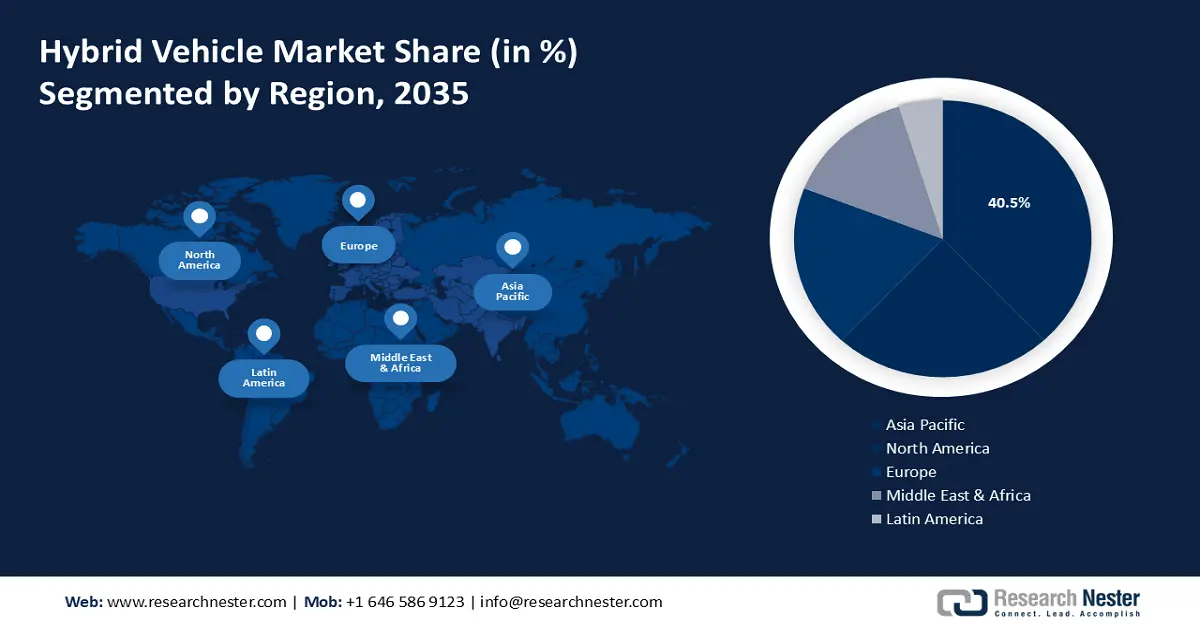

Hybrid Vehicle Market Regional Analysis:

Asia Pacific Market Insights

Asia Pacific hybrid vehicle market is expected to capture revenue share of over 40.5% by 2035, due to strict emission regulations, government incentives, and increasing consumer demand for fuel-efficient vehicles. India, China, and Japan lead the market with automakers such as Toyota, Honda, and Hyundai expanding their hybrid offerings. Rising fuel prices and urban air pollution concerns further boost HEV adoption in the region.

The hybrid vehicle market in China is expanding rapidly driven by government policies, rising fuel prices, and increasing demand for fuel-efficient transportation. Automakers such as BYD, Toyota, and Honda are investing in hybrid technology to cater to consumers seeking alternatives to fully electric vehicles. China leads the global space in adopting hybrid vehicle. In the first two months of 2025, car sales increased by 1.3% compared to the same period in 2024 driven by customer subsidies and a developing price war in the smart electric vehicle market. In February 2025, passenger vehicle sales surged by 26.1% year on year following a 12% decrease in January. Notably, new energy vehicles i.e., EVs comprised nearly 48.8% of total car sales in February reflecting China's strong push towards electrification.

The hybrid vehicle market in South Korea is expanding as consumers seek fuel-efficient and eco-friendly alternatives amid rising fuel costs and stricter emission regulations. Leading automakers such as Hyundai and Kia are investing in hybrid technology offering popular models such as Hyundai Sonata and Kia Sorento Hybrid. Moreover, government incentives and tax benefits further encourage HEV adoption. According to data from the transport ministry in 2025, the total number of hybrid vehicles registered reached 2,024,481 in 2024 touching over 2 million units for the first time. This rise in the adoption of hybrid vehicles reflects a shift in consumer behavior contributing to a steady growth of the HEV market in South Korea.

North America Market Insights

North America region is anticipated to observe substantial growth through 2035 owing to increasing demand for fuel efficiency, stricter emission regulations, and rising consumer interest in sustainable transportation. Automakers such as Ford, Toyota, and General Motors are investing in hybrid technology, particularly in the SUV and pickup truck segments. Government incentives and stringent Corporate Average Fuel Economy (CAFÉ) standards are also key reasons for HEV adoption. According to the U.S Energy Information Administration Report 2024, electric vehicle sales and hybrid sales surpassed 16% of total light-duty vehicle sales in the U.S. This increase in the electric and hybrid vehicle market share was primarily due to hybrid vehicle (HEV) sales, which increased by 30.7% year over year.

The hybrid vehicle market in the U.S. is expanding as consumers look for fuel-efficient options without fully transitioning to electric vehicles. According to a report by the U.S. Department of Energy 2024, the sale of hybrid vehicle in the U.S. witnessed a 53% increase from 2022 recording 1.2-million-unit sales. Additionally, automakers are investing in next-generation hybrid powertrains to meet stricter fuel economy standards. Further, the tax incentives provided by the Biden Administration including a USD 7500 tax credit for EV purchases drive the adoption of hybrid vehicles

The hybrid vehicle market in Canada is poised to rise as consumers seek fuel-efficient options suited for the country's diverse climate and long driving distances. Government incentives and stricter emissions regulations are encouraging automakers such as Toyota, Honda, and Ford to expand their hybrid lineups. For instance, in April 2024, Honda announced its plan to invest approximately USD 15 billion to expand its EV chain in Canada, with an EV and a battery plant in Ontario. This expansion by top automaker showcases opportunities for growth in the country especially for Hybrid SUVs and all-wheel drive models.