Hot-dip Galvanizing Market Outlook:

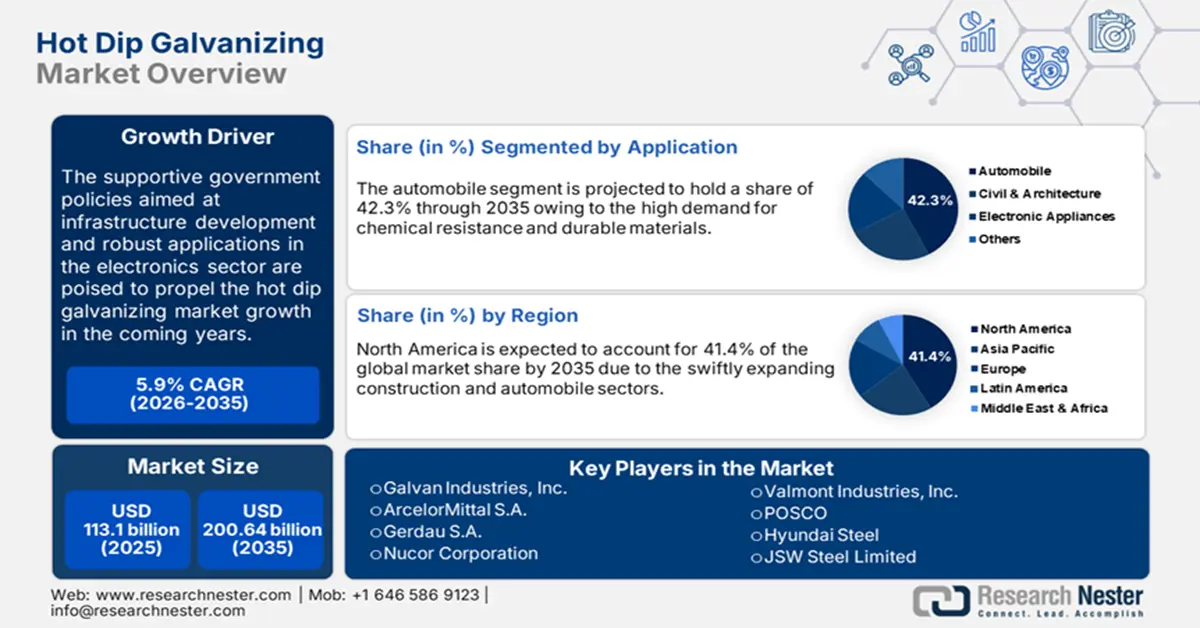

Hot-dip Galvanizing Market size was valued at USD 113.1 billion in 2025 and is set to exceed USD 200.64 billion by 2035, registering over 5.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hot-dip galvanizing is estimated at USD 119.11 billion.

The swift rise in the industrial and urban activities in developing regions such as Asia Pacific, Latin America, and MEA is opening profitable doors to hot-dip galvanizing companies. These emerging hot-dip galvanizing markets are witnessing high investment actions, particularly in infrastructure development projects. The smart city initiatives are driving the demand for several advanced materials and substances used in buildings and construction. Brenner Base Tunnel, Grand Paris Express, HS2, the Regional Environmental Sewer Conveyance Upgrade Program (RESCU), and NEOM the City of Tomorrow are some of the significant infra-development projects, worldwide. This is explaining the profitability chances of investing in the hot-dip galvanizing business.

The growth in migration activities in both developed and developing regions is driving a boom in the real estate and construction sectors. The World Bank states that 56.0% of the world’s population is residing in urban areas, around 4.4 billion are living in cities and this number is set to double by 2050. The boasting demand for residential and commercial structures is poised to propel the sales of hot-dip galvanized steel in the coming years. For instance, the U.S. Census Bureau disclosed that in January 2025, 1,483,000 residential buildings were allowed permits. Furthermore, the Office of National Statistics estimates that in Great Britain the construction output expanded by 0.5% in Q4’24 compared to Q3’23.

Key Hot-dip Galvanizing Market Insights Summary:

Regional Highlights:

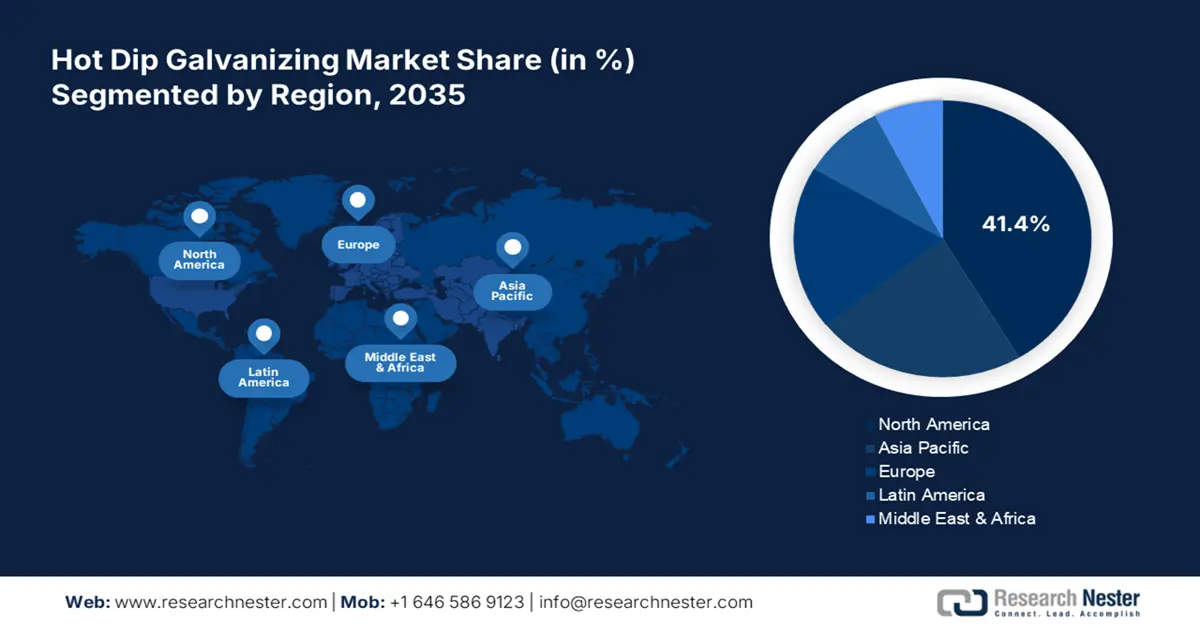

- North America holds a 41.40% share in the Hot-dip Galvanizing Market, driven by robust automobile manufacturing and infrastructure development, positioning it for strong growth through 2035.

- Asia Pacific’s Hot-dip Galvanizing Market is forecasted to achieve the fastest CAGR by 2035, driven by high government funding and favorable foreign direct investment policies.

Segment Insights:

- The Automobile segment is projected to hold 42.3% market share by 2035, fueled by booming automobile production and registrations boosting hot-dip galvanizing demand.

- The Batch Type segment is anticipated to dominate by 2035, driven by flexibility and infrastructure development.

Key Growth Trends:

- Electronics sector driving demand for innovative materials

- Finding high applications in renewable energy projects

Major Challenges:

- Easy availability of alternative coating technologies

- Environmental concerns barrier to sales growth

Key Players: Galvan Industries, Inc., ArcelorMittal S.A., Gerdau S.A., Nucor Corporation, and ThyssenKrupp AG.

Global Hot-dip Galvanizing Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 113.1 billion

- 2026 Market Size: USD 119.11 billion

- Projected Market Size: USD 200.64 billion by 2035

- Growth Forecasts: 5.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (41.4% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Brazil, Mexico, South Korea

Last updated on : 13 August, 2025

Hot-dip Galvanizing Market Growth Drivers and Challenges:

Growth Drivers

- Electronics sector driving demand for innovative materials: Continuous technological advancements are aimed to propel the profits of hot-dip galvanizing market players. Electronic appliance companies are widely employing advanced hot-dip galvanizing technologies to meet the increasing consumer demands and overall productivity. The rising sales of electronics products are augmenting the use of innovative hot-dip galvanizing technologies to enhance the corrosion resistance and aesthetics of the products.

- Finding high applications in renewable energy projects: The rising popularity of renewable energy sources is also propelling the sales of hot-dip galvanized products. The wind, hydro, and solar power generating projects are widely pushing the demand for hot-dip galvanized materials and metals. Corrosion-resistant galvanized steel components offer high durability and need less maintenance. The offshore wind energy plants’ equipment and infrastructure are established in harsh environments, and hot-dip galvanized metals and materials provide an essential solution to maintain structural integrity in extreme conditions.

Challenges

- Easy availability of alternative coating technologies: The hot-dip galvanizing companies are witnessing high competition from alternative coating technologies. The easy and cost-effective availability of alternative solutions such as hot zinc spray, powder coatings, sherardizing coatings, and electro-galvanization are prime barriers to hot-dip galvanizing sales. To overcome this issue, hot-dip galvanizing market players are estimated to adopt technological innovation strategies. Continuous technological advancements lead to the production of innovative solutions, which attract a larger customer base.

- Environmental concerns barrier to sales growth: Hot-dip galvanizing is an energy-intensive process, which has the potential to create environmental concerns. The galvanizing process also leads to the emission of hazardous chemicals and substances. The concerns related to air pollution and waste disposal are challenging the hot-dip galvanizing market growth to some extent. Integration of sustainable manufacturing practices and zero carbon technologies are poised to aid manufacturers over environmental concerns.

|

Production of Motor Vehicle Oct 2024-Oct 2024 |

|||

|

Passenger Cars |

|||

|

Standard |

Small |

Mini |

Total |

|

462,258 |

114,105 |

131,013 |

707,376 |

|

Trucks |

|||

|

Standard |

Small |

Mini |

Total |

|

44,426 |

16,400 |

37,523 |

98,349 |

Source: Japan Automobile Manufacturers Association (JAMA)

Hot-dip Galvanizing Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

5.9% |

|

Base Year Market Size (2025) |

USD 113.1 billion |

|

Forecast Year Market Size (2035) |

USD 200.64 billion |

|

Regional Scope |

|

Hot-dip Galvanizing Market Segmentation:

Application (Automobile, Civil & Architecture, Electronic Appliances, Others)

Automobile segment is projected to capture hot-dip galvanizing market share of around 42.3% by the end of 2035. Hot-dip galvanized products are widely used in automobile manufacturing such as chassis, bumper, and doors. The majority of car parts are protected through galvanizing owing to long-lasting corrosion resistance and enhanced vehicle lifespan. The booming automobile production and registrations are poised to propel the overall hot-dip galvanizing market growth in the years ahead. For instance, the European Automobile Manufacturers' Association (ACEA) estimated that nearly 85.4 million motor automobiles worldwide, in 2022. A rise of 5.7% was observed in 2022 compared to the previous year. The growing popularity of zero-emission vehicles is also estimated to back the sales of hot-dip galvanized products.

Type (Batch Type, Continuous Type)

The batch type segment is foreseen to account for a dominating hot-dip galvanizing market share by 2035. The prime factors fueling the demand for batch type galvanizing are its flexibility and customization. The global push towards infrastructure development is significantly promoting the sales of galvanized steel products. The batch type galvanization is widely preferred in building and construction owing to its durability and corrosion resistance qualities, leading to overall hot-dip galvanizing market growth. The boom in buildings, bridges, railways, and road development actions is anticipated to amplify the demand for batch type galvanizing processes.

Our in-depth analysis of the global hot-dip galvanizing market includes the following segments:

|

Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hot-dip Galvanizing Market Regional Analysis:

North America Market Forecast

North America in hot-dip galvanizing market is expected to capture around 41.4% revenue share by the end of 2035. The robust automobile manufacturing activities are propelling the sales of hot-dip galvanized products and technologies. The rising construction and infrastructure development actions are foreseen to increase the demand for hot-dip galvanized steel solutions. The strong presence of key players is also driving the overall hot-dip galvanizing market growth in both the U.S. and Canada. For instance, the American Galvanizers Association (AGA) states that around 78 galvanizing companies are established in North America with over 175 plants.

In the U.S., the swiftly expanding construction and automotive sector is positively influencing the hot-dip galvanizing technology and product sales growth. For instance, the U.S Energy Information Administration (EIA) unveiled that the country documented a significant 21.2% share of electric and hybrid vehicle sales in the third quarter of 2024. Furthermore, high investments in residential and commercial buildings are expected to increase the demand for galvanized steel products.

|

New Residential Construction, January 2025 |

|

|

Building Permits |

1,483,000 |

|

Housing Starts |

1,366,000 |

|

Housing Completions |

1,651,000 |

Source: U.S. Census Bureau

Similar to the U.S., Canada is also witnessing high infrastructure development activities coupled with favorable investments. Rising urban trends are fueling the need for residential and commercial structures. For instance, in 2023, the Government of Newfoundland and Labrador, Canada, invested USD 1.1 billion in infrastructure growth. Furthermore, the Statistique Canada states that in December 2024, the country recorded USD 15.34 billion in investment in building and construction.

Asia Pacific Market Statistics

The Asia Pacific hot-dip galvanizing market is anticipated to increase at the fastest CAGR from 2025 to 2035. The consumer electronics, automotive, construction, and fabrication sectors are opening profitable doors for hot-dip galvanizing companies. High funding from governments and favorable foreign direct investment policies are amplifying the hot-dip galvanizing trade activities in Asia pacific. China and India owing to robust industrial and urban activities are foreseen to fuel the sales of hot-dip galvanized materials and substances. On the other end, South Korea and Japan backed by innovation dominance are estimated to augment the sales of advanced hot-dip galvanizing technologies during the foreseeable period.

China’s electronics market is poised to drive the sales of hot-dip galvanizing technologies owing to their high need for chemical resistance and durable products. Research Nester’s study estimates that China’s electronics sector is estimated to hold significant revenue share during the forecast period. The rapidly growing automotive market is also set to increase the sales of hot-dip galvanized steel products. In 2024, nearly 4.0 million cars were exported by China, according to the International Energy Agency (IEA).

India is witnessing high foreign, as well as domestic investments in the infrastructure sector, owing to supportive allocations in budgets. The rise in urban moves and smart city initiatives are directly influencing the sales of hot-dip galvanizing technologies. For instance, the India Brand Equity Foundation (IBEF) reveals that the foreign direct investments (FDI) in construction and infrastructure development activities totaled USD 26.5 billion and USD 33.5 billion, respectively, between April 2000 and December 2023. Furthermore, in March 2024, around 15 airport projects were inaugurated by the Minister of Civil Aviation and Steel, worth USD 12.1 billion. Thus, the construction and building sector of India is expected to offer high returns to hot-dip galvanizing companies.

Key Hot-dip Galvanizing Market Players:

- Galvan Industries, Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- ArcelorMittal S.A.

- Gerdau S.A.

- Nucor Corporation

- ThyssenKrupp AG

- Voestalpine Group

- Steel Dynamics, Inc.

- Nippon Steel and Sumitomo Metal

- United States Steel Corporation

- Tata Steel Limited

- NLMK Group

- Rolled Steel Products, Inc.

- Valmont Industries, Inc.

- POSCO

- Hyundai Steel

- JSW Steel Limited

The hot-dip galvanizing market is characterized by the presence of industry giants and the increasing emergence of start-ups. The robust infrastructure expansion actions and boom in the automotive market are set to augment the revenues of hot-dip galvanizing companies in the years ahead. The key players are widely employing organic and inorganic strategies to multiply their revenue shares and maximize their market reach. Technological innovations and regional expansion tactics are propelling the organic sales of hot-dip galvanizing companies. Apart from this, strategic collaborations & partnerships, and mergers & acquisitions are expected to aid hot-dip galvanizing market players in uplifting their position in the global landscape.

Some of the key players include:

Recent Developments

- In September 2024, Galvan Industries, Inc. announced that their hot-dipped galvanized steel is finding high application in BMW’s new EV battery assembly plant in Woodruff, S.C. This is majorly driven by the expansion of the USD 700 million facility.

- In April 2024, the American Galvanizers Association (AGA) revealed the names of the winners of the 2024 Excellence in Hot-Dip Galvanizing Awards during their Annual Conference in St. Thomas, USVI. This year's highest honor, the Most Distinguished award was earned by the REM Light Rail in Montreal, Quebec.

- Report ID: 7238

- Published Date: Aug 13, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hot-dip Galvanizing Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.