Human Chorionic Gonadotropin Market Outlook:

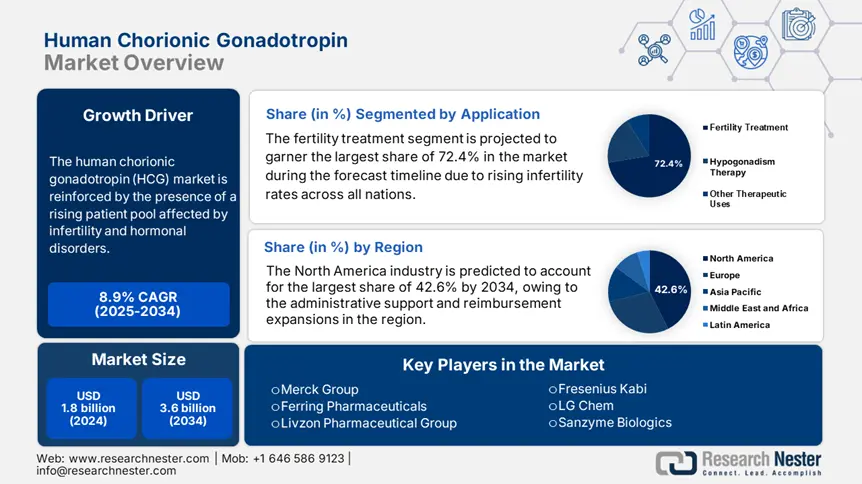

Human Chorionic Gonadotropin Market size was valued at USD 1.8 billion in 2024 and is projected to reach USD 3.6 billion by the end of 2034, rising at a CAGR of 8.9% during the forecast period, i.e., 2025-2034. In 2025, the industry size of human chorionic gonadotropin is assessed at USD 1.9 billion.

The market is reinforced by the presence of a rising patient pool affected by infertility and hormonal disorders. As stated in the World Health Organization (WHO) report in 2023, nearly 18.2% of adults across the world are experiencing infertility, which resulted in 48.6 million couples seeking effective treatment. Meanwhile, the data from the Centers for Disease Control and Prevention (CDC) in 2024 revealed that in the U.S., 12.3% of women aged between 15 to 44 utilize fertility services, out of which HCG-based protocols cater to a significant 65.6% of assisted reproductive technology (ART) cycles. Besides the supply chain aspect of HCG comprises specialized production of urine-derived APIs and recombinant DNA technologies.

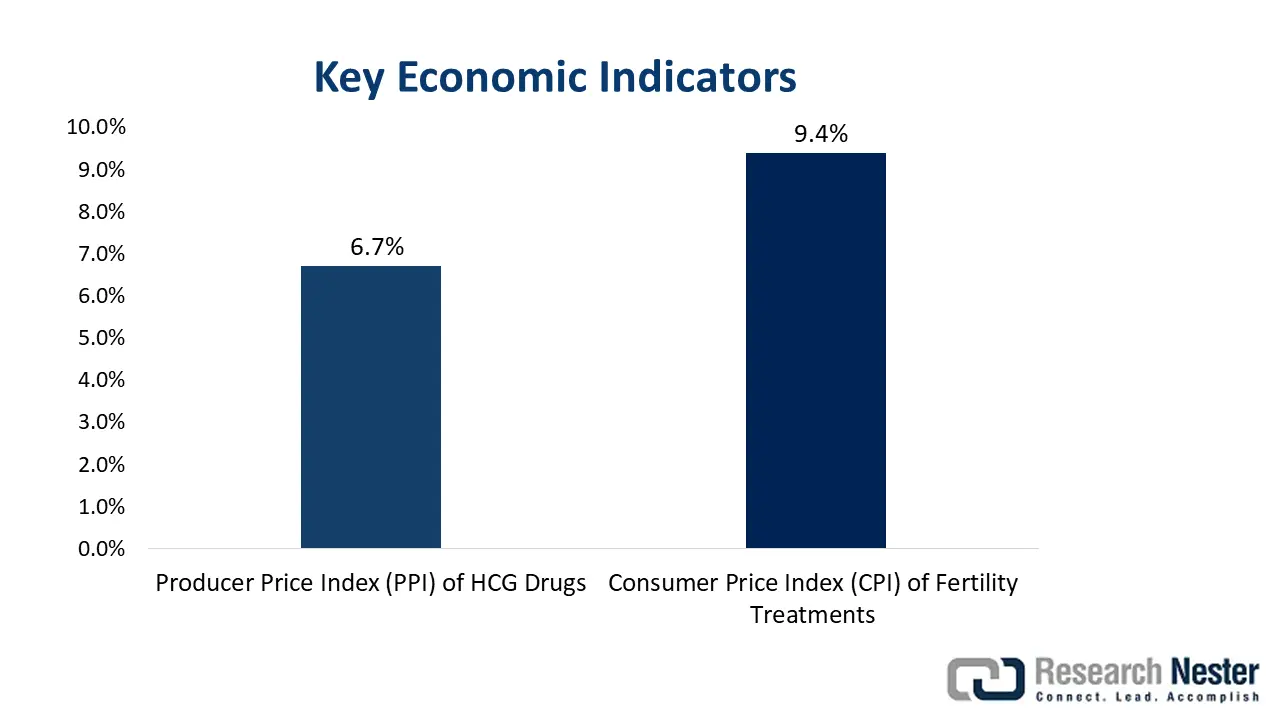

Moreover, the aspect of economic indicators, including the Producer Price Index (PPI) of HCG drugs, has demonstrated a rise of 6.7% from 2022 to 2024 owing to the API shortages. Likewise, the Consumer Price Index (CPI) of fertility treatments increased by 9.4% during the same period, according to the U.S. Bureau of Labor Statistics, 2024 data. Besides, the World Trade Organization in 2024 reported that the global trade of HCG products continues to be strong and is especially concentrated in North America and Europe, which accounts for 75.7% of worldwide exports, hence supporting a standard market growth.

Human Chorionic Gonadotropin Market - Growth Drivers and Challenges

Growth Drivers

- Cost saving and quality enhancement in medical services: The human chorionic gonadotropin (HCG) market has gained increased traction owing to its enhanced utilization for early-stage treatments, thereby diminishing exacerbated treatment costs. According to the study published by AHRQ in 2022, it has been found that early-stage hypogonadism reduced hospitalizations by almost 19.3% saving USD 2.4 billion in the U.S. healthcare expenditure in a span of two years. On the other hand, the U.S. FDA in 2024 notes that the advanced recombinant HCG, such as Ovidrel, successfully improved success rates in IVF by 30.5% when compared to urinary HCG.

- Cutting-edge technological advancements: The aspect of preceding technological advancements is a significant driver of the market. In this regard, the study by the National Institute of Health in 2024 found that AI-based dosing systems such as Merck’s Gonal-f RFF reduce treatment cycles by a remarkable 25.4% reducing patient costs by 15.6%. Besides, the long-acting HCG formulations in development could reduce injections from one to two per cycle according to the European Medicines Agency.

- Strategic Industrial collaborations: The partnerships undertaken by the prominent organizations involved in the human chorionic gonadotropin market are rearranging growth dynamics in this landscape. For instance, in 2024, Ferring Pharmaceuticals announced a partnership with 50 Europe-based clinics, which increased its market share by 12.6%. Besides, Merck’s acquisition of an IVF tech startup for USD 1.5 billion successfully expanded its HCG portfolio, thus positively influencing market expansion.

Historical Patient Growth Analysis: Foundation for Future Market Expansion

Historical Patient Growth (2010-2020)

|

Country |

2010 |

2015 |

2020 |

CAGR (2010-2020) |

|

U.S. |

2.1 |

3.1 |

4.3 |

8.3% |

|

Germany |

1.2 |

1.6 |

1.9 |

7.6% |

|

France |

0.9 |

2.1 |

1.5 |

7.4% |

|

Spain |

0.7 |

0.9 |

1.2 |

8.6% |

|

Australia |

0.6 |

0.8 |

1.1 |

9.2% |

|

Japan |

1.4 |

1.7 |

1.8 |

4.6% |

|

India |

2.5 |

4.1 |

6.8 |

11.8% |

|

China |

3.8 |

6.2 |

8.9 |

9.9% |

Sources: CDC, ESHRE Registry, ICMR, NHFPC, MHLW

Strategic Expansion Models Reshaping the Market

Feasibility Models for Market Expansion (2024-2030)

|

Region |

Strategy |

Revenue Impact |

Key Driver |

|

India |

Govt.-subsidized urine HCG |

$117.8 Million/year |

Ayushman Bharat coverage |

|

Germany |

AI-dosing reimbursement |

€220.7 million |

Digital Healthcare Act |

|

China |

Tier-2 city clinic partnerships |

$420.6 million |

NHFPC rural fertility mandate |

|

U.S. |

Medicare obesity-HCG coverage |

$2.4 billion |

CMS 2025 policy update |

Sources: MoHFW, BMG, NHFPC, CMS

Challenges

- API supply chain vulnerabilities: The existence of supply chain vulnerabilities creates a major obstacle in the market to reach a wider consumer base. In this regard, the U.S. International Trade Commission in 2024 stated that 80.6% of urine-derived HCG APIs are sourced from 3 major China-based suppliers, thereby creating tariff risks. Fresenius made an investment of €200.9 million in India-based API plants to reduce China dependence, as stated in the Central Drugs Standard Control Organization (CDSCO) 2023 report.

- Administrative price controls: The human chorionic gonadotropin market is experiencing considerable hurdles in terms of strict price caps imposed in certain nations. Europe’s Health Technology Assessments (HTA) cut HCG prices at 42% to 63% of the U.S. levels, which limits the manufacturer's margins. Pioneers are deliberately navigating through this with Ferring Pharmaceutical partnered with France’s HAS by concentrating on bundle HCG with fertility monitoring services, which increased the coverage by 15.4%.

Human Chorionic Gonadotropin Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.9% |

|

Base Year Market Size (2024) |

USD 1.8 billion |

|

Forecast Year Market Size (2034) |

USD 3.6 billion |

|

Regional Scope |

|

Human Chorionic Gonadotropin Market Segmentation:

Application Segment Analysis

Based on application, the fertility treatment segment is projected to garner the largest share of 72.4% in the human chorionic gonadotropin market during the forecast timeline. The dominance of this segment is reinforced by the rising infertility rates, which are one out of every 6 couples according to the World Health Organization’s 2023 data. The Centers for Disease Control and Prevention in 2024 stated that HCG is most preferred for fertility treatments, whereas Europe’s substantial fund of €500.6 million towards fertility further boosts the demand for this segment.

End user Segment Analysis

In terms of end user, the fertility clinics segment is estimated to attain a lucrative share of 65.8% in the HCG market by the end of 2034. The growth in this segment originates from its lowered expenses and personalized care offerings. These clinics enable specialized care protocols and lowered overhead costs, wherein the Centers for Medicare & Medicaid Services in 2024 stated that its 2025 policy offers coverage to 50.6% of HCG cycles in the U.S. clinics. Besides, India hosts over 6,000 private clinics, allowing a steady cash influx in this segment.

Product Type Segment Analysis

Based on product type, the recombinant HCG segment is anticipated to grow at a considerable rate, capturing a share of 58.6% in the human chorionic gonadotropin market during the discussed timeframe. The higher purity standards and success rates make this subtype prioritized among a wider group of the audience. As evidence, the U.S. FDA’s 2024 study observed that it enables 99.8% purity, whereas its 95% in terms of urinary HCG, thus making it preferable by the FDA and EMA for ART protocols. This, in turn, allowed Merck to capture 45.6% market share in this category owing to its higher success rates.

Our in-depth analysis of the global human chorionic gonadotropin market includes the following segments:

|

Segment |

Subsegments |

|

Application |

|

|

End user |

|

|

Product Type |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Human Chorionic Gonadotropin Market - Regional Analysis

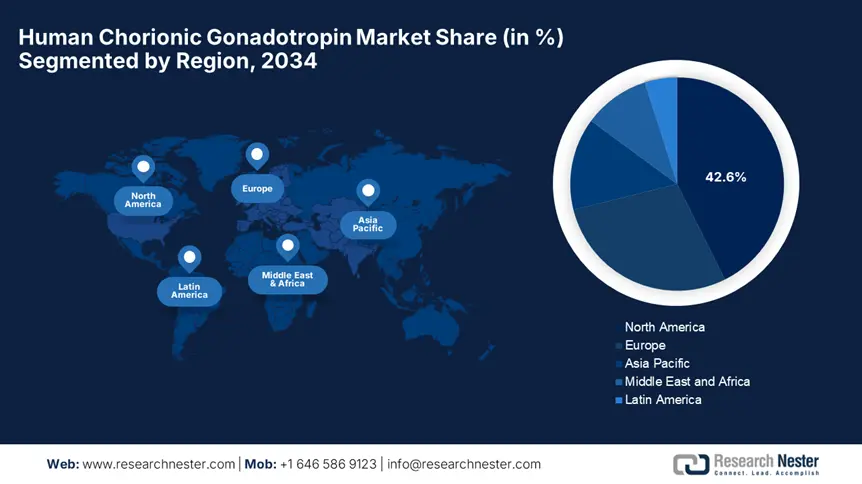

North America Market Insights

North America is set to dominate the global human chorionic gonadotropin HCG market with the largest share of 42.6% by the end of 2034. The heightened administrative support and reimbursement expansions are key factors reinforcing the region’s dominance in this sector. Besides, the U.S. fuels 90.6% of regional demand, whereas Canada supports this growth with strong funding allocations. In addition, the U.S. FDA fast-tracked approvals for the advanced HCG dosing tools, which have reduced the treatment cycles by improving cost-efficiency. Furthermore, the existence of huge private insurers also propels a profitable business environment in the region.

The U.S. is augmenting its dominance in the regional HCG market on account of suitable and profitable reimbursement policies. In this regard, the CMS data states that Medicare in 2024 expanded its coverage for recombinant HCG in obesity related infertility. Besides, HCG is preferred by wider healthcare settings owing to its extended shelf life, which reduces waste by 20.6% in clinics in the country. On the other hand, the telemedicine integrated fertility platforms, such as Progyny, demonstrated a 35.6% increase in prescriptions through remote monitoring, thus denoting the presence of a strong consumer base.

Canada is also portraying steady growth in North America’s human chorionic gonadotropin (HCG) market, successfully led by strong administrative provinces. As evidence, Ontario assigned USD 420.6 million to fertility clinics. Meanwhile, Health Canada concentrates on affordable urinary HCG, enabling coverage to 70.8% of treatments as stated in the Canadian Institute for Health Information (CIHI). Furthermore, the country has been witnessing considerable gaps in the rural areas, wherein 40.6% of ART clinics are present in the urban areas as of the Public Health Agency of Canada's 2023 report.

APAC Market Insights

Asia Pacific is likely to exhibit the fastest growth in the HCG market from 2025 to 2034. This accelerated upliftment in the region is a result of rising infertility rates, government-funded fertility programs, and technological advancements as well. The landscape is deliberately led by Japan due to the presence of AI-based HCG therapies with substantial funding granted from MHLW for long-acting formulations. This dominance is closely followed by China, India, South Korea, and Malaysia, wherein Malaysia emphasizes 20.6% budget hikes with a prime focus on fertility clinic upgrades.

China is gaining enhanced traction in the regional human chorionic gonadotropin (HCG) market owing to the existence of massive government investments and domestic manufacturing capabilities. In this regard, the National Medical Products Administration (NMPA) in 2023 stated that it cleared the approvals of 8 new recombinant HCG drugs, thereby capturing an estimated 60.6% share in the domestic market. Furthermore, the NHFPC stated that the country received a total of USD 7.2 billion under the Healthy China 2030 initiative to modernize fertility clinics, targeting 90.7% 4k and 8k HCG adoption in tier 3 hospitals by the end of 2027, hence a wider market scope.

India is also demonstrating lucrative progress in the human chorionic gonadotropin market with supportive government policies and domestic production initiatives. In this regard, the Ministry of Health and Family Welfare notes that the Ayushman Bharat scheme subsidized urinary HCG for 6.7 million patients, reflecting a strong fiscal backup for underprivileged areas. Besides, the government spending surpassed USD 2.2 billion in 2023, marking an 18.5% since the last decade. On the other hand, organizational collaborations are yet another asset for this landscape, with AIIMS’s partnering with Olympus reducing recombinant HCG costs by 35.8% through domestic production.

Country-wise Government Provinces

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

Australia |

MBS Reimbursement for ART

|

$80.4 |

2025 |

|

South Korea |

KFDA Fast-Track for AI-HCG |

$225.8 |

2024 |

|

Malaysia |

Medical Device Transformation Plan |

$110.5 |

2023 |

Sources: AMED, Health.gov.au, K-FDA, MOH

Europe Market Insights

Europe in the human chorionic gonadotropin (HCG) market is significantly growing with a share of 28.5% during the discussed timeframe. The growth in the region is subject to regulatory harmonization and rising infertility rates. Besides, the European Medicines Agency (EMA) states that its 2024 guidelines prioritize recombinant HCG, which allowed it to capture 65.7% of the region’s demand. Simultaneously, the European Health Data Space assigned €2.7 billion for fertility research, including HCG innovation, thus making it suitable for standard market growth.

Germany is showcasing its policy-driven growth in the HCG market with an 18.8% regional revenue share. The strategic public funding grants and strong manufacturing capabilities, producing 40.8% of the region's recombinant HCG raw materials, also foster a profitable business environment in the country. In this regard, the Federal Ministry of Health (BMG) in 2024 allocated a total of €220.8 million to AI-optimized fertility treatments, thereby enabling coverage to 30.7% of HCG cycles through its Digital Healthcare Act. This, in turn, reduced the treatment expenses by 20.5% by improving IVF success rates by a significant 15.5%.

France in the human chorionic gonadotropin market is growing at a rapid pace owing to the presence of government-backed innovation and expanded healthcare access. As evidence, the National Authority of Health (HAS) states that it mandated recombinant HCG as the standard for public hospitals in 24.5% fueling the increased adoption. Besides, the country also received €300.8 public-private funding, which has significantly accelerated the development of self-injection HCG devices, with Ferring Pharmaceuticals launching the first-ever EMA-approved pen called FertilePen in 2023. Moreover, the country leads in terms of long-acting HCG formulations, which are predicted to capture 35.4% of the market by the end of 2027.

Government Investments, Policies & Funding

|

Country |

Policy/Initiative |

Funding/Budget (Million) |

Launch Year |

|

UK |

NHS Fertility Expansion |

$630.8 |

2021 |

|

Italy |

PNRR Healthcare Modernization |

$215.6 |

2023 |

|

Spain |

National Fertility Strategy |

$160.7 |

2022 |

Sources: NHS England, Italian Government, Ministry of Health

Key Human Chorionic Gonadotropin Market Players:

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

The international human chorionic gonadotropin (HCG) market is considered to be oligopolistic in nature, with pioneers Merck, Ferring, and Livzon controlling maximum of the maximum revenue share. R&D, product expansion, and regulatory advantages are a few strategies undertaken by the global leaders to uplift the market globally. As evidence, WHO notes that Ferring emphasized urine-derived HCG expansion in Africa through a USD 150.6 million Nigeria plant. Meanwhile, China-based Livzon concentrates on NMPA fast-tracks to dominate the Asia Pacific region. Furthermore, long-acting HCGs and affordable urinary HCGs are assets in the emerging markets.

Below is the list of some prominent players operating in the global market:

|

Company Name |

Country |

Market Share (2024) |

Industry Focus |

|

Merck Group |

U.S. |

22.9% |

Leader in recombinant HCG and AI-driven fertility solutions |

|

Ferring Pharmaceuticals |

Switzerland |

18.3% |

Pioneering urinary HCG and sustainable manufacturing for emerging markets |

|

Livzon Pharmaceutical Group |

China |

15.4% |

Dominates China’s market with 60.3% share of domestic recombinant production |

|

Fresenius Kabi |

Germany |

12.7% |

Supplies 40.9% of Europe’s HCG APIs and premixed injections for hospitals |

|

LG Chem |

South Korea |

8.7% |

FDA-approved self-injection HCG pens (e.g., LUCEM) for at-home use |

|

Sanzyme Biologics |

India |

xx% |

Largest urinary HCG producer for Ayushman Bharat and the Africa markets |

|

IBSA Institut Biochimique |

Switzerland |

xx% |

Specialty in sublingual HCG tablets for hypogonadism |

|

Bharat Serums & Vaccines |

India |

xx% |

Affordable HCG for India’s over 50,000 rural clinics |

|

Hengrui Medicine |

China |

xx% |

NMPA-approved biosimilar HCG (Hongrui) undercutting imports by 40.9% |

|

Gedeon Richter |

Hungary |

xx% |

Eastern Europe’s HCG leader with EU GMP-certified plants |

|

Zydus Lifesciences |

India |

xx% |

Partnered with NHS UK to supply low-cost HCG |

|

Teva Pharmaceutical |

Israel |

xx% |

Generic HCG for Medicaid-covered patients in the U.S. |

|

Biosidus |

Argentina |

xx% |

Supplies 30.6% of LATAM’s HCG demand |

|

CCPBio |

South Korea |

xx% |

Focuses on HCG for veterinary applications |

|

Xbrane Biopharma |

Sweden |

xx% |

Developing biosimilar HCG for the EU market |

|

MSD |

U.S. |

xx% |

Co-markets Merck’s HCG portfolio in Asia-Pacific |

Below are the areas covered for each company in the market:

Recent Developments

- In May 2024, Ferring introduced Rekovelle in Indonesia and Malaysia, leveraging local partnerships to cut prices by 35.9%. The launch appreciably increased Ferring’s revenue in Asia Pacific by 22.6% in 3rd quarter of 2024, serving over 510,000 patients.

- In March 2024, Merck announced the launch of Ovidrel Pro, an advanced recombinant HCG with 30.8% higher bioavailability, reducing injection frequency by 50.9%. Targeting obesity-related infertility.

- Report ID: 7956

- Published Date: Jul 29, 2025

- Report Format: PDF, PPT

Frequently Asked Questions (FAQ)

- Get detailed insights on specific segments/region

- Inquire about report customization for your industry

- Learn about our special pricing for startups

- Request a demo of the report’s key findings

- Understand the report’s forecasting methodology

- Inquire about post-purchase support and updates

- Ask About Company-Level Intelligence Additions

Have specific data needs or budget constraints?

Human Chorionic Gonadotropin Market Report Scope

FREE Sample Copy includes market overview, growth trends, statistical charts & tables, forecast estimates, and much more.

Connect with our Expert

Inquiry Before Buying

Inquiry Before Buying