HVAC Systems Market Outlook:

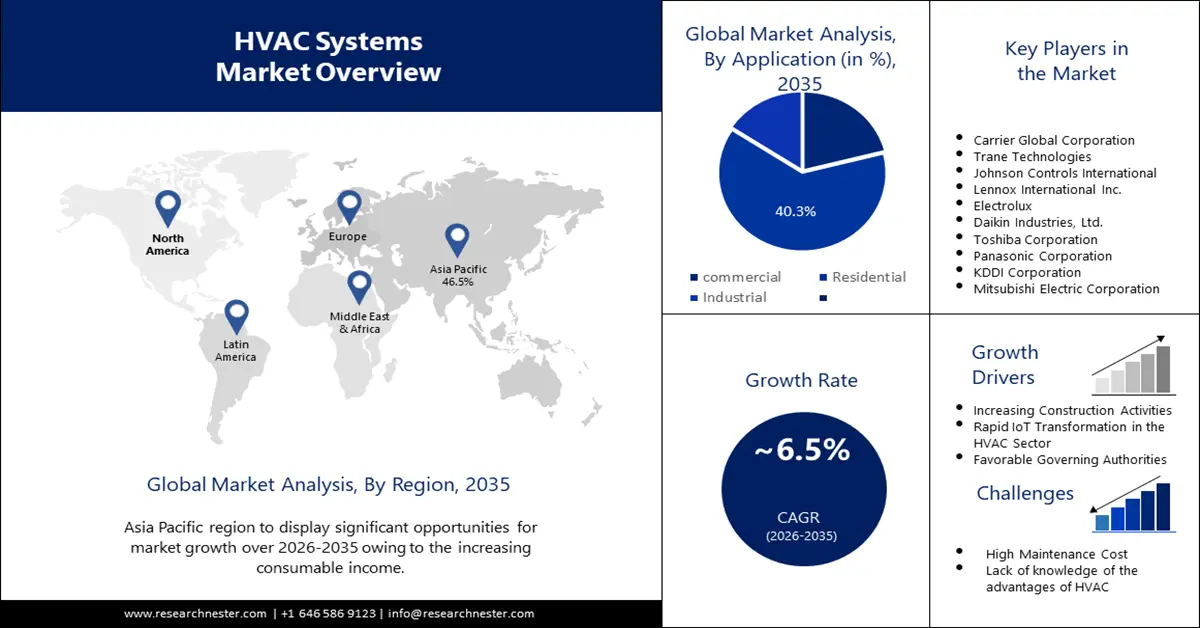

HVAC Systems Market size was over USD 240.91 billion in 2025 and is poised to exceed USD 452.22 billion by 2035, growing at over 6.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of HVAC systems is estimated at USD 255 billion.

With the rising stringency of carbon restrictions, there will be an increasing demand for energy-efficient buildings. As per the International Energy Agency, in 2022, building energy efficiency investments climbed by almost 14% to exceed USD 250 billion. Energy-efficient HVAC systems are therefore becoming increasingly necessary for both new construction and building retrofits. For instance, buildings that have undergone retrofitting can cut their energy use for heating and cooling by 50-90%. In addition, a well-maintained and energy-efficient HVAC system can significantly cut energy usage, and enable commercial buildings to lower their operating expenses and their carbon impact. Furthermore, it is anticipated that tax breaks and government programs that encourage the installation of energy-saving devices will promote the usage of HVAC systems and will have a favorable effect on HVAC system market expansion.

Key HVAC System Market Insights Summary:

Regional Highlights:

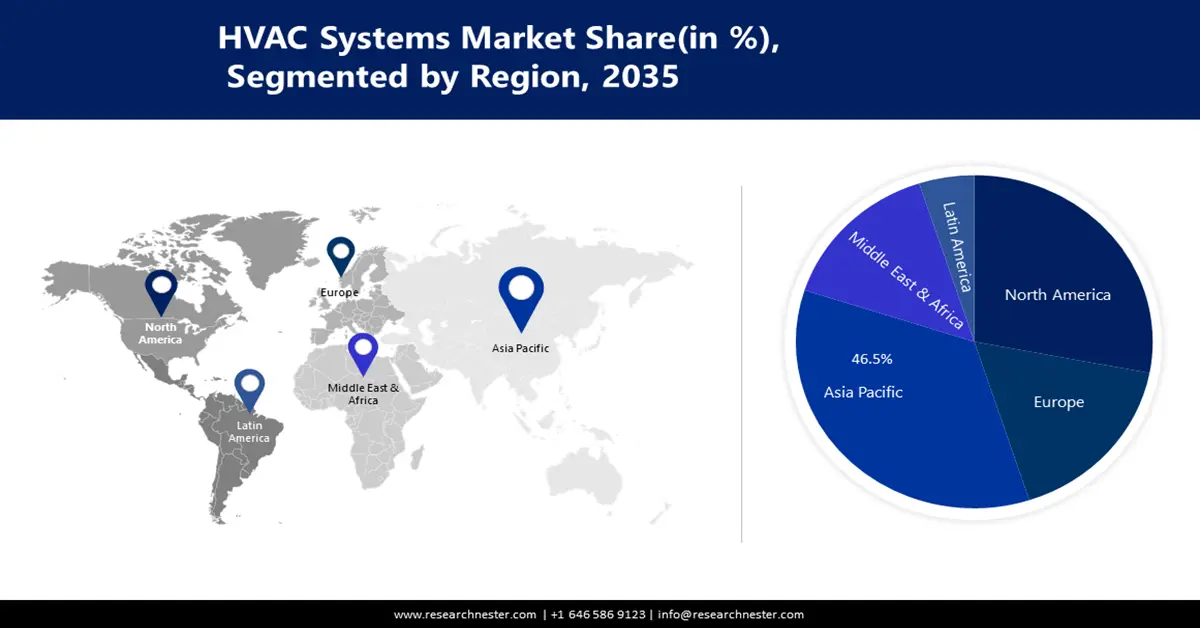

- The Asia Pacific hvac systems market will hold over 47.10% share by 2035, driven by rising living standards, rapid urbanization, and an expanding building sector.

- The North America market will achieve significant growth during the forecast timeline, attributed to growth of the healthcare industry which has resulted in an increased need for hospital HVAC systems.

Segment Insights:

- The cooling segment in the HVAC systems market is expected to capture a 45.50% share by 2035, driven by increasing demand for air conditioners in warm, developing countries.

- The new construction buildings segment in the hvac systems market is expected to hold a significant share by 2035, fueled by the growing number of hotels under construction requiring HVAC systems.

Key Growth Trends:

- Rising global temperatures

- Increasing integration of Internet of Things (IoT)

Major Challenges:

- Exorbitant initial and maintenance costs

- Environmental impact

Key Players: In terms of equipment type, the cooling segment is anticipated to account for the largest market share of 45.5% during 2025-2037.

Global HVAC System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 240.91 billion

- 2026 Market Size: USD 255 billion

- Projected Market Size: USD 452.22 billion by 2035

- Growth Forecasts: 6.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Asia Pacific (47.1% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Brazil

Last updated on : 11 September, 2025

HVAC Systems Market Growth Drivers and Challenges:

Growth Drivers

-

Rising global temperatures: The alarming global warming and concerns about environmental sustainability have led to a shift from the use of natural fossil fuels to home electrification, including washing machines, ESS solutions, air conditioners, dishwashers, and EV charging stations. In 2023, the average global temperature rose by around 1.2 degrees over pre-industrial levels. Increased global temperatures, especially in warmer climates, lead to a greater dependence on air conditioning equipment to keep interior temperatures safe and comfortable.

- Increasing integration of Internet of Things (IoT): Smart HVAC Systems are the result of a revolutionary change in HVAC technology with the integration of IoT. This allows real-time energy consumption monitoring, and obtaining data regarding the effectiveness of the system. IoT makes HVAC smart, by enabling preventative maintenance using condition-based insights and helps mitigate maintenance costs. By 2030, there will be over 30 billion Internet of Things (IoT) devices globally, nearly doubling from 15 billion in 2023.

- Incorporation of artificial intelligence (AI) in HVAC systems: With the potential to improve building efficiency, sustainability, and health, the future seems promising for AI-based automated heating and cooling systems. By evaluating data on usage patterns, AI-powered solutions are utilized to optimize the energy consumption of HVAC systems and provide a new degree of individualized comfort management. For instance, HVAC systems can lower energy use over 25% by utilizing AI's capacity to analyze massive volumes of real-time data.

Challenges

-

Exorbitant initial and maintenance costs: The initial cost of purchasing energy-efficient HVAC systems may be higher owing to the government's more stringent environmental laws in recent years which have increased the cost of manufacturing.

Additionally, air conditioners are typically more expensive since they require more connectivity, have more sophisticated capabilities than heating units, and the need for better service. - Environmental impact: Since the majority of HVAC systems run on electricity and require refrigerant, they contribute significantly to both global energy consumption and greenhouse gas emissions. The main challenge with air conditioners is that they release potent greenhouse gasses called hydrofluorocarbon refrigerants, that possess a significant GWP (global warming potential). As per the data of the United Nations Environment Programme, about 14,800 times more global warming potential (GWP) than carbon dioxide over 100 years is associated with hydrofluorocarbon (HFC)-23.

HVAC Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6.5% |

|

Base Year Market Size (2025) |

USD 240.91 billion |

|

Forecast Year Market Size (2035) |

USD 452.22 billion |

|

Regional Scope |

|

HVAC Systems Market Segmentation:

Equipment Type

The cooling segment in the HVAC system market is poised to gain the largest share of 45.5% in the coming years. The segment's tremendous growth rate can be augmented by the rapidly increasing market for air conditioners, particularly in warm, developing nations regions where temperatures are rising. In most nations, including Brazil, Thailand, Japan, Kenya, Nigeria, Australia, and Spain, more people use their air conditioners to stay cool during extreme heat waves. As per the International Energy Agency, it is anticipated that by 2050, up to 2.5 billion homes in warmer countries will own air conditioning units. Moreover, in hot areas where the entire structure needs to be cooled for extended periods, air conditioning is especially helpful in transforming living. Furthermore, there will be a substantial need for cooling as urban air temperature and solar radiation have grown.

Application

The residential segment in the HVAC system market is estimated to be the fastest-growing segment with a significant CAGR by 2035. This segment's rapid growth is attributed to the expanding rate of household air pollution caused by inadequate ventilation. A 2023 World Health Organization (WHO) report estimated that in 2020, household air pollution caused 3.2 million annual deaths, including approximately 237,000 deaths of children under the age of five. Eliminating the sources of dangerous pollutants such as allergens, and pathogens is an effective strategy to lessen their presence in households, which is possible to achieve with an HVAC system that incorporates cutting-edge filtration and purification technology that may considerably enhance indoor air quality. HVAC systems are important for infection control as they can have an impact on the mobility of infectious aerosols.

Application

The new construction buildings segment in the HVAC system market is projected to generate significant revenue over the coming years. This could be on account of the increasing number of hotels in the construction pipeline which might need HVAC systems to ensure that visitors are comfortable according to their unique requirements and preferences. For instance, as of the first quarter of 2024, there were more than 6190 hotels under development worldwide. Expanding construction endeavors encompassing the building of hotels is one of the main markets for HVAC systems. Air handling (AHU) systems are made especially for lodging facilities to circulate and purify the air, which may improve the summertime visitor experience when it's hot outside or when high humidity is likely to be uncomfortable.

Our in-depth analysis of the global market includes the following segments:

|

Application |

|

|

Equipment Type |

|

|

Sales Channel |

|

|

Service Type |

|

|

Implementation Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

HVAC Systems Market Regional Analysis:

APAC Market Insights

The Asia Pacific HVAC system market is set to gather the highest revenue share of 47.1% during the forecast period. The region's rising living standards, rapid urbanization, and an expanding building sector are likely to drive large investments in the HVAC industry from both domestic and foreign players. According to the Asian Development Bank, over 55% of Asia's population will live in cities by 2030. Moreover, people in the region will have greater access to air conditioning owing to the growing number of business buildings and offices, hotels, airports, and entertainment venues.

Also, in Japan, the data center (DC) market is expanding rapidly and is becoming increasingly attractive as a commercial prospect, led by the popularity of cloud computing and digital services. For instance, Japan's data center industry is expected to expand by around 7% between 2024 and 2029. Data centers require HVAC systems as a basic component to serve many functions outside just controlling the temperature, and keeping air quality under control.

China has become a global hub for the manufacturing of HVAC gear and components owing to its advantageous location, large pool of highly skilled workforce, and robust network of manufacturers, suppliers, and shipping firms. For instance, more than 230 million air conditioners were produced in China in 2023, roughly 21 million more than the year before.

South Korea HVAC system industry is positioned for ongoing expansion led by the increasing demand for smart homes in the country with the rapid integration of technology and digitalization. In 2020, more than 25% of households in South Korea used smart home applications.

North America Market Insights

North America region is expected to register significant growth till 2035, on account of the growth of healthcare industry which has resulted in an increased need for hospital HVAC systems, as well as associated goods and services, to regulate air quality, ventilation, humidity, and temperature inside hospital buildings. HVAC systems are essential to hospitals as they help prevent the spread of illnesses including COVID-19, MERS, SARS, and tuberculosis.

The U.S. is constantly spending on maintenance and replacement of HVAC systems due to age, obsolete parts, or improper maintenance. As per statistics published by the U.S. Department of Energy, in the United States, USD 14 billion is spent on HVAC servicing and repairs, and three million heating and cooling systems are replaced annually.

Canada's severe climate makes the HVAC system crucial for households. The winter temperatures can drop significantly, so having a reliable HVAC system is necessary to maintain the warmth. In addition, in Canada's cold regions, heat pumps are a tried-and-true technology that may give the house year-round comfort control by providing heat in the winter.

HVAC Systems Market Players:

- Samsung Electronics Co.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Carrier Global Corporation

- Daikin Industries, Ltd.

- Haier Group

- Havells India Ltd.

- Johnson Controls Inc.

- Trinity Hunt Partners

- LG Corporation

- TCCI Manufacturing

- Lennox International Inc.

- Rheem Manufacturing Company

To meet the needs of their customers, the major players in the HVAC system market are introducing a range of services by working together with well-known businesses that specialize in technology to improve their offerings.

Recent Developments

- In May 2024, Trinity Hunt Partners together with Sylvester & Cockrum (S&C) introduced its commercial HVAC platform, NexCore designed to assist its partner operating companies by making significant investments in people and technology and by fostering an industry-leading culture that places a high-value on the professional development of its workforce.

- In November 2023, TCCI Manufacturing collaborated with TekModo to close a long-standing gap in the industry by revolutionizing temperature control systems across a range of applications with a product that offers a flexible option for off-grid enthusiasts and portable sanitation systems.

- Report ID: 5207

- Published Date: Sep 11, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

HVAC System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.