Hybrid Composites Market Outlook:

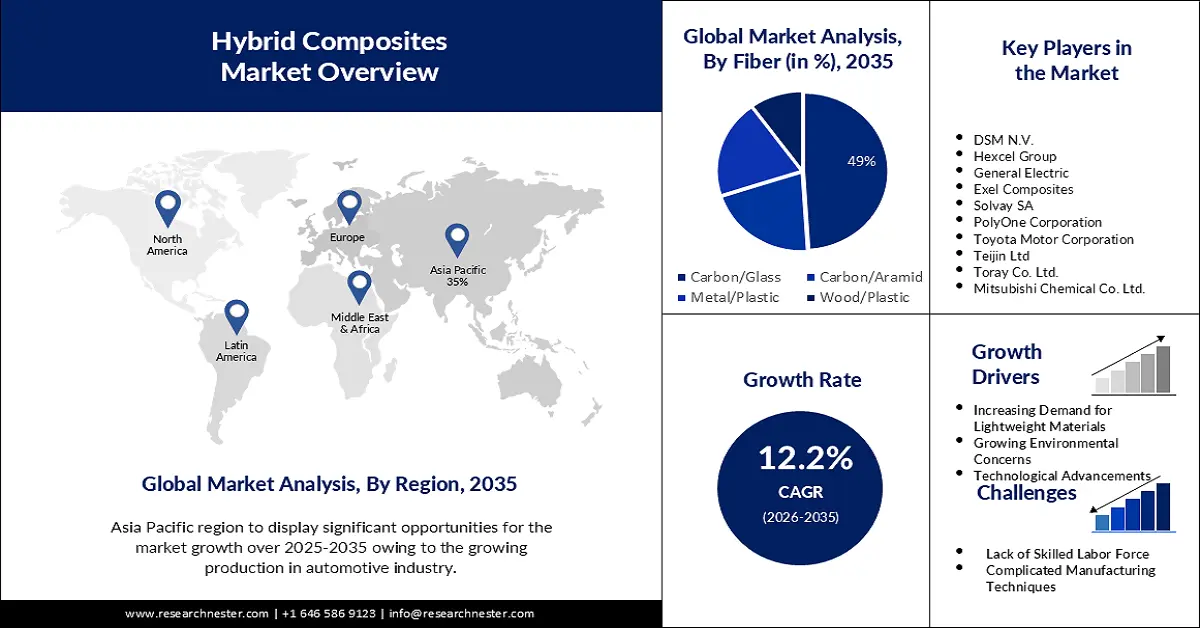

Hybrid Composites Market size was over USD 1.15 billion in 2025 and is poised to exceed USD 3.64 billion by 2035, growing at over 12.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hybrid composites is estimated at USD 1.28 billion.

Hybrid composites, which combine both glass and carbon fibers, enable manufacturers to customize mechanical qualities for any particular application without modifying the required dimensions of the tubes or poles. These properties of hybrid composites are escalating the market growth. For instance, the United Nations Environment Programme predicts that between 2017 and 2030, chemical sales will nearly quadruple.

For principal structures of commercial, industrial, aeronautical, marine, and recreational facilities a hybrid composite may be used. It's got a lot of advantages for the aeronautics industry like high fatigue and corrosion resistance, plus excellent impact protection. The U.S. commercial aviation industry contributes USD 1 trillion yearly, or 5% of the country's GDP.

Key Hybrid Composites Market Insights Summary:

Regional Highlights:

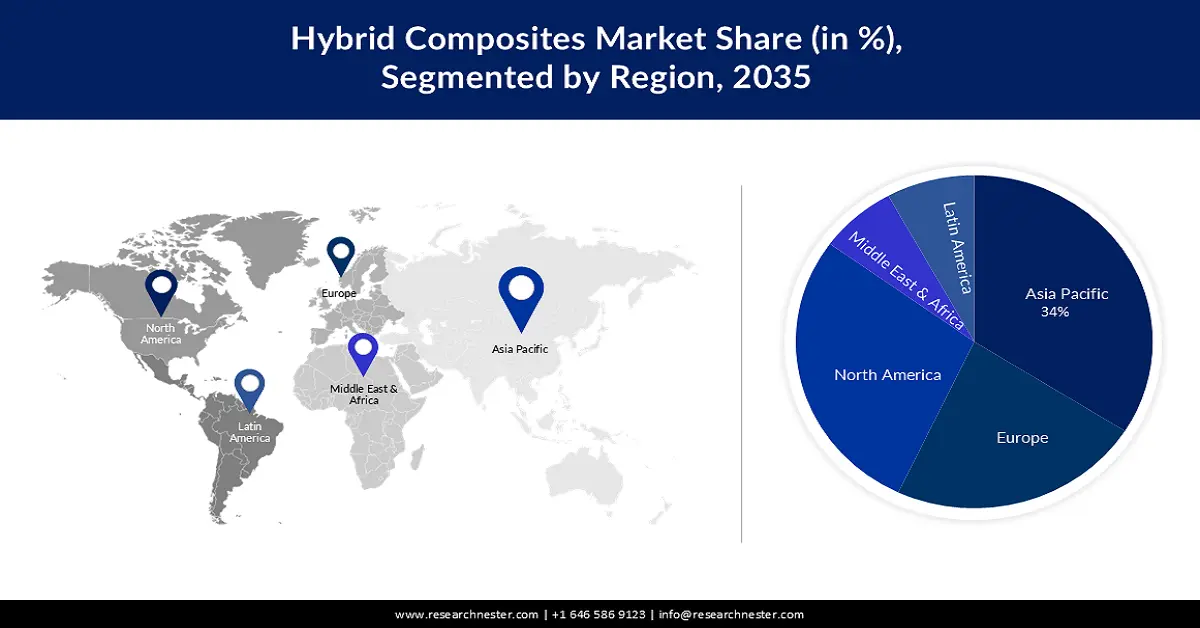

- Asia Pacific hybrid composites market will secure around 34% share by 2035, fueled by the extension of the manufacturing sector and strong growth in automotive production.

- North America market will achieve a 28% share by 2035, driven by the presence of major aircraft manufacturers and related industry expansion.

Segment Insights:

- The carbon/glass segment in the hybrid composites market is expected to secure a 49% share by 2035, attributed to the lightweight and high-performance properties of carbon/glass composites in wind blades and vehicles.

- The automotive & transportation segment in the hybrid composites market is expected to maintain the largest share by 2035, driven by improved cost and performance attributes.

Key Growth Trends:

- Increasing Demand for Lightweight Materials

- Technological Advancements

Major Challenges:

- Increasing Prices of Raw Materials

- Lack of Skilled Labour Force

Key Players: General Electric, DSM N.V., QUANTUMETA, Hexcel Group, Gurit, Exel Composites, Solvay SA, PlastiComp, Inc., SGL group, PolyOne Corporation.

Global Hybrid Composites Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 1.15 billion

- 2026 Market Size: USD 1.28 billion

- Projected Market Size: USD 3.64 billion by 2035

- Growth Forecasts: 12.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (34% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 9 September, 2025

Hybrid Composites Market Growth Drivers and Challenges:

Growth Drivers

- Increasing Demand for Lightweight Materials – Composites and polymers, for example, are a great deal lighter than steel, brass, alloys, iron, etc. By using these materials, manufacturers may reduce the weight of airplane components, which helps to minimize fuel costs. Thus, the increasing demand for lightweight materials in the aerospace and defense industry is accelerating the hybrid composites market growth. For instance, Airbus has delivered over 484 narrow-body commercial aircraft in 2020, compared to Boeing's over 43 deliveries.

- Technological Advancements - Technological advances that reduce the duration of production are expected to have a positive impact on demand for automotive products. 85.4 million motor vehicles were produced globally in 2022, a 5.7% increase from 2021.

- Growing Environmental Concerns - Manufacturers are now using these hybrid composites in place of metal parts due to rising worries about fuel usage and CO2 emission levels. This will drive market expansion as well.

Challenges

- Increasing Prices of Raw Materials – The raw materials needed for the production of hybrid composite are expensive, making consecutive component production expensive. The cycle time, which is closely related to the amount of time needed for filling and curing, has a substantial impact on the production cost of hybrid composite products. These factors may become hindrances for the market of hybrid composites.

- Lack of Skilled Labour Force

- Complicated Manufacturing Techniques

Hybrid Composites Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

12.2% |

|

Base Year Market Size (2025) |

USD 1.15 billion |

|

Forecast Year Market Size (2035) |

USD 3.64 billion |

|

Regional Scope |

|

Hybrid Composites Market Segmentation:

Fibre Segment Analysis

The carbon/glass category is poised to lead the market during the forecast period with about 49% share of the global hybrid composites market. Carbon/glass composites have better properties such as lightweight that help in reducing the weight of the wind blades and vehicles. In the production of hybrid composite laminates, carbon/glass and glass fiber-reinforced fabrics with an epoxy matrix are used. These composite materials offer a range of properties that increase demand in industry and beyond, e.g. reduced thermal expansion, strong rigidity, tolerance to temperatures up to 1 500 C, chemical resistance values higher than 700 C as well as lower weight. With significantly less expense than if they had utilized carbon fiber, users can achieve up to 85 to 90% of the benefits of carbon.

End-Use Segment Analysis

The automotive & transportation industry is expected to garner the largest market share. In the automotive sector, the usage of hybrid composites has made high-performance and luxury affordable. Hybrid composites' improved cost and performance attributes are anticipated to fuel demand in the automotive and transportation end-use sectors.

Our in-depth analysis of the global market includes the following segments:

|

Fiber |

|

|

End-User |

|

|

Resin Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hybrid Composites Market Regional Analysis:

APAC Insights

By region, Asia Pacific is projected to hold 34% share of hybrid composites market during the forecast period. The market is growing owing to the extension of the manufacturing sector besides strong growth in automotive production in the region. The region is also the most profitable destination for the construction, aerospace, and electronics sectors because of the presence of major key players. In 2022, 66% of investors want to make investments in Australian infrastructure. In the meantime, 60% plan to make investments in Singapore's infrastructure.

North America Insights

North America is expected to hold the second-largest share of about 28% in the market during the forecast period. The market in the region is growing owing to the presence of countries such as the United States which is one of the major manufacturers of commercial aircraft, cargo jets, and defense aircraft, and is also projecting the growth of the market. A total of 35 mergers and acquisitions deals for more than USD 10.3 Billion have been revealed in North America's aerospace and defense industry over the previous year.

Hybrid Composites Market Players:

- General Electric

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- DSM N.V.

- QUANTUMETA

- Hexcel Group

- Gurit

- Exel Composites

- Solvay SA

- PlastiComp, Inc.

- SGL group

- PolyOne Corporation

Recent Developments

- The quick press molding technique is being used by Hexcel Corporation (NYSE: HXL) in conjunction with NaCa Systems, a Tier 1 provider of natural fiber composite automobile interior parts, to create a lightweight carbon fiber prepreg and wood fiber composite sports car seat back.

- Solvay helps to produce additively made carbon fiber reinforced plastic CFRP parts in mass production by working with advanced manufacturing technology OEM 9T Labs AGZrich, Switzerland

- Report ID: 3890

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hybrid Composites Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.