Hydraulics Market Outlook:

Hydraulics Market size was over USD 45.33 billion in 2025 and is anticipated to cross USD 62.11 billion by 2035, growing at more than 3.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydraulics is assessed at USD 46.64 billion.

The construction industry is shifting toward adopting cutting-edge hydraulic solutions, owing to the growing emphasis on modernization and urban development. The global infrastructure developments in many parts of the globe are also escalating the demand for hydraulic systems. The construction machines, including excavators, loaders, and cranes, use hydraulic power to provide precise control features, enhanced power transmission, and better efficiency in major projects. Construction activities are receiving additional momentum, therefore creating increasing hydraulic equipment sales. The industry requirements are driving key hydraulics market participants to extend their product lines. The industrial framing solutions line from Airline Hydraulics was launched in March 2024 to meet growing demands for construction and industrial applications.

Key Hydraulics Market Insights Summary:

Regional Highlights:

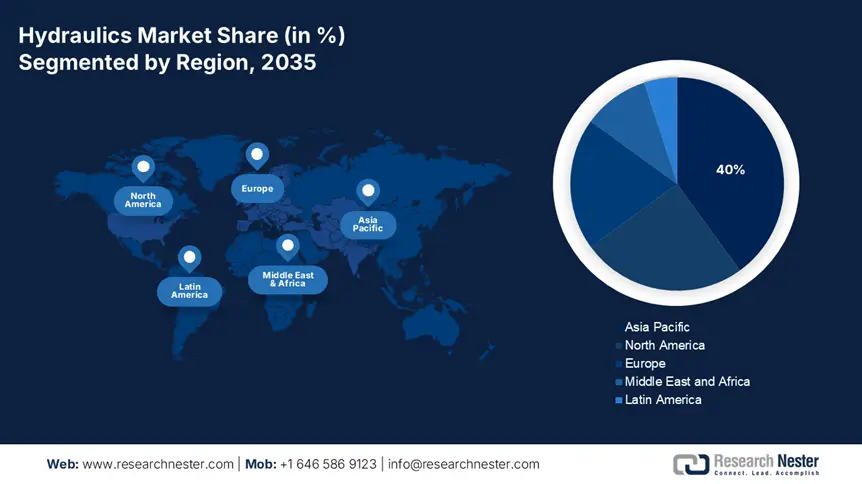

- Asia Pacific commands a 40% share in the Hydraulics Market, fueled by infrastructure investments and industrial growth, bolstering growth prospects through 2035.

- North America’s Hydraulics Market is anticipated to experience robust growth through 2026–2035, attributed to smart hydraulic technology and domestic manufacturing capacity.

Segment Insights:

- The Mobile Hydraulics segment is anticipated to see significant revenue growth through 2026-2035, propelled by increasing infrastructure projects and smart hydraulic systems adoption.

- The Cylinders segment of the Hydraulics Market is projected to hold a 40.5% share by 2035, driven by product innovation using lightweight and durable materials for enhanced performance.

Key Growth Trends:

- Expansion of industrial automation

- Growth in agriculture mechanization

Major Challenges:

- Complex installation and integration issues

- Noise and heat generation

- Key Players: Bosch Rexroth, Danfoss, Parker-Hannifin Corporation, and HYDAC.

Global Hydraulics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 45.33 billion

- 2026 Market Size: USD 46.64 billion

- Projected Market Size: USD 62.11 billion by 2035

- Growth Forecasts: 3.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (40% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Japan, Germany, South Korea

- Emerging Countries: China, Japan, South Korea, India, Brazil

Last updated on : 12 August, 2025

Hydraulics Market Growth Drivers and Challenges:

Growth Drivers

-

Expansion of industrial automation: The increasing adoption of industrial automation is expected to fuel the demand for hydraulic systems, as these systems provide high-force precision capabilities to metal-forming processes, injection molding operations, and material handling systems. These manufacturing processes depend on hydraulic systems for their required power functions and control mechanisms to deliver precision results throughout automated manufacturing operations. The metal-forming industry requires hydraulic presses to exert pressing power that shapes materials into necessary configurations and serves the aerospace and automotive sectors.

Injection molding machines leverage hydraulic systems to process materials while accurately filling molds to create intricate parts needed within different sectors. Recent developments in hydraulic technology underscore its critical role in industrial automation. The servo-hydraulic drive technology portfolio from Bosch Rexroth was introduced in April 2024 specifically for compressors to enhance industrial performance alongside energy efficiency. The industry is incorporating modern hydraulic approaches, fulfilling the automation requirements through this breakthrough.

-

Growth in agriculture mechanization: The growing global requirement for food is anticipated to accelerate the use of modern agricultural machinery and lead to substantial expansion of the hydraulics market. Modern agricultural equipment depends on hydraulic systems to enhance performance while decreasing labor requirements in vehicles such as tractors, harvesters, and irrigation equipment. These systems offer the required power and precision for lift functions, steering operations, and various implement operations, resulting in improved farming efficiency and productivity.

In February 2025, SwarmFarm established a production center in Australia to build autonomous farming robots at Toowoomba. The robots are expected to employ modular designs and advanced hydraulic systems, enabling farmers to execute tasks including fertilizing together with herbicide spraying and weed detection, therefore leading to modern farming transformations. The project is expected to highlight the formation of advanced technological work opportunities and the advancing agricultural trend that depends on automation to address increasing food requirements.

Challenges

-

Complex installation and integration issues: The implementation of hydraulic systems demands complicated work, including precise assembly along with long ducts and strict liquid regulation practices required to reach maximum system efficiency. Hydraulic systems pose difficulties in connecting them to modern automated machinery as Industry 4.0 and IoT-driven smart systems are rapidly expanding. Businesses across various sectors opt for electric actuators instead of hydraulic systems due to their seamless installation and digital control system compatibility. Businesses avoid selecting hydraulic solutions mainly due to specialized expertise requirements, time-intensive installation procedures, and integration challenges instead of simpler technology options.

-

Noise and heat generation: Operating hydraulic systems generate large amounts of heat and noisy emissions that create difficulties for industries operating machinery with energy conservation needs. Workplace discomfort occurs due to the high-pressure fluid movement together with mechanical components that generate sound and vibrations while possibly leading to regulatory complications. The excessive creation of heat in hydraulic systems leads to reduced efficiency, increased wear and tear of components, and shorter overall component lifespan. Owing to this issue, the additional cooling systems become mandatory, leading to increased energy expenses and operational costs, making hydraulics less competitive than alternative systems that are more efficient.

Hydraulics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.2% |

|

Base Year Market Size (2025) |

USD 45.33 billion |

|

Forecast Year Market Size (2035) |

USD 62.11 billion |

|

Regional Scope |

|

Hydraulics Market Segmentation:

Component (Cylinders, Pumps, Motors, Valves, Filters, Accumulators, Transmissions)

By 2035, cylinders segment is set to hold hydraulics market share of more than 40.5%, owing to the enhanced product designs and mutually beneficial business partnerships. Manufacturers use lightweight and high-strength materials in their products for more efficient operations with reduced energy usage and increased durability. For instance, Liebherr launched hybrid hydraulic cylinders in February 2023 that integrated steel components and carbon-fiber-reinforced plastic materials to reduce overall weight by 50% compared to steel cylinders. Load-support capacities improve substantially through this innovation, reducing equipment wear and making the product suitable for construction, aerospace, and material handling applications.

Material (Mobile Hydraulics, Industrial Hydraulics)

The mobile hydraulics segment in hydraulics market is expected to register significant revenue during the forecast period, attributed to continually developing infrastructure projects and the wider adoption of intelligent solutions. Organizations in different nations are set to invest to build and update infrastructure systems, therefore driving increased requirements for hydraulic equipment across construction mining, and agricultural sectors.

The segment is expected to experience significant traction due to the integration of the Internet of Things and telematics into technological systems. These technological breakthroughs enable predictive servicing and real-time equipment surveillance to improve operational performance and minimize equipment stoppages. Manufacturers are working on creating energy-efficient and environmentally friendly hydraulic systems that conform to emerging environmental requirements. For instance, Bosch Rexroth AG acquired HydraForce in February 2023 to expand its compact hydraulics operations in North America.

Our in-depth analysis of the global hydraulics market includes the following segments:

|

Component |

|

|

Application |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydraulics Market Regional Analysis:

Asia Pacific Market Analysis

Asia Pacific in hydraulics market is predicted to hold over 40% revenue share by the end of 2035, attributed to industrialization and urbanization in India, China, and Japan, resulting in significant infrastructure development. This requires essential hydraulic systems to operate construction machinery. Therefore, governments are investing heavily in infrastructure projects, fostering the demand for hydraulic equipment in the region. A notable instance includes the estimation of the Asian Development Bank that the region will require USD 1.7 trillion per year up until 2030 in infrastructure investments to finance telecommunications and transport and energy system development projects.

China hydraulics market is expected to experience a significant growth, owing to the rapidly expanding petrochemical and chemical industries. The country, being a worldwide manufacturing leader, is expected to depend heavily on hydraulic systems to help automate and optimize its manufacturing operations.

The hydraulics market in India highlights a robust expansion due to increasing investments in domestic manufacturing along with strategic business agreements. For instance, in June 2023, Micron Technology announced its plans to set up a semiconductor assembly and test facility in Gujarat for producing DRAM and NAND products to offer services to national and international markets. The strategic initiative works in synergy with India's national objectives regarding the growth of its semiconductor industry and import reduction strategy.

North America Market

The North America hydraulics market is expected to grow at a robust pace owing to the progressive manufacturing industry in the region. The adoption of advanced hydraulic technology, including electro-hydraulic systems together with smart actuators, is anticipated to improve operational safety and efficiency across different industries.

The hydraulics market in the U.S. is increasing, attributed to partnerships and collaborations between companies to bolster domestic hydraulics manufacturing capacity. Bosch reached a preliminary agreement with the U.S. Commerce Department in December 2024, to receive maximum subsidies of USD 225 million, to enable the production of silicon carbide hydraulicss in Roseville California facilities. The allocated funding is expected to enable Bosch to carry out its USD 1.9 billion investment for SiC production at its Roseville facility that targets electric vehicles and additional product applications.

The hydraulics market in Canada is expected to grow, owing to the increasing pace of development within the oil and gas industry. The reliability and efficiency of hydraulic tools make them a primary choice for exploration drilling and production tasks. The oil and gas sector uses hydraulic equipment extensively to maintain and operate facilities despite difficulties in extending its pipelines. New energy industry projects are expected to require more hydraulic systems as the local government continues its support of hydrogen production through the announcement of over 80 low-carbon hydrogen projects.

Key Hydraulics Market Players:

- Bosch Rexroth

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Danfoss

- Parker-Hannifin Corporation

- Enerpac Tool Group

- HYDAC

- Wipro Enterprises

- Caterpillar

The competitive landscape of the hydraulics market is rapidly evolving, attributed to the integration of advanced technologies in the industry by key players. They are focused on developing new technologies and products catering to the stringent regulatory norms and consumer demand. These key players are adopting several strategies such as mergers and acquisitions, joint ventures, partnerships, and novel product launches to enhance their product base and strengthen their market position. Here are some key players operating in the global hydraulics market:

Recent Developments

- In July 2023, Parker Hannifin released the F10 series, which improves F11 and F12 products with better efficiency and performance in a compact, lightweight design.

- In July 2022, Bosch Rexroth acquired BRUSA HyPower, to enhance its eLION product range for off-road vehicle electrification as part of an emerging business trend.

- Report ID: 7293

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydraulics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.