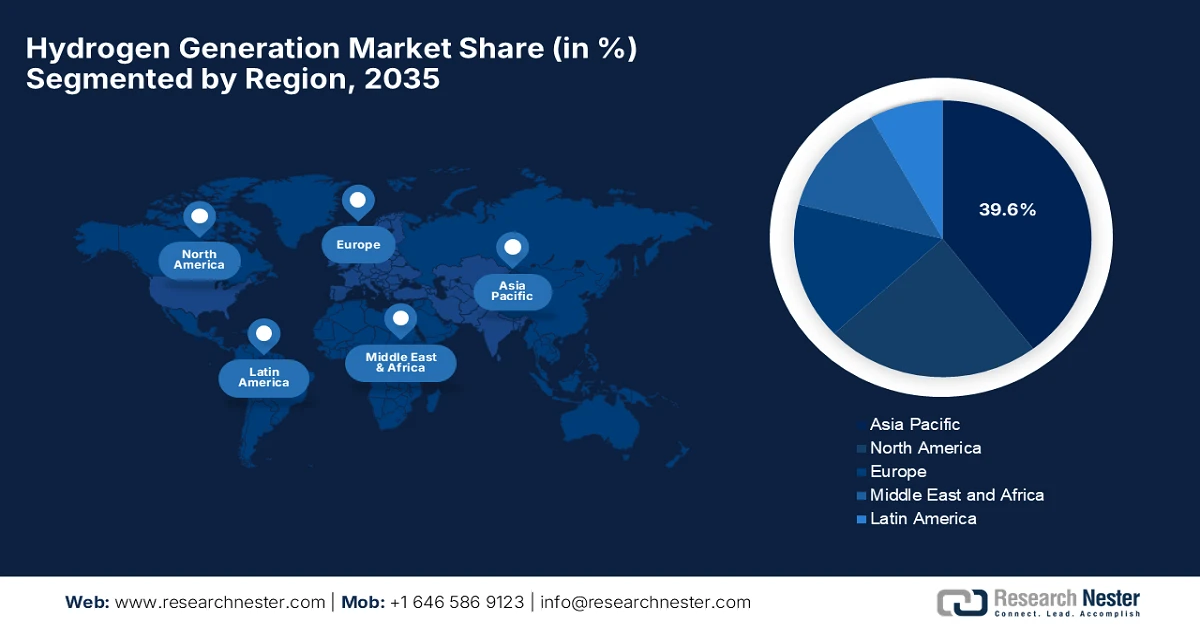

Hydrogen Generation Market - Regional Analysis

APAC Market Insights

The Asia Pacific hydrogen generation market is forecast to emerge as the largest regional landscape, representing an estimated 39.6% share by the end of 2035. The rapid industrial growth, demand for refining/chemicals, and large renewable hydrogen projects are the key factors behind the region’s leadership. In September 2025, Toyota reported that it had joined the TOKYO H2 project launched by the Tokyo Metropolitan Government to position Tokyo as a global leader in hydrogen. As part of the initiative, Toyota introduced the Crown fuel cell vehicle into the taxi fleet, aiming to deploy 200 units by fiscal year 2025, and renovated the TOYOTA MIRAI Showroom as a hydrogen information hub. In addition, the project is mainly focused on expanding hydrogen adoption in commercial mobility, creating demand across the supply chain, and advancing Tokyo toward a sustainable hydrogen society.

China hydrogen generation market has gained enhanced traction on account of industrial usage, renewable energy integration, and policy support for carbon neutrality. The country’s hydrogen generation market is witnessing progress in terms of both low-carbon hydrogen from natural gas reforming and green hydrogen from renewable sources. Industrial sectors such as refining, chemicals, and steel are key consumers, and the country is proactively developing hydrogen infrastructure and mobility solutions. In this regard, in June 2025, Wison Engineering and Sungrow Hydrogen together announced that they have launched MegaFlex, which is a turnkey plant-as-a-product solution for green hydrogen production, showcased at the SNEC Conference in Shanghai. In addition, the company also notes that this system offers scalable, modular water electrolysis technology with a 500 MW single-unit capacity, especially designed for rapid deployment, cost efficiency, and flexible project sizing from small to GW-level plants.

India hydrogen generation market is growing exponentially, facilitated by government initiatives under the National Hydrogen Mission, industrial demand, and renewable energy adoption. Green hydrogen projects, especially electrolyzer-based plants, are being commissioned across industrial clusters, providing lucrative business opportunities for pioneers in this field. As per the article published by the country’s government in November 2025, India is advancing its green hydrogen ecosystem under the National Green Hydrogen Mission by targeting 5 MMT annual production by the end of 2030. It also mentioned that pilot projects have been launched across ports, mobility, steel, and petroleum refining sectors, whereas 19 companies have been allocated a cumulative 862,000 tonnes annual production capacity, and 15 firms are set to manufacture 3,000 MW of electrolyzers on a yearly basis. Simultaneously, strategic initiatives such as SIGHT, Green Hydrogen Hubs, GHCI certification, and SHIP R&D partnerships are accelerating production, innovation, and industrial adoption.

Key Statistics and Initiatives under India’s National Green Hydrogen Mission (NGHM)

|

Metric |

Details |

|

Targeted Green Hydrogen Production by 2030 |

5 MMT annually |

|

Companies Allocated Production Capacity |

19 companies, 862,000 tonnes/year |

|

Electrolyzer Manufacturing Capacity |

15 firms, 3,000 MW/year |

|

SIGHT Scheme Outlay |

₹17,490 crore (USD 2.1 billion) till FY 2029-30 |

|

Pilot Projects in Mobility |

37 vehicles, 10 routes, 9 refueling stations |

|

Port-Based Green Hydrogen Facilities |

V.O. Chidambaranar & Deendayal Port, MW-scale |

|

Estimated Investments |

Over ₹8 lakh crore (USD 96 billion) |

|

Fossil Fuel Import Reduction |

Over ₹1 lakh crore (USD 12 billion) by 2030 |

Source: Government of India

North America Market Insights

The North America hydrogen generation market is witnessing robust progress over the forecasted years owing to the rising industrial demand, technological innovation, and supportive governmental policies. The region is leveraging renewable energy integration and green hydrogen projects, whereas both public and private stakeholders are continuously making investments in hydrogen infrastructure. In this regard, the California Energy Commission (CEC) in December 2024 announced that it has approved a USD 1.4 billion investment plan to expand electric vehicle (EV) charging and hydrogen refueling infrastructure across the state. The funding is a part of California’s broader USD 48 billion Climate Commitment, which will deploy nearly 17,000 new light-duty chargers, support 96 public hydrogen stations, and provide incentives for ZEV trucks, buses, and school buses. Hence, this initiative aims to strengthen zero-emission transportation, prioritize disadvantaged communities, and prepare the workforce for the clean energy economy.

In the U.S. hydrogen generation market is mainly propelled by federal initiatives, which are promoting clean energy and carbon reduction. The country is also making continued investments in electrolyzer technology and fuel cell mobility, positioning the country as a predominant leader in both green and low-carbon hydrogen production. In this regard, in October 2023, the country’s president announced up to USD 7 billion in federal grants to establish seven clean hydrogen hubs across the U.S., with a prime focus to decarbonize heavy-duty transportation and industrial processes while creating high-quality jobs. In addition, the initiative includes support for electrolyzer manufacturing, such as the USD 10 million Cummins facility in Minnesota, and positions hydrogen as a central component of the nation’s clean energy strategy as a major climate and economic move, hence making it suitable for overall hydrogen generation market growth.

Canada hydrogen generation market is efficiently shaped by the presence of ample renewable resources, particularly hydro and wind power, which are facilitating green hydrogen generation. Besides, the provincial and federal programs are supporting research, infrastructure development, and industrial applications, which include ammonia production and mobility solutions. In this regard, the Ontario government in October 2025 announced a USD 30 million investment to expand its Hydrogen Innovation Fund, thereby doubling support for projects that integrate low-carbon hydrogen across electricity, transportation, manufacturing, and heavy industry. It also stated that the fund aims to create jobs, drive economic growth, and establish Ontario as a leader in the hydrogen economy, including the development of hydrogen hubs connecting producers with end-users. Therefore, this initiative supports the province’s long-term energy strategy, Energy for Generations, and complements efforts to reduce emissions and enhance energy security.

Europe Market Insights

Europe hydrogen generation market is representing notable growth owing to the presence of government-backed green hydrogen initiatives. The region’s focus on renewable energy, hydrogen pipelines, and mobility adoption efficiently drives demand. Countries in the region are proactively promoting electrolyzer deployment, carbon capture in steam methane reforming, and integration of hydrogen into industrial hubs. In this regard, Germany and the European Commission In January 2026, reported that they agreed to support the construction of new gas-fired power plants that are hydrogen-ready, with the first units expected online by 2031. These plants will ensure electricity supply security as the country phases out coal and expands renewable energy, with plans for additional tenders in 2027 and 2029 to meet controllable capacity needs. Furthermore, the initiative aims to transition to green hydrogen over time by also maintaining industrial competitiveness and grid stability.

Germany hydrogen generation market is central to the regional landscape in which the national hydrogen strategies support large-scale electrolyzer projects, industrial decarbonization, and export potential. Simultaneously, the collaborations between industry and government have positioned the country as a testbed for hydrogen technologies and integrated hydrogen value chains. In November 2025, Shell Energy Europe reported that it had signed power purchase agreements with Nordsee One and Solarkraftwerk Halenbeck-Rohlsdorf in Germany to supply renewable electricity for its 100 MW REFHYNE 2 electrolyser at the Shell Energy and Chemicals Park Rheinland. The company also mentioned that REFHYNE 2 will produce up to 16,000 tonnes of low-carbon hydrogen annually to decarbonise fuels, chemicals, and other industrial processes, supporting EU renewable hydrogen targets.

The UK hydrogen generation market is mainly fueled by the Net Zero 2050 targets and industrial decarbonization programs. The government is supporting hydrogen adoption in power, transport, and industrial sectors through strategic investments and pilot projects. In November 2025, Plug Power notified that it had been selected by Carlton Power to supply 55 MW of GenEco PEM electrolyzers across three UK green hydrogen projects, i.e., Barrow-in-Furness (30 MW), Trafford (15 MW), and Langage (10 MW). These projects are backed by the country’s Government’s hydrogen business model and will produce renewable hydrogen to decarbonize local industrial operations and transportation. Therefore, this deployment marks the largest combined electrolyzer contract in the UK, reinforcing Plug Power’s leadership in industrial-scale green hydrogen solutions across Europe.