Anti-hypertensive Drugs Market Outlook:

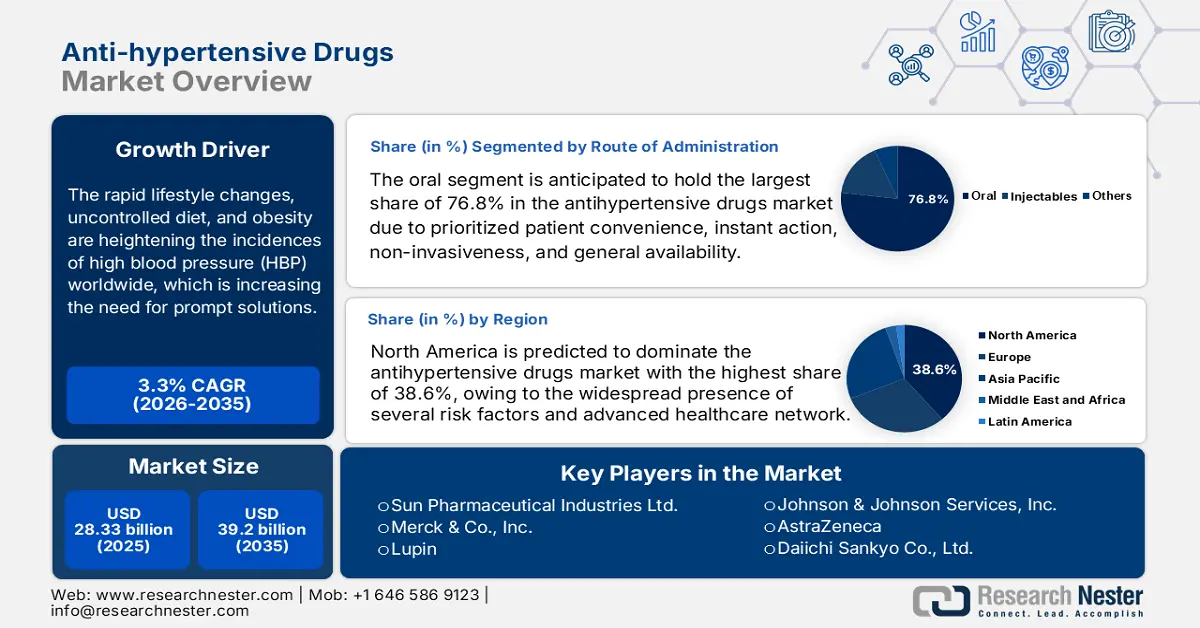

Anti-hypertensive Drugs Market size was over USD 28.33 billion in 2025 and is anticipated to cross USD 39.2 billion by 2035, growing at more than 3.3% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of anti-hypertensive drugs is assessed at USD 29.17 billion.

The rapid lifestyle changes, uncontrolled diet, and obesity are heightening the incidences of high blood pressure (HBP) worldwide, which is increasing the need for prompt solutions. According to WHO, the global population of people living with this condition, aged between 30 and 79, surpassed 1.2 million in 2023. Only 42.0% of this volume received proper treatment and diagnosis and over 46.0% were unaware of having it. To combat the situation, various medical authorities set an aim of a 33.0% reduction in this widespread by 2030 from 2010. The market is continuously introducing new ranges of therapeutic options, tailored to address every individual’s need. This is perfectly aligning with the initiatives taken by such governing bodies, securing a steady capital influx in this sector.

The anti-hypertensive drugs market has been witnessing a significant urge for innovative yet simplified solutions, such as diuretics, to cover for severely ill patients. Components including hydrochlorothiazide, chlorthalidone, mannitol, and hypertonic saline are widely utilized during treatment by eliminating excessive body fluid. For instance, a 2020 NLM study revealed that both mannitol and hypertonic saline are efficiently capable of managing intracranial hypertension. Thus, the merchandise for such products is exponentially growing. As per OEC, the overall value of mannitol business across the globe was calculated to be USD 357.0 million in 2023, showcasing a 16.1% increment from 2022. France was recognized as the largest exporter with a value of USD 162.0 million and India registered the 1st rank in imports with USD 47.6 million.

Country-wise Import-Export Database for Mannitol (2023)

|

Country |

Import (USD, million) |

Export (USD, million) |

|

U.S. |

38.8 |

41.0 |

|

Germany |

24.4 |

20.3 |

Source: 2023 OEC Report

Key Anti-hypertensive Drugs Market Insights Summary:

Regional Highlights:

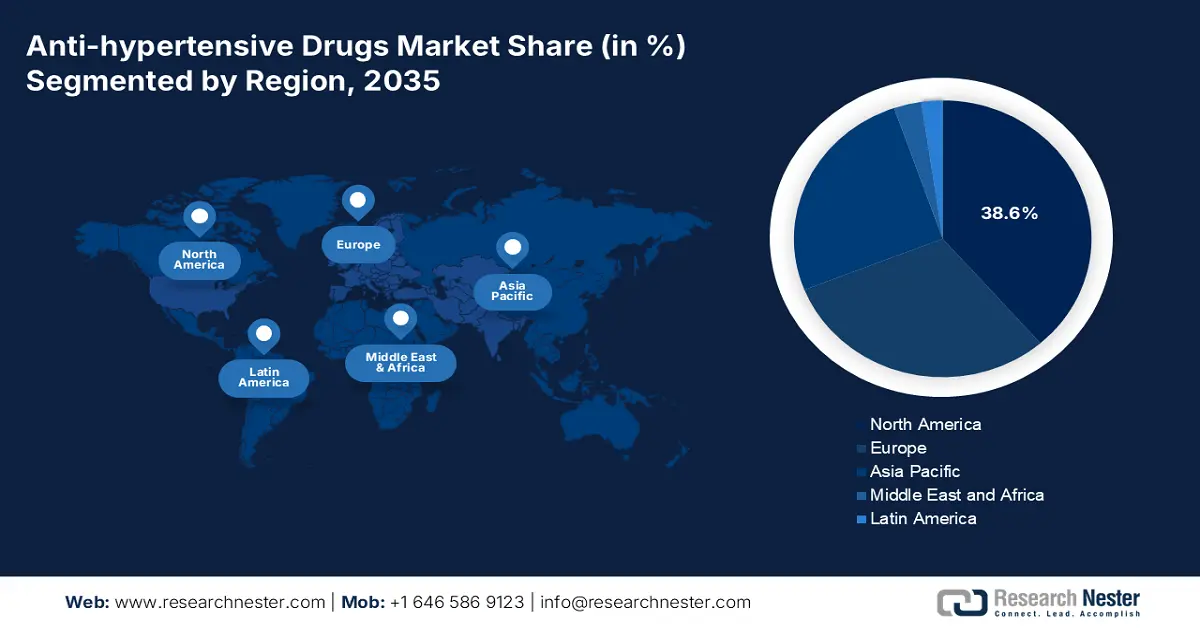

- North America commands a 38.6% share in the Anti-hypertensive Drugs Market, fueled by the widespread presence of risk factors such as obesity, alcohol consumption, and sedentary lifestyle, driving significant growth through 2026–2035.

Segment Insights:

- The Oral segment is forecasted to hold a 76.80% share by 2035, propelled by patient convenience, instant action, and higher prescription rates.

- The Primary Hypertension segment of the Anti-hypertensive Drugs Market is anticipated to achieve a remarkable share from 2026 to 2035, driven by the severity and large patient population compared to other types.

Key Growth Trends:

- Introduction of combination therapies

- Growing demand for preventive medications

Major Challenges:

- History of side effects and overdose

- Lack of resources and awareness in rural areas

- Key Players: Sun Pharmaceutical Industries Ltd., Lupin, AstraZeneca, Merck & Co., Inc., Johnson & Johnson Services, Inc., Novartis AG, Medtronic Plc..

Global Anti-hypertensive Drugs Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 28.33 billion

- 2026 Market Size: USD 29.17 billion

- Projected Market Size: USD 39.2 billion by 2035

- Growth Forecasts: 3.3% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, France, Japan

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 12 August, 2025

Anti-hypertensive Drugs Market Growth Drivers and Challenges:

Growth Drivers

- Introduction of combination therapies: The evolving market is rigorously engaged in extensive R&D to offer faster action and elongated effectiveness. Following this cohort, in March 2024, Idorsia Pharmaceuticals earned approval from the FDA for its newly developed combination therapy of TRYVIO (aprocitentan) with other anti-hypertensives. The unique approach of amalgamating endothelin receptor antagonist with conventional routine therapeutics proved its efficacy against resistant HBP in adult residents, surpassing the superiority of placebo. Such improved administration and reduced adverse reaction are attracting a larger volume of consumers, inspiring companies to innovate more efficient solutions.

- Growing demand for preventive medications: Hypertension has the potential to worsen a patient’s situation in several life-threatening chronic diseases, which makes the consumption of products from the market a necessity. A 2023 study from the Korean Society of Hypertension revealed that the utility of these curatives in South Korea increased from 2.5 million to 10.5 million during a timeframe, i.e. 2002-2021. It also mentioned that among the 12.3 million patient pool in 2021, the treatment adherence stood at 7.8 million, representing a 58.5% increment from 2002. Thus, with the heightening mortality and disability in diabetes, chronic kidney disease (CKD), and cardiovascular disease (CVD) due to HBP, expenditure on these medications rises.

Challenges

- History of side effects and overdose: There are many events where the offerings from the anti-hypertensive drugs market caused adverse reactions such as dizziness, fatigue, and nausea. Patients often develop non-compliance with these therapeutics, which may prevent them from consuming. Moreover, these cases overlap with their known benefits, creating hesitation in purchase. Thus, the effectiveness of products with improved kinetics may get ignored due to the old perception of non-adherence and addition, limiting acceptance and cash flow in this sector.

- Lack of resources and awareness in rural areas: Uninterrupted growth in the market requires steady sales to survive and thrive, which may get hindered by the absence of adequate distribution channels. People from underserved regions often face disparity in medicine availability and accessibility, shrinking the consumer base. Particularly in lower- and middle-income countries (LMICs), the investments in healthcare infrastructure and promotional activities are limited, making it difficult to reach optimum adoption.

Anti-hypertensive Drugs Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.3% |

|

Base Year Market Size (2025) |

USD 28.33 billion |

|

Forecast Year Market Size (2035) |

USD 39.2 billion |

|

Regional Scope |

|

Anti-hypertensive Drugs Market Segmentation:

Route of Administration (Oral, Injectables, Others)

Oral segment is estimated to capture anti-hypertensive drugs market share of around 76.8% by the end of 2035. This segment is gaining traction due to prioritized patient convenience, instant action, non-invasiveness, and general availability. Above all, the higher prescription rates in both primary and secondary medical settings are also fueling the urge for this type of drug delivery system. According to an NLM article, the solid oral medicine industry was estimated to be at USD 550.0 million in 2022. It also stated that 46.0% of the total FDA approved modalities and applications were in the form of oral immediate-release products. Besides easy compliance, this segment’s growth is also driven by the innovations in their action process, such as the introduction of extended and controlled release.

Type (Primary Hypertension, Secondary Hypertension)

In terms of type, the primary hypertension segment is expected to register a remarkable share in the anti-hypertensive drugs market during the assessed period. The severity and large patient population of this segment is notably higher than the other type. This can be testified by the wide prevalence according to age differences. On this note, in March 2023, a survey was conducted by the American Heart Association (AHA), on the prevalence of primary HBP among pediatric residents, which was found to be 10 times higher compared to the secondary one. Moreover, the uncertain cause of occurrence among both adults and children makes this condition more complex and concerning for healthcare organizations. Despite the absence of a definite cause, this type is often identified by heterogeneity and certain birth-related abnormalities.

Our in-depth analysis of the global market includes the following segments:

|

Route of Administration |

|

|

Type |

|

|

Drug Class |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Anti-hypertensive Drugs Market Regional Analysis:

North America Market Analysis

North America in anti-hypertensive drugs market is predicted to capture over 38.6% revenue share by 2035. The widespread presence of several risk factors such as obesity, alcohol consumption, and sedentary lifestyle is emphasizing the volume of patient community in this region. However, the proactive government initiatives such as regulatory ease and a highly advanced healthcare network have established a reliable supply-demand channel, bringing convenience for both consumers and suppliers. For instance, in March 2024, Merck attained clearance from the FDA for its activin signaling inhibitor therapy, WINREVAIR (sotatercept-csrk) injection, available in 45mg and 60mg vials. The breakthrough drug is indicated to manage pulmonary arterial hypertension (PAH) in adults.

The U.S. is one of the largest consumer bases of the anti-hypertensive drugs market. As per AHA report, the age-adjusted HBP prevalence in the U.S. was 44.7% between 2017 and 2020. Another government survey revealed that around 50.0% (119.9 million) of the adult residents in this country were living with hypertension during the same timeframe. Thus, the continuously enlarging patient pool in this country is fostering great opportunities and pioneers, making it a target landscape for every global leader.

The efforts from the government bodies in Canada are helping improve the general accessibility of the market. This is commendably contributing to strengthening the domestic network and supply, inspiring the pharma producers for participation and investments. For instance, in August 2023, Pharmascience introduced a generic form of medicine, pms-PERINDOPRIL-INDAPAMIDE (perindopril erbumine/indapamide). The ACE inhibitor is specifically engineered to offer adherence to every age and mild-to-moderate HBP.

APAC Market Statistics

Asia Pacific is projected to acquire a notable share in the anti-hypertensive drugs market during the forecast timeline. Besides the enlarging demand, the region is also pledged with some of the leading pioneers in this field such as Daiichi Sankyo, Sun Pharma, Lupin, and others. Domestic and international collaborations are also boosting diversity in this marketplace, making it more accessible for patients from all economic backgrounds. On this note, in February 2024, Handok collaborated with Sanofi for the commercial launch of a new combination therapy, Aprovasc, in South Korea for treating HBP. The combination of Irbesartan and Amlodipine makes this solution effective for offering a simplified version of the individual drug actions while preventing nephropathy and CVD from worsening.

Being an emerging force of pharmaceutical production and discovery, India is garnering lucrative scope of investments in the market. The existing well-versed dynamics of this country are evidence of a pre-crafted atmosphere to execute a profitable business with these drugs. For instance, in January 2024, Lupin solidified its strong domestic presence by gaining the FDA recognition for its solely developed extended-release formulation with oral delivery system, Propranolol Hydrochloride Capsules. The product is a generic alternative of Inderal (by ANI Pharma) and is available in four different doses of 60 mg, 80 mg, 120 mg, and 160 mg.

China is one of the largest production houses in the anti-hypertensive drugs market. Its global trading capacity is a notable indication of progress and strong distribution capabilities. In this regard, OEC highlighted a 62.4% increment in exports of a diuretic, mannitol, from 2023 to 2024 and a total positive trade balance of USD 7.0 million in 2024. This signifies the country’s emphasis on globally used treatment solutions. Furthermore, China also has a steady demand chain from its own patient volume and aging population. Besides, the nation’s developing healthcare infrastructure and government efforts are ensuring maximum adoption in this field.

Key Anti-hypertensive Drugs Market Players:

- Sun Pharmaceutical Industries Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Lupin

- Pfizer Inc.

- AstraZeneca

- Merck & Co., Inc.

- Johnson & Johnson Services, Inc.

- Novartis AG

- Boehringer Ingelheim International GmbH

- Sanofi

- Medtronic Plc.

- Celltrion Pharm Inc.

- Roivant Sciences Ltd.

Owing to the wide application and utilities, the anti-hypertensive drugs market is becoming a well-versed merchandise with a broad spectrum of opportunities. Key players in this sector are sufficiently producing innovative pipelines and finding new indications to increase the field of action for these medicines. For instance, in November 2024, Alembic gained abbreviated new drug application (ANDA) allowance from the FDA for its Diltiazem Hydrochloride Extended-Release Capsules USP, in 120 mg, 180 mg, 240 mg, 300 mg, and 360 mg doses. The company aimed at consolidating its position in this sector with a revenue of USD 105.3 million. through such discoveries. This creates diverse genres of pharmaceutical excellence, presenting a healthy and steady growth. Such key players are:

Recent Developments

- In February 2025, Celltrion Pharm announced the commercial release of its combination drug, Amrozet Tablet, in South Korea, available in 5/5/10 mg, 5/10/10 mg, 10/5/10 mg, and 10/10/10 mg. The combination of amlodipine with rosuvastatin and ezetimibe is indicated to treat hypertension and hyperlipidemia.

- In December 2024, Roivant Sciences launched a new subsidiary company, Pulmovant, to market the recently acquired phase 2-ready pulmonary hypertension drug, Mosliciguat, from Bayer against an upfront cash of USD 14.0 million. Further, the inhaled activator is expected to benefit Bayer with USD 280.0 million for globalization.

- Report ID: 7280

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Anti-hypertensive Drugs Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.