Homecare Ventilator Market Outlook:

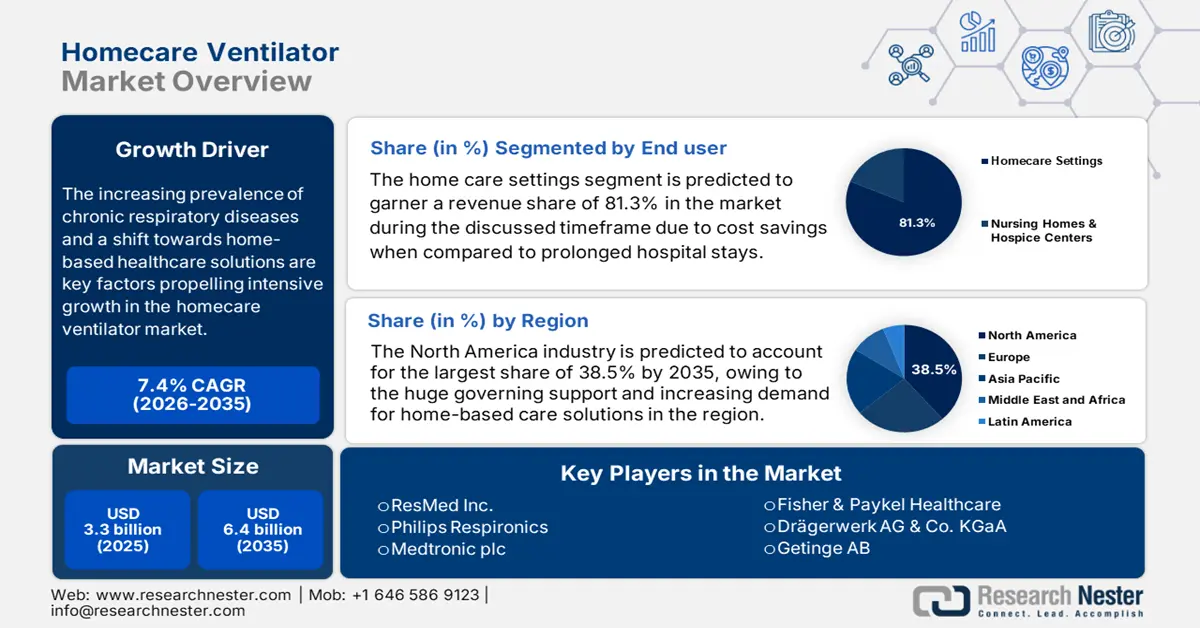

Homecare Ventilator Market size was valued at USD 3.3 billion in 2025 and is projected to reach USD 6.4 billion by the end of 2035, rising at a CAGR of 7.4% during the forecast period, i.e., 2026-2035. In 2026, the industry size of homecare ventilator is estimated at USD 3.5 billion.

The increasing prevalence of chronic respiratory diseases and a shift towards home-based healthcare solutions are key factors propelling intensive growth in the homecare ventilator market. In this context, the report from WHO in June 2025 revealed that above 80 million individuals are affected by chronic respiratory diseases, and a large group of people are undiagnosed yet. Therefore, the data underscores the huge necessity for home care ventilators across different nations.

Furthermore, the market benefits from the healthcare payers that include insurance companies and government programs, which are increasingly recognizing the benefits of home care ventilators, leading to expanded reimbursement policies. This can be evidenced from the report of CMS published in March 2025 that states that noninvasive positive pressure ventilation and home mechanical ventilators are now proposed for national coverage for the treatment of chronic respiratory failure, hence creating an encouraging opportunity for global pioneers.

Key Homecare Ventilator Market Insights Summary:

Regional Highlights:

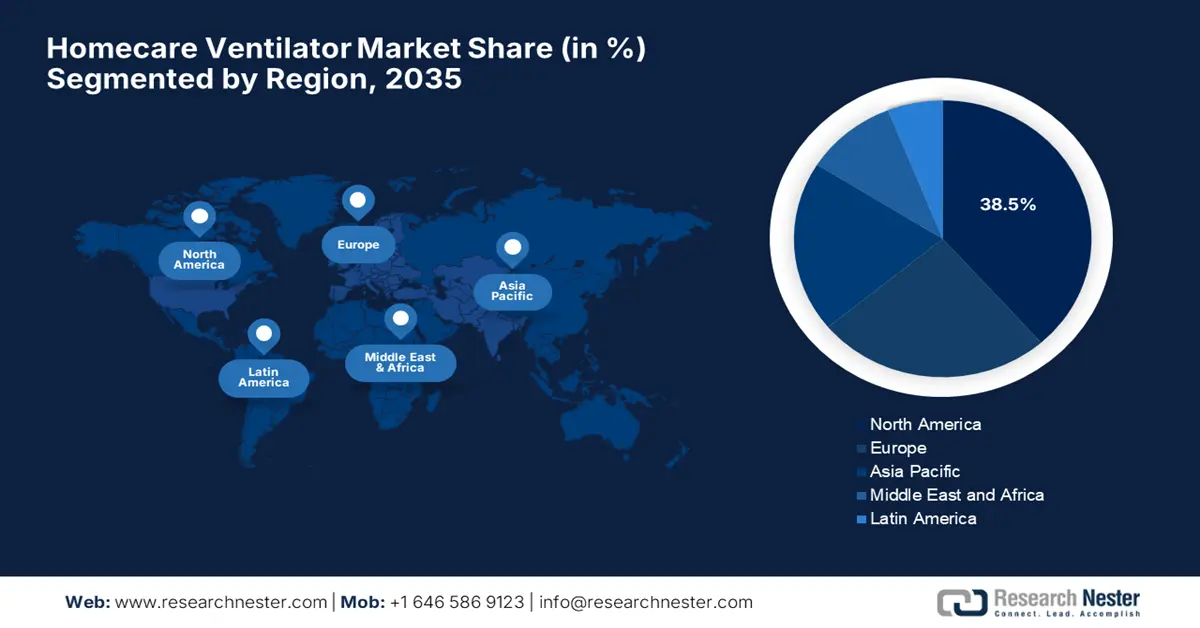

- North America is predicted to hold a 38.5% share of the Homecare Ventilator Market by 2035, owing to strong regulatory backing and the rising preference for home-based care solutions.

- Europe is anticipated to emerge as the second-largest regional contributor by 2035, supported by government initiatives promoting home-based respiratory care to alleviate hospital congestion.

Segment Insights:

- Based on end user, the homecare settings segment is expected to account for 81.3% share by 2035 in the Homecare Ventilator Market, driven by the ongoing transition from institutional to home-based care for improved cost efficiency and patient satisfaction.

- By type, the noninvasive ventilator segment is projected to command a 68.5% share by 2035, propelled by its vital role in treating COPD and sleep apnea while reducing the risk of ventilator-associated pneumonia.

Key Growth Trends:

- Aging population & associated comorbidities

- Increasing preference for home-based care

Major Challenges:

- Complex patient management

- Inadequate reimbursement

Key Players: ResMed Inc., Philips Respironics, Medtronic plc, Fisher & Paykel Healthcare, Drägerwerk AG & Co. KGaA, Getinge AB, Vyaire Medical Inc., Löwenstein Medical GmbH, General Electric (GE) Healthcare, Inogen Inc., Koninklijke Philips N.V., BMC Medical Co. Ltd., DeVilbiss Healthcare LLC, Sunrise Medical (US) LLC, Hillrom (Baxter), O-Two Medical Technologies.

Global Homecare Ventilator Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 3.3 billion

- 2026 Market Size: USD 3.5 billion

- Projected Market Size: USD 6.4 billion by 2035

- Growth Forecasts: 7.4% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (38.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, China, Japan, United Kingdom

- Emerging Countries: India, South Korea, Brazil, Australia, Indonesia

Last updated on : 22 September, 2025

Homecare Ventilator Market - Growth Drivers and Challenges

Growth Drivers

- Aging population & associated comorbidities: As the worldwide population is aging at a rapid pace, the demographics are disproportionately affected by chronic respiratory conditions such as COPD, sleep apnea, and neuromuscular diseases that lead to respiratory failure. Therefore, the WHO data in October 2024 revealed that 80% of the aged population will be residing in developing nations and are more likely to be affected with conditions such as COPD, thereby driving a constant demand for home care ventilators.

- Increasing preference for home-based care: There has been a pronounced trend towards home-based care, driven by consumer preference for lower risk of hospital-acquired infections. As per an NIH article published in April 2024, primary care patients in China showcased a strong preference for home-based healthcare services, particularly those focused on disease diagnosis and treatment. The study also revealed that the majority prioritized comprehensive medical services, a smaller segment valued care provider credentials, and another group was mainly concerned about financial costs.

- Product advancements: The continuous innovations in this sector are expanding the field of applications in the homecare ventilator market. For instance, in August 2024, Fisher & Paykel Healthcare announced the launch of the F&P my820 System in the U.S., which is a new home-based respiratory humidifier designed for invasive, noninvasive, and high-flow therapies, hence suitable for standard market growth.

Age-Adjusted Death Rates from Chronic Lower Respiratory Diseases in U.S. Populations (2015-2020)

|

Year |

NH White |

NH Black or African American |

NH Asian or Pacific Islander |

NH American Indian or Alaska Native |

|

2015 |

~68 |

~59 |

~36 |

~31 |

|

2016 |

~67 |

~59 |

~36 |

~30 |

|

2017 |

~66 |

~58 |

~35 |

~30 |

|

2018 |

~66 |

~57 |

~34 |

~29 |

|

2019 |

~65 |

~57 |

~34 |

~29 |

|

2020 |

~61 |

~57 |

~34 |

~28 |

Source: NIH

Lung Health Research Projects Supporting Homecare Ventilator Advancements in Canada as of Health Canada 2024 Data

|

Project Title |

Funding |

|

Canadian consortium for understanding the role of airway mucus occlusions in cough, COPD, and asthma (CANMuc) |

USD 2,000,000 |

|

Harnessing Data to Improve Lung Health in Canada: Data4LungHealth |

USD 3,493,555 |

Source: Health Canada

Challenges

- Complex patient management: The homecare ventilator market faces considerable hurdles in terms of patient management since managing patients on long-term requires consistent monitoring. Besides the respiratory parameters, ventilator settings, and potential complications like infections or airway blockages, lead to an incomprehension among family members and caregivers. Therefore, this creates huge pressure on home-based healthcare services and concerns about patient safety.

- Inadequate reimbursement: The homecare ventilator market faces significant hurdles in terms of inadequate reimbursement policies and insurance coverage, which are limiting adoption among both service providers and consumers. Also, payers, such as public and private insurers, impose strict eligibility criteria and documentation, which ultimately creates a delayed access to the necessary equipment.

Homecare Ventilator Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

7.4% |

|

Base Year Market Size (2025) |

USD 3.3 billion |

|

Forecast Year Market Size (2035) |

USD 6.4 billion |

|

Regional Scope |

|

Homecare Ventilator Market Segmentation:

End user Segment Analysis

Based on end user homecare settings segment is predicted to garner a revenue share of 81.3% in the market during the discussed timeframe. The dominance in the segment is attributable to the shift from institutional to home-based care, owing to the significant cost savings when compared to the prolonged hospital stays. On the other hand, the positive patient outcomes, telehealth emergence, and satisfaction are better received in a home environment, which has made it easier to manage complexities, hence denoting a positive market outlook.

Type Segment Analysis

In terms of type noninvasive ventilator segment is projected to attain a significant share of 68.5% in the homecare ventilator market by the end of 2035. The growth in the segment is effectively driven by its pivotal role in managing conditions such as COPD and sleep apnea and lowering the risk of ventilator-associated pneumonia. In January 2024, Getinge introduced the Servo-air Lite, a new addition to its long-standing Servo ventilator portfolio, which is focused on non-invasive ventilation and high-flow therapy, combining reliable performance with enhanced patient comfort.

Indication Segment Analysis

Based on the indication chronic obstructive pulmonary disease segment is expected to gain a share of 35.7% in the homecare ventilator market during the analyzed timeframe. The increased prevalence and the necessity of long-term oxygen therapy are positioning this subtype at the forefront to generate revenue in this field. In this context the clinical study by NIH in September 2024 revealed that it evaluated the effectiveness of noninvasive ventilator therapy in patients with severe COPD and type II respiratory failure involving 124 patients. the study found that those receiving noninvasive ventilation showed greater improvements in lung function (FEV1, FEV1/FVC), arterial blood gases when compared to those who received standard care alone.

Our in-depth analysis of the homecare ventilator market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Type |

|

|

Indication |

|

|

Interface |

|

|

Mode |

|

|

Age Group |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Homecare Ventilator Market - Regional Analysis

North America Market Insights

North America is predicted to capture the largest revenue share of 38.5% in the homecare ventilator market by the end of 2035. The region benefits from huge governing support and increasing demand for home-based care solutions. As of December 2024, CMS data in 2023, healthcare spending in the U.S. reached a total of USD 4.9 trillion, accounting for 17.6% of the nation’s GDP, reflecting increased utilization and insurance coverage. Hence, this underscore expanding opportunities for home care ventilator providers as health systems are increasingly preferring home-based care models.

The U.S. is the key growth engine for the regional homecare ventilator market, which is propelled by the rising occurrence of chronic respiratory conditions, rising disposable income, and a preference for cost-efficient care at home. As of the CDC December 2024 article, the country has around 11,400 home health agencies, with a significant majority (83.5%) operating under for-profit ownership models. It also stated that around 3 million patients received and completed home health care services, highlighting the extensive reach of home-based care.

There is a huge exposure for Canada in the homecare ventilator market due to the existence of the country’s publicly funded healthcare system that strengthens critical care infrastructure and incorporates home therapies. In July 2024, Health Canada reported that the country’s government, in partnership with others, is investing a total of USD 19.3 million in nine new interdisciplinary research projects focused on lung health. These projects aim to deepen understanding of how different factors influence respiratory health, addressing both current and emerging threats to lung health.

Real Disposable Personal Income in the U.S. (May 2022 - June 2025)

|

Date |

Real Disposable Personal Income (Billions of Chained 2017 Dollars) |

|

May 2022 |

~16,000 |

|

Sep 2022 |

~16,300 |

|

Jan 2023 |

~16,800 |

|

May 2023 |

~17,000 |

|

Sep 2023 |

~17,100 |

|

Jan 2024 |

~17,400 |

|

May 2024 |

~17,450 |

|

Sep 2024 |

~17,500 |

|

Jan 2025 |

~17,600 |

|

May 2025 |

~17,750 |

|

Jun 2025 |

17,811.8 |

Source: FRED

APAC Market Insights

Asia Pacific is recognized as the fastest-growing region in the homecare ventilator market, which is effectively attributed to the heightened demand for homecare ventilators. The escalating patient pool affected by respiratory diseases is also a stimulating factor for this landscape, driving continued business. Besides the investments in digital health and remote patient monitoring technologies, are enhancing homecare delivery is being enhanced, particularly in urban centers. Moreover, government programs targeting rural healthcare access are also expanding the pace of progress in this field.

China is solidifying its dominance in the homecare ventilator market, backed by the government initiatives promoting telemedicine and remote diagnostics. A WHO article published in November 2023 revealed that the country’s approach to COPD care resulted in the distribution of 30,000 portable spirometry devices. Over 140,000 primary health care workers were trained in a span of three years, and nearly 1.5 million people screened within 2 years via questionnaires and spirometry, denoting a greater potential for home care ventilator manufacturers to capitalize on this sector.

India also represents one of the most influential landscapes in the homecare ventilator market, owing to the increasing patient preference for home treatment and government support for home healthcare models. In this regard, NITRD states that Ayushman Bharat Pradhan Mantri Jan Arogya Yojna (PM-JAY), the world’s largest government-funded health assurance scheme, provides ₹5 lakhs coverage per family annually for secondary and tertiary care in the respiratory department. It also targets over 12 crore poor families, offers cashless healthcare services including diagnostics, treatments, medicines, and surgeries at empanelled hospitals nationwide.

Europe Market Insights

Europe is predicted to be the second-largest regional market for homecare ventilators during the analyzed timeframe. The governments across the region are proactively encouraging home-based respiratory care to ease hospital overflow. For instance, in May 2021, CorVent Medical reported that it had received CE Mark approval for its RESPOND-19 ventilator, which offers both invasive and non-invasive respiratory support, making it suitable for both hospital and home care settings.

The U.K. is the central player in Europe’s homecare ventilator market, owing to its healthcare infrastructure, and the government's push for improved community care is creating opportunities for innovative ventilator technologies. In September 2023, Motorised Air Products Ltd, in collaboration with LTG Aktiengesellschaft, introduced the FVPpulse system in the country, which is a decentralized ventilation unit that mimics natural air movement, thereby positively influencing the market’s upliftment.

France has gained enhanced recognition in the homecare ventilator market due to the huge focus on integration of smart, adaptive ventilator technologies tailored to home use and a growing emphasis on environmentally sustainable, energy-efficient models. In July 2024, Air Liquide Medical Systems reported that it had launched Monnal TEO, a next-generation ventilator designed and manufactured entirely in the country, which was developed in collaboration with the intensive care unit at Angers University Hospital.

Estimated Annual Cost of Home Mechanical Ventilation (HMV) Equipment for Neuromuscular Disorder (NMD) Patients as of NIH 2022

|

Cost Aspect |

Estimated Cost (€) |

|

Budget including services and maintenance |

3,232€/patient/year |

|

Budget including services and maintenance |

5,037€/patient/year |

Source: NIH

Key Homecare Ventilator Market Players:

- ResMed Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Philips Respironics

- Medtronic plc

- Fisher & Paykel Healthcare

- Drägerwerk AG & Co. KGaA

- Getinge AB

- Vyaire Medical, Inc.

- Löwenstein Medical GmbH

- General Electric (GE) Healthcare

- Inogen, Inc.

- Koninklijke Philips N.V. (Philips)

- BMC Medical Co., Ltd.

- DeVilbiss Healthcare LLC

- Sunrise Medical (US) LLC

- Hillrom (Baxter)

- O-Two Medical Technologies

The global market for home care ventilators is extremely consolidated, wherein the top three players, ResMed, Philips, and Medtronic, gained control over half of the total market share. Also, the industry is characterized by intense competition owing to amplifying technological innovation, strategic mergers and acquisitions, and a strong focus on expanding geographic presence. On the other hand, the top pioneers are proactively investing in developing smaller and smarter devices integrated with digital health platforms for remote patient monitoring.

Below is the list of some prominent players operating in the global market:

Recent Developments

- In February 2025, IMT Innovations introduced its new box ventilator prototype, which is designed for critical care with increased adaptability and user-friendly features for a wide range of medical settings.

- In November 2023, Inspiration Healthcare Group plc notified that it has launched the SLE1500, which is a compact non-invasive ventilator designed to support neonatal patients.

- Report ID: 8113

- Published Date: Sep 22, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Homecare Ventilator Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.