Hydrogen Fuel Cell Vehicle Market Regional Analysis:

APAC Market Insights

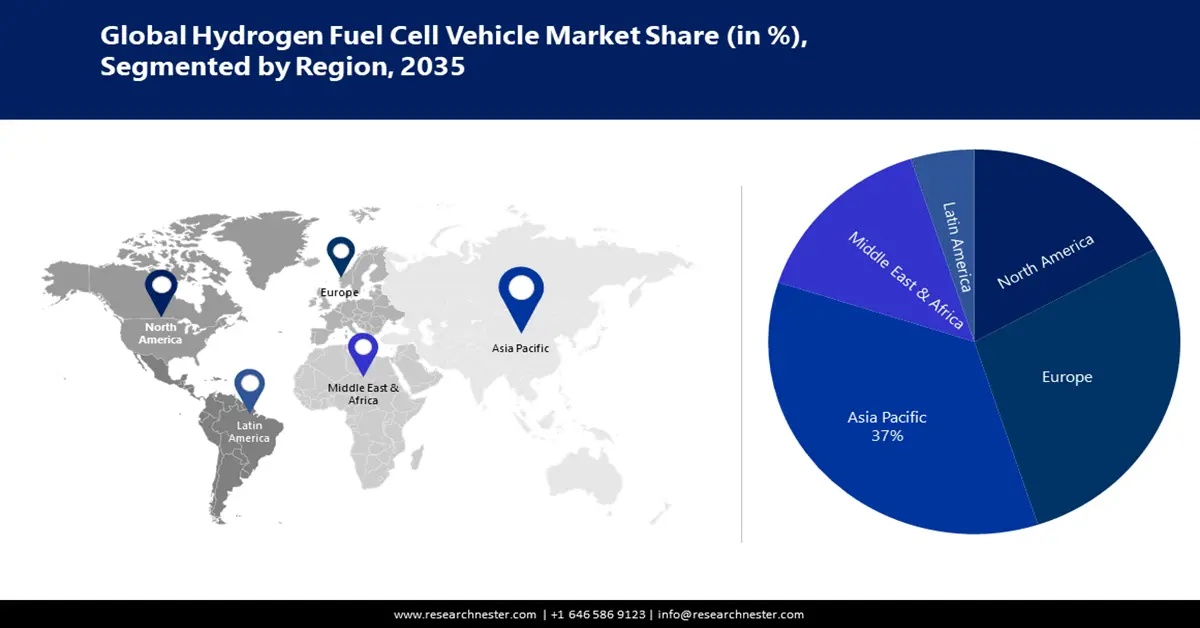

By the end of 2035, Asia Pacific hydrogen fuel cell vehicle market is likely to hold the largest revenue share of over 37%, owing to supportive government initiatives and rising FDI. Programs such as the Hydrogen Road Maps and the Hydrogen Council are aiding market growth. A directive from China's Development and Reform Commission issued in November 2021 mandated the production of 5,000 hydrogen fuel cell vehicles for port transportation, buses, and intercity logistics by the end of 2025. In India, the focus on hydrogen mobility is a pivotal step toward the net-zero emission objective by 2070. Kerala’s ongoing developments in hydrogen mobility are anticipated to pave a path for the rest of India to scale sustainable transport initiatives. According to the World Economic Forum, the transit sector accounts for 8.4% of the country’s carbon footprint, which has long struggled to electrify heavy-duty vehicles.

China is the world’s largest hydrogen manufacturer, with a yield of 25 million tons (Mt). Most of it is sourced from fossil fuels (25% from natural gas and 60% from coal) as feedstocks in chemical facilities or refineries. China’s commitment to attain carbon neutrality by 2060 underscores a key policy-oriented progress that could drive a shift to renewables from fossil fuels and steadfast FCV deployment. According to the CSIS 2022 report, China’s hydrogen demand is estimated to cross 35 Mt in 2030 (5% of the country’s energy supply), by 2050 it will be about 60 Mt (10% of China's energy supply), and 100 Mt by 2060 (20%). In addition, there were 8,400 FCVs in 2020, making China the world’s third-largest FCV market. CSIS anticipates that the 1 million FCVs will be supplied and 1,000 operational HRS by 2030.

Europe Market Insights

By 2035, Europe is estimated to capture hydrogen fuel cell vehicle market share of over 27%. The hydrogen fuel cell vehicle market expansion can be attributed majorly to the European Commission’s commitment to lower carbon emissions and the increasing awareness about the benefits of hydrogen fuel cell vehicles. For instance, Daimler announced in May 2022 that they are planning to include electric vehicles and hydrogen fuel vehicles in their portfolio by 2030. This is leading to the development of more efficient and cost-effective hydrogen fuel cell vehicles.

Germany hydrogen fuel cell vehicle market is driven by government strategies that outline the goal of carbon neutrality by subsidizing hydrogen generation. In 2020, the government rolled out its National Hydrogen Strategy (NHS), and later, in May 2024, the Hydrogen Acceleration Act was introduced to fast-track this journey toward sustainability. Public funding significantly multiplied after the NHS. In June of 2020, an economic stimulus package was integrated by the government that allocated USD 7.6 billion to ramp up hydrogen technology development and another USD 2.2 billion for international partnerships.