HVDC Converter Station Market Outlook:

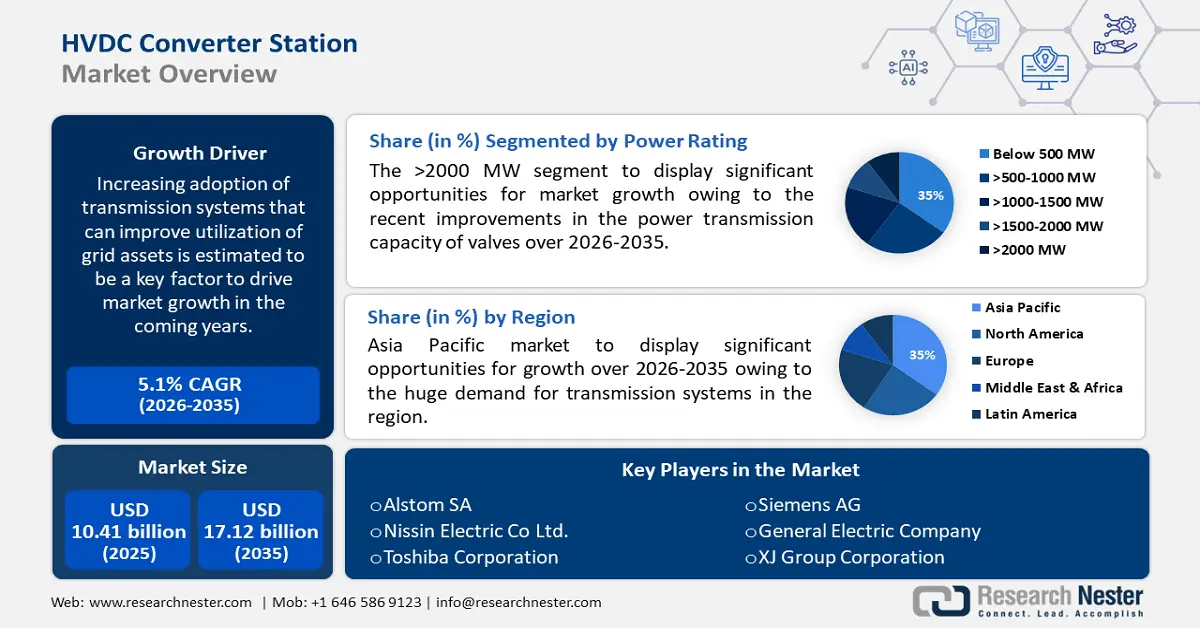

HVDC Converter Station Market size was valued at USD 10.41 billion in 2025 and is likely to cross USD 17.12 billion by 2035, registering more than 5.1% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of HVDC converter station is assessed at USD 10.89 billion.

Increasing adoption of transmission systems that can improve utilization of grid assets is estimated to be a key factor to drive market growth in the coming years. Moreover, the growing number of offshore wind farms coupled with favorable government policies for the construction of HVDC converter stations is projected to bring ample growth opportunities to the market in the near future. The market growth can also be attributed to the increasing demand for renewable energy across the world. Renewable energy has become increasingly popular in recent years owing to the urgent need to reduce carbon emissions and mitigate climate change. In the year 2020, renewable energy accounted for nearly 73% of global net additions to power capacity, with solar and wind power leading the way.

The purpose of the HVDC converter station is to facilitate the transmission of large amounts of power over long distances, which is often more efficient and economical than using traditional AC transmission systems. HVDC transmission systems are used to transmit power from remote renewable energy sources such as offshore wind farms or hydropower plants to urban centers, or to interconnect power grids that operate at different frequencies or in different regions. HVDC converter station refers to a specialized facility used in high-voltage direct current (HVDC) transmission systems to convert alternating current (AC) power to direct current (DC) power or vice versa. The converter station typically consists of multiple components, including transformers, converters, filters, switchgear, and control systems.

The HVDC converter station market includes the various companies involved in the design, manufacturing, and installation of these specialized facilities, as well as the maintenance and service providers that support them throughout their operational life. The market is driven by the increasing demand for renewable energy, the need to upgrade aging power transmission infrastructure, and the growing interest in interconnecting regional power grids to enhance energy security and resilience. In addition to this, the power capacity is becoming more dependent on renewable energy day by day. The International Renewable Energy Agency (IRENA) estimates that renewable energy could account for 90% of the world's power capacity by the year 2050. In addition to environmental benefits, renewable energy can also bring economic benefits. The renewable energy sector has created millions of jobs globally and has the potential to create many more in the coming years. Furthermore, renewable energy can reduce dependence on imported fossil fuels, improve energy security, and provide access to electricity in remote and underdeveloped areas. Hence, it is estimated to fuel the growth of the global HVDC converter station market over the projected period.

Key HVDC Converter Station Market Insights Summary:

Regional Highlights:

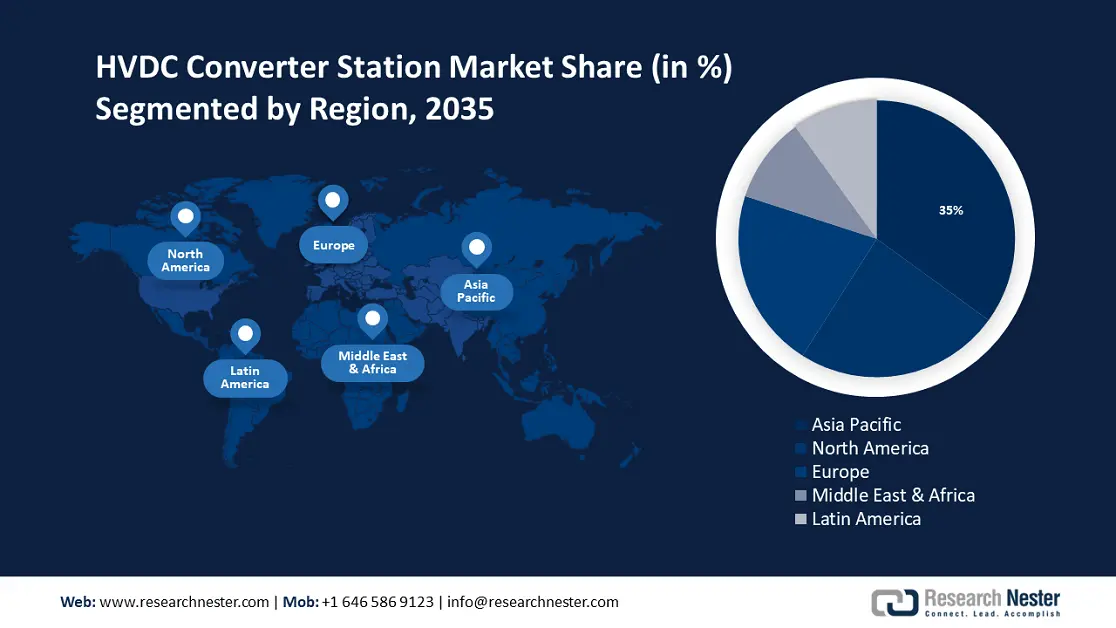

- Asia Pacific hvdc converter station market will hold around 35% share by 2035, driven by electricity demand, EV adoption, and investment in transmission systems.

- North America market will capture a 24% share by 2035, attributed to automotive industry expansion and increased vehicle ownership.

Segment Insights:

- The >2000 mw segment in the hvdc converter station market is projected to capture a 35% share by 2035, fueled by rising demand for high-capacity power transmission and renewable integration.

- The dc equipment segment in the hvdc converter station market is anticipated to achieve a 30% share by 2035, attributed to the increasing demand for renewable energy, energy storage, and EV infrastructure.

Key Growth Trends:

- Rising Installed Renewable Energy Capacity

- Rise in Research Spending

Major Challenges:

- High Cost of Installing HVDC Terminal Stations

- Dearth of Skilled Professionals

Key Players: ABB, Ltd., Siemens AG, General Electric Company, XJ Group Corporation, Bharat Heavy Electricals Limited, Alstom SA, Nissin Electric Co Ltd., Toshiba Corporation, Hitachi Ltd., C-EPRI Electric Power Engineering Co. Ltd.

Global HVDC Converter Station Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 10.41 billion

- 2026 Market Size: USD 10.89 billion

- Projected Market Size: USD 17.12 billion by 2035

- Growth Forecasts: 5.1% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: China, United States, Germany, Japan, India

- Emerging Countries: China, India, Japan, South Korea, Thailand

Last updated on : 9 September, 2025

HVDC Converter Station Market Growth Drivers and Challenges:

Growth Drivers

- Rising Installed Renewable Energy Capacity – The world has seen a significant increase in renewable energy generation capacity in recent years. As of the end of 2020, renewable energy had a total installed capacity of 2,799 GW, which represents an increase of 45% compared to 2015. HVDC converter stations play a crucial role in the transmission of renewable energy, particularly over long distances. HVDC converter stations are used to transmit power from offshore wind farms to onshore grids. Since offshore wind farms are typically located far from shore, HVDC transmission is often more cost-effective and efficient than using traditional AC transmission systems.

- Ongoing Urbanization around the world - Rising income levels and increasing demand for electricity nationwide contribute to increased demand for HVDC transmission. In today's world, 56% of his population live in urban areas, which is driving the demand for electricity across the globe. The urban population is expected to double by 2050, with almost 7 in 10 people living in cities.

- Rise in Research Spending – Growth in the global market during the forecast period can be further attributed to increased investment in research and development activities to continuously find more viable solutions for electricity transmission. Research reports show that global R&D spending has more than tripled in real terms since 2000, rising from about USD 680 billion to more than USD 2.5 trillion in the year 2019.

- Rapidly Growing Chemical Industry – For instance, chemical demand is expected to increase by 8% each year by 2025. By 2025, India's chemical industry will contribute USD 290 billion to its gross domestic product.

- Spiking Electricity Consumption – The world consumed nearly 23,500 TWh (terawatt-hours) of electricity in the year 2020, according to the International Energy Agency (IEA) and it is anticipated to grow more over the forecast period.

Challenges

- High Cost of Installing HVDC Terminal Stations – The cost of installing HVDC terminal stations can be high owing to several factors, including equipment costs, civil works, and others, which is estimated to hamper the market growth.

- Dearth of Skilled Professionals

- Presence of Product Alternative

HVDC Converter Station Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.1% |

|

Base Year Market Size (2025) |

USD 10.41 billion |

|

Forecast Year Market Size (2035) |

USD 17.12 billion |

|

Regional Scope |

|

HVDC Converter Station Market Segmentation:

Power Rating Segment Analysis

>2000 MW segment is poised to hold over 35% HVDC converter station market share by the end of 2035, accredited to the recent improvements in the power transmission capacity of valves. Apart from that, the need for high performance to connect renewable energy sources to the grid is also expected to drive the growth of the market segment in the future. Moreover, the line rectifier converter segment is estimated based on the technology to capture the largest share during the forecast period. This is owing to the low cost and high reliability of this technology compared to voltage source converters. The >2000 MW segment refers to large-scale power transmission projects that have a capacity of 2000 megawatts or more. The majority of >2000 MW projects are located in Asia, with China, India, and Pakistan leading the way. The most common technology used for >2000 MW projects is high-voltage direct current (HVDC) transmission, which is more efficient than traditional alternating current (AC) transmission over long distances.

Component Segment Analysis

DC equipment segment is expected to hold over 30% HVDC converter station market share by the end of 2035. DC is an abbreviation for direct current, which is a current that flows in one direction. In DC circuits, current flows in one direction, as opposed to alternating current (AC), where the current reverses 50 or 60 times per second, depending on the frequency of the power source. The growth of the segment can be accredited to the fact that production of DC equipment is growing rapidly as demand for renewable energy, energy storage, and electric vehicles continues to increase. According to a report by the International Energy Agency (IEA), global EV charger installations grew by 40% in the year 2020, reaching a total of 1.4 million chargers. While the COVID-19 pandemic may have temporarily slowed production and installation rates, the long-term trend is towards continued growth in the DC equipment segment.

Our in-depth analysis of the global market includes the following segments:

|

By Component |

|

|

By Power Rating |

|

|

By Technology |

|

|

By Configuration

|

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

HVDC Converter Station Market Regional Analysis:

APAC Market Insights

Asia Pacific region is estimated to capture HVDC converter station market share of around 35% by the end of 2035, attributed to the fact that there is a huge demand for transmission systems in China and India and a growing need for electricity to transport bulk goods in the region. Moreover, growing installations of electric vehicles throughout the region is also expected to fuel the regional market growth. According to a report by the International Energy Agency (IEA), China continues to lead the industry for EV chargers, accounting for nearly 80% of global installations in the year 2020. The demand for electricity in Asia Pacific is expected to grow significantly over the next few decades owing to population growth, urbanization, and economic development. This is driving the need for more efficient and reliable power transmission infrastructure, including HVDC converter stations. Many countries in Asia Pacific are investing in renewable energy sources such as solar and wind power to reduce their reliance on fossil fuels and address climate change. HVDC transmission technology is essential for integrating these variable renewable energy sources into the grid and ensuring stable and reliable power supply.

North American Market Insights

By the end of 2035, North America region is anticipated to account for HVDC converter station market share of more than 24%, primarily be attributed to the rapid expansion of the automotive industry. Approximately 923,000 Americans are engaged in manufacturing automobiles and their parts, and 1,251,600 work in dealerships. As of the year 2021, the U.S. auto and parts industry will generate approximately USD 1.5 trillion in revenue. The automobile industry contributes 3% of GDP to America. In addition, increased per capita income for local residents is estimated to enable them to switch to individual, environmentally friendly vehicles. Nearly 75% of the Americans say they owned a car by the year 2022, and another 20% say they would own a business or family car. Hence, this is expected to drive the market growth.

Europe Market Insights

Europe region is expected to observe significant growth till 2035, attributed majorly to the early and rapid adoption of advanced technologies and the increasing number of offshore wind farms. According to the WindEurope organization, Europe's offshore wind capacity increased by 2.9 GW in the year 2020. This year, 365 new offshore wind turbines were connected to the continent's grid. Moreover, increasing demand for electricity is expected to boost the market growth.

HVDC Converter Station Market Players:

- ABB, Ltd.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Siemens AG

- General Electric Company

- XJ Group Corporation

- Bharat Heavy Electricals Limited

- Alstom SA

- Nissin Electric Co Ltd.

- Toshiba Corporation

- Hitachi Ltd.

- C-EPRI Electric Power Engineering Co. Ltd

Recent Developments

-

IBSRELA, the first and only NHE3 inhibitor for the treatment of irritable bowel syndrome with constipation (IBS-C) in adults, is now available from the biopharmaceutical company Ardelyx. The first of its Ardelyx products approved by the US Food and Drug Administration is IBSRELA.

-

Indegene, a provider of technology-driven healthcare solutions, and meta Me Health, the manufacturer of Regulora and a prescription digital therapy (PDT) company, have announced that Regulora is a drug for the treatment of stomach pain (IBS) associated with irritable bowel syndrome.

- Report ID: 3723

- Published Date: Sep 09, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

HVDC Converter Station Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.