Hydrogen Generation Market Outlook:

Hydrogen Generation Market size was valued at USD 205.3 billion in 2025 and is projected to reach USD 449.5 billion by the end of 2035, growing at a CAGR of 9.1% during the forecast period, i.e., 2026-2035. In 2026, the industry size of hydrogen generation is estimated at USD 223.9 billion.

The hydrogen generation market is driven by the worldwide push toward decarbonization, renewable energy integration, and industrial sustainability. Green hydrogen is viewed as a key solution for hard-to-electrify sectors such as steel, refining, chemicals, and heavy transportation. As per the article published by IEA, the worldwide hydrogen demand reached nearly 100 million tonnes in 2024, with most production still reliant on fossil fuels without emissions capture, and traditional sectors such as oil refining remaining the largest consumers. It also mentioned that low-emissions hydrogen currently represents less than 1% of total supply but is projected to grow to around 4% by the end of 2030, driven by policy support and technology deployment, hence denoting a positive hydrogen generation market outlook. Moreover, accelerated action on demand creation, infrastructure development, and regulatory clarity is essential to scale low-emissions hydrogen, particularly for hard-to-abate sectors.

Furthermore, tax credits, collaborations between governments, energy companies, and technology providers are strengthening the supply chain in the hydrogen generation market. In January 2025, the U.S. Department of the Treasury and IRS released final rules for the Section 45V Clean Hydrogen Production Tax Credit by providing clarity and flexibility for producers using electricity, natural gas with carbon capture, renewable natural gas, and coal mine methane. It also notes that these rules establish lifecycle emissions standards, investment certainty, and pathways for incremental clean electricity, enabling both electrolytic and methane-based hydrogen projects to qualify. By incorporating safeguards, hourly accounting options, and updated methodologies for methane leakage and alternative feedstocks, the regulations aim to accelerate deployment of clean hydrogen, support low-carbon industrial sectors, and strengthen the U.S. position in the global hydrogen economy.

Key Statistics and Infrastructure Metrics for U.S. Hydrogen Hubs and Demonstration Projects (2022-2023)

|

Category |

Data / Value |

|

DOE Regional Clean Hydrogen Hubs Grants |

USD 7 billion allocated for 7 finalists |

|

Total IIJA Appropriation for Hydrogen Hubs |

USD 8 billion (includes USD 1 billion for Demand-side Support Initiative) |

|

Number of Finalists for Regional Hubs |

7 |

|

Minimum Non-Federal Cost Share Required |

50% |

|

Execution Timeline for Hub Projects |

8-12 years |

|

Current U.S. Hydrogen Pipeline Length |

1,600 miles |

|

U.S. Natural Gas Pipeline Length (for comparison) |

300,000 miles |

|

Hydrogen Refueling Stations in California (as of June 30, 2023) |

65 public retail (light-duty) + 6 heavy-duty |

|

Planned Additional Stations in California |

35 light-duty + 4 heavy-duty + 5 multi-use |

|

Registered FCEVs in the U.S. (End of 2022) |

14,900 |

|

Cumulative FCEV Sales / Lease (through Oct 25, 2023) |

>17,000 |

|

Material Handling Equipment (MHE) Hydrogen Units |

>60,000 (2023) |

|

DOE Loan Guarantee for Advanced Clean Energy Storage |

USD 504 million |

|

Electrolyzer Capacity at Delta, UT Facility |

220 MW |

|

Hydrogen Storage Capacity per Cavern |

5.5 million kg (110 GWh) |

|

Shore-to-Store Project Funding |

USD 41.4 million (project partners) + USD 41.1 million (CARB) |

Source: Congress.gov

Key Hydrogen Generation Market Insights Summary:

Regional Highlights:

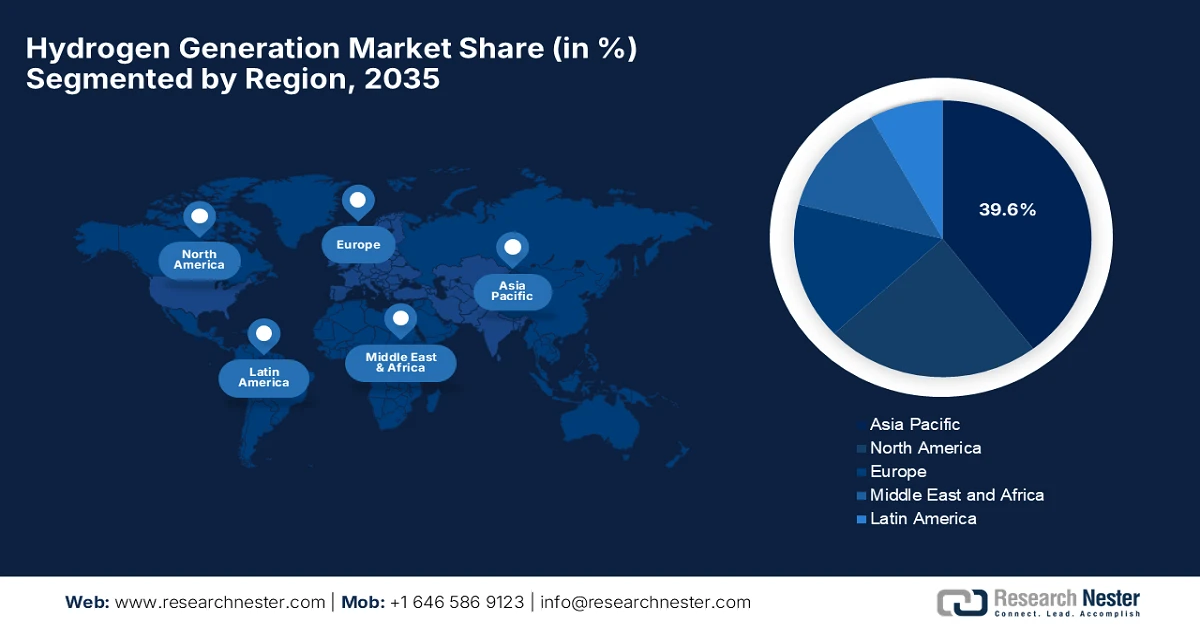

- Asia Pacific is projected to command an estimated 39.6% share by 2035 in the hydrogen generation market, underpinned by rapid industrial expansion, strong refining and chemical demand, and large-scale renewable hydrogen projects.

- North America is witnessing accelerated momentum across the 2026–2035 period as hydrogen generation adoption is being reinforced by rising industrial demand, sustained technological advancements, and supportive government-backed infrastructure investments.

Segment Insights:

- The captive segment is anticipated to dominate the hydrogen generation market with a 69.5% share by 2035, supported by increasing on-site hydrogen production for direct industrial consumption that minimizes dependence on external supply and distribution infrastructure.

- The industrial segment is expected to expand significantly by 2035, stimulated by hydrogen’s expanding utilization as a core feedstock in ammonia synthesis, refining operations, and petrochemical processes.

Key Growth Trends:

- Growing demand from transportation

- Industrial demand & feedstock use

Major Challenges:

- Limited infrastructure and distribution networks

- Regulatory and policy uncertainty

Key Players: Plug Power, Inc. (U.S.), Nel ASA (Norway), ITM Power Plc (UK), McPhy Energy S.A. (France), Thyssenkrupp Nucera AG & Co. KGaA (Germany), Cummins, Inc. (U.S.), John Cockerill S.A. (Belgium), Bloom Energy Corporation (U.S.), Electric Hydrogen Co. (U.S.), HydrogenPro ASA (Norway), Sunfire GmbH (Germany), Ohmium International, Inc. (India/U.S.), Longi Hydrogen Technology Co., Ltd. (China), Hygreen Energy (China), PERIC Hydrogen Technologies Co., Ltd. (China), Air Liquide S.A. (France), Siemens Energy (Hydrogen) (Germany), Linde PLC (UK / Germany), Waaree Group (India), Enapter AG (Germany / Thailand).

Global Hydrogen Generation Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 205.3 billion

- 2026 Market Size: USD 223.9 billion

- Projected Market Size: USD 449.5 billion by 2035

- Growth Forecasts: 9.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (39.6% Share by 2035)

- Fastest Growing Region: North America

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: India, Australia, Canada, Brazil, Saudi Arabia

Last updated on : 22 January, 2026

Hydrogen Generation Market - Growth Drivers and Challenges

Growth Drivers

- Growing demand from transportation: Hydrogen fuel cell vehicles, such as cars, buses, and trucks, are gaining traction as emission regulations keep tightening and electrification advances. This fuels demand in the hydrogen generation market to supply clean fuel for mobility applications. In January 2026 Ministry of Climate, Energy, and Environment (MCEE) of South Korea reported that in 2025, the country witnessed a 182% year-on-year increase in hydrogen vehicle deployment, which surpassed 6,903 units, driven by new passenger vehicle models. The government also announced KRW 576.2 billion in 2026 funding to deploy 7,820 hydrogen vehicles, including buses, passenger vehicles, and freight trucks. To support this, hydrogen refueling infrastructure will expand with KRW 189.7 billion allocated to build over 500 stations, including a pilot for mobile refueling units, hence denoting a wider hydrogen generation market scope.

Hydrogen Vehicle Deployment and Refueling Station Statistics - South Korea (2024-2026)

|

Category |

2024 |

2025 |

YoY Change (%) |

2026 Target / Funding |

|

Total hydrogen vehicles deployed |

3,784 |

6,903 |

+182% |

7,820 vehicles (KRW 576.2B) |

|

Passenger vehicles |

2,717 |

5,708 |

+210% |

6,000 vehicles |

|

Hydrogen buses |

– |

– |

– |

1,800 buses (800 low-floor, 1,000 high-floor) |

|

Freight & sanitation vehicles |

– |

– |

– |

20 vehicles |

|

Hydrogen refueling stations (cumulative) |

386 |

461 |

+19.4% |

>500 stations (KRW 189.7B) + mobile stations |

Source: Ministry of Climate, Energy and Environment (MCEE) of South Korea

- Industrial demand & feedstock use: Beyond energy, hydrogen is highly essential in refining, ammonia and methanol production, metal processing, and petrochemicals sectors that are expanding and seeking cleaner inputs. This is providing encouraging opportunities for pioneers in the hydrogen generation market. In December 2025, Mitsubishi Heavy Industries reported that it successfully produced 99% pure hydrogen at its pilot plant in Nagasaki by cracking ammonia using steam heating, which is a world-first at pilot scale. This technology operates at lower temperatures than conventional combustion systems by reducing costs and enabling potential miniaturization. In addition, MHI aims to develop medium-scale, decentralized ammonia cracking systems near hydrogen demand sites, supporting the hydrogen supply chain and advancing decarbonization efforts in collaboration with NEDO and partners.

- Technological advancements in production: Continuous improvements in electrolyzers and other hydrogen generation technologies, such as solid oxide, advanced catalysts, are boosting efficiency and reducing costs, especially for green hydrogen produced from renewables. In this context, BASF in March 2025 announced that it has commissioned a 54 MW PEM electrolyzer at its Ludwigshafen site, producing up to 8,000 metric tons of green hydrogen annually for chemical production, which includes ammonia, methanol, and vitamins. It is built in collaboration with Siemens Energy and integrated directly into the plant’s hydrogen network, wherein the electrolyzer reduces greenhouse gas emissions by up to 72,000 tons per year. Furthermore, this project, supported by the German federal and Rhineland-Palatinate governments, represents a world-first industrial integration of electrolyzer technology to advance green hydrogen production, hence benefiting the hydrogen generation market.

Challenges

- Limited infrastructure and distribution networks: The absence of proper hydrogen infrastructure is a major obstacle hindering the expansion of the hydrogen generation market. Production sites are mostly located far from end users, and there are few pipelines, storage facilities, or fueling stations that are capable of handling hydrogen safely and efficiently. On the other hand, transporting hydrogen either as a compressed gas, liquid, or carrier involves very high costs, technical complexity, and safety risks owing to its low volumetric energy density and flammability. The presence of this infrastructure gap limits the scaling of industrial, mobility, and energy applications. Meanwhile, the hydrogen generation market growth relies mostly on investments in hydrogen pipelines, refueling stations, storage solutions, and international supply chains, wherein the lack of coordinated development of production and distribution networks will lead to a slower hydrogen generation market upliftment.

- Regulatory and policy uncertainty: This is yet another barrier to the progression of the hydrogen generation market. The aspect of incentives, subsidies, and carbon pricing mechanisms varies between countries, creating uneven hydrogen generation market conditions. In some regions, the absence of clear safety standards, certification processes, and grid integration rules complicates project approvals and financing. The existence of policy delays can stall electrolyzer deployment, infrastructure development, and international hydrogen trade. Moreover, long-term planning is difficult for private investors due to fluctuating government commitments to hydrogen roadmaps. Stable, transparent, and harmonized regulatory frameworks are highly essential to attract investment, scale production, and create global supply chains.

Hydrogen Generation Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

9.1% |

|

Base Year Market Size (2025) |

USD 205.3 billion |

|

Forecast Year Market Size (2035) |

USD 449.5 billion |

|

Regional Scope |

|

Hydrogen Generation Market Segmentation:

Systems Segment Analysis

The captive is expected to lead the hydrogen generation market with a share of 69.5% during the forecast duration. The subtype involves the production of hydrogen on-site for direct consumption by eliminating reliance on external transportation and distribution infrastructure. In May 2024, GAIL (India) Limited announced that it had inaugurated its first 10 MW green hydrogen plant at the Vijaipur facility in Madhya Pradesh, which is aligned with India’s National Green Hydrogen Mission. The PEM electrolyzer-based plant produces 4.3 tons per day of high-purity (99.999%) hydrogen using renewable electricity. It also stated that initially, the hydrogen is used captively on-site as fuel alongside natural gas for existing industrial processes, eliminating reliance on external hydrogen supply and distribution infrastructure, hence denoting a wider segment scope.

Application Segment Analysis

By the conclusion of 2035, the industrial segment will grow at a considerable rate in the hydrogen generation market. The growth of the segment is highly attributable to hydrogen’s prominent role in ammonia synthesis, refining, and petrochemical feedstocks. As of the November 2025 data from Bharat Petroleum Corporation Limited, its Bina Refinery has demonstrated strong industrial adoption of hydrogen through the commissioning of a 5 MW green hydrogen plant, producing 2.15 tonnes per day of high-purity hydrogen using renewable energy. It also notes that the hydrogen is used directly within refinery operations, supporting refining and petrochemical processes by reducing dependence on fossil-based hydrogen and cutting around 9,000 metric tonnes of CO₂ on a yearly basis. Hence, this initiative highlights hydrogen’s expanding role as a critical industrial feedstock in refining and petrochemicals, reinforcing growth prospects for the industrial segment of the hydrogen generation industry in the years ahead.

Technology Segment Analysis

In the technology segment, the steam methane reforming will grow with a significant share in the hydrogen generation market over the forecasted years. The growth of the segment is highly attributable since the natural gas reforming delivers most commercial hydrogen to reduce emissions. In August 2025, NEXTCHEM (MAIRE Group) announced that it was awarded a contract in the U.S. to deploy its NX eBlue electric steam methane reforming technology for the production of 15,000 Nm³/h of low-carbon hydrogen. This project represents the first commercial application of electric SMR by combining renewable electricity, advanced reforming, and integrated carbon capture to significantly reduce CO₂ emissions. Thus, the initiative highlights the continued importance of natural gas reforming technologies in large-scale hydrogen generation.

Our in-depth analysis of the hydrogen generation market includes the following segments:

|

Segment |

Subsegments |

|

Systems |

|

|

Application |

|

|

Technology |

|

|

Production Mode |

|

|

Source |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrogen Generation Market - Regional Analysis

APAC Market Insights

The Asia Pacific hydrogen generation market is forecast to emerge as the largest regional landscape, representing an estimated 39.6% share by the end of 2035. The rapid industrial growth, demand for refining/chemicals, and large renewable hydrogen projects are the key factors behind the region’s leadership. In September 2025, Toyota reported that it had joined the TOKYO H2 project launched by the Tokyo Metropolitan Government to position Tokyo as a global leader in hydrogen. As part of the initiative, Toyota introduced the Crown fuel cell vehicle into the taxi fleet, aiming to deploy 200 units by fiscal year 2025, and renovated the TOYOTA MIRAI Showroom as a hydrogen information hub. In addition, the project is mainly focused on expanding hydrogen adoption in commercial mobility, creating demand across the supply chain, and advancing Tokyo toward a sustainable hydrogen society.

China hydrogen generation market has gained enhanced traction on account of industrial usage, renewable energy integration, and policy support for carbon neutrality. The country’s hydrogen generation market is witnessing progress in terms of both low-carbon hydrogen from natural gas reforming and green hydrogen from renewable sources. Industrial sectors such as refining, chemicals, and steel are key consumers, and the country is proactively developing hydrogen infrastructure and mobility solutions. In this regard, in June 2025, Wison Engineering and Sungrow Hydrogen together announced that they have launched MegaFlex, which is a turnkey plant-as-a-product solution for green hydrogen production, showcased at the SNEC Conference in Shanghai. In addition, the company also notes that this system offers scalable, modular water electrolysis technology with a 500 MW single-unit capacity, especially designed for rapid deployment, cost efficiency, and flexible project sizing from small to GW-level plants.

India hydrogen generation market is growing exponentially, facilitated by government initiatives under the National Hydrogen Mission, industrial demand, and renewable energy adoption. Green hydrogen projects, especially electrolyzer-based plants, are being commissioned across industrial clusters, providing lucrative business opportunities for pioneers in this field. As per the article published by the country’s government in November 2025, India is advancing its green hydrogen ecosystem under the National Green Hydrogen Mission by targeting 5 MMT annual production by the end of 2030. It also mentioned that pilot projects have been launched across ports, mobility, steel, and petroleum refining sectors, whereas 19 companies have been allocated a cumulative 862,000 tonnes annual production capacity, and 15 firms are set to manufacture 3,000 MW of electrolyzers on a yearly basis. Simultaneously, strategic initiatives such as SIGHT, Green Hydrogen Hubs, GHCI certification, and SHIP R&D partnerships are accelerating production, innovation, and industrial adoption.

Key Statistics and Initiatives under India’s National Green Hydrogen Mission (NGHM)

|

Metric |

Details |

|

Targeted Green Hydrogen Production by 2030 |

5 MMT annually |

|

Companies Allocated Production Capacity |

19 companies, 862,000 tonnes/year |

|

Electrolyzer Manufacturing Capacity |

15 firms, 3,000 MW/year |

|

SIGHT Scheme Outlay |

₹17,490 crore (USD 2.1 billion) till FY 2029-30 |

|

Pilot Projects in Mobility |

37 vehicles, 10 routes, 9 refueling stations |

|

Port-Based Green Hydrogen Facilities |

V.O. Chidambaranar & Deendayal Port, MW-scale |

|

Estimated Investments |

Over ₹8 lakh crore (USD 96 billion) |

|

Fossil Fuel Import Reduction |

Over ₹1 lakh crore (USD 12 billion) by 2030 |

Source: Government of India

North America Market Insights

The North America hydrogen generation market is witnessing robust progress over the forecasted years owing to the rising industrial demand, technological innovation, and supportive governmental policies. The region is leveraging renewable energy integration and green hydrogen projects, whereas both public and private stakeholders are continuously making investments in hydrogen infrastructure. In this regard, the California Energy Commission (CEC) in December 2024 announced that it has approved a USD 1.4 billion investment plan to expand electric vehicle (EV) charging and hydrogen refueling infrastructure across the state. The funding is a part of California’s broader USD 48 billion Climate Commitment, which will deploy nearly 17,000 new light-duty chargers, support 96 public hydrogen stations, and provide incentives for ZEV trucks, buses, and school buses. Hence, this initiative aims to strengthen zero-emission transportation, prioritize disadvantaged communities, and prepare the workforce for the clean energy economy.

In the U.S. hydrogen generation market is mainly propelled by federal initiatives, which are promoting clean energy and carbon reduction. The country is also making continued investments in electrolyzer technology and fuel cell mobility, positioning the country as a predominant leader in both green and low-carbon hydrogen production. In this regard, in October 2023, the country’s president announced up to USD 7 billion in federal grants to establish seven clean hydrogen hubs across the U.S., with a prime focus to decarbonize heavy-duty transportation and industrial processes while creating high-quality jobs. In addition, the initiative includes support for electrolyzer manufacturing, such as the USD 10 million Cummins facility in Minnesota, and positions hydrogen as a central component of the nation’s clean energy strategy as a major climate and economic move, hence making it suitable for overall hydrogen generation market growth.

Canada hydrogen generation market is efficiently shaped by the presence of ample renewable resources, particularly hydro and wind power, which are facilitating green hydrogen generation. Besides, the provincial and federal programs are supporting research, infrastructure development, and industrial applications, which include ammonia production and mobility solutions. In this regard, the Ontario government in October 2025 announced a USD 30 million investment to expand its Hydrogen Innovation Fund, thereby doubling support for projects that integrate low-carbon hydrogen across electricity, transportation, manufacturing, and heavy industry. It also stated that the fund aims to create jobs, drive economic growth, and establish Ontario as a leader in the hydrogen economy, including the development of hydrogen hubs connecting producers with end-users. Therefore, this initiative supports the province’s long-term energy strategy, Energy for Generations, and complements efforts to reduce emissions and enhance energy security.

Europe Market Insights

Europe hydrogen generation market is representing notable growth owing to the presence of government-backed green hydrogen initiatives. The region’s focus on renewable energy, hydrogen pipelines, and mobility adoption efficiently drives demand. Countries in the region are proactively promoting electrolyzer deployment, carbon capture in steam methane reforming, and integration of hydrogen into industrial hubs. In this regard, Germany and the European Commission In January 2026, reported that they agreed to support the construction of new gas-fired power plants that are hydrogen-ready, with the first units expected online by 2031. These plants will ensure electricity supply security as the country phases out coal and expands renewable energy, with plans for additional tenders in 2027 and 2029 to meet controllable capacity needs. Furthermore, the initiative aims to transition to green hydrogen over time by also maintaining industrial competitiveness and grid stability.

Germany hydrogen generation market is central to the regional landscape in which the national hydrogen strategies support large-scale electrolyzer projects, industrial decarbonization, and export potential. Simultaneously, the collaborations between industry and government have positioned the country as a testbed for hydrogen technologies and integrated hydrogen value chains. In November 2025, Shell Energy Europe reported that it had signed power purchase agreements with Nordsee One and Solarkraftwerk Halenbeck-Rohlsdorf in Germany to supply renewable electricity for its 100 MW REFHYNE 2 electrolyser at the Shell Energy and Chemicals Park Rheinland. The company also mentioned that REFHYNE 2 will produce up to 16,000 tonnes of low-carbon hydrogen annually to decarbonise fuels, chemicals, and other industrial processes, supporting EU renewable hydrogen targets.

The UK hydrogen generation market is mainly fueled by the Net Zero 2050 targets and industrial decarbonization programs. The government is supporting hydrogen adoption in power, transport, and industrial sectors through strategic investments and pilot projects. In November 2025, Plug Power notified that it had been selected by Carlton Power to supply 55 MW of GenEco PEM electrolyzers across three UK green hydrogen projects, i.e., Barrow-in-Furness (30 MW), Trafford (15 MW), and Langage (10 MW). These projects are backed by the country’s Government’s hydrogen business model and will produce renewable hydrogen to decarbonize local industrial operations and transportation. Therefore, this deployment marks the largest combined electrolyzer contract in the UK, reinforcing Plug Power’s leadership in industrial-scale green hydrogen solutions across Europe.

Key Hydrogen Generation Market Players:

- Plug Power, Inc. (U.S.)

- Nel ASA (Norway)

- ITM Power Plc (UK)

- McPhy Energy S.A. (France)

- Thyssenkrupp Nucera AG & Co. KGaA (Germany)

- Cummins, Inc. (U.S.)

- John Cockerill S.A. (Belgium)

- Bloom Energy Corporation (U.S.)

- Electric Hydrogen Co. (U.S.)

- HydrogenPro ASA (Norway)

- Sunfire GmbH (Germany)

- Ohmium International, Inc. (India/U.S.)

- Longi Hydrogen Technology Co., Ltd. (China)

- Hygreen Energy (China)

- PERIC Hydrogen Technologies Co., Ltd. (China)

- Air Liquide S.A. (France)

- Siemens Energy (Hydrogen) (Germany)

- Linde PLC (UK / Germany)

- Waaree Group (India)

- Enapter AG (Germany / Thailand)

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Plug Power, Inc. is a global leader in terms of integrated hydrogen solutions, which provides electrolyzers, fuel cells, storage, and hydrogen fueling infrastructure. The company is focused mainly on large-scale industrial and mobility applications, particularly material handling and heavy industry. Moreover, Plug Power has rapidly expanded its international footprint with projects in the U.S., Europe, and Asia, including multi-megawatt electrolyzer deployments such as the 100 MW project at Galp’s Sines Refinery.

- Nel ASA is based in Norway and is leading in terms of electrolyzers and hydrogen fueling solutions, with expertise in proton exchange membrane (PEM) and alkaline technologies. The company supplies industrial-scale hydrogen generation systems across the world by targeting both green hydrogen production and mobility infrastructure. Nel has also invested in manufacturing capacity expansions in Europe and the U.S., forming partnerships to accelerate the deployment of electrolyzers.

- ITM Power Plc is considered to be a pioneer in electrolyzer manufacturing, specializing in PEM systems for industrial, transport, and energy applications. Besides, the company strongly emphasizes renewable energy integration, producing green hydrogen using wind and solar power. Collaborations with major industrial players, governments, and renewable energy firms to deploy large-scale electrolyzer projects are a few strategies opted for by the firm to secure a leading hydrogen generation market position.

- McPhy Energy S.A. is based in France and is an industrial leader providing hydrogen production, storage, and distribution solutions, with a strong focus on industrial decarbonization and mobility applications. The company designs alkaline and PEM electrolyzers, thereby offering scalable solutions for refineries, steel, and chemical industries. Strategic initiatives opted by McPhy include international partnerships, project financing, and turnkey installations, which are positioning McPhy as a key supplier for green hydrogen in Europe.

- Thyssenkrupp Nucera AG & Co. KGaA is a central player in this field, which specializes in large-scale industrial hydrogen plants and electrolyzers, primarily targeting ammonia, refining, and chemical industries. The company’s strengths lie in engineering expertise, turnkey project delivery, and integration of advanced PEM and alkaline technologies. Thyssenkrupp’s approach also combines industrial scale, technology reliability, and global service networks, making it a leading player in large hydrogen generation projects across almost all nations.

Below is the list of some prominent players operating in the global hydrogen generation market:

The hydrogen generation market is readily evolving, hosting both traditional industrial giants and specialized electrolyzer manufacturers who are constantly vying for leadership. Key players in this field are expanding production capacities and forming strategic partnerships and acquisitions to scale green hydrogen deployment and meet heightened global demand. In this regard, Thyssenkrupp Nucera in September 2025 reported that it had completed the acquisition of key technology assets from Green Hydrogen Systems (GHS), which included intellectual property and a full-size test facility in Skive, Denmark. This acquisition strengthens thyssenkrupp nucera’s expertise in alkaline water electrolysis, now including pressurized solutions capable of producing hydrogen at up to 35 bars, which is ideal for industrial applications. In addition, this strategic move enhances the company’s innovation and global leadership in green hydrogen technology, supporting its development roadmap.

Corporate Landscape of the Hydrogen Generation Market:

Recent Developments

- In October 2025, Plug Power reported that it had delivered the first 10 MW GenEco electrolyzer for Galp’s Sines Refinery in Portugal, marking the initial step of a 100 MW green hydrogen project. Once fully deployed, the project will produce up to 15,000 tons of renewable hydrogen per year, replacing 20% of grey hydrogen use.

- In October 2025, Hyundai Motor inaugurated a new hydrogen fuel cell and PEM electrolyzer production facility in Ulsan, South Korea, by investing KRW 930 billion (USD 700 million), and it is set to produce 30,000 fuel cell units annually.

- In June 2025, NuScale Power Corporation reported that it has advanced research on integrated energy systems using small modular reactors to simultaneously address clean water production, hydrogen generation, and industrial brine reuse.

- In March 2025, INOX Air Products announced that it had commissioned India’s first green hydrogen plant for the float glass industry at Asahi India Glass’s Soniyana facility in Rajasthan, under a 20-year off-take agreement. The solar-powered plant has a total capacity of 190 TPA and will supply 95 TPA of green hydrogen in Phase-1, reducing carbon emissions by around 1,250 MT annually.

- Report ID: 3134

- Published Date: Jan 22, 2026

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrogen Generation Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.