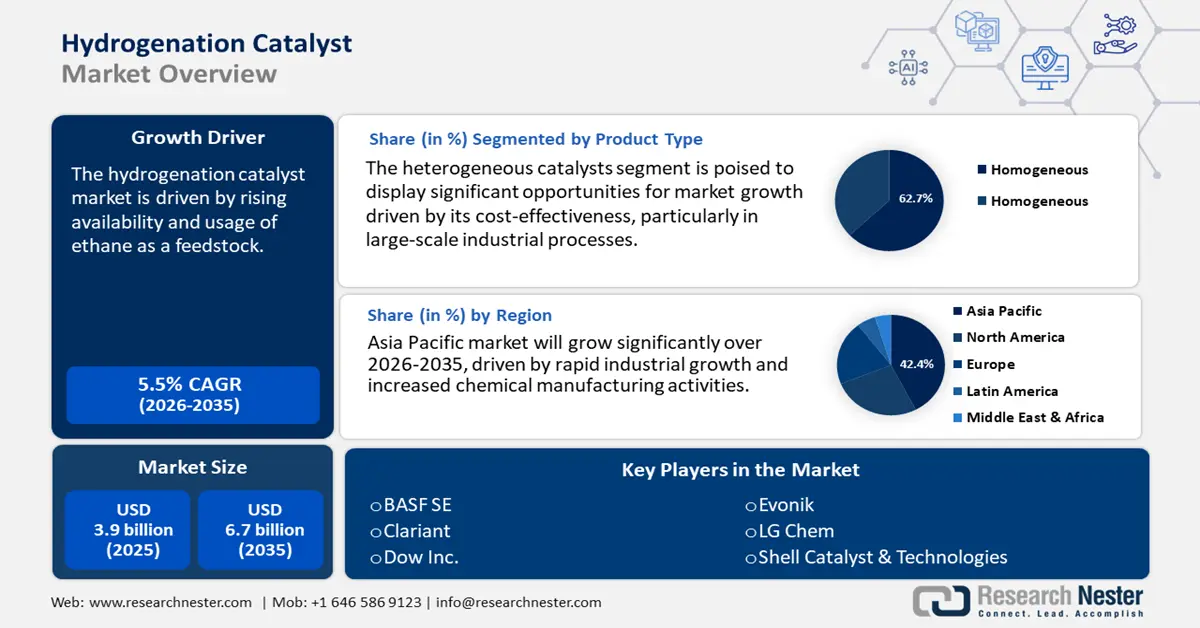

Hydrogenation Catalyst Market size was valued at USD 3.9 billion in 2025 and is projected to reach USD 6.7 billion by the end of 2035, rising at a CAGR of 5.5% during the forecast period 2026-2035. In 2026, the industry size of hydrogenation catalysts is evaluated at USD 4.3 billion.

The global hydrogenation catalyst market is anticipated to witness significant growth over the forecast years, primarily driven by increased regulatory requirements for ultra-low sulfur fuels. Adherence to the International Maritime Organization's (IMO) 2020 sulfur cap and similar national regulations has necessitated refineries around the world to upgrade their hydro processing units, thereby greatly increasing the demand for high-performance hydrogenation catalysts. Furthermore, the vessels that will navigate the Mediterranean Sea Emission Control Area (ECA) must use marine fuel with not more than 0.10% mass by mass (m/m) of sulfur, which is a substantive reduction of the 0.50% cap of marine fuel used in the global waters. These new sulfur limits are coming into effect after amendments to MARPOL Annex VI to the Marine Environment Protection Committee (MEPC), with implementation commencing on 1 May 2025 in the Mediterranean and other areas to be implemented in the years to come, such as the Canadian Arctic Waters and the Norwegian Sea.

Additionally, the U.S. Energy Information Administration (EIA) expects the global refining capacity to increase continuously up to 2028, with 2.6 to 4.9 million barrels per day of new capacity. This growth is mainly focused in Asia-Pacific, particularly India and China, and in the Middle East. This expansion is indicative of continued investments in terms of building to respond to increasing demand, even as there is uncertainty in the schedule of project completion. These advancements are driving the requirement for sophisticated catalyst technologies that can function effectively under strict emission control standards, which further facilitates the hydrogenation catalyst market growth.

In response to global trade fluctuations and geopolitical uncertainties, the hydrogenation catalyst market is adapting by localizing its production infrastructure. In February 2024, imports of nickel into the U.S. were USD 168.75 million, a slight increase from the long-term average of USD 163.77 million imports on a monthly basis since 1989. This stable nickel importation rate is an indication of the increased demand for nickel-based hydrogenation catalysts as a result of the continued increase in the number of catalyst applications in different chemical and industrial reactions. According to the December 2024 Producer Price Index (PPI) report by the Bureau of Labor Statistics, the price index of the chemical manufacturing industry has increased with a 6.2% increase in the price index in comparison to the past year. This trend in increasing prices of chemicals and other related products is similar to the increased demand for hydrogenation catalysts.

The trend of the PPI shows that the cost of production and the market growth of hydrogenation catalysts may increase due to the ongoing growth of investments in the refineries. The Directorate on Technology, Innovation and Partnerships (TIP) of the U.S. National Science Foundation has funded more than USD 1.4 billion in swifter technologies in the fiscal years 2022-2024, as a method to enhance innovation in a region and the development of the workforce and translation of technologies. The investment has funded over 1,200 startups and killed many breakthrough projects throughout the major technological fronts, including advanced catalyst technologies. These are strategic investment activities that underscore the role of NSF in enhancing the competitiveness of the U.S. in the areas of critical technology. Trade agreements with the European Union also entail standardized catalyst specifications, which facilitate smoother export processes and enhance global hydrogenation catalyst market integration.

Key Hydrogenation Catalyst Market Insights Summary:

Regional Highlights:

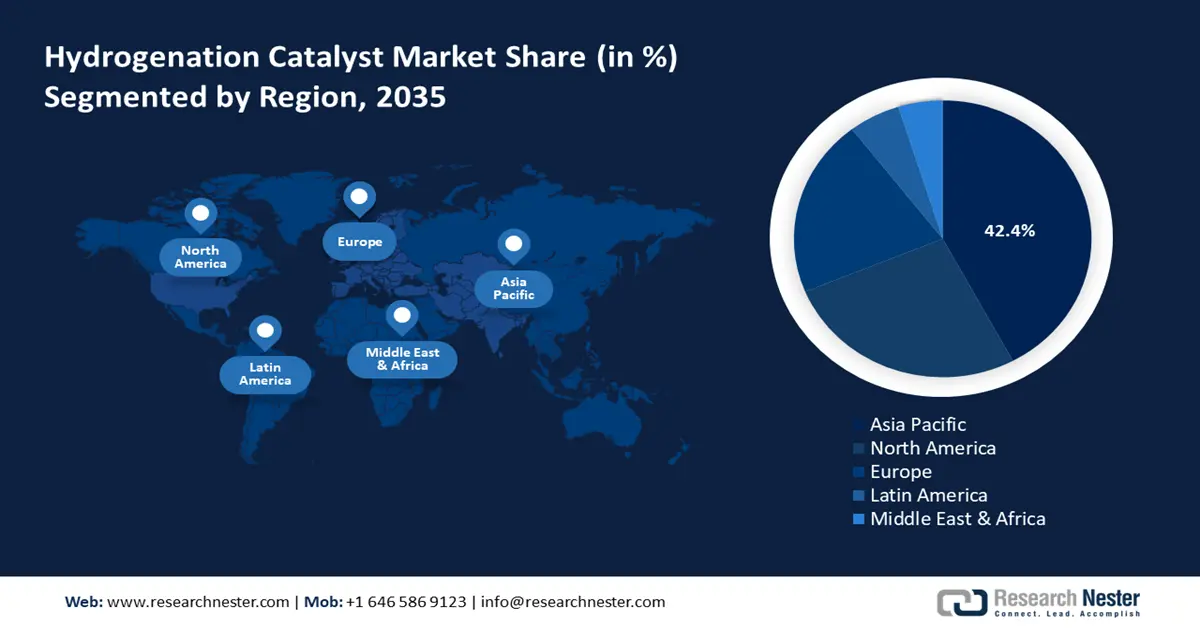

- Asia Pacific is projected to dominate the hydrogenation catalyst market with a 42.4% share during 2026–2035, propelled by rapid industrial expansion, surging chemical manufacturing, and strong governmental support for sustainable hydrogen production.

- North America is expected to secure a 26.5% share by 2035, attributed to increasing use of hydrogenation catalysts in petrochemical, food processing, and renewable fuel production amid tightening environmental regulations and expanding clean fuel refineries.

Segment Insights:

- The heterogeneous catalysts segment is projected to account for a 62.7% share of the hydrogenation catalyst market by 2035, driven by their ease of separation, reusability, and cost-effectiveness in large-scale industrial processes such as edible oil hydrogenation and biofuel production.

- The nickel-based catalysts segment is anticipated to hold a 42% market share by 2035, owing to their affordability, high catalytic efficiency, and expanding use in petrochemical, food, and pharmaceutical hydrogenation applications.

Key Growth Trends:

- Catalytic innovation and efficiency gains

- Surge in bio-based chemical production

Major Challenges:

- Complex and varied regulatory landscapes across regions

- Trade barriers and import/export restrictions

Key Players: Advanced Refining Technologies (ART), Albemarle Corporation, Criterion Catalysts & Technologies L.P., BASF SE, Clariant AG, Evonik Industries AG, Johnson Matthey plc, Haldor Topsoe A/S, Honeywell UOP, Axens SA, Sinopec Catalyst Co., Ltd., CNPC (China National Petroleum Corporation), Umicore N.V., Nippon Ketjen Co., Ltd., JGC Catalysts and Chemicals Ltd.

Global Hydrogenation Catalyst Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.9 billion

- 2026 Market Size: USD 4.3 billion

- Projected Market Size: USD 6.7 billion by 2035

- Growth Forecasts: 5.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (42.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, Japan, United States, Germany, India

- Emerging Countries: South Korea, Indonesia, Brazil, United Kingdom, Malaysia

Last updated on : 30 September, 2025

Hydrogenation Catalyst Market - Growth Drivers and Challenges

Growth Drivers

- Catalytic innovation and efficiency gains: Innovations in catalytic hydrogenation processes have resulted in notable efficiency improvements, with state-of-the-art catalysts demonstrating enhancements in production efficiency. The Hydrogen Production Technologies subprogram of the U.S. Department of Energy, FY 2023 and 2024, received at least annual funding of USD 15 million to develop catalytic innovations and efficiency improvements in clean hydrogen production. The 36 projects that receive funding amount to $1.1 billion (of which approximately 470 million is at the federal level), devoted to the development of new-generation electrolysers, new materials, and new routes. These activities are meant to decrease the price of Hydrogen to USD 2 per kilo by 2026 and to USD 1 per kilo by 2031, and improve the performance and life of the catalysts. These developments improve reaction selectivity and prolong the lifespan of catalysts, thereby lowering operational costs and boosting throughput for chemical manufacturers. Consequently, enhanced hydrogenation catalyst technologies are increasingly sought after, particularly in industries that encounter intense competition and stringent regulatory standards.

- Surge in bio-based chemical production: The worldwide increase in the production of bio-based chemicals is driving a heightened demand for hydrogenation catalysts, which are vital for the conversion of biomass into valuable products such as fuels, bioplastics, and specialty chemicals. For example, the catalytic hydrogenation of bio-oil and intermediates made by the biomass is essential in the production of bio-based products, e.g., fuels, bioplastics, and specialty chemicals. Hydrogenation has been proven to be efficient in upgrading lignin and other biomass components, as representative catalytic systems such as Ru/C have conversion rates of up to 77% with a monomer yield of 30.6%. Hydrogenation catalysts are crucial for the refinement of fatty acids and other renewable feedstocks, facilitating their efficient transformation into sustainable materials. This trend signifies a larger movement towards circular and green economies, establishing hydrogenation catalysts as a fundamental component in the shift from fossil-based to renewable chemical production systems.

- Policy and regulatory push to decarbonization: Climate policies and decarbonization requirements of industries supported by the government are accelerating the need for advanced hydrogenation catalysts. In the U.S., the Infrastructure Investment and Jobs Act (IIJA) provides USD 9.5 billion to fund clean hydrogen development, USD 1 billion towards electrolysis research and development, and half a billion to hydrogen made and recycled. These investments are meant to reduce the cost of hydrogen production and improve the catalyst performance, especially in the heavy industries such as refining, ammonia, and steel, where hydrogenation reactions are crucial. In addition, the DOE Hydrogen Shot initiative aims at reducing the cost of clean hydrogen to less than 1/kg in 2031, stimulating the need to use more efficient and durable catalysts. Such regulatory incentives are not only transforming the industrial activities but also strengthening hydrogenation catalysts as the key instruments in the comprehension of national and global climate objectives.

1. Import & Export Trends

Supported catalysts with nickel or its compound imports by country, 2023

|

Country |

Import Value (USD '000) |

Quantity (kg) |

|

South Korea |

148,363.47 |

9,930,600 |

|

China |

148,088.07 |

5,171,540 |

|

United States |

128,807.46 |

9,910,500 |

|

Germany |

97,100.07 |

5,837,280 |

|

Philippines |

94,510.80 |

643,886 |

|

Indonesia |

56,780.96 |

2,784,880 |

|

Canada |

51,816.99 |

3,515,070 |

|

India |

50,151.37 |

N/A |

|

Japan |

46,652.29 |

2,534,920 |

Source: worldbank.org

Supported catalysts with nickel or its compound exports by country, 2023

|

Country |

Exports (USD ’000) |

Quantity (Kg) |

|

United States |

466,351.85 |

26,126,500 |

|

European Union |

476,996.48 |

22,147,600 |

|

Denmark |

320,163.16 |

12,712,400 |

|

France |

212,949.33 |

12,789,600 |

|

Germany |

195,771.91 |

12,862,200 |

|

Japan |

97,785.34 |

7,696,560 |

|

China |

96,836.24 |

5,738,640 |

|

India |

73,921.68 |

5,397,450 |

|

Saudi Arabia |

60,913.42 |

3,168,850 |

Source: worldbank.org

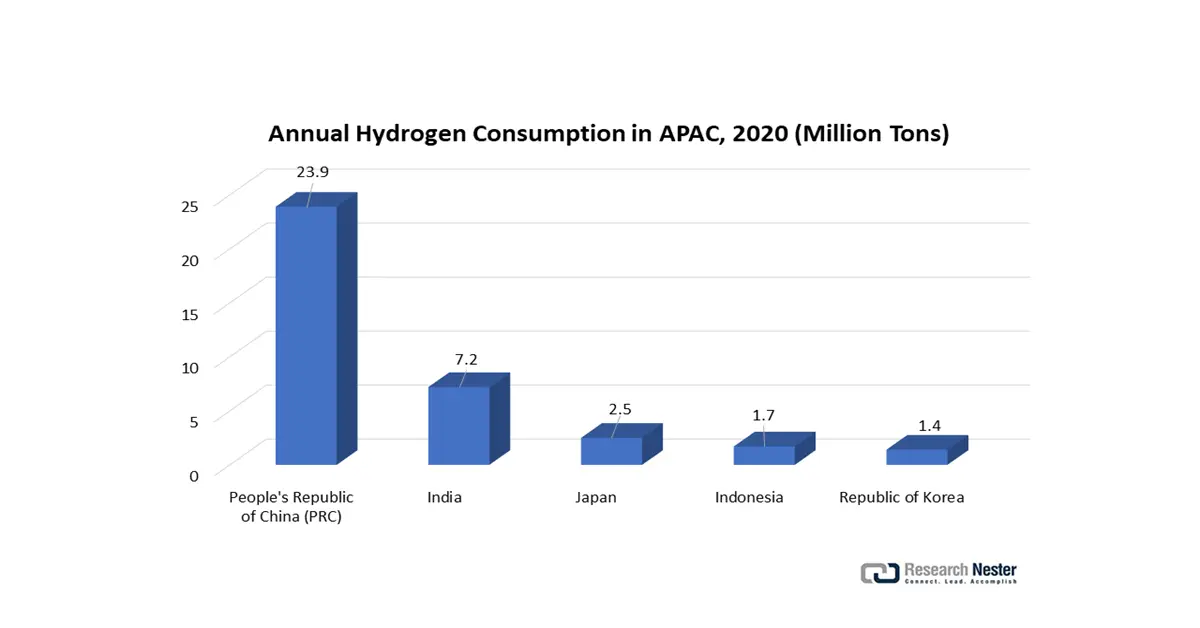

2. Rising Hydrogen Consumption as a Catalyst for Hydrogenation Market Growth

Growing demand for hydrogen in refining processes, petrochemicals, edible oils, and specialty chemicals boosts the need for catalysts that can enhance reaction rates, selectivity, and energy efficiency. In particular, the transition toward cleaner fuels and sustainable chemical production is increasing hydrogen use in desulfurization, biofuel upgrading, and green chemistry applications, thereby creating stronger demand for advanced hydrogenation catalysts. As hydrogen consumption rises across diverse sectors, the catalyst market expands in tandem, reflecting its dependency on hydrogen utilization trends.

Source: adb.org

Challenges

- Complex and varied regulatory landscapes across regions: Manufacturers encounter challenges in managing varying regulatory requirements across different jurisdictions. For example, the REACH regulations in the European Union mandate rigorous chemical registration and testing, while the Ministry of Ecology and Environment in China implements distinct safety standards and approval procedures. Such disparities cause companies to have region-specific compliance teams, pay high costs to test and certify, and they have to modify production processes to be in line with local environmental and safety regulations. This disintegration causes delays in the introduction of products to the hydrogenation catalyst market, diminished economies of scale, and uncertainty in investment planning for international manufacturers, particularly when regulations change rapidly or are inconsistently applied at international boundaries.

- Trade barriers and import/export restrictions: Tariffs, quotas, and non-tariff barriers, often presented as measures for environmental or safety protection, are hindering the international trade of hydrogenation catalysts. These regulatory challenges elevate costs, restrict hydrogenation catalyst market entry, and disrupt supply chains, posing difficulties for manufacturers aiming to expand operations and satisfy the rising demand for sustainable chemical production globally. For example, importation of key raw materials such as platinum and nickel can drive up the cost of production, and exportation of some catalyst formulations may restrict market access. Similarly, there are the lead times caused by customs and failure to meet uneven documentation requirements, which make just-in-time production of catalysts more hazardous and less competitive in world markets for small and mid-sized manufacturers.

Hydrogenation Catalyst Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

5.5% |

|

Base Year Market Size (2025) |

USD 3.9 billion |

|

Forecast Year Market Size (2035) |

USD 6.7 billion |

|

Regional Scope |

|

Hydrogenation Catalyst Market Segmentation:

Product Type Segment Analysis

The heterogeneous catalysts segment is expected to grow with the largest revenue share of 62.7% over the projected years, attributed to their practical benefits, such as ease of separation from reaction mixtures, reusability, and enhanced cost-effectiveness, especially in large-scale industrial applications. These catalysts find extensive use in processes like the hydrogenation of edible oils, biofuel production, and petrochemical processing. Their solid-phase characteristics facilitate more efficient handling and lower operational costs, rendering them particularly advantageous for continuous processing systems. As industries increasingly prioritize scalable and sustainable production, the demand for heterogeneous catalysts is on the rise across major end-use sectors.

The supported catalysts, where the nickel or platinum is dispersed on a carrier like alumina or carbon, are due to their high surface area, thermal stability, and cost-effectiveness. Such catalysts find extensive use in biomass upgrading and chemical hydrogenation; in each case, support properties are important to enhance activity and longevity. Meanwhile, unsupported catalysts are entirely made of active components (e.g., Fe-Co nanoalloys) and are particularly important in high-purity or high-temperature conditions, such as hydrogenation of CO 2, giving them high specific activity and selectivity characteristics. This combination of subsegments addresses the large-scale, as well as the specialty, hydrogenation requirements, setting the pace of innovation, broadening the scope of applications, and maintaining flexibility to meet the changing sustainability and performance requirements of the chemical manufacturing sectors worldwide.

Metal Type Segment Analysis

Nickel-based catalysts are expected to hold a 42% share of the hydrogenation catalyst market by 2035, highlighting their essential function in industrial applications. Recognized for their affordability, high catalytic efficiency, and adaptability, nickel catalysts are extensively utilized in hydrogenation processes within the petrochemical, food processing, and pharmaceutical industries. Their effectiveness in transforming unsaturated compounds, along with their relative abundance compared to precious metals, positions them as a favored option for large-scale production. Furthermore, ongoing research aimed at improving the thermal stability and selectivity of nickel-based systems is promoting increased adoption, especially in environmentally conscious operations and bio-based chemical production.

Raney nickel is an established hydrogenation catalyst that is valued due to its high surface area (usually superior to 100 m 2/g) and good performance in reducing nitriles, carbonyls, and oils, and is required in pharmaceuticals, agrochemicals, and specialty chemicals. It is thermos and chemically stronger to support large-scale operations. Meanwhile, the growth of the hydrogenation catalyst market is being propelled by supported nickel catalysts, whereby nickel is dispersed over surfaces such as alumina or silica, which has better dispersion of nickel, is cost-effective, and extends catalyst life. The export of supported nickel catalysts also reflects the industrial significance of the product. As of 2023, the U.S. exports of the supported nickel catalysts are worth $466 million, which indicates the robust global demand. Together, the two subsegments support high-volume and precision-oriented hydrogenation operations, which further confirms that nickel is at the center of the worldwide hydrogenation catalyst market.

Our in-depth analysis of the hydrogenation catalyst market includes the following segments:

|

Segment |

Sub-Segments |

|

Product Type |

|

|

Metal Type |

|

|

Application

|

|

|

End-User Industry

|

|

|

Form

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogenation Catalyst Market - Regional Analysis

Asia Pacific Market Insights

Asia Pacific is anticipated to dominate the hydrogenation catalyst market with the largest revenue share of 42.4% over the forecast years from 2026 to 2035, owing to swift industrial expansion, heightened chemical manufacturing activities, and strong governmental initiatives aimed at promoting sustainable chemical production. As per the report on Global Hydrogen Review 2024 by the International Energy Agency, the Asia Pacific region contributes more than 40% of the global production capacity of hydrogen, showing that there are significant regional investments in hydrogen technologies, such as catalysts. In addition, the report of Asian Development Bank stated that half of the world demand of industrial hydrogen is in the Asia and Pacific region, and it has a huge potential of producing clean hydrogen, which makes hydrogen a key factor in decarbonization of hard-to-abate industrial processes, including oil refining, chemical production, iron and steel production, and the use of heat produced in high temperature.

Furthermore, the region is leading the world in terms of investment in hydrogen, with 73% of the total hydrogen investments being in the region in the year 2020. This influx of investment is promoting improvements in catalyst technology in hydrogenation, which is needed in the production and use of hydrogen efficiently. The developments are significant in fulfilling the increasing need for sustainable chemical processes and the shift towards the low-carbon economy of the Asia Pacific region.

The hydrogenation catalyst market in China is predicted to dominate the Asia Pacific region with a significant revenue share over the forecast period by 2035, owing to a robust growth in the petrochemical and chemical production industries. China is the largest hydrogen manufacturer in the world, producing around 25 million tons every year, which constitutes a quarter of the world's production. The China Hydrogen Alliance estimates that by 2030, national demand will go up to 35 million tons and 60 million tons by 2050. The industry will have a market value of RMB 1 trillion (USD 157 billion) in 2025, supported by robust state support. In addition, in 2025, China targets 200,00 tonnes of green hydrogen, through its Green Hydrogen Energy Plan. The China Hydrogen Alliance also aims to have 80 GW of electrolyzer capacity by the year 2030.

Moreover, China encouraged the use of hydrogen-fuelled vehicles, and a target of 50,000 hydrogen vehicles on the streets was set as of 2025. Such aggressive goals are inspiring the quest for advancing hydrogenation catalysts, particularly nickel or precious metal-based systems that operate efficiently in both green hydrogen and industrial applications such as refining, chemical processing, and energy storage.

India’s market is anticipated to grow with the fastest CAGR during the projected years from 2026 to 2035, attributed to the government initiatives such as the National Hydrogen Mission and Chemical Industry development programs targeted at fostering sustainable manufacturing. The present hydrogen consumption in India is roughly estimated as 6 million metric tons per annum (mmtpa), with oil refining industries consuming approximately 3 mmtpa and ammonia production consuming approximately 2.5 mmtpa. Demand is likely to be 12 mmtpa by 2030, and Hydrogen prices are expected to be USD 2-2.5 per kilogram. This rising demand is likely to see a dynamic growth in the hydrogenation catalysts, particularly in greater efficiency, durability, and cost-effectiveness in the large-scale refining, fertilizer, and chemical manufacturing industries.

Furthermore, in January 2023, the National Green Hydrogen Mission was approved by India with an outlay of USD 2.5 billion (₹19,744 crore) for the production of 5 million metric tons of green hydrogen per year by 2030. The program is expected to minimize the importation of fossil fuel by USD 12 billion, attract more than USD 100 billion in investments, and reduce 50 million metric tons of CO2 per year. This massive shift is likely to spur high demand for hydrogenation catalysts in the process of refining, fertilizers, and clean energy. Such growth prospects are straining the need to have stronger hydrogenation catalysts, particularly nickel and precious metal-based, to sustain scaled clean hydrogen generation, increased reaction efficiencies, and stability in a variety of industrial environments.

North America Market Insights

North American hydrogenation catalyst market is projected to grow steadily over the forecast years, with a revenue share of 26.5%, owing to the high demand in such industries as petrochemicals, food processing, and pharmaceuticals. These industries use a lot of hydrogenation catalysts to produce refined fuels, oils, and other chemicals. For example, Prairie Energy Partners will build a USD 5.56 billion decarbonized refinery in Oklahoma with both blue and green hydrogen as the process heating medium and fuel feeds with an objective of reducing 95 percent of GHG emissions. The plant will also have a hydrogen complex that has CCS, which will substitute the heating process that uses natural gas with hydrogen-oxygen combustion. This is a massive hydrogen integration that directly serves the market as a result of the expansion in clean fuel refining technologies. The rising push for sustainable, bio-based feedstocks and stringent environmental regulations is driving market growth. For instance, the EPA has suggested a 5.61 billion-gallon by 2026, and 7.50 (5.86 billion gallons) in 2027. This is a direct increase in the demand for hydrotreating units and hydrogenation catalysts in the production of renewable diesel. Additionally, major corporations like BASF, Johnson Matthey, and Clariant are leading the pack in offering innovative catalyst solutions within the region.

U.S. market is likely to lead the North American region with the largest revenue share by 2035, attributed to the high demand in each of the oil refining, food processing, and automotive industries. The U.S Department of Energy targets to minimize the cost of hydrogen production to remove 2 per kilogram in 2026 and 1 per kilogram in 2031 with reduced electrolyzer and fuel cell costs. These cuts will lead to an increase in hydrogen consumption in refining and chemicals; this will result in a greater need for hydrogenation catalysts and will drive the growth of the U.S. catalyst industry. Besides this, the development of biofuels in the U.S. is also affected by renewable energy projects and government support of cleaner technology. In 2023, the U.S. biofuel production capacity was 23.8 billion gallons per year, with renewable diesel and biodiesel on top of 3.9 and 2.9 billion gallons, respectively. The policies, such as the Renewable Fuel Standard and programs such as the Sustainable Aviation Fuel Grand Challenge, help in growth. This growth increases the need for hydrogenation catalysts that are essential to transform bio-based feeds into high-quality fuels. Furthermore, the future market trends are likely to be influenced by the demand for renewable diesel, sustainable fuel, and the efficiency of catalysts. The major participants like Haldor Topsoe, BASF, and W. R. Grace are taking the initiative to continuously innovate to keep the lead in the market.

The market in Canada is expected to grow at a steady rate during the projected years, driven by the increased demand in the chemical, pharmaceutical, and food industries. In the evolution of the hydrogenation industry in the country, Natural Resources Canada states that there is a growing trend of biofuels and a general shift in the direction of sustainability. Since 2020, Canada has had over 80 low-carbon hydrogen production projects online, which amount to an estimated CAD 100 billion in investment potential. By 2024, 13 functioning low-carbon hydrogen plants will be present on the territory of the country, generating more than 3,000 tonnes of hydrogen per year. The emerging hydrogen output environment is also directly related to the need to produce hydrogenation catalysts in Canada that are required in the refining and renewable fuel processes that utilize hydrogen as a major feedstock. Furthermore, Canada's objective to eliminate its greenhouse gases and to produce more renewable energy is driving the use of new technologies to improve the process of hydrogenation.

Europe Market Insights

By 2035, the European market is expected to account for around 20.7% of the global market revenue, fueled by robust industrial demand and advancing environmental regulations in major European economies. The UK and Germany are significant contributors to this hydrogenation catalyst market, bolstered by substantial government backing and advancements in green chemistry. The 2021 Hydrogen Strategy by the UK government places a bold goal of 10 GW of low-carbon hydrogen production capacity by 2030, in a bid to create a sufficient quantity of hydrogen to serve more than 3 million households every year. The latter strategy is the basis of the increase in investments in hydrogen production technologies, such as electrolytic and hydrogen-enabled through CCUS. This growing emphasis on green hydrogen is also accompanied by an augmented interest in enhanced hydrogenation catalysts, which are required to generate renewable fuels, chemicals, and special products, and thus, promote innovation and growth of the UK hydrogenation catalyst market.

Furthermore, Germany was the second-biggest global exporter of Reaction and Catalytic Products, as in 2023 it exported its products valued at USD 4.46 billion, sharing 16.6% market share of the global market. Germany also imported these products in large volumes, USD 4.4 billion, with the largest share of the market in the world at 16.4%. The high level of trade is an indicator of a strong industrial base in Germany and the increasing demand for hydrogenation catalysts due to the rising number of chemical and refining industries. The large level of exports and imports provides evidence of the important part played by Germany in the manufacture, development, and usage of advanced hydrogenation catalysts to sustain the growth in the market.

Key Hydrogenation Catalyst Market Players:

- Advanced Refining Technologies (ART)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Albemarle Corporation

- Criterion Catalysts & Technologies L.P.

- BASF SE

- Clariant AG

- Evonik Industries AG

- Johnson Matthey plc

- Haldor Topsoe A/S

- Honeywell UOP

- Axens SA

- Sinopec Catalyst Co., Ltd.

- CNPC (China National Petroleum Corporation)

- Umicore N.V.

- Nippon Ketjen Co., Ltd.

- JGC Catalysts and Chemicals Ltd.

The global hydrogenation catalyst market exhibits a significant level of concentration, with the leading three companies, Advanced Refining Technologies (ART), Albemarle Corporation, and Criterion Catalysts & Technologies, together holding around 43% of the market share. These firms utilize their extensive research and development capabilities, strategic alliances, and diverse product offerings to sustain their competitive advantage. European companies such as BASF SE, Clariant AG, and Evonik Industries AG emphasize sustainable solutions and innovation to meet various industrial needs. Johnson Matthey plc, known for its long-standing expertise in catalysis, continues to invest in cutting-edge technologies to facilitate clean energy transitions. Meanwhile, Asian firms like Sinopec Catalyst Co., Ltd. and CNPC are broadening their global presence through capacity improvements and technological progress. In summary, the hydrogenation catalyst market is dynamic, with companies implementing strategies such as mergers and acquisitions, technological advancements, and regional growth to enhance their market positions. The table below outlines the top 50 companies and their share in the global hydrogenation catalyst market.

Top Global Hydrogenation Catalyst Manufacturers

Recent Developments

- In July 2025, N.E. CHEMCAT CORPORATION announced the CHOIS-5D palladium catalyst, which is capable of reacting with sulfur-containing nitro compounds under difficult conditions to produce hydrogenated organic products. Based on its introduction in 2024 as a debenzylation reaction involving less palladium, CHOIS-5D has now been shown to be highly active in hydrogenating nitro compounds with sulfides, sulphonyl groups, and thiophene rings. The problem of catalyst poisoning by sulfur is solved in this development, which is economically viable in terms of producing pharmaceutical intermediates, high-performance polymer monomers, and electronic material/dye amino compounds.

- In April 2024, Clariant introduced its most recent propane dehydrogenation catalyst, named CATOFIN 312, that builds upon the proven performance of earlier CATOFIN catalysts through better selectivity and up to 20 percent longer life. This innovation would increase productivity by up to 20 million dollars during the lifespan of the catalyst in a typical plant of 600 KTA PDH. CATOFIN 312 is designed to optimize the benefits of the propylene producers with the support of the digital service portal CLARITY of Clariant, which provides real-time catalyst performance information and rich analytics. The use of CATOFIN technology in the production of olefins is a well-established technology in the world that has been utilized in 40 new projects across the globe since 2017, a fact that is strong in the propane dehydrogenation catalysts.

- Report ID: 3872

- Published Date: Sep 30, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogenation Catalyst Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.