Hydrogen Purifier Market Outlook:

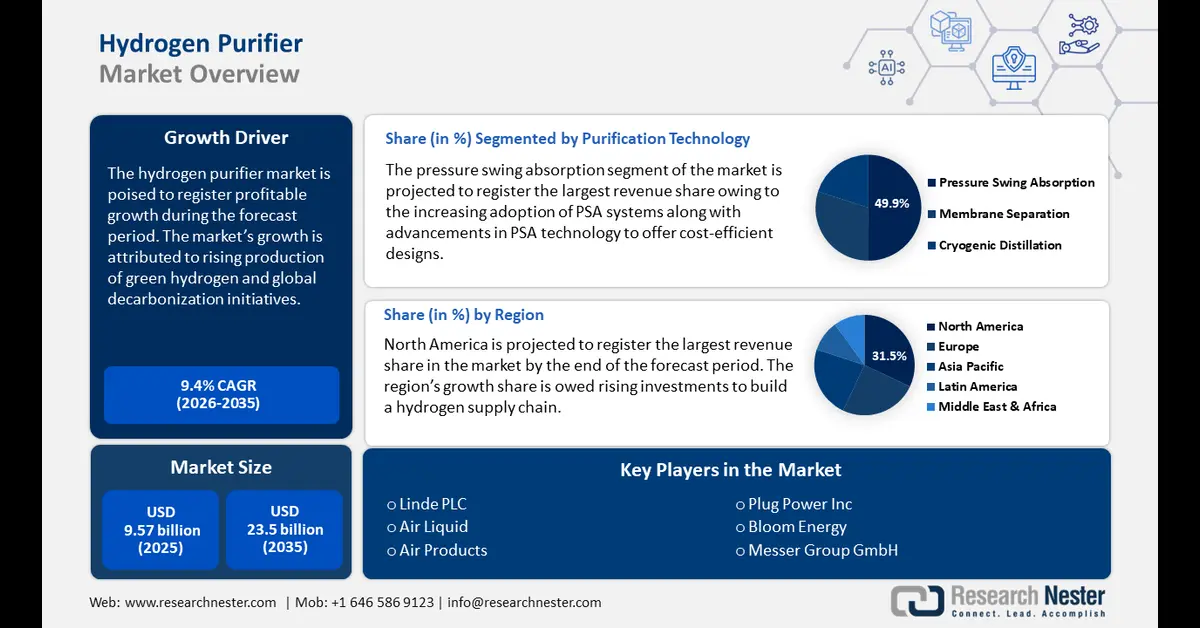

Hydrogen Purifier Market size was over USD 9.57 billion in 2025 and is poised to exceed USD 23.5 billion by 2035, witnessing over 9.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrogen purifier is estimated at USD 10.38 billion.

The major driver of the rapid growth of the hydrogen purifier market is the increasing adoption across diverse industries such as energy, transportation, chemical manufacturing, etc. Globally, the net zero carbon initiatives have bolstered the emergence of hydrogen as an alternative fuel. Countries around the world are investing in increasing hydrogen generation. For instance, in July 2024, the U.S. Department of Energy (DOE) and ARCHES announced a USD 12.6 billion agreement to build a clean, renewable hydrogen hub in California, U.S., including up to USD 1.2 billion in federal funding. Projects such as federal backing create profitable opportunities for the manufacturers of hydrogen purifiers.

The hydrogen purifier market is witnessing rising adoption of hydrogen purifiers in sectors such as pharmaceuticals and electronics that require ultra-pure hydrogen for precision applications. Additionally, the development of cost-efficient purifier technologies further supports the sector’s expansion by bolstering scalability for smaller hydrogen production units. Catalyst poisoning in hydrogen fuel cells is a major challenge, and hydrogen purifiers are required to remove impurities and expand fuel cell lifespan. For instance, in August 2024, Bloom Energy announced a hydrogen solid oxide fuel cell with 60% electrical efficiency and 90% high-temperature heat & power efficiency, and the improved electricity efficiency will require increased hydrogen necessitating efficient purification systems.

Key players in the hydrogen purifier industry are expected to boost their revenue streams by expanding to emerging markets in APAC, Middle East & Africa. Linde PLC, a major player in the hydrogen purifier market, released its third-quarter financial report for 2024, indicating USD 8.3 billion worth of sales in all the regions combined, and the company’s expansion of hydrogen projects in emerging economies augurs well for the potential of the hydrogen purifier sector. For instance, in October 2024, Linde was selected by NEXTCHEM to supply new carbon capture technology in the UAE.

Additionally, partnerships between energy firms and technology providers foster innovations in hydrogen purifiers. As the global hydrogen economy matures, the demand for scalable hydrogen purification solutions is expected to surge assisting a stable hydrogen purifier market growth by the end of the forecast period.

Key Hydrogen Purifier Market Insights Summary:

Regional Highlights:

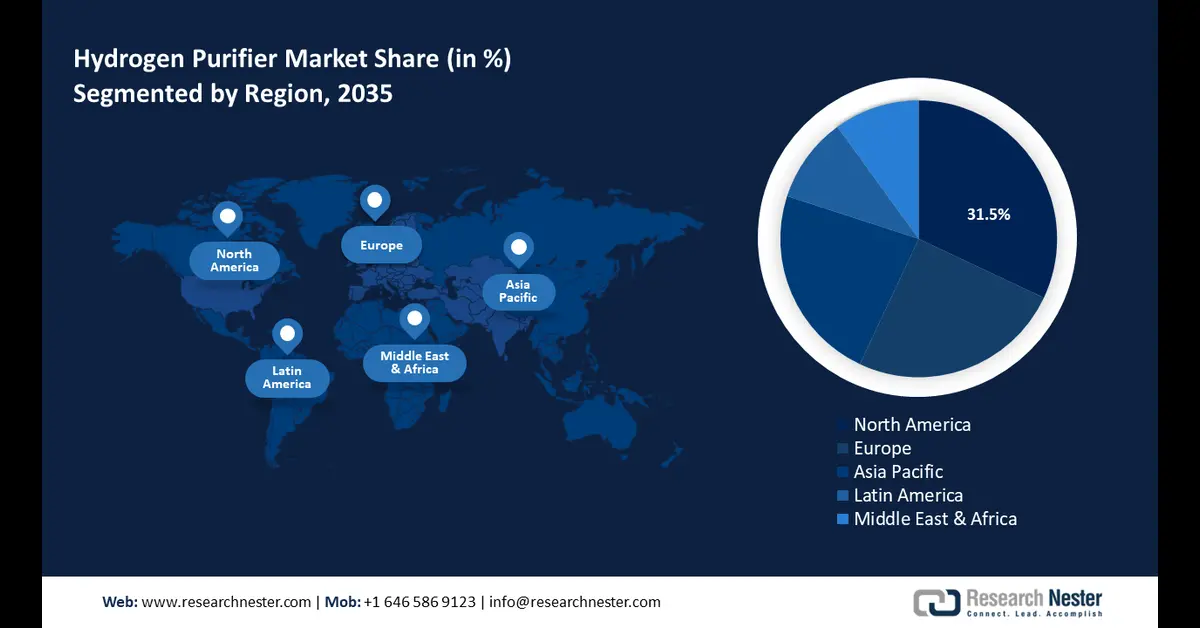

- North America leads the Hydrogen Purifier Market with a 31.5% share, supported by hydrogen adoption, clean energy initiatives, and proactive federal hydrogen strategies, enhancing growth prospects through 2026–2035.

- Europe's hydrogen purifier market is set for the fastest growth by 2035, fueled by EU hydrogen strategy and sustainability-driven investments in countries like Germany and France.

Segment Insights:

- The Pressure Swing Absorption segment is set for substantial growth from 2026-2035, driven by its ability to produce high-purity hydrogen with minimal operational complexity.

Key Growth Trends:

- Increase of green hydrogen production

- Expansion of industrial hydrogen applications

Major Challenges:

- Energy consumption in purification processes

- Variability in feedstock quality

- Key Players: Linde PLC, Air Liquid, Air Products, Plug Power Inc, ITM Power, Messer Group GmbH, Adani Green Energy, Bloom Energy.

Global Hydrogen Purifier Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 9.57 billion

- 2026 Market Size: USD 10.38 billion

- Projected Market Size: USD 23.5 billion by 2035

- Growth Forecasts: 9.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (31.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, China, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 13 August, 2025

Hydrogen Purifier Market Growth Drivers and Challenges:

Growth Drivers

-

Increase of green hydrogen production: A key trend shaping the hydrogen purifier market is the rapid expansion of green hydrogen projects worldwide. Despite the production of relatively pure hydrogen by electrolysis, a purifier is required to remove impurities such as water vapor so that it does not affect the end use applications. Furthermore, the expansion of green hydrogen projects provides a favorable ecosystem for manufacturers to supply advanced hydrogen purifier solutions. For instance, in May 2024, Total Energies, EREN Groupe, and Verbund signed a MoU with the Republic of Tunisia to explore the export of green hydrogen to Europe through pipelines in the project titled H2 Notos. The expanded application of green hydrogen is positioned to create a surging demand for the installation of hydrogen purifiers.

-

Expansion of industrial hydrogen applications: Increasing application of hydrogen in the industrial sector necessitates investments to improve commercial production, which is a major driver of the hydrogen purifier market. The pivot towards sustainability positions hydrogen as one of the most vital gases for various industries. The global expansion of hydrogen projects is a key indicator of the importance placed by governments across the world on increasing hydrogen production capabilities, and these projects create sustained demand for hydrogen purifiers.

Additionally, the surging popularity of hydrogen as a fuel for the aerospace and maritime industries opens new avenues for purifier adoption. For instance, in June 2024, Essar Group announced a USD 3.65 billion investment over the next four years in setting up a hydrogen plant in India. - Surge in ammonia and methanol production: The hydrogen purifier sector is positioned to benefit from a surge in methanol and ammonia production as hydrogen is a critical feedstock in the production process. The requirement for high-purity hydrogen to maintain the production quality of methanol and ammonia for end use in flourishing industries such as agriculture, chemicals, and energy storage systems is projected to drive demand for hydrogen purifiers. For instance, in October 2024, AM Green placed an order with John Cockerill Hydrogen for one of the world’s largest green ammonia projects to be produced with 1.3 GW of electrolyzers. The large-scale investment in the projects creates burgeoning opportunities for manufacturers to provide advanced hydrogen purifier solutions with high-purity hydrogen remaining a crucial input in the Haber-Bosch process.

Challenges

-

Energy consumption in purification processes: Hydrogen purification technologies such as cryogenic and PSA systems can be energy intensive. The energy-intensive applications can add to operational costs. In regions where energy costs are high, and the subsidization rates for industry applications are low, the operational costs can be affected. Development of energy-efficient purification systems is underway but it may take time to become commercially viable.

-

Variability in feedstock quality: The hydrogen feedstock quality varies significantly depending on the production method. Diverse feedstock characteristics can complicate standardization and add to development costs. The variability can cause challenges to businesses seeking to scale operations across multiple geographies.

Hydrogen Purifier Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.4% |

|

Base Year Market Size (2025) |

USD 9.57 billion |

|

Forecast Year Market Size (2035) |

USD 23.5 billion |

|

Regional Scope |

|

Hydrogen Purifier Market Segmentation:

Purification Technology (Pressure Swing Absorption, Membrane Separation, Cryogenic Distillation)

Pressure swing absorption (PSA) segment is predicted to capture hydrogen purifier market share of over 49.9% by 2035. PSA systems are widely used in the hydrogen production process to remove impurities and their versatility is driving adoption. A key driver is the ability to produce high-purity hydrogen with minimal operational complexity, which makes PSA systems mainstays in industries. For instance, in June 2022, Xebec Adsorption Inc. announced a PSA supply agreement with Haffner Energy for cost-effective production of green hydrogen indicating the burgeoning opportunities to be leveraged in the segment. Additionally, advancements in PSA technology such as modular energy-efficient designs boost the scalability of the systems by expanding usage in centralized and decentralized hydrogen production setups.

The membrane separation segment of the hydrogen purifier market is poised to offer profitable opportunities during the forecast period. A key driver is its adoption and suitability for small-to-medium-scale applications. For instance, in February 2024, H2SITE commissioned a palladium membrane separator to extract 5 to 20% blends of hydrogen at 99% purity in Spain, and it is the first installation to use palladium-alloy membrane separators reaching a 97% hydrogen recovery rate. The contract to provide palladium membrane separators indicates burgeoning opportunities for membrane separation solutions providers in this segment to expand their hydrogen purifier market revenue shares.

Furthermore, membrane separation offers an eco-friendly alternative to conventional methods of separating hydrogen from impurities, and sustainable separation technologies are experiencing a surge in demand in the current market scenario. Advancements in membrane materials are poised to improve durability under varying conditions, positioning it as a lucrative separation technology.

Purity Level (95-99.9%, 99.9-99.999%, 99.999% and above)

By purity level, the 95-99.9% segment in hydrogen purifier market is projected to exhibit growth due to increasing applications in ammonia production. Moderately pure hydrogen suffices for numerous chemical manufacturing processes, with the cost-effectiveness of achieving this purity range driving adoption. The growing demand for hydrogen in industrial applications is expected to assist a steady demand for the 95-99.99% purity level of hydrogen, and manufacturers are positioned to find continued opportunities to supply efficient hydrogen purifiers for extraction.

Additionally, the development of energy-efficient solutions is poised to drive hydrogen production at the 95-99.9% purity level. For instance, in February 2022, the Ministry of Science & Technology of India released a statement that a method to produce hydrogen with high purity (99.99%) from a methanol-water mixture at ambient pressure and temperature that uses only one-third of the electrical energy required in water electrolysis was developed. Such advancements bode well for an increased production of hydrogen at various purity levels, and bolstering demand for hydrogen purifiers.

Our in-depth analysis of the global hydrogen purifier market includes the following segments:

|

Purification Technology |

|

|

Purity Level |

|

|

Application |

|

|

Flow Rate |

|

|

End use Industry |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogen Purifier Market Regional Analysis:

North America Market Forecast

North America hydrogen purifier market is predicted to hold revenue share of over 31.5% by the end of 2035. A major driver of the sector’s growth is the decarbonization initiatives bolstering hydrogen adoption. Green energy initiatives boost investments in building robust hydrogen infrastructure in the region, which is beneficial for the growth of the hydrogen purifier sector. Major initiatives such as the Hydrogen Shot initiative by the U.S., aiming to reduce the cost of clean hydrogen to USD 1 per KG by 2031, are poised to lead to a five-fold increase in the usage of hydrogen, up to 50 million metric tons per year by 2050. Proactive federal initiatives are expected to be major drivers of building a hydrogen economy and create robust supply chains that hydrogen purifier manufacturers in North America can leverage.

The U.S. is poised to hold a dominant market share in the North America hydrogen purifier market owing to major government initiatives to push an increase in hydrogen production. An additional driver of the market in the U.S. is the rising number of HFCVs bolstering hydrogen production and refueling stations. Furthermore, subsidies by the government for companies acquiring hydrogen from the seven Regional Clear Hydrogen Hubs are indicative of the pro-hydrogen economy stance of the country.

In November 2024, the government announced up to USD 2.2 billion for two Regional Clean Hydrogen Hubs to accelerate the commercial-scale deployment of clean, low-cost hydrogen. The trends are favorable for a major expansion of the hydrogen purifier market in the U.S., which is poised to add to the profitable opportunities for hydrogen purifier solutions providers during the forecast period.

Canada is poised to offer lucrative revenue streams for the hydrogen purifier sector. The hydrogen strategy of Canada aims to have 30% of the country’s end use energy from hydrogen by 2050, and realizing the goal has boosted investments in creating a sustainable hydrogen infrastructure. The supportive regulatory ecosystem and a sustained push by the government are projected to drive demand for hydrogen purifiers as production increases.

In August 2024, the government announced an investment of USD 9.14 million to support clean hydrogen deployment in Canada, creating a favorable ecosystem for industry stakeholders to bolster hydrogen production. Furthermore, companies have leveraged the government Energy Transition Programs in the past to create hydrogen complexes in the country that require hydrogen purifiers. For instance, in November 2022, Air Products received around USD 352 million from the Energy Transition Program for the Net-Zero Hydrogen Energy Complex in Alberta, Canada.

Europe Market Forecast

The Europe hydrogen purifier market is projected to register the fastest growth during the forecast period. The ambitious hydrogen strategy of the European Union (EU) aims to achieve 10 million tons of renewable hydrogen by 2030, as a part of the decarbonization goals. The imitative sets the tone for lucrative market opportunities for hydrogen purifying solutions as production is poised to expand exponentially. Germany, Netherlands, Poland, Italy, and France registered around 56% of the total hydrogen capacity in Europe, creating profitable domestic markets for key companies operating in the hydrogen purifier sector. Additionally, sustainability initiatives in multiple countries in the region are poised to assist the continued growth of the industry.

Germany is projected to register the largest revenue share in the hydrogen purifier market. The country has spurred large-scale investments to decarbonize and is a leading producer of hydrogen in Europe, creating profitable opportunities for hydrogen purification solutions. Furthermore, plans to expand the hydrogen pipelines are a major driver for the market. The Holstebro-Hamburg pipeline in Denmark and Germany is expected to boost hydrogen availability in the country, and further bolster the domestic hydrogen purifier hydrogen purifier market.

Major companies are leveraging the ambitious goals of Germany for complete decarbonization. For instance, in September 2022, Siemens commissioned one of the largest green hydrogen plants in Germany that will generate up to 1,350 tons of green hydrogen annually from renewable solar and wind power. Hydrogen purification solutions are projected to find increasing opportunities in expanding hydrogen plants in Germany.

France is poised to expand its market share in the hydrogen purifier market by the end of the forecast period. The country’s commitment to becoming a leader in the hydrogen economy is poised to be a significant driver for the industry. The Plan France 2030 has set a decarbonized hydrogen production target of 700,000 tons of renewable or low-carbon hydrogen per annum by 2030, and an electrolyzer capacity target of 6.5 GW by 2030.

Key companies in France are leveraging the country's favorable hydrogen production ecosystem. For instance, in November 2024, Haffner Energy launched its hydrogen production, training, and testing center in France. It will produce renewable hydrogen using its patented biomass and organic waste thermolysis process. The rising investments by companies in France indicate growing opportunities for the hydrogen purifier market.

Key Hydrogen Purifier Market Players:

- Linde PLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Air Liquid

- Air Products

- Plug Power Inc

- ITM Power

- Messer Group GmbH

- Adani Green Energy

- Bloom Energy

The global hydrogen purifier market is poised to expand profitably during the forecast period. Key market players are investing in advanced purification technologies to increase the production of high-purity hydrogen. Furthermore, companies are leveraging opportunities from emerging economies to expand their hydrogen production portfolio. Additionally, companies are benefiting from supportive government policies worldwide to create a robust hydrogen infrastructure.

Here are some key players in the hydrogen purifier market:

Recent Developments

- In September 2024, Linde announced the signing of a long-term agreement to supply clean hydrogen to Dow’s Path2Zero project in Canada. Linde’s new on-site complex will use auto thermal reforming, combined with Linde’s proprietary HISORP carbon capture technology, to produce clean hydrogen and will also recover hydrogen contained in off-gases from Dow’s ethylene cracker.

- In January 2024, Pall Corporation introduced SepraLYTE liquid gas coalescers that is an innovative solution designed to meet the rising demand for efficient separation of electrolyte aerosols from gas in the green hydrogen production process. SepraLYTE coalescers excel in the separation of water or electrolyte aerosols (30% potassium hydroxide solution) from hydrogen, ensuring the purity of hydrogen produced from electrolysis processes.

- Report ID: 6841

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogen Purifier Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.