Hydrochloric Acid Electrolysis Market Outlook:

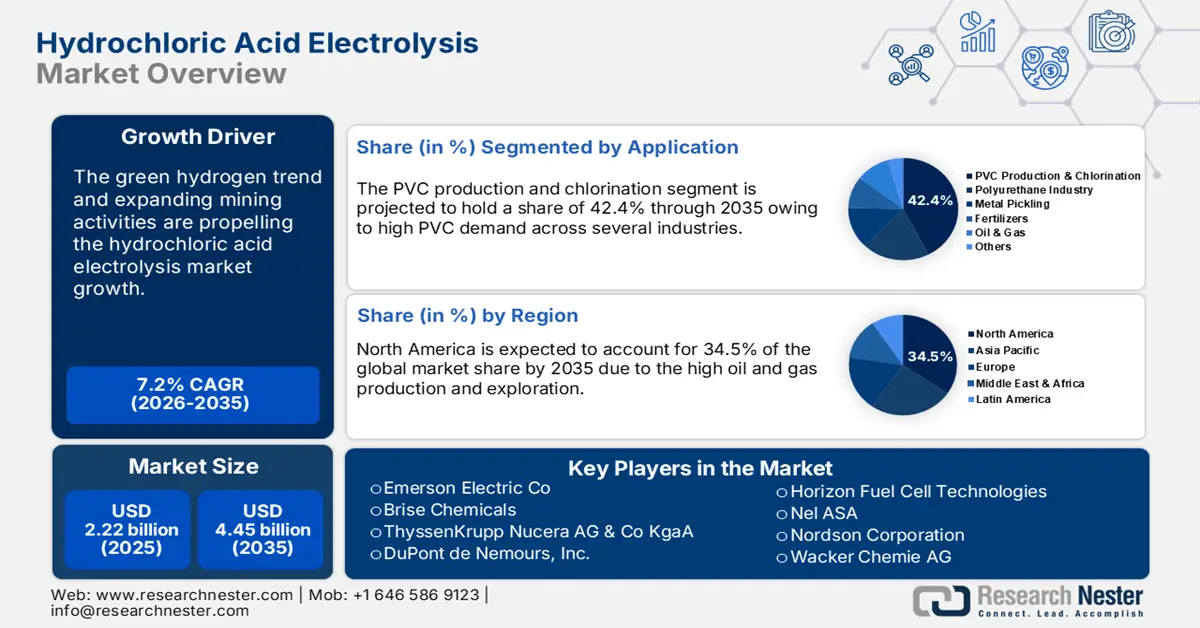

Hydrochloric Acid Electrolysis Market size was over USD 2.22 billion in 2025 and is poised to exceed USD 4.45 billion by 2035, growing at over 7.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrochloric acid electrolysis is estimated at USD 2.36 billion.

The increasing application of hydrochloric acid electrolysis methods in industries such as water treatment, metal, oil & gas, and plastics are significantly contributing to the overall HCL electrolysis market growth. The hike in these sectors is directly backing the demand for hydrochloric acid electrolysis technologies. The metal mining companies make wide use of hydrochloric acid electrolysis solutions for pickling processes. The rapidly increasing urban and industrial activities in both developing and developed countries are augmenting the high demand for metals, which is creating profitable opportunities for hydrochloric acid electrolysis market players.

|

Metals |

|||

|

Country |

Export Value in USD Billion |

Country |

Import Value in USD Billion |

|

China |

296 |

U.S. |

196 |

|

Germany |

131 |

China |

144 |

|

U.S. |

84.7 |

Germany |

131 |

|

Japan |

69.7 |

Italy |

66.6 |

|

Italy |

65.4 |

France |

57.8 |

Source: OEC World

The study by the Observatory of Economic Complexity (OEC) reveals that the metal trade is boasting at a robust pace around the globe. Metals held a rank as the world’s 5th most-traded product, with a total trade of USD 1.7 trillion, in 2022. The product complexity index (PCI) stood at 13th rank and represented 7.37% of the total global trade. China and the U.S. are the top exporters and importers of metals. Using Shannon Entropy, the market concentration amounted to 5.29, underscoring export dominance by 39 countries.

Key Hydrochloric Acid Electrolysis Market Insights Summary:

Regional Highlights:

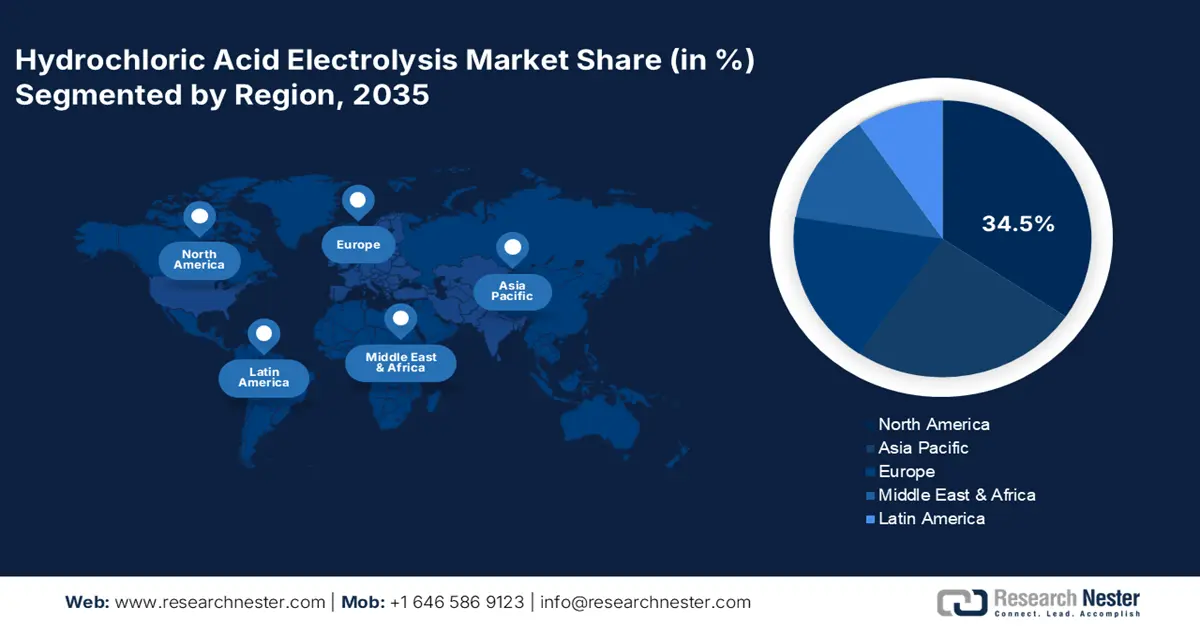

- North America's 34.5% share in the Hydrochloric Acid Electrolysis Market is driven by the green hydrogen trend, high demand for renewable energy systems, and technological advancements in electrolysis, fostering growth through 2026–2035.

- Asia Pacific's Hydrochloric Acid Electrolysis Market is expected to see the fastest growth by 2035, attributed to high industrial and urban activities, expanding mining activities, and dominant consumer goods markets.

Segment Insights:

- The PVC Production & Chlorination Segment is anticipated to achieve a 42.4% share by 2035, propelled by high demand for chlorine in PVC resin production.

Key Growth Trends:

- High chemical production

- Green hydrogen trend

Major Challenges:

- Installation and maintenance challenges

- Poor reaction and durability

- Key Players: Brise Chemicals, ThyssenKrupp Nucera AG & Co KgaA, DuPont de Nemours, Inc., and Covestro AG.

Global Hydrochloric Acid Electrolysis Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.22 billion

- 2026 Market Size: USD 2.36 billion

- Projected Market Size: USD 4.45 billion by 2035

- Growth Forecasts: 7.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (34.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 13 August, 2025

Hydrochloric Acid Electrolysis Market Growth Drivers and Challenges:

Growth Drivers

- High chemical production: The thriving global chemical industry is a major driver for the sales of hydrochloric acid electrolysis technologies. HCI electrolysis is a vital method for the production of various essential chemical intermediates. The booming use and demand for chemicals in several industries such as plastic, pharmaceuticals, homecare products, and pesticides are contributing to the sales of hydrochloric acid electrolysis solutions. For instance, the International Council of Chemical Associations (ICCA) reveals that its 164 members capture around 98.0% of the global chemical trade, totaling USD 2 trillion to the global economy. Asia Pacific chemical production majorly contributes to global GDP followed by North America, and Europe. The booming trade activities owing to chemicals a catalyst to every industry’s growth are generating lucrative opportunities for hydrochloric acid electrolysis technology producers.

- Green hydrogen trend: The increasing integration of hydrochloric acid electrolysis in renewable energy sources is leading to the effective production of carbon-free hydrogen. The green hydrogen trend and growing demand for renewable energy systems for energy production are set to drive the sales of hydrochloric acid electrolyzers. For instance, the U.S. Department of Energy (DOE) reveals its interim target to meet the Hydrogen Shot clean hydrogen cost target of USD 2/kg H2 by 2025 using CO2-free electricity. The world is spending heavily on green hydrogen production owing to the decarbonization trend. According to industry trackers such as the Hydrogen Council and IEA, cumulative announced direct investments in hydrogen projects have already surpassed USD 600 billion, and green hydrogen is expected to outpace fossil gas–based production by around 2030. The green hydrogen projects are estimated to outpace fossil gas-based production by 2030. China attracts more direct investments in green hydrogen projects followed by North American and European countries.

Challenges

- Installation and maintenance challenges: The high cost associated with the setup of a hydrochloric acid electrolysis plant often acts as an entry barrier for small-scale and new companies. The installation and maintenance of electrolysis cells and other specialized equipment is high. Thus, the hydrochloric acid electrolysis demand is hampered to some extent in price-sensitive HCL electrolysis markets.

- Poor reaction and durability: The poor durability and activity of the catalyst and the slow kinetics of the oxygen reduction reaction at cathodes hamper the demand for hydrochloric acid electrolysis. This is often observed due to a lack of technological advancements. This further drives the demand for alternative methods, challenging the revenue growth of hydrochloric acid electrolysis companies.

Hydrochloric Acid Electrolysis Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.2% |

|

Base Year Market Size (2025) |

USD 2.22 billion |

|

Forecast Year Market Size (2035) |

USD 4.45 billion |

|

Regional Scope |

|

Hydrochloric Acid Electrolysis Market Segmentation:

Application (PVC Production & Chlorination, Polyurethane Industry, Metal Pickling, Fertilizers, Oil & Gas, Others)

PVC production & chlorination segment is set to dominate hydrochloric acid electrolysis market share of around 42.4% by the end of 2035. Polyvinyl chloride (PVC) is the most consumed plastic across construction, automotive, healthcare, and consumer goods industries. The need for chlorine in PVC resin production propels the demand for hydrochloric acid electrolysis technologies. PVC or polyvinyl chloride is the world’s 193rd most traded product, according to the OEC report. The total trade of polyvinyl chloride reached USD 17.8 billion, in 2022, with high saturation in the U.S. and India. Using Shannon Entropy, the HCL electrolysis market concentration stood at 4.3, in 2022, explaining the export dominance by 19 countries. The developing countries are majorly contributing to the PVC demand and subsequently hydrochloric acid electrolysis.

|

Polyvinyl Chloride (PVC) |

|||

|

Country |

Export Value in USD Billion |

Country |

Import Value in USD Million |

|

U.S. |

3.27 |

India |

2320 |

|

China |

2.56 |

Turkey |

1250 |

|

Chinese Taipei |

1.35 |

Germany |

1040 |

|

Germany |

1.26 |

Italy |

979 |

|

France |

1.08 |

Vietnam |

821 |

Source: OEC World

Our in-depth analysis of the hydrochloric acid electrolysis market includes the following segments:

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrochloric Acid Electrolysis Market Regional Analysis:

North America Market Forecast

North America hydrochloric acid electrolysis market is set to dominate revenue share of around 34.5% by the end of 2035. The green hydrogen trend, high demand for renewable energy systems, and technological advancements in electrolysis solutions are contributing to the overall HCL electrolysis market growth. The strict regulations on carbon emission and the strong presence of oil and gas production facilities are further augmenting demand for hydrochloric acid electrolysis technologies in both the U.S. and Canada.

The U.S.’s increasing investments in green hydrogen production are driving the sales of hydrochloric acid electrolysis technologies. This is major backed by the sustainability initiatives and energy transition goals. The growing interest in renewable energy sources for hydrogen production is also driving the demand for hydrochloric acid electrolysis solutions. According to the U.S. DOE, around 10 million metric tons (MMT) of hydrogen is produced in the country annually. In support of the Hydrogen Energy Earthshot goal of mitigating the price of clean hydrogen by 80.0% to USD 1/1 kg in a decade, the Department of Energy’s Hydrogen and Fuel Cell Technologies Office is concentrated on the production of solutions, which can develop hydrogen at USD 2 per 1 kg by 2026 and USD 1 per 1 kg by 2031.

The strong presence of oil reserves in Canada is fueling the use of hydrochloric acid electrolysis technologies. The booming production cycle is augmenting the application of hydrochloric acid electrolysis methods in oil and gas plants. The Canadian Centre for Energy Information states that the country to the major producer of oil and gas, worldwide. Crude oil contributes to 41.0% of the total primary energy production in 2022. Furthermore, the U.S. Energy Information Administration (EIA) estimates that oil production captured nearly 51.7% of the total energy production in Canada, in 2022.

Asia Pacific Market Statistics

The Asia Pacific hydrochloric acid electrolysis market is anticipated to increase at the fastest pace during the assessed period. The high industrial and urban activities are major drivers of hydrochloric acid electrolysis solution sales. The dominant consumer goods and homecare products market is creating a profitable pool for hydrochloric acid electrolysis technology manufacturers. The expanding mining activities are also driving the sales of hydrochloric acid electrolysis systems in the region. China, India, South Korea, and Japan are the topmost marketplaces for hydrochloric acid electrolysis companies.

China’s chemical sector is an advantage for hydrochloric acid electrolysis companies to expand their operations across the country. Continuous technological advancements in trade activities are fueling the demand for innovative hydrochloric acid electrolysis systems. The OEC study reveals that the chemical export trade in China totaled USD 248.0 billion, in 2022. The major exports of Chinese chemical products were saturated across the U.S., India, South Korea, and Japan.

In India, the expanding mining and oil & gas exploration activities are fueling the sales of hydrochloric acid electrolysis solutions. Oil and gas are one of the 8 core industries that are significantly driving the country’s GDP. The India Brand Equity Foundation (IBEF) report reveals that the oil and gas industry is anticipated to attract around USD 25.0 billion of investments in exploration and production activities. Between Q2 and Q3 of 2024, the crude oil production reached 13.26 MMT. Furthermore, the same source states that in 2022, there were 1,319 metallic minerals reporting mines in the country. The production of metallic minerals stood at USD 12.76 billion in 2023.

Key Hydrochloric Acid Electrolysis Market Players:

- Emerson Electric Co

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Brise Chemicals

- ThyssenKrupp Nucera AG & Co KgaA

- DuPont de Nemours, Inc.

- Covestro AG

- Horizon Fuel Cell Technologies

- Nel ASA

- Nordson Corporation

- Wacker Chemie AG

Leading companies in the hydrochloric acid electrolysis market are implementing several organic and inorganic strategies to earn high profits. Some of them include technological innovations, new product launches, mergers & acquisitions, collaborations & partnerships, and regional expansions. The majority of industry giants adopt global expansion and partnership strategies to boost their HCL electrolysis market revenues and reach. To stand out in the crowd and expand their product offerings with minimum capex, some hydrochloric acid electrolysis market players prefer investing in merger and acquisition strategies.

Some of the key players include:

Recent Developments

- In December 2024, ThyssenKrupp Nucera AG & Co KgaA announced that its efficient electrolysis plants had grown strongly in the 2023/2024 fiscal year in the field of green hydrogen. Through the strategic partnership with Fraunhofer IKTS for innovative solid oxide electrolysis cell (SOEC) technology, the company strengthened its technology portfolio.

- In August 2023, Wacker Chemie AG announced the successful expansion of its hyperpure hydrogen chloride production at its Burghausen site in Germany. This move is strengthening the company’s chemical portfolio.

- Report ID: 7014

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.