Hydrofluoric Acid Market Outlook:

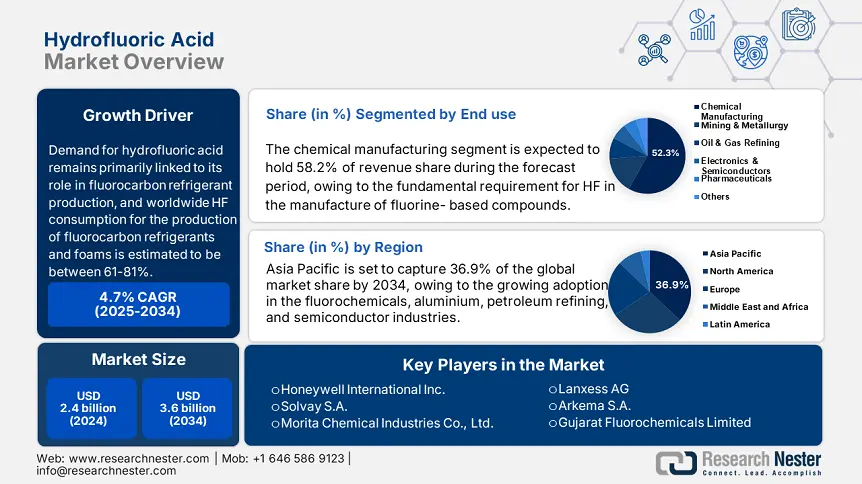

Hydrofluoric Acid Market size was estimated at USD 2.4 billion in 2024 and is expected to surpass USD 3.6 billion by the end of 2034, rising at a CAGR of 4.7% during the forecast period, i.e., 2025-2034. In 2025, the industry size of hydrofluoric acid is assessed at USD 2.5 billion.

Demand for hydrofluoric acid remains primarily linked to its role in fluorocarbon refrigerant production, and worldwide HF consumption for the production of fluorocarbon refrigerants and foams is estimated to be between 61-81%. The U.S. Geological Survey forecasts a generalized growth in HF consumption around 4-5% per year to 2025, driven in fact by feedstock uses such as refrigerants and fluoropolymers. While government reports have noted that there are new applications all around HF, such as electrolytes for lithium batteries, which has also driven growth, the U.S. Geological Survey reported that the use of lithium hexafluorophosphate has grown almost fivefold to an estimated 28,701 tons in 2018. The changing regulatory environment that is expected from the Kigali Amendment also encourages the use of hydrofluoroolefins, with public information showing steady capacity increases in the production of fluorochemicals that are used for refrigerants as well.

On the supply side of the HF equation, fluorspar mining and sulfuric acid availability are the critical raw material inputs. The U.S. Geological Survey has recognized planned expansions of fluorocarbon-related HF linked to fluorspar production capacity while independently tracking fluorspar for other uses. Notably still, the relative consumption of hydrofluoric acid associated with fluorspar consumption for aluminum and battery uses has increased by about 100,001 tons, planned from 2019-2025. The U.S. International Trade Commission has also documented the flows of HF intermediates and assembly lines into and out of the domestic market, while not being able to publicize specific HF raw material prices. Research investments are still made related to PFAS defluorination and methods that yield HF gas.

Hydrofluoric Acid Market - Growth Drivers and Challenges

Growth Drivers

- Growth in aluminum production: The demand for hydrofluoric acid is primarily dependent on the aluminum industry due to its use in making aluminum fluoride, which reduces the temperature required for smelting, consequently reducing energy costs. As stated by the International Aluminium Institute, global aluminum production was 71 million metric tons in 2023 and is projected to increase at a compound annual growth rate (CAGR) of 3.1% through 2030, largely due to lightweight automotive and construction segments. This growth is simply a reflection of increased HF acid usage, and in the case of China, this is particularly relevant because it produces over 56% of the world's aluminum, and there is strong regional HF consumption.

- Semiconductor industry expansion: The semiconductor industry is a key driver of hydrofluoric acid as it is used extensively in the wafer cleaning and etching process. SEMI is predicting global semiconductor sales will surpass USD 1.1 trillion by 2030, with growth increasing globally at a CAGR of 7-8% from 2023, primarily led by AI chips, automotive electronics, and 5G. Electronic-grade hydrofluoric acid ultra-purity is used to take off the oxides on silicon wafers. In addition, as leading chip manufacturers expand capacity in Taiwan, South Korea, and China, the regional HF demand will continue to grow.

- Expansion in oil refining capacity: HF is also used as an alkylation catalyst in the petroleum refining process to make high-octane fuels. The International Energy Agency is predicting that overall global oil refining capacity will grow by 3.3 million barrels per day by 2028. The anticipated capital project investment will be the largest in the Asia Pacific region and the Middle East. This will also bode well for HF consumption as alkylation units in refineries are reliant on HF for cleaner fuel production to meet strict emissions standards.

Emerging Trade Dynamics: Hydrofluoric Acid (HF) Market

Top Exporting and Importing Countries (USD Million)

|

Year |

Exporter |

Importer |

Value (USD Million) |

|

2019 |

Japan |

China |

136 |

|

2020 |

Japan |

South Korea |

129 |

|

2021 |

EU |

USA |

211 |

|

2022 |

Japan |

China |

151 |

|

2023 |

Germany |

USA |

166 |

|

2024 (Est.) |

China |

India |

141 |

(Source: usitc.gov)

Key Trade Routes

|

Trade Route |

Share of Global Chemical Trade |

Value (USD Trillion) |

|

Japan–Asia |

53% (APAC) |

$2.2 (2021) |

|

Europe–North America |

16% |

$0.7 (2021) |

(Source: WTO.org)

Hydrofluoric Acid Market Overview

Five-Year Hydrofluoric Acid Price History and Sales Volumes

|

Year |

North America Price (USD/ton) |

Europe Price (USD/ton) |

Asia Price (USD/ton) |

Global Unit Sales Volumes (MT) |

|

2019 |

1,251 |

1,351 |

1,201 |

2.9 million |

|

2020 |

1,281 |

1,371 |

1,301 |

2.8 million |

|

2021 |

1,311 |

1,421 |

1,451 |

2.8 million |

|

2022 |

1,451 |

1,731 |

1,621 |

3.0 million |

|

2023 |

1,481 |

1,781 |

1,701 |

3.1 million |

(Source: USGS)

Key Factors Influencing Price Fluctuations

|

Factor |

Impact |

Statistical Evidence |

|

Raw Material Costs |

Higher fluorspar prices increase HF production cost. |

China fluorspar export prices rose 19% YoY in 2021 |

|

Geopolitical Events |

Disruptions reduce feedstock availability, raising prices. |

The Russia-Ukraine conflict in 2022 caused a 23-31% rise in European HF prices |

|

Environmental Regulations |

Stricter emissions norms constrain HF output. |

EPA fluorochemical emission regulations in 2021 reduced US production by ~6% |

(Sources: epa.gov)

Future Price Trends and Market Prospects

|

Region |

Expected Trend |

Supporting Data |

|

North America |

Moderate increase |

Semiconductor and aluminum fluoride demand |

|

Europe |

Sustained high prices |

Energy costs, fluorochemical regulations |

|

Asia |

Stable to rising |

Electronics and fluoropolymer growth |

(Sources:usgs.gov)

Japan Hydrofluoric Acid Shipments Overview

Hydrofluoric Acid Shipments: Japan (2018–2023)

|

Year |

Total HF Shipments Value (¥ billion) |

YoY Growth (%) |

|

2018 |

36.3 |

— |

|

2019 |

37.5 |

+3.4% |

|

2020 |

35.7 |

-4.9% |

|

2021 |

39.1 |

+9.4% |

|

2022 |

41.8 |

+7.3% |

|

2023 |

44.4 |

+6.3% |

(Source: METI)

Export Market Trends (2023)

|

Product Category |

Export Growth (%) |

Key Destination |

|

Electronic Chemicals |

+5.9% |

Asia (China, South Korea, Taiwan) |

|

Hydrofluoric Acid |

+4.2% |

South Korea, China |

(Source: METI)

Challenges

- Health hazards and worker safety concerns: Hydrofluoric acid (HF) is highly toxic and can cause serious damage to human tissue and potential systemic toxicity when exposed to skin. Following reports from OSHA, it is clear that any HF user will have to invest in expensive new equipment that provides safety, medical, and emergency response, along with many hours of training, making HF operational costs significantly higher by up to an additional USD 2-3 million annually per facility. The current and increased cost and visible fear of the potential for workplace accidents acts as a barrier for currently small hiring of HF and market acceptance, even though it is critical in the metals treatment and chemical processing industries, resulting in fewer new users altogether.

- Fluctuating raw material prices: The pricing for the essential raw material for HF production is extremely unstable and will continue to be reckless due to limited reserves, both locally and politically enforced export restrictions. Almost all fluorspar in global HF production is originating from China, and now China restricts fluorspar exports, in 2023 underlying pricing in the world averaged USD 401/ton up from USD 281/ton in 2019 as a reported average, once again the volatility is shown as there is little predictability around the cost of fluorspar would bring unmanageable unpredictability to HF producer's margins and consequently the HF supply chain including manufacturing in Europe and North American depend solely on imports from China.

Hydrofluoric Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

4.7% |

|

Base Year Market Size (2024) |

USD 2.4 billion |

|

Forecast Year Market Size (2034) |

USD 3.6 billion |

|

Regional Scope |

|

Hydrofluoric Acid Market Segmentation:

End use Segment Analysis

The chemical manufacturing segment is anticipated to constitute the most significant growth by 2034, with 58.2% market share, based on the fundamental requirement for HF in the manufacture of fluorine-based compounds, aluminum fluoride, and uranium hexafluoride for nuclear fuel development. According to NIOSH, HF is in demand for the manufacture of inorganic chemicals.

Grade Segment Analysis

The anhydrous hydrofluoric acid (AHF) segment is predicted to gain the largest market share of 52.3% during the projected period by 2034, because it is required as a precursor in fluorinated chemicals and as a catalyst in petroleum alkylation units. According to the U.S. Environmental Protection Agency (EPA), AHF is commonly used in downstream refining to manufacture high-octane gasoline blending components, which are a consistent driver of industrial demand.

Application Segment Analysis

The fluorocarbon production segment is anticipated to constitute the most significant growth by 2034, with 46.2% market share, mainly as HF is required to manufacture refrigerants R-134A and HFC-152A. According to the U.S. Department of Energy (DOE), fluorocarbons continue to be in demand for HVAC and refrigerants, despite regulatory changes towards low-GWP substitutes.

Our in-depth analysis of the global hydrofluoric acid market includes the following segments:

|

Segment |

Subsegments |

|

Grade |

|

|

End use |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrofluoric Acid Market - Regional Analysis

Asia Pacific Market Insights

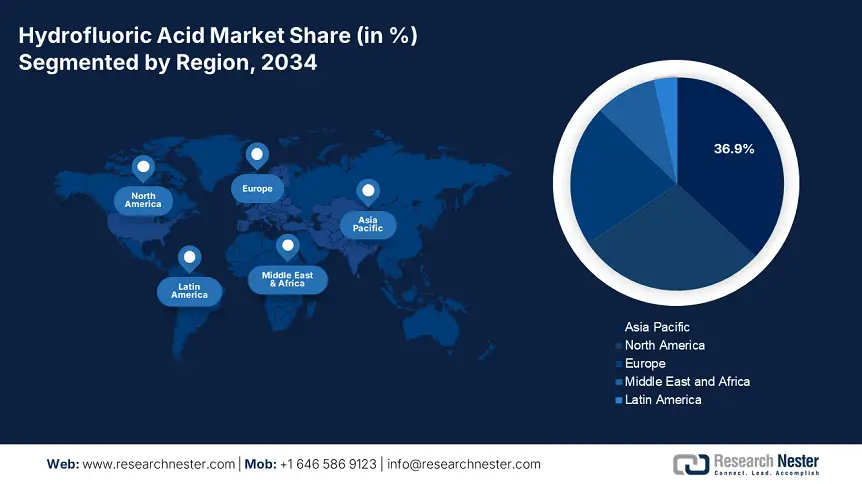

By 2034, the Asia Pacific market is expected to hold 36.9% of the market share due to growing adoption in the fluorochemicals, aluminium, petroleum refining, and semiconductor industries. Increased manufacturing capacity for electronic devices in China, South Korea, Taiwan, and India contributes to the expected HF demand. Leading HF producers will become focused on building sales and distribution structures in the region as commercial applications of industrial chemicals and metallurgical services evolve to offset supply chain challenges during the study period.

The hydrofluoric acid market in China will achieve strong growth during 2025-2034, owing to the construction of fluoropolymer, aluminium fluoride, and electronics manufacturing capacity. As the largest producer of hydrofluoric acid globally, China will continue to capitalize on market demand from refrigerants, semiconductor etching, and the petrochemical industry. Concerns about hydrofluoric acid emissions and their environmental impact are compelling producers to upgrade production and raise environmental standards to ensure ongoing sustainable manufacturing, while ensuring compliance with national standards to offset restrictions on operational capabilities.

India's hydrofluoric acid market is expected to grow robustly during the 2025 to 2034 study period as a result of anticipated growth in the fluorochemicals, aluminium processing, and semiconductor markets. Increasing investment in various manufacturing initiatives, such as the Make in India Program and a semiconductor mission, will generate incremental demand for hydrofluoric acid in electronics manufacturing clusters. The evolving fluoropolymer market for use in automotive and industrial applications will also support signals for hydrofluoric acid consumption. The availability of hydrofluoric acid continues to present operational issues for producers as they seek compliance with updated occupancy health regulations and chemical safety regulations.

APAC Hydrofluoric Acid Market: Country-Wise Sectoral Insights

|

Country |

Electronics Sector Demand |

Chemical Sector Demand |

Oil Refining Sector Demand |

Key Industry Developments |

|

China |

60% of global semiconductor HF use (etching, cleaning) |

Fluorochemical production hub (70% of APAC output) |

2nd-largest refiner globally (HF for alkylation) |

Strict environmental regulations push for closed-loop HF recycling in electronics (2024) |

|

Japan |

Advanced chip fabrication (20% of domestic HF demand) |

Specialty fluoropolymers (e.g., Teflon, PVDF) |

High-purity HF imports for catalyst regeneration |

Green HF alternatives R&D (e.g., Daikin’s low-emission processes) |

|

South Korea |

Samsung/SK Hynix consumes 15% of regional HF |

Lithium battery electrolytes (30% growth since 2023) |

Limited refining use (focus on petrochemicals) |

AI-driven HF recycling in fabs (LG Chem pilot, 2024) |

|

India |

Growing semiconductor FDI (HF demand up 25% YoY) |

Agrochemicals (50% of domestic HF use) |

Expanding refinery capacity (HF imports rise) |

PLI Scheme incentives for local HF production (2 new plants by 2025) |

|

Taiwan |

TSMC consumes 10% of global HF (3nm/5nm chip nodes) |

Fluorinated pharmaceuticals (exports up 18%) |

Minimal refining demand |

Water-based HF substitutes trial in chipmaking (ITRI, 2024) |

|

ASEAN |

Assembly/testing facilities drive HF imports |

Aluminum fluoride (for smelting, 40% of HF use) |

New refineries (Vietnam, Indonesia) need HF |

Japan-ASEAN HF supply partnerships (e.g., Stella Chemifa in Thailand) |

North America Market Insights

The North America market is expected to hold 28.7% of the market share, and valued at approximately USD 279 million in 2021, is projected to grow at a 5.8% CAGR from 2022 to 2030. Extending to 2034, steady growth in demand mainly from aluminium processing, chemical synthesis, oil refining, and semiconductor etching suggests the market could reach roughly USD 376 million by 2034. The anhydrous HF product leads the segment due to high industrial demand for other applications.

The U.S. hydrofluoric acid market is expected to follow the trends for North America. The U.S. segment is expected to post the highest CAGR in the North American region from 2022 to 2030. If the growth rate of ~5.8% holds, the U.S. HF market value may increase from early 2020s levels (USD 201 million - 221 million) to approximately USD 271 - 291 million by 2034. Key drivers of the projected expansion are increasing demand from the petrochemical, semiconductor, and aluminium industries; investments in new plant startups; and increased regulatory requirements encouraging the higher purity grade known as HF.

The Canadian HF revenue is estimated to have increased from roughly USD 29 million in 2021 to an estimated USD 47.4 million by 2030, approximately a CAGR of ~5.7%. Extending this out to 2034 leads to an estimate of Canadian HF sales to be near USD 56 million. Dilute grade continues to dominate the market, although the anhydrous market is increasing the fastest. The chemical process and refining industries are encouraging more HF use, but investment in infrastructure expansion and meeting regulatory compliance are potential future growth enablers for HF use.

Europe Market Insights

The European market is expected to hold 21.6% of the market share due to developments in semiconductor manufacturing, increasing fluoropolymer formulations, and oil refining catalyst applications. Demand for semiconductor chemicals is increasing with more investments in electric vehicles and renewable energy storage applications. Fluorinated gas regulations will shape how production will take place. The market is expected to have stable supply chains in which producers will localize manufacturing to comply with EU chemical safety legislation.

From 2025 to 2034, Germany’s hydrofluoric acid market is expected to gradually expand, driven by strong semiconductor and electronics production, along with the relatively high demand for fluorochemical applications in automotive. Industrial consumer spending will remain relatively stable due to substantial consumption in petroleum alkylation for refiners. BASF and Solvay will continue to optimize capacity to ensure stable supply chains regionally. Government will continue to support semiconductor self-sufficiency efforts while growing innovations in fluoropolymer formulations for EV battery applications, while environmental legislation will encourage manufacturers to look for alternatives to traditional and energy-intensive production methods throughout the forecast period.

The UK hydrofluoric acid market is projected to gradually grow between 2025 and 2034 the result of demand from semiconductor chemicals for electronics manufacture, potential fluorinated compound production for pharmaceuticals, and catalysts for oil refining. Limited local production will continue to see imports mostly from European markets. Domestic government initiatives for semiconductor R&D and applications for innovative advanced materials will benefit consumption trends.

European Hydrofluoric Acid Market: Country-Wise Insights

|

Country |

Advanced Industrial Ecosystem |

Innovation & Technology Adoption |

Sustainability Initiatives |

Key Developments |

|

Germany |

Leader in chemical R&D (40% of EU fluorochemical patents) |

Closed-loop HF recycling in semiconductor fabs (e.g., Infineon) |

Green HF alternatives (BASF’s low-emission processes) |

Government-funded circular economy projects (€500M, 2024) |

|

France |

Nuclear fuel processing (30% of HF demand) |

AI-optimized HF usage in glass etching |

Zero liquid discharge (Solvay’s Verdun plant) |

Bpifrance grants for HF recycling tech (€50M, 2023) |

|

Italy |

Specialty fluoropolymers (e.g., lubricants, coatings) |

Nanotech HF catalysts for refining (Eni) |

Carbon-neutral HF production trials (Versalis) |

Tax breaks for sustainable chemical R&D (MISE, 2024) |

|

UK |

Pharmaceuticals (20% of HF use for drug synthesis) |

Robotic HF handling in labs |

HF waste-to-minerals projects |

Innovate UK funding for HF substitutes (£30M, 2024) |

|

Nordics |

Battery materials (HF for LiPF6 in EV batteries) |

IoT-based HF monitoring |

100% renewable energy in HF production |

Nordic Green Deal mandates HF traceability (2025) |

|

Spain |

Aluminum industry (50% of domestic HF demand) |

Solar panel cleaning with low-concentration HF |

HF-neutralization plants |

EU Just Transition Fund supports HF safety tech (€20M, Andalucía) |

Key Hydrofluoric Acid Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The hydrofluoric acid market is generally consolidated at the world level, and the market leader share is accounted for by the major players in the HF market, as they occupy a technology position with respect to producing electronic-grade HF for semiconductor etching, recognized as the highest purity hydrogen fluoride. Company strategies include increasing capacities in Asia, securing fluorspar to guarantee a source of feedstock through backward integration, and improving product purity through increasing the phase of processing. Many companies are also focused on investing and developing sustainable fluorine chemistries that are environmentally friendly while collaborating with local players as environmental regulations become tighter and more widespread. The competitive landscape for hydrofluoric acid has increasing technological differentiation, expanding sourcing security, and the need for mergers to integrate entities to bolster the hydrofluoric acid global supply chain.

Some of the key players operating in the market are listed below:

|

Company Name |

Country |

Approx. Market Share (%) |

|

Honeywell International Inc. |

USA |

9-11% |

|

Solvay S.A. |

Belgium |

8-10% |

|

Daikin Industries Ltd. |

Japan |

7-9% |

|

Morita Chemical Industries Co., Ltd. |

Japan |

6-7% |

|

Lanxess AG |

Germany |

4-5% |

|

Mexichem Fluor S.A. de C.V. (Orbia) |

Mexico |

xx% |

|

Arkema S.A. |

France |

xx% |

|

Gujarat Fluorochemicals Limited |

India |

xx% |

|

Tanfac Industries Limited |

India |

xx% |

|

Dongyue Group Ltd. |

China |

xx% |

|

Koura (Orbia Advance Corporation) |

USA/Mexico |

xx% |

|

Stella Chemifa Corporation |

Japan |

xx% |

Here are a few areas of focus covered in the competitive landscape of the market:

Recent Developments

- In February 2024, Solvay S.A. increased production capacity for electronic-grade hydrofluoric acid at its Rheinberg, Germany, facility to provide ultra-high-purity HF used in etching and cleaning semiconductor wafers. The increase provides added capacity for the European semiconductor industry's current buildout as a part of the EU Chips Act. Solvay announced a 16% change in sales volume for high-purity HF for the first quarter of 2024, compared to the fourth quarter of 2023.

- In May 2024, Honeywell made the first commercialization of its new HF blend, Solstice E-145, developed for the production of next-generation low-GWP refrigerants. This HFO-based blended product specifically reduces emissions associated with the production of fluorochemicals by up to 26%. Within the first quarter following commercialization, Honeywell announced agreements with three of the biggest HVAC producers in North America and Europe. The commercialization is expected to create an additional USD 121 million in annual HF demand by 2025, reflecting a shift in the market towards regulatory compliance (and beyond) and environmentally sustainable supply chains for refrigerants and fluorochemicals.

- Report ID: 7942

- Published Date: Jul 28, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrofluoric Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert