Human Genetics Market Outlook:

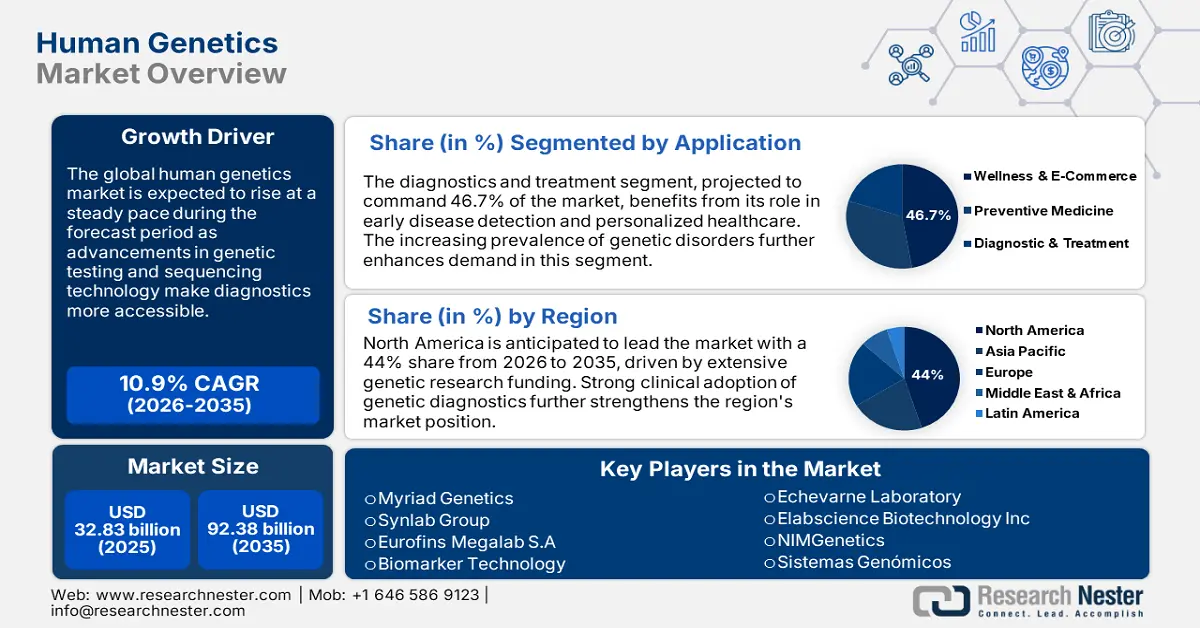

Human Genetics Market size was over USD 32.83 billion in 2025 and is poised to exceed USD 92.38 billion by 2035, growing at over 10.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of human genetics is evaluated at USD 36.05 billion.

Human genetics adoption is gaining traction due to advancements in gene sequencing technologies and an increasing need for personalized health solutions. Genetic testing permits early diagnosis, evaluation of risk, and treatment approaches for various life-threatening diseases, including some rare diseases and cancers. In July 2023, Novartis Espana partnered with DBGen Ocular Genomics to deliver genetic testing services for retinitis pigmentosa and Leber congenital amaurosis. Such collaborations highlight the demand for precision diagnostics in human genetics market. The engagement in such partnerships underlines the commitment of industry players to continuous innovation. This also opens up prospects for further growth, as governments and private investors are continually investing in genetic research and infrastructure.

Government support for genetic testing and personalized medicine creates more scope for players in the human genetics market. Many governments fund national genomic initiatives to study population-specific genetic information, which could help achieve better results in public health and ensure innovative healthcare. As governments continue to emphasize funding in healthcare research and develop policies that favor genetic advancements, the growth in the global human genetics industry is expected to be sustained.

Key Human Genetics Market Insights Summary:

Regional Highlights:

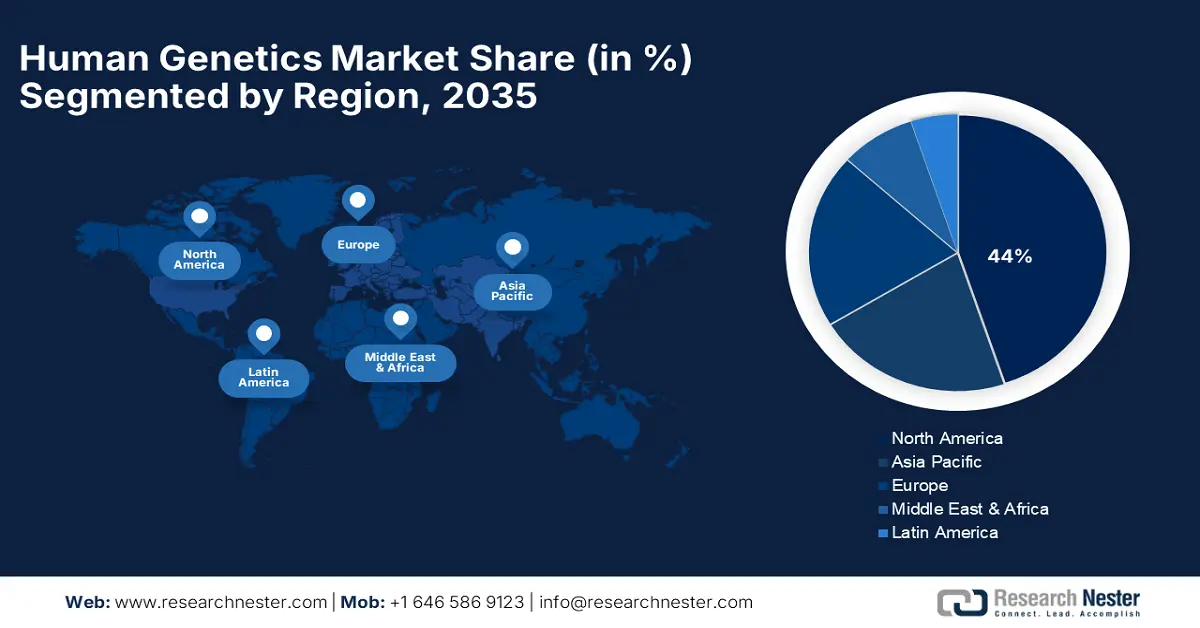

- North America dominates the Human Genetics Market with a 44.00% share, propelled by the high demand for personalized medicine and established healthcare infrastructure, fostering strong growth by 2035.

- The Asia Pacific region is projected to experience a significant growth rate in the Human Genetics Market from 2026 to 2035, driven by government support for genomic initiatives and a focus on personalized healthcare.

Segment Insights:

- The Diagnostics & Treatment segment is expected to hold a 46.70% share by 2035, fueled by growing demand for precise diagnosis and personalized treatment options.

- Non-Invasive Prenatal Testing segment is forecasted to achieve a 35% share by 2035, driven by growing demand for safe prenatal diagnosis.

Key Growth Trends:

- Advancements in sequencing technology

- Personalized medicine tailoring

Major Challenges:

- Ethical and privacy concerns

- Challenging regulatory environment

- Key Players: Myriad Genetics, LabCorp, GE Healthcare, QIAGEN, Agilent Technologies, Thermo Fisher Scientific, Illumina, Promega, biorad laboratories, Bode Technology, Orchid Cellmark, and LGS Forensic.

Global Human Genetics Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 32.83 billion

- 2026 Market Size: USD 36.05 billion

- Projected Market Size: USD 92.38 billion by 2035

- Growth Forecasts: 10.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (44% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, United Kingdom, Japan, France

- Emerging Countries: China, India, Brazil, Russia, Mexico

Last updated on : 14 August, 2025

Human Genetics Market Growth Drivers and Challenges:

Growth Drivers

-

Advancements in sequencing technology: Continuous improvements in next-generation sequencing (NGS) technology have made genetic testing more affordable and accurate, driving demand for human genetics applications. In March 2023, Illumina launched Connected Insights, a cloud-based software for comprehensive genomic profiling supporting complex genetic analysis. This innovation reflects the industry's progress in delivering faster, more accessible sequencing solutions, fueling human genetics market growth.

-

Personalized medicine tailoring: The shift towards personalized medicine raises demand because it enables the establishment of proper treatment programs based on a patient's genes. For example, Roche extended its partnership with Janssen in February 2023 to develop companion diagnostics and emphasize genetics in precision healthcare. This trend of care plans tailored to individuals enhances segment growth since healthcare providers want to offer better treatment options.

-

Increasing awareness and health prevention: As individuals become concerned that they may be genetically at risk of a particular disease, they undergo preventive genetic tests. This growth reflects increased demand for consumer-direct testing, taking steps towards prevention, thus contributing to the market's growth. Furthermore, with individuals becoming proactive with their health, interest in finding out potential health risks before symptoms arise prevails. Consequently, health providers and companies are investing in easily accessible genetic screening options to meet the high demand for preventive measures.

Challenges

-

Ethical and privacy concerns: Expanded access to genetic testing raises significant issues regarding data privacy and the responsible use of genetic information. Without fully developed regulatory requirements for data management, it becomes the responsibility of companies to comply with existing privacy legislation, which secures this sensitive genetic information about individuals. Sharing and possible misuse of genetic information by third parties is another critical issue that raises demand for stringent measures and transparency of use.

-

Challenging regulatory environment: Many genetics companies have faced challenging regulatory environments including the diverse needs of various regions. Long approval periods for genetic tests mean that new products cannot enter the market immediately, which limits consumer choice for new solutions. In addition, regulations are so intricate that companies must continuously adjust to these changing situations and there is significant investment involved in managing compliance with various jurisdictions.

Human Genetics Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.9% |

|

Base Year Market Size (2025) |

USD 32.83 billion |

|

Forecast Year Market Size (2035) |

USD 92.38 billion |

|

Regional Scope |

|

Human Genetics Market Segmentation:

Application (Wellness & E-Commerce, Preventive Medicine, Diagnostic & Treatment)

The diagnostics & treatment segment is expected to hold a share of 46.7% through 2035 due to the growing demand for precise diagnosis and personalized treatment options. This is attributed to the advancement of genetic testing, which provides essential insights into patient management. In July 2023, Quest Diagnostics launched Genetic Insights, which provides health reports tailored to an individual's genes, further cementing the need to enable early detection and preventive care in this segment. This trend reflects an increasing role of diagnostics in improving healthcare outcomes.

Test (NIPT, Carrier Testing, Pharmacogenomic Testing, Karyotype Testing, Thrombophilia Testing, Septin 9 Biomarker Testing, NGS, Others)

In human genetics market, Non-Invasive Prenatal Testing (NIPT) segment is set to capture revenue share of over 35% by 2035 due to the growing demand for safe prenatal diagnosis. NIPT facilitates early detection of genetic disorders in the fetus, offering vital importance in prenatal care. For instance, in July 2023, Optical Genome Mapping, an advanced technology for next-generation genetic testing, was introduced by a team of scientists from the Centre for Cellular and Molecular Biology, India. This development underlines the increase in the usage of complex genetic testing methodologies, thereby driving the demand for NIPT during the forecast period.

Our in-depth analysis of the human genetics market includes the following segments:

|

Application |

|

|

Test |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Human Genetics Market Regional Analysis:

North America Market Analysis

North America industry is predicted to hold largest revenue share of 44% by 2035, owing to its established healthcare infrastructure and high demand for personalized medicine for genetic testing. There is a strong concentration on precision health and preventive genetic testing activities, hence driving substantial growth in this region. Initiatives taken by governments and favorable reimbursement policies widen access to genetic testing. This lays a higher footing for healthcare and technology to continue promoting North America's leadership in genetics.

The U.S. is leading in genetic testing and precision medicine due to favorable regulatory settings and massive investments in genomic research. In March 2023, a report by Alnylam Pharmaceuticals, Inc. noted that its RNAi therapeutics had benefited more than 2,500 patients, underlining commitments within the U.S. toward state-of-the-art genetic therapies. As a result, such an adoption level places the U.S. among the leading countries in human genetics, particularly in RNA-based treatments.

The human genetics market in Canada is rising at a considerable pace due to government support for research, in addition to individual interest in genetic testing as a form of preventive care. For example, Health Canada advocates for the adoption of genetic diagnostics, making Canada a lucrative market for human genetics solutions. Furthermore, in January 2023, Canada supported the Genome Canada initiative to enhance genetic research, reflecting the country's commitment to precision medicine and innovative healthcare.

Asia Pacific Market Analysis

Asia Pacific human genetics market is anticipated to witness steady growth throughout the forecast period, due to the support of genomic initiatives by governments and a focus on personalized healthcare. The large population and increasing demand for healthcare create the backdrop for the potential expansion of applications in human genetics. Moreover, newly developed local infrastructure for biotechnology and research calls for accelerated regional innovation. With more nations investing in genomic research, Asia Pacific is likely to emerge as a major contributor to the global market.

The human genetics market in China is supported by the governmental approach to precision medicine with significant investments in genetic research infrastructures. Due to the large population, the country has focused on genomic research to address healthcare challenges. In October 2022, Oxford Nanopore Technologies partnered with 10x Genomics to streamline workflows in genetic testing, reflecting the country's emphasis on advanced diagnostics. Such a focus places China as one of the leading players in Asia Pacific.

The adoption of human genetics in India is being driven by plans for increasing infrastructure for genetic testing and research. Recently, India initiated the Genome Asia 100K project regarding the sequencing of Asian genomes, underlining a commitment toward population-specific genetic understanding. This initiative aligns with country’s goal toward precision medicine development and growth in the human genetics market.

Key Human Genetics Market Players:

- Myriad Genetics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Synlab Group

- Eurofins Megalab S.A

- Biomarker Technology

- Echevarne Laboratory

- Elabscience Biotechnology Inc

- NIMGenetics

- Sistemas Genómicos

- FullGenomics

- GENinCode

- Atrys Health

The human genetics market is fiercely competitive and consolidated in nature, with key major players including Myriad Genetics, LabCorp, GE Healthcare, QIAGEN, Agilent Technologies, Thermo Fisher Scientific, Illumina, Promega, Bio-Rad Laboratories, Bode Technology, Orchid Cellmark, and LGC Forensics. These companies focus on extending genetic testing portfolios through continuous technological development, partnerships, and acquisitions. The competitive landscape of the industry depicts a strong focus on precision medicine, wherein leading market players invest intensively in R&D to introduce new genetic tests and personalized healthcare solutions.

In September 2023, Myriad Genetics and Illumina announced two significant deal milestones for the advancement of genomic profiling and homologous recombination deficiency testing. The deal represents the strategic alliance trend among key players to advance specialized genetic diagnostics development. This partnership further highlights the importance of pooling resources and expertise to meet the rising demand for precision medicine, intensifying competition in the global human genetics market.

Here are some leading players in the human genetics market:

Recent Developments

- In March 2024, Nucleus Genomics introduced a DNA analysis product aimed at democratizing personalized medicine. While the link between DNA and health is well-established, healthcare has historically lacked comprehensive insights into how genetic variations impact individual health. This product seeks to bridge that gap.

- In December 2023, SNP Therapeutics Inc. launched a range of prenatal nutrition products alongside its Genate Test, a prenatal genetic screening tool. The new Generate Prenatal Nutrition line enables women to customize their diets based on specific gene variations that affect nutrient metabolism.

- Report ID: 6680

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Human Genetics Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.