Hydraulic Gear Pump Market Outlook:

Hydraulic Gear Pump Market size was valued at USD 2.12 billion in 2025 and is likely to cross USD 3.02 billion by 2035, expanding at more than 3.6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydraulic gear pump is assessed at USD 2.19 billion.

The market’s growth is attributed to the extensive applications of hydraulic gear pumps across industries such as automotive, agriculture, construction, and manufacturing. The expansion in the scope of applications has opened opportunities for investment in the hydraulic gear pump market. Governments worldwide are prioritizing infrastructure development to stimulate economic recovery, creating a sustained demand for hydraulic machinery. The table below reflects recent major investments announced to boost infrastructure development across regions, which is poised to assist the application of hydraulic gear pumps in construction equipment and heavy machinery.

Major Infrastructure Investments

|

Date |

Details |

|

January 2025 |

The EU announced the decision to invest USD 1.2 billion in cross-border infrastructure coordinating to build Energy Union |

|

October 2024 |

The U.S. announced USD 2.4 billion in 122 new rail improvement projects to strengthen the supply chains in the country |

|

August 2024 |

The African Development Bank invested USD 20 million equity investment in the African Infrastructure Investment Fund 4 (AIIF4) to bolster infrastructure across the region |

|

January 2024 |

KKR announced the closing of the KKR Asia Pacific Infrastructure Investors II SCSp, i.e., a USD 6.4 billion fund aimed at infrastructure-related investments across APAC |

Additionally, the hydraulic gear pump market benefits from geopolitical realignments and supply chain diversification strategies, with initiatives underway to recalibrate production networks. For instance, India’s Production-Linked Incentive (PLI) incentivizes domestic manufacturing of machinery components, including hydraulic systems. Furthermore, niche opportunities arise in the growing investments in offshore wind farms for corrosion-resistant gear pumps. The favorable trends along with evolving trade agreements and labor cost arbitrage in regions such as Mexico and Eastern Europe, highlight emerging macroeconomic factors impacting the sector’s growth. Investors seeking long-term growth will find the favorable growth curve instrumental in identifying regional hotspots in the market.

Key Hydraulic Gear Pump Market Insights Summary:

Regional Highlights:

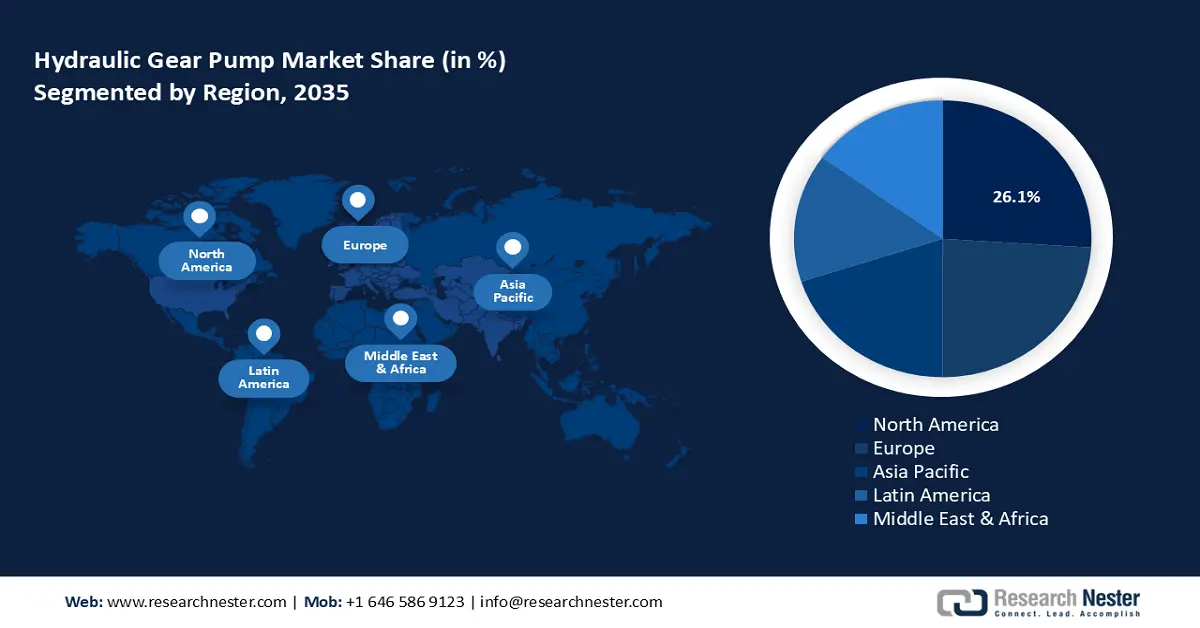

- North America hydraulic gear pump market will account for 26.10% share by 2035, driven by infrastructure development and advanced manufacturing pushing hydraulic pump demand.

Segment Insights:

- The external gear pump segment in the hydraulic gear pump market is projected to hold a 63.30% share by 2035, driven by its durability in handling various fluid viscosities.

- The lifting application segment in the hydraulic gear pump market is projected to see the largest share by 2035, driven by the surge in infrastructure development and e-commerce.

Key Growth Trends:

- Modernization of agriculture in emerging economies

- Expansion of automated manufacturing and robotics

Major Challenges:

- Competition from alternative technologies

- Risks of counterfeit products in emerging markets

Key Players: Bosch Rexroth AG, Linde Hydraulics GmbH & Co. KG, Eaton Corporation, Parker Hannifin Corporation, Atlas Copco Group, Kawasaki Heavy Industries Ltd., Daikin Industries Ltd., HPI Group, Casappa S.p.A., Marzocchi Pompe S.p.A., Danfoss A/S.

Global Hydraulic Gear Pump Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.12 billion

- 2026 Market Size: USD 2.19 billion

- Projected Market Size: USD 3.02 billion by 2035

- Growth Forecasts: 3.6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (26.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, Italy

- Emerging Countries: China, India, Brazil, Mexico, Thailand

Last updated on : 18 September, 2025

Hydraulic Gear Pump Market Growth Drivers and Challenges:

Growth Drivers

- Modernization of agriculture in emerging economies: Initiatives and investments to improve food security and export competitiveness in emerging economies such as India, Brazil, and Southeast Asia have created regional hotspots for investments in the hydraulic gear pump market. For instance, the PM-KISAN Scheme of India subsidizes hydraulic-powered tractors and harvesters, which impacts an increase in the adoption of farm machinery. Additionally, trade agreements such as the African Continental Free Trade Area (AFCTA) assist in reducing import barriers for agricultural machinery, creating opportunities for manufacturers and suppliers of hydraulic gear pumps to penetrate the markets of emerging economies.

- Expansion of automated manufacturing and robotics: A significant trend bolstering the application of hydraulic gear pumps is the rapid growth in automated manufacturing and robotics. Moreover, the Industry 4.0 initiatives are at the backdrop of fueling demand for high-precision hydraulic gear pumps in automated production lines. Two major ongoing nationwide initiatives supporting automation upgrades are the Made in 2025 strategy of China and Germany’s Plattform Indusrtie 4.0. With hydraulic systems integral to heavy-duty robotic arms, the table below highlights the increase in industrial robot stocks worldwide.

Global Industrial Stock of Industrial Robots

|

Year |

Particular (million) |

|

2023 |

4.28 |

|

2022 |

3.90 |

|

2021 |

3.47 |

|

2020 |

3.02 |

Source: The World Robotics Report

The report highlights the growth in industrial robots which influences the rise in demand for hydraulic gear pumps, in applications requiring high power, durability, and precision.

- Rising push for the transition to renewable energy infrastructure: The advent of global renewable energy projects such as solar power installations and offshore wind farms is driving the demand for durable hydraulic gear pumps that can operate in harsh environments. The table below highlights key recent investments aimed at advancing offshore wind and floating solar farm capacities which are positioned to create opportunities for manufacturers of hydraulic gear pumps to supply corrosion-resistant durable pumps.

Investments in Renewable Energy Infrastructure

|

Year |

Particular |

|

September 2024 |

The U.S. Administration announced the approval of the Maryland Offshore Wind Project, which is the tenth offshore commercial-scale wind energy project in the country to complement the U.S. goals to generate 30 gigawatts of offshore wind energy by 2030. |

|

May 2024 |

RWE announced an investment decision for its Nordseecluster with wind farms to be built in the North Sea with a total capacity of 1.6 gigawatts. |

|

December 2023 |

PLN and Masdar announced development plans for the floating solar power plant in Southeast Asia. The recent plans include a framework agreement to expand Cirata's capacity to up to 500MW. |

Challenges

- Competition from alternative technologies: The rise of advanced technologies, such as electrically operated medium-pressure pumps has led to a competitive threat to traditional hydraulic gear pumps. If alternative technologies provide greater operational reliability, then end users will adopt them more over hydraulic gear pumps. The constraint can contribute to a decline in the demand for conventional hydraulic gear pumps.

- Risks of counterfeit products in emerging markets: The rapid industrialization of emerging economies in APAC and Africa has contributed to the surge in demand for hydraulic gear pumps. However, the growth is accompanied by a rise in counterfeit products and IP infringement. The World Intellectual Property Organization (WIPO) report in 2023 identified Southeast Asia to account for a large share of counterfeit components. This can lead to the constraint of the market being flooded with substandard products which can affect the market share of key players operating in the sector.

Hydraulic Gear Pump Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

3.6% |

|

Base Year Market Size (2025) |

USD 2.12 billion |

|

Forecast Year Market Size (2035) |

USD 3.02 billion |

|

Regional Scope |

|

Hydraulic Gear Pump Market Segmentation:

Product Type Segment Analysis

The external gear pump segment is anticipated to hold hydraulic gear pump market share of over 63.3% by the end of 2035, attributed to its durability in handling a range of fluid viscosities. The expansion of use cases includes the application of external gear pumps in lubrication and fuel injection systems in the automotive industry. Opportunities are rife with the growing calls to improve vehicle performance to bolster the demands of external gear pumps in the automotive sector. Moreover, in chemical processing, external gear pump applications are expanding for precise fluid transfer. The lucrativeness of the segment is highlighted by recent market acquisitions to acquire external gear pump portfolios. For instance, in December 2023, the Atlas Copco Group announced an agreement to acquire KRACHT GmbH (Kracht), a manufacturer of high-quality technologies including external gear pumps.

Application Segment Analysis

The rising demand for material handling equipment across industries such as logistics, manufacturing, construction, etc. has ensured that the lifting application segment holds a larger share of the hydraulic gear pump market. A major driver is the surge in infrastructure development initiatives globally, with initiatives such as the U.S. Infrastructure Investment and Job Act and China’s Belt and Road Initiative accelerating the requirement for hydraulic-powered cranes, forklifts, and lifting platforms. An additional factor contributing to the profitability within the segment is the rapid expansion of e-commerce and warehousing activities which is bolstering the demand for hydraulic lifting systems to streamline logistics operations.

Operating Pressure Segment Analysis

The 100-300 bar operating pressure segmOent of the hydraulic gear pump market is poised to account for a significant revenue share throughout the stipulated timeframe. The extensive application and demand for pumps within this pressure range have bolstered opportunities for manufacturers and suppliers. Reliable hydraulic systems capable of delivering medium to high-pressure outputs for efficient operations expand applications in powering heavy machinery. The rise in construction activities in regions experiencing rapid urbanization, such as Japan, India, and China is expected to drive the potential of robust ROI opportunities in the segment. A major investment that is expected to assist growth in demand for hydraulic gear pumps operating within 100-300 bar is the USD 5.5 million investment announced by the U.S. Department of Agriculture in December 2024 to support the regional agricultural industry.

Our in-depth analysis of the global market includes the following segments:

|

Product Type |

|

|

Application |

|

|

Operating Pressure |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydraulic Gear Pump Market Regional Analysis:

North America Market Insights

North America hydraulic gear pump market is anticipated to capture revenue share of over 26.1% by 2035. The thriving market is driven by the region’s leadership in advanced manufacturing and robust infrastructure development initiatives. The large-scale investments to upgrade transportation, energy, and water systems in the region have bolstered a steady demand for hydraulic gear pumps in construction equipment such as excavators, cranes, and loaders. Moreover, the U.S.-Mexico-Canada Agreement (USMCA) has ensured seamless cross-border trade of raw materials such as aluminum and steel, which are critical for pump manufacturing.

The Observatory of Economic Complexity reported that the U.S. imported more than 40% of aluminum and around 30% of steel from Canada. While the recent trade tariffs in the region can cause instability in the supply chain to manufacture hydraulic gear pumps, a burgeoning trade with other regions remains promising to ensure the mitigation of bottlenecks in the manufacturing process.

The U.S. hydraulic gear pump market is projected to account for the largest revenue share in North America. The market’s growth is propelled by extensive infrastructure projects and construction activities in the country. The Infrastructure Investment and Jobs Act (IIJA), aka Bipartisan Infrastructure Law (BIL) of the U.S., which came into force in 2021 has been instrumental in accelerating the allocation of funds to modernize highways, bridges, and ports, contributing to the boost in demand for hydraulic systems in construction machinery. An emerging facet of the U.S. market is the push to bolster the manufacturing capabilities of electric vehicles (EVs), which drives increasing application of hydraulic systems for assembly line automation and battery production.

The Canada hydraulic gear pump market is projected to register robust growth opportunities within the forecast period owing to the infrastructure development initiatives in the country. Canada’s commitment to expanding renewable energy production has driven demand for hydraulic systems in power generation. According to Natural Resources Canada, the country aims to generate more than 70% of its electricity from renewable sources by 2030, creating ample opportunities for the usage of hydraulic gear pumps in turbine control and maintenance. In January 2025, ReNew Canada released a report, i.e., the Top 100 Projects Report, highlighting the 100 largest public sector infrastructure projects under development across the country with USD 300 billion in investments. The large number of high-investment infrastructure projects creates steady opportunities in the Canada market.

Europe Market Insights

The Europe market is forecasted to represent the second-largest revenue share in the global market by the end of 2035. The region offers promising opportunities for manufacturing with robust cross-Europe supply chains in place, while the market is propelled by growing investments for infrastructure development, industrial automation, and sustainability. Lucrative opportunities are forecasted to arise via the European Green Deal aiming for carbon neutrality by 2050 and surging investments to improve offshore wind power capacity by 2030, creating ample scope for hydraulic gear pumps in turbine pitch and yaw systems.

The Germany hydraulic gear pump market is projected to expand during the stipulated timeframe. The Germany market is characterized by its leadership in advanced manufacturing and engineering. The country’s Industrie 4.0 initiative provides opportunities for an increase in the adoption of smart hydraulic systems in automated production lines. In May 2024, Germany Trade & Invest (GTAI) reported a significant rise in FDI worth more than USD 35 billion which bodes well for the expansion of infrastructure projects. The trends forecast heightened demand for hydraulic pump gear by the end of 2035.

The France hydraulic pump gear market is estimated to register robust growth during the forecast period. Opportunities within the market are in green energy projects supported by the France Relance recovery plan. Emerging drivers of the market are the growing demands from the aerospace sector of France for aircraft landing gear and flight control mechanisms. Moreover, France is among the leading agricultural economies in the EU, accounting for more than 15% of production and the agri-food industry is one of the largest contributors to the trade balance of France. The USD 2.45 billion investment to accelerate the third agricultural and food revolution in the country is poised to drive greater applications of hydraulic gear pumps in the agricultural sector.

Hydraulic Gear Pump Market Players:

- Bosch Rexroth AG

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Linde Hydraulics GmbH & Co. KG

- Eaton Corporation

- Parker Hannifin Corporation

- Atlas Copco Group

- Kawasaki Heavy Industries Ltd.

- Daikin Industries Ltd.

- HPI Group

- Casappa S.p.A.

- Marzocchi Pompe S.p.A.

- Danfoss A/S

The hydraulic gear pump market is poised to expand during the forecast period. Leading companies are investing in research and development to improve product efficiency. Acquisitions and partnerships are ensuring that companies are able to expand their global footprint. Companies that are able to align product offerings with industry trends and customer requirements are expected to maintain a competitive advantage in the sector.

Here are some key players in the market:

Recent Developments

- In August 2024, the Pump & Motor Division Europe of Parker Hannifin launched its new T7G Series of hydraulic pumps for trucks. The new series is designed for use in diesel trucks, hybrid, electric, and hydrogen vehicles.

- In February 2024, Dana Incorporated announced the definitive agreement to sell its European hydraulic business to HPI Group, a hydraulics business jointly held by Apogee Group and EiM Capital. The transaction includes operations in Italy, France, and Germany that produce industrial components including hydraulic motors, pumps, valves, and power packs.

- Report ID: 7205

- Published Date: Sep 18, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydraulic Gear Pump Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.