Hydrate Inhibitors Market Outlook:

Hydrate Inhibitors Market size was valued at USD 219.91 million in 2025 and is likely to cross USD 390.13 million by 2035, expanding at more than 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hydrate inhibitors is assessed at USD 231.59 million.

The growing adoption of Low-Dosage Hydrate Inhibitors (LDHI) is a key factor driving the growth of the hydrate inhibitors market. LDHIs are more cost-effective compared to traditional hydrate inhibitors, such as thermodynamic inhibitors, because they require lower doses to prevent hydrate formation. This reduces the overall operational costs for oil and gas operators. Moreover, LDHIs are more effective at lower concentrations, making them efficient for various applications, including offshore production, deepwater exploration, and subsea operations. Their ability to function effectively in harsh conditions, such as high-pressure, low-temperature environments, has led to wider adoption.

Hydrate inhibitors are critical in Liquified Natural Gas (LNG) operations because they prevent hydrate formation, which can otherwise block pipelines, damage infrastructure, and disrupt LNG flow. As the LNG trade continues to expand globally, the importance of hydrate inhibitors in ensuring the safe, efficient, and environmentally responsible transportation and regasification of LNG grows significantly. The International Group of Liquefied Natural Gas Importers (GIIGNL) reports that from 2.6 MT in 1971 to 372.3 MT in 2021, the LNG trade has increased at an average annual rate of 11% during the past 50 years. In 2021, the total number of LNG deliveries surpassed 116,000.

Key Hydrate Inhibitors Market Insights Summary:

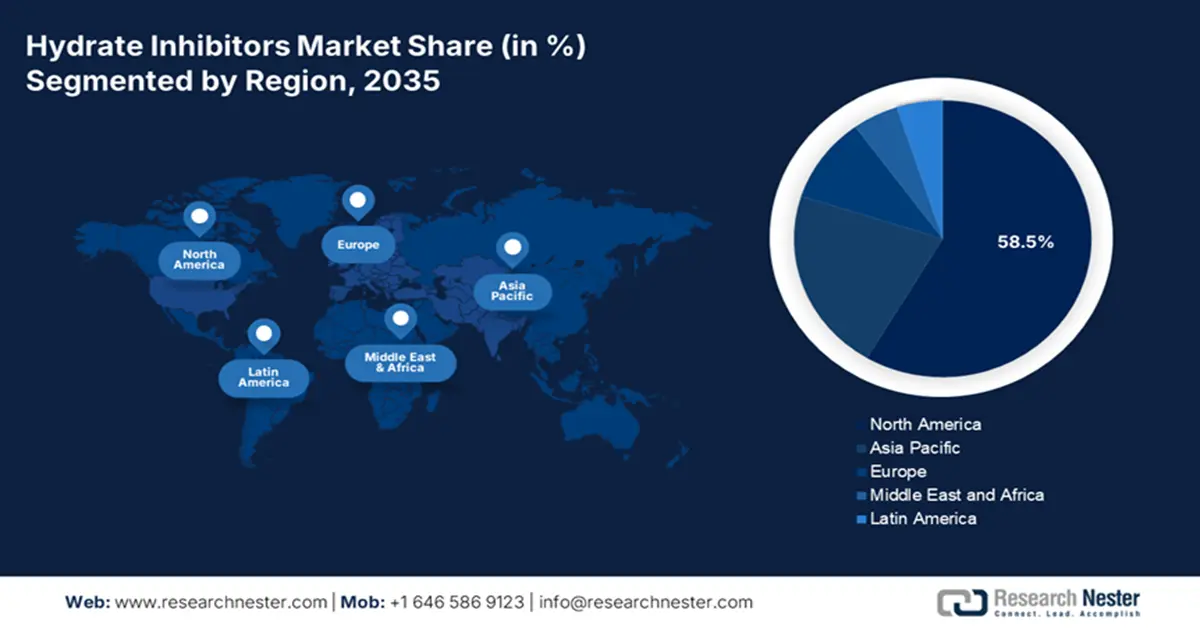

Regional Highlights:

- North America holds a 58.5% share in the Hydrate Inhibitors Market, bolstered by sizable refineries, advancements in oil and gas sector, and rising need for clean fuel, driving growth through 2026–2035.

- Asia Pacific’s hydrate inhibitors market is expected to see stable growth by 2035, driven by infrastructure development and investments in energy infrastructure in China and India.

Segment Insights:

- The low-dosage hydrate inhibitors segment of the Hydrate Inhibitors Market is forecasted to achieve a 47.10% share by 2035, propelled by cost-effectiveness and suitability for offshore applications.

Key Growth Trends:

- Growing demand for oil and gas

- Technological advancements and innovations

Major Challenges:

- Environmental concerns and regulatory constraints

- High cost of advanced inhibitors

- Key Players: Kinder Morgan Inc., Ecolab Inc., Baker Hughes Inc., Innospec Inc., JSC Gazprom, BASF SE, Evonik Industries AG, Clariant AG, GasHydrate LLC.

Global Hydrate Inhibitors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 219.91 million

- 2026 Market Size: USD 231.59 million

- Projected Market Size: USD 390.13 million by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (58.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Canada, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, UAE

Last updated on : 13 August, 2025

Hydrate Inhibitors Market Growth Drivers and Challenges:

Growth Drivers

-

Growing demand for oil and gas: The rising need for oil and gas drives the hydrate inhibitors market as more exploration, production, and transportation infrastructure is needed to meet global energy requirements. As the oil and gas industry expands into more challenging environments, such as offshore and deepwater regions, the need for effective hydrate management solutions, including inhibitors, becomes increasingly important. Hydrate inhibitors are vital for ensuring a safe, efficient, and uninterrupted flow of oil and gas, making them an essential component of modern energy infrastructure. According to the India Brand Equity Foundation (IBEF), by 2045, the country's oil consumption is expected to double to 11 million barrels per day. Furthermore, the nation's natural gas consumption increased by 25 billion cubic meters (BCM), averaging 9% yearly growth until 2024.

- Technological advancements and innovations: Technological advancements such as real-time monitoring and automated dosing systems enhance operational efficiency, ensure environmental sustainability, and support the industry’s expansion into more challenging environments. Also, ongoing research focuses on formulating inhibitors tailored to specific conditions, such as high salinity or unconventional gas reservoirs broadening their applicability. Moreover, innovations in hydrate inhibitors are expanding their use beyond traditional oil and gas sectors, such as in methane hydrate extraction for alternative energy sources.

Challenges

-

Environmental concerns and regulatory constraints: The U.S. Environmental Protection Agency (EPA) states that some hydrate inhibitors, particularly thermodynamic inhibitors like methanol and ethylene glycol, can damage marine life if they are discharged into the environment, posing an environmental risk, leading to stricter regulations. Compliance with these regulations increases costs for manufacturers and end users.

- High cost of advanced inhibitors: Advanced inhibitors like LDHIs are more expensive than traditional inhibitors such as methanol, making them less accessible to smaller or cost-conscious companies. Smaller oil and gas operators often prioritize immediate cost savings over long-term efficiency, leading to lower adoption rates.

Hydrate Inhibitors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 219.91 million |

|

Forecast Year Market Size (2035) |

USD 390.13 million |

|

Regional Scope |

|

Hydrate Inhibitors Market Segmentation:

Type (Thermodynamic Inhibitors, Low-Dosage Hydrate Inhibitors, and Hybrid)

Low-dosage hydrate inhibitors segment is set to capture hydrate inhibitors market share of around 47.1% by the end of 2035. In offshore gas production systems, one of the best ways to manage gas hydrate formation problems and guarantee flow is to employ LDHIs. Operators can benefit from the usage of this technology in various ways, such as the potential for large cost savings, the extension of gas system life, and the use of combination goods. LDHIs are increasingly being used, particularly in offshore applications such as subsea pipelines and flow lines.

In the highly regulated and cost-sensitive offshore oil and gas industry, LDHIs are favored due to their cost-effectiveness and environmental advantages. As these inhibitors function well at low concentrations, operators wishing to avoid gas hydrate formation without incurring the high costs of conventional high-dose techniques have an inexpensive alternative. In keeping with the industry's growing focus on sustainability, the ability to accomplish the required inhibition with smaller chemical amounts not only decreases operating costs but also lessens environmental effects.

Raw Material (Alcohol, Glycol, Ionic Salt, And Others)

Based on the raw material, the glycol segment in hydrate inhibitors market is likely to hold a notable share by the end of 2035. The gas stream's glycol absorbs the system's free water, preventing the formation of hydrate. Glycols, such as ethylene glycol, are therefore the most often employed hydrate inhibitors due to their diverse chemical characteristics. The production output of natural gas has increased as a result of its rising demand. For instance, the International Energy Administration (IEA) reports that South America's gas demand rose by 7.5%, and Europe's gas consumption rose by 5.5%. Glycol inhibitors will be used more frequently during natural gas processing as a result of the rise in natural gas output brought on by this increase in demand and consumption.

Our in-depth analysis of the hydrate inhibitors market includes the following segments:

|

Type |

|

|

Operations |

|

|

Raw Material |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hydrate Inhibitors Market Regional Analysis:

North America Market Analysis

North America hydrate inhibitors market is projected to hold revenue share of over 58.5% by the end of 2035, owing to the presence of sizable refineries, ongoing advancements in the oil and gas sector, and the rising need for clean fuel. In 2023, the U.S. and Canada's hydrogen and clean fuels industries saw a tremendous upsurge that was characterized by important project milestones, scientific breakthroughs, and regulatory changes. The market for green hydrogen has enormous potential, with estimates ranging from USD 642 billion by 2030 to USD 980 billion by 2040 and USD 1.4 trillion by 2050.

In the U.S., hydrate inhibitors like methanol and ethylene glycol will be used increasingly frequently during the natural gas production process as a result of rising natural gas output and consumption. Nearly 1.63 million metric tons of ethylene glycol were produced in the country in 2019. In Canada, its well-established energy infrastructure and emphasis on cutting-edge assurance technologies are expanding the hydrate inhibitors market. Furthermore, Canada is a significant player in deepwater exploration, which increases the need for hydrate inhibitors to preserve pipeline integrity and reduce the risk of hydrate formation. The country’s hydrate inhibitors market leadership is further reinforced by the presence of important industrial companies.

APAC Market Analysis

Asia Pacific is expected to experience a stable CAGR during the forecast period due to the development of infrastructure and industry in developing nations like China and India. The increasing need for hydrate inhibition solutions is a result of the region's significant investments in energy infrastructure, such as facilities for the exploration and production of oil and gas. Additionally, the increasing focus on renewable energy sources supports the use of hydrate inhibitors at LNG facilities and offshore wind farms around the region. For instance, by 2050, net LNG and pipeline imports are predicted to account for more than half of Asia Pacific's total natural gas supply.

The requirement for hydrate inhibitors in the oil and gas sector of China is strongly impacted by the country's growing domestic energy consumption. China's natural gas imports made up 42% of the total natural gas supply in 2023, with an average of 16.0 Bcf/d, up from 15% in 2010. China imports natural gas as LNG) and through pipelines. For the second time since 2021, China emerged as the world's top LNG importer in 2023. Data from China’s General Administration of Customs shows that the average LNG imports from China in 2023 were 9.5 Bcf/d, up 13% from 2022.

Significant investments in offshore oil and gas projects, especially in shallow and deepwater fields, have been spurred by the country’s growing energy needs. Offshore natural gas and crude oil reserves made up 77% and 58% of India's total reserves, respectively. India is positioned as a key growth hub for hydrate inhibitors as a result of the nation's governments progressively implementing cutting-edge technologies to increase operational efficiency.

Key Hydrate Inhibitors Market Players:

- WBI Energy Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Kinder Morgan Inc.

- Ecolab Inc.

- Baker Hughes Inc.

- Innospec Inc.

- JSC Gazprom

- BASF SE

- Evonik Industries AG

- Clariant AG

- GasHydrate LLC

Government rules, industry progress, and market and economic conditions all affect how the hydrate inhibitors market players grow. Therefore, to meet demand, the players should concentrate on increasing their manufacturing capacity, improving their services, and developing new technologies to produce supplier-quality items.

Here are some leading players in the hydrate inhibitors market:

Recent Developments

- In February 2022, WBI Energy Inc. recently opened the North Bakken pipeline extension project with the potential to rise to 625 million cubic feet per day, which can currently move 250 million cubic feet of natural gas per day from the Bakken producing area in North Dakota.

- In July 2021, Kinder Morgan Inc. acquired Kinetrex Energy for USD 310 million. Two small-scale domestic LNG production and fueling facilities as well as a 50% stake in an Indiana landfill-based renewable natural gas (RNG) facility are part of the deal.

- Report ID: 6982

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hydrate Inhibitors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.