Hydraulic Cylinder Market - Regional Analysis

Asia Pacific Market Insights

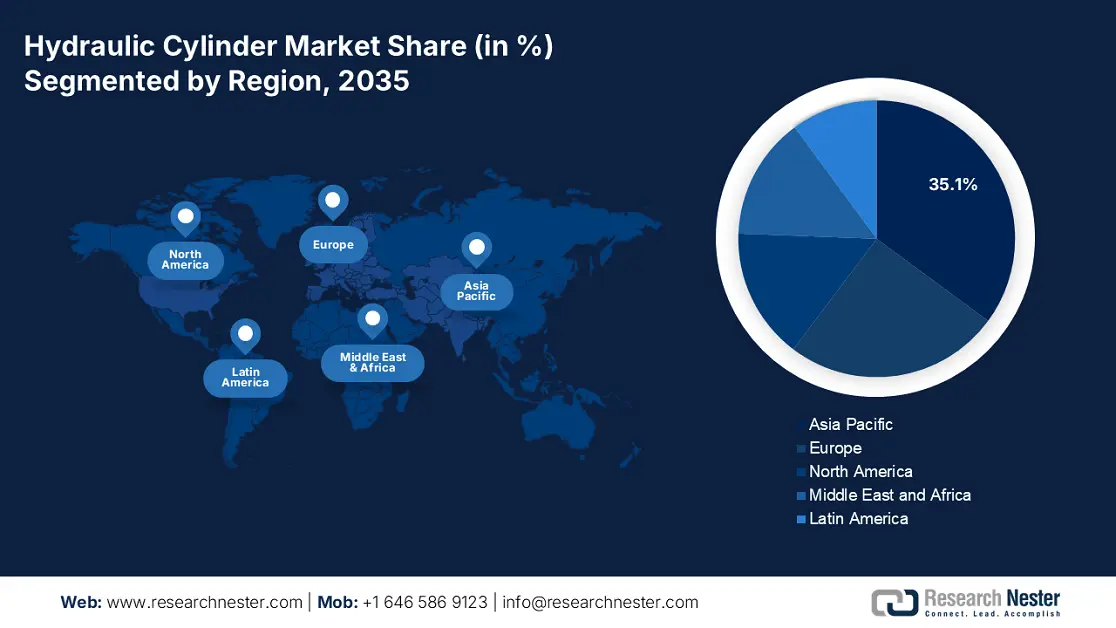

By 2035, the Asia Pacific market is expected to hold 35.1% of the market share, due to heavy infrastructure programs, equipment replacement in manufacturing, and rising mechanization in agriculture. Expect continued expansion 2026–2035 with volume gains concentrated in China, India, and Southeast Asian construction markets. Currently, welded cylinders dominate the product segment, with mill types generating the fastest revenue growth rates.

The China hydraulic cylinder sector is projected to grow primarily due to urbanization and an expansion of the mining sector. China has recently produced the most potent hydraulic cylinder in the world for moving marine piles, among other notable advances in hydraulic cylinder technology. With a maximum push of 5,000 tons, this new creation was unveiled in Changzhou, Jiangsu province. It further indicates that strong government infrastructure investment and rapid movement toward smart manufacturing in the supply chain coincide to create a favorable environment for hydraulic cylinders.

The hydraulic sector in China experienced significant growth in the period between 2020 and 2021, with the market size expanding from €6.6 billion to €9.8 billion in 2021, representing a compound annual growth rate (CAGR) of 6.8 %. The three core product categories for this categorized hydraulic market comprised pumps, valves, and cylinders. The key product categories each made up over 60 % of the value of the overall market in 2021. The hydraulic industry has also benefited from economic recovery measures, including intelligent manufacturing programs. By 2023, the estimated value is expected to exceed €12 billion as the hydraulic industry advances towards climate change issues, energy saving, advanced control, automation, new materials, and intelligentization.

Europe Market Insights

The European market is expected to hold 25.2% of the market share by 2035. The growth of the hydraulic/pneumatic systems market is fuelled by robust manufacturing, continuing infrastructure O&M investment, and moving more towards integrating eco-efficient automated hydraulic systems. There is also strong long-term support from the technological improvements and sustainability targets set by the EU Green Deal across all industrial equipment and mobile equipment applications.

The UK hydraulic-cylinder demand from 2026 to 2035 will be supported by construction, offshore energy (including windfarm installation/maintenance), and industrial refurbishment projects. This channel often spends more in aftermarket when fleets can start to be modernized and when fleet- and equipment-owners would rather minimize downtime, adopting sealed, higher-duty cycles and service contracts instead. Notable growth niches included telescopic cylinders for access and lifting applications and corrosion-resistant finishes for offshore use. In new builds, there tends to be a bias towards suppliers that include integrated diagnostics or field service to achieve recurring revenues during the forecast decade.

European Union Aircraft Under-Carriages and Parts Thereof Imports by Country in 2023

|

Partner Country |

Trade Value (USD thousand) |

Quantity (kg) |

|

United States |

892,980.27 |

5,491,640 |

|

United Kingdom |

631,333.29 |

2,519,700 |

|

Turkey |

86,696.13 |

152,094 |

|

Canada |

74,494.27 |

282,912 |

|

China |

38,713.46 |

323,415 |

|

Singapore |

20,392.09 |

63,877 |

(Source: WITS)

North America Market Insights

The North American market is expected to hold 15.3% of the market share by 2035. The growth in these markets is attributed to growing automation in agricultural, construction, and industrial machinery. Infrastructure bills passed, such as the U.S. Infrastructure Investment and Jobs Act (IIJA), have positively impacted the demand for hydraulic equipment. Original equipment manufacturers (OEMs) are committed to more efficient hydraulic cylinder solutions to meet sustainability guidelines and initiatives. Additionally, Canada’s focus on mining automation will improve local opportunities.

The hydraulic cylinder market in the U.S. is primarily driven by strong demand from the construction, agriculture, and material handling industries, where heavy gear is significantly reliant on hydraulic systems. Furthermore, increased automation in industrial and infrastructure modernization activities are accelerating growth. The demand for energy-efficient and robust hydraulic components is especially important, as companies prioritize sustainability and long equipment lifespans. Hydraulic technology innovations, such as smart cylinders with IoT connectivity, are helping to shape market trends.