Hyaluronic Acid Market Outlook:

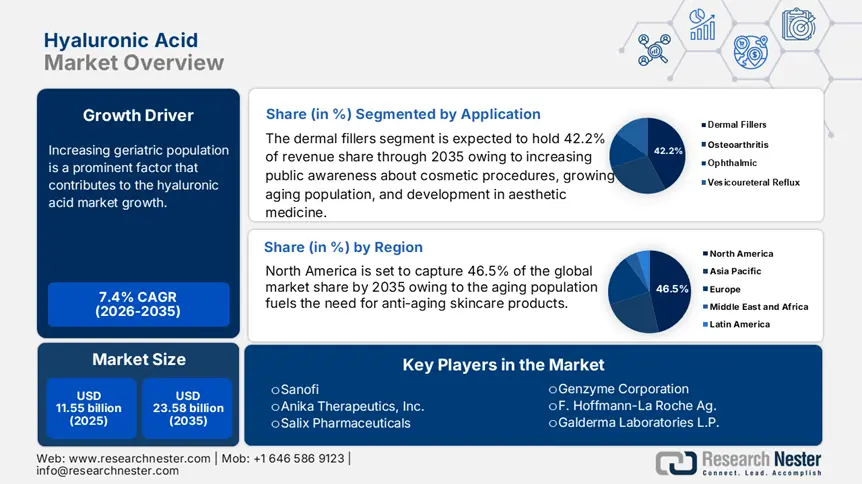

Hyaluronic Acid Market size was valued at USD 11.55 billion in 2025 and is set to exceed USD 23.58 billion by 2035, expanding at over 7.4% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hyaluronic acid is estimated at USD 12.32 billion.

Increasing geriatric population is a prominent factor that contributes to the hyaluronic acid market growth. According to the World Health Organization (WHO), the proportion of people aged 60 years and above is predicted to rise from 1 billion in 2020 to 1.4 billion by 2037 and is predicted to reach 2.1 billion by 2050. Further, growing awareness about the high prevalence of target diseases and antiaging products is a key factor driving the hyaluronic acid market growth in the forecast period.

Hyaluronic acid is broadly utilized in ophthalmology applications such as dry eye treatment, contact lenses, and intravitreal injections. According to a 2022 study on hyaluronic acid in the treatment of dry eye disease, published by the National Library of Medicine, projected that hyaluronic acid, a key ingredient in artificial tears in concentrations ranging from 0.1% to 0.4%, is a safe and effective treatment for dry eye disease (DED). Hyaluronic acid possesses lubricating, anti-inflammatory, antioxidant, and anti-toxic properties on the eye surface.

Increasing awareness about antiaging products boosts the need for antiaging cosmetic and aesthetic treatments. Hyaluronic acid-based products are valued for their unique viscoelastic and moisturizing properties and their low toxicity levels, especially minimally invasive antiaging solutions. Currently, a large number of people, particularly women, are more conscious about aesthetics and looking younger, further intensifying their overall awareness and need for anti-aging products. Consequently, the hyaluronic acid market based products such as dermal fillers and treatment for vesicoureteral reflux is expected to increase due to the awareness and minimally invasive nature.

The prevalence of orthopedic and ophthalmic disorders is increasing day by day due to lifestyle changes and the aging population. According to the Osteoarthritis Alliance U.S, 1 in 4 adults in the U.S is affected by some kind of arthritis, wherein osteoarthritis is the most common one, affecting nearly 32.5 million U.S adults. A report by NVISION Eye Centers published in December 2022, stated that in the U.S, 12 million people aged 40 and above suffer from vision impairment, and approximately 1 million experience blindness. Furthermore, WHO reveals that globally 2.2 billion people have eye or vision problems, highlighting the global scale of these health challenges.

Key Hyaluronic Acid Market Insights Summary:

Regional Highlights:

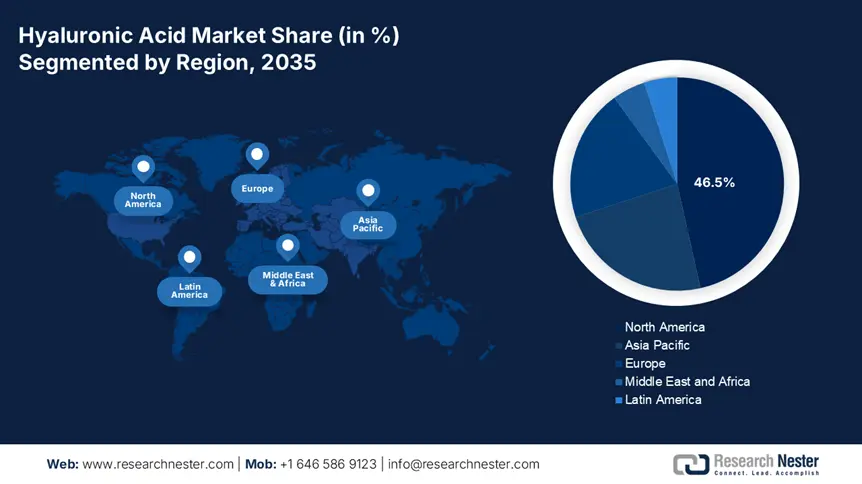

- North America commands a 46.50% share in the Hyaluronic Acid Market, driven by rising demand for anti-aging skincare and dermal fillers, ensuring strong growth prospects by 2035.

- Asia Pacific’s Hyaluronic Acid Market is expected to see substantial growth by 2035, driven by increased cosmetic product demand and medical tourism.

Segment Insights:

- Dermal Fillers segment are anticipated to hold a 42.2% share by 2035, propelled by growing demand for anti-aging products and aesthetic procedures.

- The Osteoarthritis segment of the Hyaluronic Acid Market is poised for fast growth through 2035, driven by the effectiveness of hyaluronic acid injections in treating joint pain.

Key Growth Trends:

- Increasing demand for natural and safe ingredients

- Rising consumption of hyaluronic acid in medical and cosmetic industries

Major Challenges:

- Side effects associated with hyaluronic acid

- Safety concerns with hyaluronic acid products

- Key Players: Anika Therapeutics, F. Hoffmann-La Roche Ag., Allergan, Sanofi, Inc., Salix Pharmaceuticals, Genzyme Corporation, Galderma Laboratories L.P., Seikagaku Corporation.

Global Hyaluronic Acid Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 11.55 billion

- 2026 Market Size: USD 12.32 billion

- Projected Market Size: USD 23.58 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (46.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, Russia

Last updated on : 12 August, 2025

Hyaluronic Acid Market Growth Drivers and Challenges:

Growth Drivers

-

Increasing demand for natural and safe ingredients: Skincare, pharmaceuticals, and nutraceuticals have a growing demand for natural and safe ingredients that support or enhance hyaluronic acid’s production, stability, or absorption. Natural ingredients such as aloe vera are well known for their moisturizing and hydrating qualities of their own, which help skin relieve dryness or irritation, thus improving the moisturizing effect of hyaluronic acid. Additionally, green tea extract, rich in antioxidants, guards the skin from environmental damage and minimizes inflammation, further supporting skin-rejuvenating benefits of hyaluronic acid.

Vitamin C acts as an antioxidant that helps to brighten the complexion, stimulates collagen production, and guards against damage from free radicals. Further, it enhances the skin's look and health when mixed with hyaluronic acid. Ceramides are naturally occurring lipids present in the outer layer of the skin and play a key role in maintaining the integrity of the skin barrier. -

Rising consumption of hyaluronic acid in medical and cosmetic industries: The increasing trend of hyaluronic acid reflects its usage and popularity across several sectors. In skincare, hyaluronic acid proved its ability to hydrate and plump the skin, thus minimizing the appearance of wrinkles and fine lines. Hence hyaluronic acid is used as a key ingredient in serums, moisturizers, and other beauty products. In the medical field, hyaluronic acid is broadly used in dermal fillers for cosmetic improvements and in osteoarthritis treatment to lubricate joints and alleviate pains. In 2023, the Arthritis Foundation revealed that the majority of 166 patients who were injected with hyaluronic acid showed 50% improvement in stiffness, pain, and mobility.

In 2024, one trial published a comparison of 1 dose of 60 mg hyaluronic acid to 3 doses of 30 mg hyaluronic acid in people affected with osteoarthritis. Though both types relieve stiffness and pain, 3 doses were more effective due to the larger dose of hyaluronic acid. Its natural presence and biocompatibility in the human body contribute to its broad acceptance and use. Ongoing research uncovers its diverse potential, and the need for hyaluronic acid in both the medical and cosmetic industries is expected to grow significantly. -

Rising initiatives by market players: Market players in the healthcare industry are taking initiatives to address the challenges associated with hyaluronic acid usage, driven by increasing need and rising awareness of its therapeutic potential. Pharmaceutical companies are boosting their research and development efforts to innovate enhanced formulations and delivery systems for hyaluronic acid-based treatment, aiming to improve efficacy and patient outcomes. Moreover, medical device manufacturers are investing in enhanced technologies to improve the production and application of hyaluronic acid-based products, extending their usage across several medical industries such as ophthalmology, orthopedics, and dermatology.

Furthermore, strategic collaborations between industrial stakeholders and academic institutions are cultivating a deeper understanding of the hyaluronic acid mechanism and its various clinical applications, thereby accelerating the development of new treatment modalities. These collective efforts highlight a concerted effort within the healthcare industry to harness the therapeutic benefits of hyaluronic acid and address the demands of patients globally.

Challenges

-

Side effects associated with hyaluronic acid: Hyaluronic acid, a naturally occurring substance found in the human body, is often utilized in cosmetic and medical treatments due to its aesthetic and therapeutic benefits. General tolerable side effects occur while injecting hyaluronic acid into cosmetic procedures. Some of the common side effects include bruising, redness, tenderness, and swelling at the injection site. In rare cases, an allergic reaction may lead to rash, itching, or difficulty breathing.

Furthermore, improper injection methods or placement will result in unevenness or lumps in the skin. It is most significant to consult with healthcare professionals to discuss the benefits and risks before undergoing any hyaluronic acid-based treatment, thus minimizing the risk of adverse effects. -

Safety concerns with hyaluronic acid products: Safety concerns related to hyaluronic acid are challenging, especially in medical and cosmetic applications. Even though hyaluronic acid is naturally present in the human body and is considered safe, there is a potential risk from its extract or synthetic form utilized in dermal fillers and other treatments. It causes adverse effects such as allergic reactions, granuloma formation, and infections, especially if the product is not properly administered or purified.

Furthermore, improper injection methods lead to complications such as vascular occlusion, which may lead to tissue necrosis and in adverse cases, it may lead to blindness. Securing the safety of hyaluronic acid products requires strict quality control measures, undergoing clinical testing, and administration by qualified healthcare providers.

Hyaluronic Acid Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 11.55 billion |

|

Forecast Year Market Size (2035) |

USD 23.58 billion |

|

Regional Scope |

|

Hyaluronic Acid Market Segmentation:

Application (Dermal Fillers, Osteoarthritis, Ophthalmic, and Vesicoureteral Reflux)

Dermal fillers segment is predicted to hold more than 42.2% hyaluronic acid market share by 2035. The need for hyaluronic acid-based dermal fillers is driven by various factors such as increasing public awareness about cosmetic procedures, the aging population, and development in aesthetic medicine. Customers are highly seeking a more natural outlook that refines their features without appearing exaggerated. In September 2024, it was estimated that 70% of women buy or use antiaging products, and among them, 64% of women use at least 4 different products labeled as antiaging. They highly prefer antiaging products to enrich skin elasticity, minimize lines and wrinkles, deep hydration, and sun protection. These factors significantly increase the need for hyaluronic acid.

Hyaluronic acid is a highly preferable material for dermal fillers due to its high compatibility and natural presence in the body, thus reducing the risk of adverse reactions or complications. These kinds of fillers are widely used to provide a natural outlook, making them popular in aesthetic medicine. Continuous enhancement in cross-linking methods, formulation, and delivery systems has improved the performance and longevity of hyaluronic acid-based fillers. In addition, the rising need for subtle improvements and shorter recovery periods has driven the expanding preference for minimally invasive cosmetic procedures such as dermal fillers.

While North America and Europe dominate the dermal filler market, growing regions such as Asia Pacific and Latin America show substantial development potential. The growth of these regions is driven by increasing disposable incomes, awareness of aesthetic procedures, and the fast-growing cosmetic and aesthetic sector. For business operations in this sector, acquiring regulatory permits and complying with safety standards are crucial. Dermal fillers are subjected to manufacturing, marketing, and distribution under standard regulations to ensure patient safety and maintain high product quality.

The osteoarthritis segment is projected to witness fast growth in the hyaluronic acid market during the forecast period. In the medical sector, hyaluronic acid is broadly utilized in osteoarthritis treatment. Hyaluronic acid injections are more effective in treating keen pain caused by osteoarthritis in patients who were previously treated with painkillers or some other therapies. It is injected into joints to serve as lubricant and cushion, reducing discomfort and increasing joint range of motion, thus helping in the proper functioning of knees. Ongoing research and development continue to explore new applications for hyaluronic acid. These injections are called viscosupplements, they provide thick fluid for the lubrication of joints. Sunvisc-One, Monovisc, Euflexxa, Supartz, Hyalgan, and Orthovisc are a few brands of hyaluronic acid approved for treating knee osteoarthritis. To improve the effectiveness of hyaluronic acid-based medicines, manufacturers are focusing on developing enhanced formulations and delivery techniques.

End user (Pharmaceutical Industry, Cosmetic Surgery Centers, and Dermatology Clinics)

The dermatology clinics segment is estimated to hold the largest share of the hyaluronic acid market, highlighting the vital role these clinics play in the skincare sector. This prominence reflects the expanding need for hyaluronic acid-based products in dermatological treatment and aesthetic procedures.

Dermatology clinics serve as primary providers of professional skincare solutions, providing a range of services from routine dermatological consultations to enhanced cosmetic procedures. These clinics are staffed by skincare specialists, medical professionals, and qualified dermatologists, who specialize in diagnosing and treating several skin conditions such as aging, acne, dermatitis, and hyperpigmentation.

Our in-depth analysis of the global hyaluronic acid market includes the following segments:

|

Application |

|

|

End users |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hyaluronic Acid Market Regional Analysis:

North America Market Statistics

North America hyaluronic acid market is expected to hold revenue share of over 46.5% by the end of 2035. North America's aging population fuels the need for anti-aging skincare products. Hyaluronic acid's moisture retention and ability to improve skin plumpness make it a primary ingredient in cosmetic formulations to minimize the appearance of wrinkles and fine lines on the skin. In addition, increasing awareness about skincare and utilization of goods with potent ingredients accelerates hyaluronic acid market growth in this region.

In the U.S and Canada, hyaluronic acid is becoming a prominent ingredient in skincare formulations due to its proven moisture and skin-rejuvenating nature. In non-surgical cosmetic procedures, hyaluronic acid-based derma fillers are broadly utilized to improve volume and reduce the appearance of wrinkles. The rising need for these aesthetic treatments in these countries continues to drive the growth of the hyaluronic acid market. in the U.S. since 2019, a staggering 90% or more of American Academy of Facial Plastic and Reconstructive Surgery (AAFPRS) surgeons have performed facelifts annually. Members conducted an average of 48 facelifts or partial facelifts in 2023, a 60% increase from 2017. Over the last seven years, the number of facelifts has consistently climbed year after year.

Facelifts (performed by 86% of surgeons) were by far the most popular surgery among women in 2022. The next most common procedures for women were nose jobs (rhinoplasties) and eye lifts (blepharoplasties), with 79% and 73%, respectively. Rhinoplasty (done by 83% of surgeons), blepharoplasties (49%), facelifts and partial facelifts (48%) were the top three surgical operations across all genders, as they had been in previous years.

Asia Pacific Market Analysis

Asia Pacific has surpassed the hyaluronic acid market at a substantial CAGR during the forecast period. This expansion is highly driven by the rising need for skincare and cosmetic products. Hyaluronic acid is widely used in personal care products and cosmetics due to its hydrating and anti-aging nature. This surge in need is highly fueled by growing lifestyle trends, increasing disposable income, and increasing skin regimens for cosmetic and skincare products.

Medical tourism has become popular in countries such as Thailand and South Korea, driving the need for hyaluronic acid-based dermal fillers for aesthetic procedures. Further, government initiatives to strengthen healthcare infrastructure and promotion by the pharmaceutical and cosmetic industry created a favorable environment for the growth of the hyaluronic acid market in Asia Pacific.

Key Hyaluronic Acid Market Players:

- Smith & Nephew Plc

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Sanofi

- Anika Therapeutics, Inc.

- Salix Pharmaceuticals

- Genzyme Corporation

- F. Hoffmann-La Roche Ag.

- Galderma Laboratories L.P.

- Symrise AG

Leading players are adopting numerous advanced strategies such as new product launches, mergers, and acquisitions to maintain dominance. In addition, these companies concentrate on new delivery systems, distribution enhancement, and partnerships to grow in this sector. These companies achieve a competitive advantage by implementing effective pricing techniques and handling minimal operational costs.

Some of the key players in hyaluronic acid market:

Recent Developments

- In March 2023, Symrise launched a new range of Diana FoodTM bioactives for cosmetics. The company expanded its product line by creating these nutricosmetic components. They offered a variety of products for anti-aging, skin conditioning, skin brightening, and nail & hair care. It's made of bioactive substances such as vitamin A & C, collagen type I, and polyphenols, which are acquired naturally from different fruits. This introduction strengthens Symrise's history in the cosmetic sector by offering a wide range of cosmetic ingredients.

- In February 2022, JUVÉDERM VOLBELLA XC, a product of Allergan, was approved by the U.S. Food and Drug Administration (FDA) to treat infraorbital hollows in individuals over 21. This boosted the company's growth in its aesthetic product line in the U.S. market.

- In February 2025, Seikagaku Corporation revealed that the development of Gel-One for the treatment of osteoarthritis of the knee and hip has begun in Japan. Gel-One, an intra-articular injection, contains a cross-linked hyaluronate hydrogel made with Seikagaku's proprietary technology. Gel-One injections, which include highly viscoelastic hyaluronate, are predicted to give long-term pain relief due to their ability to stay in the joint cavity. Since 2012, the product has been sold in global countries under the names Gel-One (U.S.) and HyLink (Taiwan and Italy), intended for knee osteoarthritis.

- Report ID: 7281

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hyaluronic Acid Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.