Hydrogenated Nitrile Butadiene Rubber Market Outlook:

Hydrogenated Nitrile Butadiene Rubber Market size was valued at USD 651.9 million in 2025 and is likely to cross USD 1.34 billion by 2035, registering more than 7.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrogenated nitrile butadiene rubber is assessed at USD 695.9 million.

Hydrogenated nitrile butadiene rubber is gaining traction across various end use industries owing to its unique and versatile characteristics. Manufactured using acrylonitrile and butadiene as base materials, HNBR sales are directly associated with their trade. Asia Pacific has high dominance in the acrylonitrile and butadiene trade. This is attributed to the strong presence of chemical industries and supportive regulations. The positive foreign direct investments (FDI) in the chemical sector are augmenting the overall hydrogenated nitrile butadiene rubber market growth.

|

Acrylonitrile Butadiene Rubber (NBR) Except as Latex |

|||

|

Country |

Exports Value in USD Million |

Country |

Exports Value in USD Million |

|

South Korea |

317 |

China |

236 |

|

France |

225 |

U.S. |

192 |

|

U.S. |

190 |

Germany |

122 |

|

Japan |

167 |

India |

105 |

|

Russia |

86.2 |

Belgium |

85 |

Source: OEC

The Observatory of Economic Complexity (OEC) study reveals that the acrylonitrile butadiene rubber (NBR) except as latex trade was calculated at USD 1.4 billion, in 2022, representing 0.0059% of the global trade. Holding the 1840th position as the most traded product, the high trade activities were signified by South Korea and China. The market concertation was measured at 3.51 using Shannon Entropy, explaining export dominance by 11 countries. The major importers of South Korean NBR expect latex were China, India, the U.S., Italy, Vietnam, Germany, and Turkey, in 2022. These estimates highlight high growth aspects for HNBR manufacturers in the coming years.

Key Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Insights Summary:

Regional Highlights:

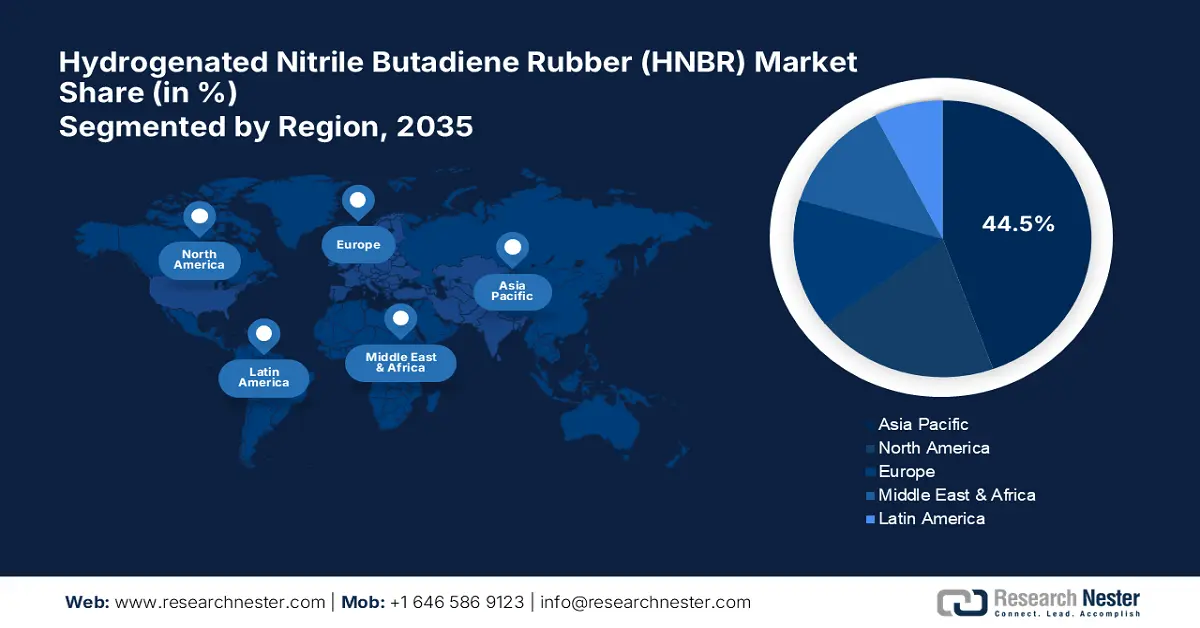

- Asia Pacific dominates the Hydrogenated Nitrile Butadiene Rubber Market with a 44.5% share, driven by the strong presence of chemical manufacturers, high raw material production, and supportive government policies, fostering growth through 2026–2035.

Segment Insights:

- The HNBR Solid segment is set to capture over 68.2% market share by 2035, attributed to growth in aerospace and defense sectors demanding durable, high-performance products.

- The Automotive segment is expected to capture over a 53.5% share by 2035, driven by the rapidly increasing number of vehicle registrations worldwide.

Key Growth Trends:

- Rising demand from the oil and gas sector

- Urban and industrial growth

Major Challenges:

- Competition from alternatives

- Fluctuations in the raw material supply chain

- Key Players: Lianda Corporation, Rahco Rubber, Inc., Fluotech (Xiamen) New Materials Co., Ltd., and Synthos S.A.

Global Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 651.9 million

- 2026 Market Size: USD 695.9 million

- Projected Market Size: USD 1.34 billion by 2035

- Growth Forecasts: 7.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (44.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, India

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 13 August, 2025

Hydrogenated Nitrile Butadiene Rubber Market Growth Drivers and Challenges:

Growth Drivers

- Rising demand from the oil and gas sector: The superior resistance to oil is driving the use of hydrogenated nitrile butadiene rubber in oil and gas plants. The chemical’s ability to withstand extreme temperatures is primarily contributing to its sales growth. The expanding oil and gas demand worldwide is directly fueling the sales of hydrogenated nitrile butadiene rubber solutions. For instance, the U.S. Energy Information Administration (EIA) estimates that 2025 and 2026 are expected to witness high liquid fuel production, globally owing to the relaxation of OPEC and production cuts. The 2025-2026 period is also expected to witness production growth from countries outside OPEC (Organization of the Petroleum Exporting Countries). Global fuel production is estimated to surpass 0.5 million b/d in 2024 to 1.8 million b/d by 2025. Furthermore, the International Energy Agency (IEA) revealed that the worldwide oil demand increased seasonally in the fourth quarter of 2024 representing an annual growth of 1.5 mb/d. The factors contributing to the high consumption of oil are abundant petrochemical feedstocks and colder weather across the Northern Hemisphere.

- Urban and industrial growth: The hike in urban and industrial activities across the world is one of the leading growth drivers for the sales of hydrogenated nitrile butadiene rubbers. Booming construction and infrastructural development activities, automotive production, and manufacturing industries are generating lucrative opportunities for hydrogenated nitrile butadiene rubber manufacturers. For instance, the Industrial Statistics 2024 edition by the United Nations Industrial Development Organization (UNIDO) reveals that the industrial sector accounted for 21.3% of the global GDP, in 2023. The manufacturing growth is anticipated to expand swiftly in low-income countries in the coming years. The global expansion strategies by HNBR manufacturers to grab untapped opportunities are expected to boost their revenue growth in high-potential economies.

Challenges

- Competition from alternatives: Rubber is a highly competitive marketplace, and the easy accessibility of alternatives acts as a significant barrier to growth. ETERNATHANE polycarbonate-based polyurethane prepolymers are hampering the sales of hydrogenated nitrile butadiene rubbers to some extent. Technical resistance and inherent strength are some of the major aspects promoting the use of polycarbonate-based polyurethane prepolymers, and hindering the HNBR market growth.

- Fluctuations in the raw material supply chain: The price fluctuations of the raw materials used in the production of hydrogenated nitrile butadiene rubber such as acrylonitrile and butadiene have the potential to hinder the production cycle. The pricing instability often leads to high costs of final products, impacting the sales structure of HNBR manufacturers.

Hydrogenated Nitrile Butadiene Rubber Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.5% |

|

Base Year Market Size (2025) |

USD 651.9 million |

|

Forecast Year Market Size (2035) |

USD 1.34 billion |

|

Regional Scope |

|

Hydrogenated Nitrile Butadiene Rubber Market Segmentation:

Product (HNBR Solid, HNBR Latex)

The HNBR solid segment is likely to hold hydrogenated nitrile butadiene rubber (HNBR) market share of over 68.2% by the end of 2035. The solid segment is bifurcated into belts & cables, seals & O-rings, hoses, adhesives & sealants, foamed products, and others. The solid HNBR solutions are finding high applications in the aerospace and defense sectors owing to their high durability and performance under extreme conditions. These characteristics are expanding their use in seals, gaskets, and other critical components. The growth in the aerospace and defense industry is set to directly fuel the demand for solid hydrogenated nitrile butadiene rubber products.

End use Industry (Automotive, Machinery, Oil & Gas, Medical, Construction, Others)

In hydrogenated nitrile butadiene rubber (HNBR) market, automotive segment is set to dominate revenue share of over 53.5% by 2035. The rapidly increasing number of vehicle registrations across the world is highlighting the use of HNBR in production. For instance, in February 2024, the World Economic Forum (WEF) stated that China is the major exporter of vehicles across the globe. Furthermore, the OEC report reveals that in 2022, cars were the 5th most traded products accounting for USD 782.0 billion of trade. The CAGR of car exports between 2021 to 2022 was registered at 7.51%. Germany and the U.S. were the top exporters and importers of cars totaling USD 149 billion and USD 159 billion worth of trade, respectively, in 2022.

Our in-depth analysis of the global hydrogenated nitrile butadiene rubber (HNBR) market includes the following segments:

|

Product |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogenated Nitrile Butadiene Rubber Market Regional Analysis:

Asia Pacific Market Forecast

By 2035, Asia Pacific hydrogenated nitrile butadiene rubber market is predicted to dominate over 44.5% revenue share. The strong presence of chemical manufacturers, high raw material production activities, and supportive government policies are collectively contributing to the overall market growth. South Korea, Japan, China, and India are the most opportunistic marketplaces for hydrogenated nitrile butadiene rubber manufacturers.

In China, the expanding manufacturing operations of HNBR manufacturers are backing the trade of hydrogenated nitrile butadiene rubber products. For instance, the OEC report estimates that the export value of raw materials of HNBR specifically acrylonitrile butadiene rubber (NBR) except as latex was calculated at USD 62.7 million, in 2022. The major importers of Chinese NBR except as latex were India, Vietnam, Chinese Taipei, South Korea, Indonesia, and Malaysia, accounting for 18.7%, 14.7%, 10.8%, 5.54%, and 5.08% of the total export trade share, in 2022, respectively.

India’s boasting chemical industry is highlighting how opportunistic the country is for HNRB producers. Supportive regulations and foreign direct investment policies are uplifting the market growth in the country. The study by the India Brand Equity Foundation (IBEF) states that the export trade of organic and inorganic chemicals totaled USD 14.09 billion between Q2 and Q3 2024. The chemical industry has a major influence on India’s economic growth and contributes 7% to the GDP. The country holds 8th and 14th position on the global scale as the importer and exporter of chemicals.

North America Market Statistics

The North America hydrogenated nitrile butadiene rubber (HNBR) market is foreseen to increase at the fastest pace during the study period. The strong presence of end use industries such as automotive, aerospace & defense, oil & gas, and construction is fueling the sales of hydrogenated nitrile butadiene rubber products. The infrastructure development projects are offering lucrative opportunities for hydrogenated nitrile butadiene rubber manufacturers in both the U.S. and Canada.

In the U.S., HNBR is finding extensive use in automobile and component manufacturing such as belts, seals, and gaskets. The growth in the automotive trade reflects the consumption of hydrogenated nitrile butadiene rubber products. For instance, in April 2023, the Washington International Trade Association (WITA) stated that in Q1’23, U.S. auto exports reached 19.3% YoY to USD 22.1 billion, and imports surpassed 21.6% to USD 44.5 billion. Thus, the booming auto trade activities are anticipated to generate high-earning opportunities for HNRB producers.

In Canada, the ongoing infrastructure development projects and advancements in the oil sands industry are augmenting a high demand for hydrogenated nitrile butadiene rubber products. The Canadian Association of Petroleum Producers (CAPP) reveals that the Canadian oil sand reserves hold the top position globally with 164.0 billion barrels of production. Furthermore, the Statistics Canada report stated that the transportation and water infrastructure in the country totaled a replacement value of around USD 1.8 trillion in 2022. These statistics highlight that the high oil production and infra-development investment initiatives are augmenting the consumption of hydrogenated nitrile butadiene rubber products in the country.

Key Hydrogenated Nitrile Butadiene Rubber Market Players:

- Arlanxeo

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Polycomp

- Eriks NV

- Rahco Rubber, Inc.

- Mantaline

- Trelleborg Sealing Solutions

- MCM SpA

- Lianda Corporation

- Rahco Rubber, Inc.

- Fluotech (Xiamen) New Materials Co., Ltd.

- Synthos S.A.

The global hydrogenated nitrile butadiene rubber (HNBR) market is characterized by the emergence of new companies and the existence of industry giants. The new companies are investing in R&D activities to develop innovative products and stand out in the crowded landscape. The leading companies are employing several organic and inorganic strategies such as new product launches, strategic collaborations & partnerships, regional expansions, and mergers & acquisitions to attain a dominant position in the global market. Considering the high demand from end use industries, the HNRB manufacturers are majorly focusing on expanding production units.

Some of the key players include:

Recent Developments

- In April 2024, Arlanxeo revealed the launch of its Therban hydrogenated nitrile butadiene rubber (HNBR) plant in Changzhou, China. The manufacturing unit is anticipated to start its operations in the Q3 of 2025.

- In April 2023, Fluotech (Xiamen) New Materials Co., Ltd., a subsidiary of Dowhon, announced the introduction of a new HNBR production line. This expansion with a production capacity of 1,000 tons is aiding the company to expand its applications in the lithium battery industry.

- Report ID: 7013

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogenated Nitrile Butadiene Rubber (HNBR) Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.