Hydrogenated Starch Hydrolysate Market Outlook:

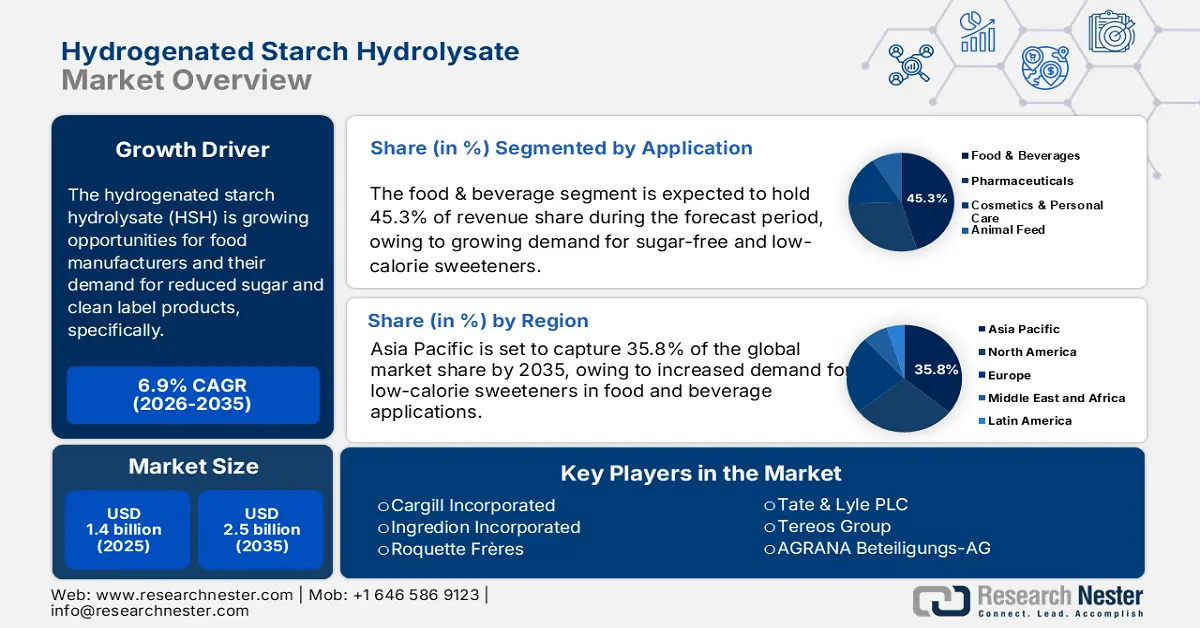

Hydrogenated Starch Hydrolysate Market size was estimated at USD 1.4 billion in 2025 and is expected to surpass USD 2.5 billion by the end of 2035, rising at a CAGR of 6.9% during the forecast period, i.e., 2026-2035. In 2026, the industry size of hydrogenated starch hydrolysate is assessed at USD 1.7 billion.

Hydrogenated starch hydrolysate (HSH) presents growing opportunities for food manufacturers, driven by increasing demand for reduced-sugar formulations and clean-label products that support healthier consumer choices. According to FRED, the producer index for "Starch and Vegetable Fats and Oils Manufacturing" for August 2025 was 176.373, and continues to exhibit price inflation in the upstream market scheduled for future delivery. USDA projects 2025/26 U.S. sugar imports at 2.474 million STRV, highlighting constrained supply and encouraging manufacturers to diversify toward polyol alternatives and proactively adjust supply chains to mitigate potential disruptions.

The movement of goods and the availability of raw materials have a significant influence on commercial HSH supply chains. U.S. imports of polyols show recent volatility, and the USITC reported total erythritol imports (as a proxy for sugar-alcohol trade) for all sources of 70,634 in 2021 and 73,040 in 2022, before falling to 35,023 in 2023, both of which showed variability, including variability attributable to inventory as well. The capacity upstream of feedstock remains significant, e.g. USDA reported U.S. corn exports of around 1.6 billion bushels in 2022/23, sufficient to support cornstarch/glucose syrup inputs. Finally, EPA technical guidance on starch manufacture describes the steps wet-milling, enzymatic hydrolysis, catalytic hydrogenation and drying, which are on the assembly line and which each have their own energy, capital and compliance implications for production planning.