Hydrogen Vehicle Market Outlook:

Hydrogen Vehicle Market size was valued at USD 18.79 billion in 2025 and is likely to cross USD 292.74 billion by 2035, registering more than 31.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrogen vehicle is assessed at USD 24.13 billion.

The rising focus on fuel economy worldwide as well as surging demand for fuel-efficient cars is strengthening the demand for hydrogen vehicles. Research unveils that hydrogen fuel economy is equivalent to around 2x that of gasoline vehicles owing to which there is a surge in demand for hydrogen cars globally. It was found that the global sale of hydrogen cars grew by 8.8%, and reached a total of 16,195 units in the January-October period of 2022 from 14,879 in 2021. Moreover, it is projected that the demand for low-carbon hydrogen from transport will be surged up to 6TWh by 2030.

Most fuel cell electric vehicles (FCEVs) are powered by hydrogen. These electric vehicles (EVs) use an electric motor to power the wheels instead of an internal combustion engine and comprise an electric traction motor, battery, battery pack, fuel cell stack, fuel filler, fuel tank, direct current (DC) converter, power electronics controller, thermal system, and transmission. FCEVs rely primarily on hydrogen (H2) gas in the fuel tank of vehicles and oxygen (O2) in the air to generate electricity with water and heat as byproducts. Hydrogen car companies are constantly working on different types of hydrogen cars as well as green hydrogen projects and by 2030, it is anticipated that hydrogen to be in use across a range of transport modes, including, cars, buses, large goods vehicles (LGV), and rail, besides early stage uses in commercial shipping and aviation.

Hydrogen fuel cell vehicles (FCV) are zero-emission vehicles (ZEVs) and it complies with the mandate of many countries that are moving away from fossil fuel energy owing to its rapid depletion. Hence, with the growing environmental concerns as well as the high demand for fuel-efficient as well as low-emission vehicles owing to the depleting reserves of conventional fossil fuels along with the increasing government initiatives for the development of hydrogen fuel cell infrastructure, the global hydrogen market is anticipated to grow. For instance, California’s ZEV mandate and internal combustion engine ban will boost the market for hydrogen vehicles in that country.

Key Hydrogen Vehicle Market Insights Summary:

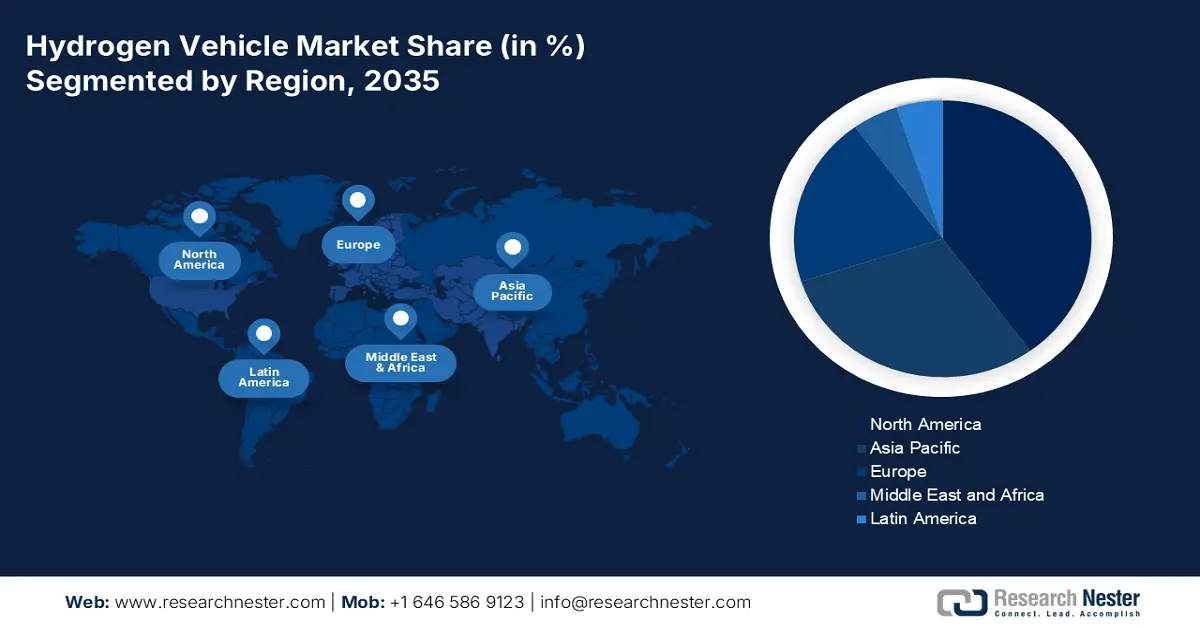

Regional Highlights:

- North America hydrogen vehicle market captures the largest share by 2035, driven by clean vehicle policies and hydrogen infrastructure expansion.

- Asia Pacific market will secure the second largest share by 2035, fueled by growing automotive demand and investment in hydrogen vehicles.

Segment Insights:

- The passenger vehicle segment in the hydrogen vehicle market is expected to capture the largest share by 2035, driven by increasing vehicle demand and rising disposable income among middle-class consumers.

- The pem fuel cells segment in the hydrogen vehicle market is forecasted to attain a significant share by 2035, driven by PEM’s suitability for transport and stationary fuel-cell applications.

Key Growth Trends:

- Increasing Concern About Rising Vehicular Emission

- Increasing Investment in Clean and Renewable Sources of Energy

Major Challenges:

- Increasing Concern About Rising Vehicular Emission

- Increasing Investment in Clean and Renewable Sources of Energy

Key Players: Ballard Power System Inc., Toyota Motor Corporation, Mercedes-Benz Group AG, Hyundai Motor Company, Hydrogenics, Bayerische Motoren Werke AG, Cummins Inc., General Motors Company, Power System PLC, Horizon Fuel Cell Technologies.

Global Hydrogen Vehicle Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 18.79 billion

- 2026 Market Size: USD 24.13 billion

- Projected Market Size: USD 292.74 billion by 2035

- Growth Forecasts: 31.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America

- Fastest Growing Region: Asia Pacific

- Dominating Countries: Japan, South Korea, China, Germany, United States

- Emerging Countries: China, Japan, South Korea, India, Singapore

Last updated on : 9 September, 2025

Hydrogen Vehicle Market - Growth Drivers and Challenges

Growth Drivers

- Increasing Concern About Rising Vehicular Emission - the growing emission of various harmful gases such as greenhouse gases (GHG) mainly carbon dioxide (CO2), nitrous oxide (N2O), and methane from the transport sector as well as the rising concern about the global climate change is estimated to boost the growth of the market over the projected period. It was found that greenhouse gas emissions from the transportation sector almost equaled nearly 27% of total U.S. greenhouse gas emissions, and were the largest contributor to U.S. GHG emissions.

- Increasing Investment in Clean and Renewable Sources of Energy - the growing investment in clean energy fuel as well as increasing infrastructural development such as the erection of charging stations for electric vehicles and hydrogen vehicles is anticipated to propel the market growth. For instance, it was found that the investment made by the United States in clean energy amounted to approximately USD 55 Billion in 2019. Moreover, the increasing investment in the development of green hydrogen projects for transport applications as hydrogen is abundant and can be made from renewable energy, is further expected to boost the market growth.

- Incentivizing Policies for Electric Vehicles (EVs) and Hydrogen Cars to Reduce Air Pollution - Hydrogen as a fuel has the potential to reduce air pollutant emissions arising from the transport sector. Hence, governments worldwide are providing incentives, loans, tax exemptions, and other subsidies for the speedy penetration of these clean fuel vehicles. For instance, The EV policies of India for EV purchases include financial incentives, exemption from road taxes and car registration fees, and low loan interest rates. All these factors are estimated to augment the market growth.

- Increasing Demand for Hydrogen Fuel Cell Passenger Vehicles - it was observed that passenger cars were the most numerous road vehicle type that utilized hydrogen fuel cell technology. The sale of more than 56, 000 hydrogen fuel cell passenger vehicles took place around the world in 2022.

Challenges

- High Fuel Cost – compared to gasoline, the cost of hydrogen fuel cell vehicles (FCV) is high which is a major challenge restraining market growth. Hydrogen’s unique physical properties are the primary reason leading to the cost hike of fuel. Hydrogen fuel cost can only be lowered with its higher volume sales or greater economies of scale. FCV fuel cost is higher by 3 times per mile than a gasoline hybrid and higher than 2 times that of a conventional gasoline vehicle, making it tougher for hydrogen vehicles to be competitive with hybrid gasoline vehicles. Thus, these factors are hampering the market growth.

- Lack of Infrastructure

- Reluctance in Customers Regarding its Adoption

Hydrogen Vehicle Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

31.6% |

|

Base Year Market Size (2025) |

USD 18.79 billion |

|

Forecast Year Market Size (2035) |

USD 292.74 billion |

|

Regional Scope |

|

Hydrogen Vehicle Market Segmentation:

Vehicle Type Segment Analysis

The passenger vehicle type segment is estimated to gain the largest market share in the year 2035, attributed to the strong customer demand along with the increasing disposable income of the middle-class population worldwide. Recent data states that in India the total passenger vehicle sales rose by around 26.7% month-over-month to 298090 units in January 2023. Moreover, the improved supplies from automakers as well as the rising culture of shared mobility especially car sharing by daily commuters is further expected to hike the demand for passenger cars, resulting in segment growth.

Technology Segment Analysis

The PEM segment is expected to garner a significant share in the year 2035. The factors applicable to the growth of the segment include the rapid development of PEM fuel cells for transport applications, with its growing suitability in-vehicle applications, such as cars, buses, and heavy-duty trucks. The rising demand for PEM can also be attributed to its growing use in portable fuel-cell applications and for stationary fuel-cell applications. PEM fuel cells are capable of high energy densities of up to 39.7 kW/kg, compared to 2.5 kW/kg for solid oxide fuel cells.

Our in-depth analysis of the global market includes the following segments:

|

By Vehicle Type |

|

|

By Technology |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogen Vehicle Market Regional Analysis:

North American Market Insights

The North American hydrogen vehicle market is projected to hold the largest market share by the end of 2035, attributed majorly to the rising initiatives taken by policymakers to cut CO2 emissions by 50% by 2030 from a 2005 baseline, owing to which a number of significant laws are made in the region. For instance, one such law is The Inflation Reduction Act 2022, which contains USD 500 billion in new spending and tax breaks, and has a provision to claim a tax credit for clean vehicles. Such policies are acting as a significant catalyst for incentivizing EVs and hydrogen cars in the region. Moreover, it is found that in 2021, some 48 retail hydrogen stations were functioning in the United States, which depicts the region’s increasing adherence to adopting clean energy fuel.

APAC Market Insights

The Asia Pacific hydrogen vehicle market is projected to hold the second largest share during the projected period, attributed to the presence of many giant automobile industries in the region as well as the increasing demand for vehicles by the vast pool of the population. It was observed that nearly 34 million passenger cars were sold within the Asia-Pacific region in 2021, 21 million of which were sold in China alone. This exponentially expanding base of automobiles in the region is leading to not only a rise in levels of traffic leading but also an elevation in greenhouse gas emissions caused by the transport sector along with the increasing consequences of air pollution. Hence, the increasing vehicular emission as well as the growing production of electric vehicles along with the rising investment in future transportation fuel such as hydrogen for zero-emission vehicles is estimated to propel the market growth.

Europe Market Insights

Europe region is anticipated to register substantial growth through 2035, attributed majorly to the rising inclination as well as obligations of phasing out fossil fuels from the transport sector along with increasing investment in clean energy for the green economy. As it is a known fact the European Union is working towards phasing out the internal combustion engine by 2040, with this the growth opportunities for hydrogen vehicles in the region are augmenting

Hydrogen Vehicle Market Players:

- Ballard Power System Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Toyota Motor Corporation

- Mercedes-Benz Group AG

- Hyundai Motor Company

- Hydrogenics, Bayerische Motoren Werke AG

- Cummins Inc.

- General Motors Company

- Power System PLC

- Horizon Fuel Cell Technologies

Recent Developments

-

Ballard Power Systems a developer and manufacturer of proton exchange membrane fuel cell products received a purchase order for 15 70-kilowatt FCmoveTM-HD fuel cell modules from Tata Motors Limited.

-

Mercedes-Benz Group AG a revolutionizer in automobile production with Linde will jointly develop liquid-hydrogen refueling technology for hydrogen-powered vehicles.

- Report ID: 3617

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogen Vehicle Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.