Hospital Information System Market Outlook:

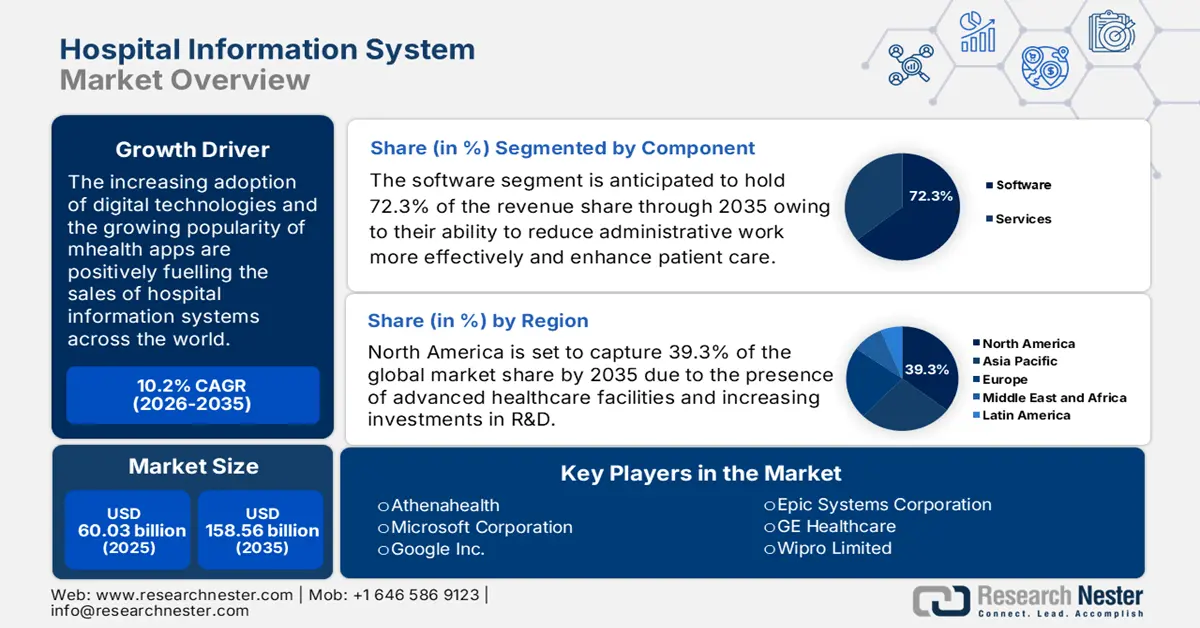

Hospital Information System Market size was over USD 60.03 billion in 2025 and is anticipated to cross USD 158.56 billion by 2035, growing at more than 10.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hospital information system is estimated at USD 65.54 billion.

The hospital information system also known as the hospital management system effectively streamlines the workflow in the healthcare facilities. The rising adoption of telehealth and digital health solutions sustainably supports the hospital information system market growth. Many healthcare providers use digital healthcare applications to understand their health history as these applications seamlessly integrate with hospital management software and improve the overall productivity of healthcare facilities.

The Global Strategy on Digital Health 2020 to 2025 is expected to fuel the adoption of advanced hospital information system in the coming years. This plan aims to promote digital health knowledge and enhance the public-centered healthcare system. Thus, the digitalization trend is anticipated to augment the sales of hospital information system during the projected period.

Key Hospital Information System Market Insights Summary:

Regional Highlights:

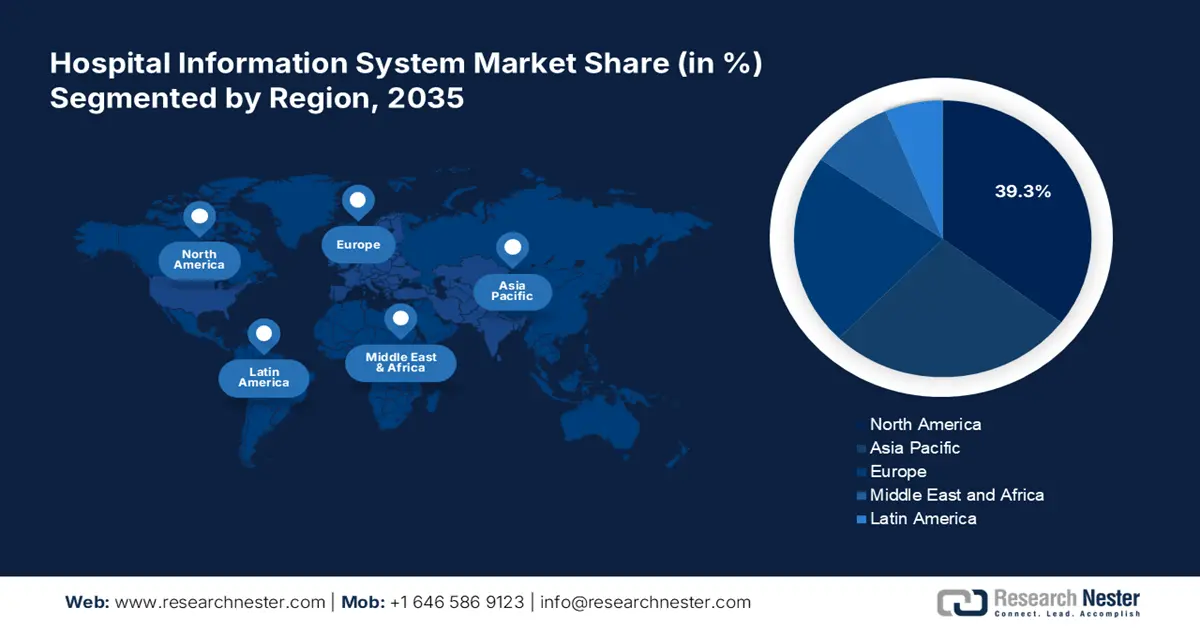

- North America holds a 39.3% share in the Hospital Information System Market, driven by advanced healthcare facilities and robust market players, ensuring strong growth through 2026–2035.

- The Asia Pacific Hospital Information System market is forecasted for rapid expansion by 2035, driven by increasing investments in healthcare facilities and digital adoption.

Segment Insights:

- The Software segment is projected to lead with a 72.3% market share by 2035, driven by the increasing need to enhance healthcare infrastructure and develop advanced solutions.

- The Cloud-based segment is expected to capture 58.6% market share by 2035, driven by the cost-effectiveness of cloud systems supporting low-budget healthcare facilities.

Key Growth Trends:

- Integration of AI and ML

- Investments to improve healthcare facilities

Major Challenges:

- Data privacy concerns

- Resistance to change

- Key Players: Athenahealth, Google Inc., Microsoft Corporation, Cerner Corporation, Comarch SA., and Dedalus SpA.

Global Hospital Information System Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 60.03 billion

- 2026 Market Size: USD 65.54 billion

- Projected Market Size: USD 158.56 billion by 2035

- Growth Forecasts: 10.2% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (39.3% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 14 August, 2025

Hospital Information System Market Growth Drivers and Challenges:

Growth Drivers

- Integration of AI and ML: Advanced technologies such as cloud computing, artificial intelligence (AI), and machine learning (ML) are widely adopted in several sectors and healthcare is no exception. For instance, around 18.7% of hospitals in the U.S. adopt some form of artificial intelligence in their systems. Hospital information system are being increasingly integrated with these technologies to improve the features and overall operations in healthcare facilities. In the long-term view, these technologies are estimated to evolve more and transform the landscape of healthcare management systems.

- Investments to improve healthcare facilities: Public healthcare facilities witness a high intake of patients, and due to less availability of digital technologies most of the administrative work is carried out on paper. The loss of one document can significantly hamper patient care and challenge the workflow. Thus, to overcome this issue, governments worldwide are spending more on advancing their healthcare facilities. Hospital information system such as electronic health records, administrative information systems, and clinical informative systems enhance administrative and patient care environments in public settings. Apart from this, some governments are also engaging in initiatives to improve healthcare systems in other regions. For instance, the U.S. Agency for International Development invests in strengthening the healthcare systems in different regions to reduce the risk of any future pandemics and optimize administrative work.

Challenges

- Data privacy concerns: The rise in the adoption of software solutions can attract several cyber attackers even in healthcare settings. Hackers often try to steal the financial information of patients, which can lead to high losses due to ransom payments. Also, high-profile breaches can lead to public distrust hampering the goodwill of healthcare providers and limiting the adoption of information systems. For instance, the U.S. Department of Health and Human Services, Tri County Medical Supply and Respiratory Services Inc. reported a data breach in October 2024 affecting around 8000 people.

- Resistance to change: Many hospital facilities in developing economies often resist adopting advanced technologies due to lack of knowledge and familiarity with existing conventional systems. The integration of advanced technologies also requires high investments in terms of installation and maintenance. Many healthcare facilities don’t employ skilled IT technicians and rely on third-party service providers, which again contributes to the overall costs.

Hospital Information System Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

10.2% |

|

Base Year Market Size (2025) |

USD 60.03 billion |

|

Forecast Year Market Size (2035) |

USD 158.56 billion |

|

Regional Scope |

|

Hospital Information System Market Segmentation:

Component (Software, Services)

Software segment is predicted to dominate hospital information system market share of over 72.3% by 2035, owing to the increasing need to enhance the existing healthcare infrastructure. Several key players are focused on developing advanced software and solutions. In March 2022, Medical Information Technology Inc. (MEDITECH) and Google Health joined hands to improve the clinical search and discovery of Medictech’s Expanse EHR Platform.

Deployment (Cloud-based, Web-based, On-premise)

In hospital information system market, cloud-based segment is likely to hold revenue share of more than 58.6% by 2035, owing to the swift digital shift in the healthcare sector. The cloud-based systems mitigate the excess cost associated with complex on-site IT infrastructure. This cost-effectiveness boosts the adoption of cloud-based hospital information system among small and low-budget healthcare facilities. In May 2020, Microsoft launched its first cloud system in the healthcare sector. This technology drives automation and offers high-value operational workflow in healthcare facilities.

Our in-depth analysis of the global market includes the following segments

|

Component |

|

|

Deployment |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hospital Information System Market Regional Analysis:

North America Market Forecast

North America industry is estimated to dominate majority revenue share of 39.3% by 2035, due to the presence of advanced healthcare facilities and robust market players. The significant investments in healthcare IT infrastructure and prime focus on research and development activities are leading to the production of advanced hospital information system. The rise in telehealth services due to the COVID-19 outbreak is set to drive the sales of hospital information system going ahead.

The U.S. market for hospital information system is poised to expand at substantial CAGR till 2035 owing to favorable state and federal regulations to maintain electronic health records. For instance, according to the Assistant Secretary for Technology Policy/Office of the National Coordinator for Health Information Technology, around 78% of office-based physicians have employed advanced hospital information system, particularly electronic health record technologies.

In Canada, continuous innovations in medical record technologies are significantly transforming the hospital workflow. This is a key factor expected to boost market growth in the country. Moreover, efforts by the government to promote these systems and increasing investments to develop advanced systems are expected to drive market growth in the coming years.

Asia Pacific Market Statistics

The Asia Pacific hospital information system market is foreseen to increase at a fast pace during the projected period owing to the increasing investments in advancing healthcare facilities. Governments in developing economies are adopting digital technologies to improve the workflow of their public hospitals. The presence of industry giants in countries such as Japan and South Korea is also supporting regional market growth.

In India, the government is investing to enhance its healthcare settings, which is expected to fuel the demand for hospital information system. For instance, to drive digital infrastructure in healthcare settings the Government of India allocated around USD 10.7 billion in its 2024-2025 union budget. Apart from this, the rising prevalence of chronic disorders leading to high hospital visits and growing medical tourism in the country is necessitating healthcare facilities to adopt advanced hospital information system.

Key Hospital Information System Market Players:

- Athenahealth

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Google Inc.

- Microsoft Corporation

- Cerner Corporation

- Comarch SA.

- Dedalus SpA

- eClinicalWorks

- Epic Systems Corporation

- GE Healthcare

- Greenway Health

- McKesson Corporation

- Medical Information Technology, Inc.

- NextGen Healthcare

- Siemens Healthineers

- Veradigm LLC

- Wipro Limited

Key players in the hospital information industry are employing strategies such as new product launches, regional expansion, strategic collaborations, and mergers & acquisitions. They are collaborating with other players to introduce innovative hospital information system. Industry giants are also focusing on regional expansion to tap into high-potential markets to earn robust shares.

Some of the key players include:

Recent Developments

- In May 2024, Athenahealth announced the launch of athenaOne for women’s health and urgent care. This product launch is set to enhance the company’s position in the global marketplace.

- In August 2023, Google Cloud collaborated with HCA Healthcare to use generative AI technology to enhance workflows on time-consuming tasks in healthcare settings. This collaboration is expected to improve patient care by making clinical documentation easy for physicians and nurses.

- Report ID: 6605

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hospital Information System Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.