Home Ultrasonic Scaler Market Outlook:

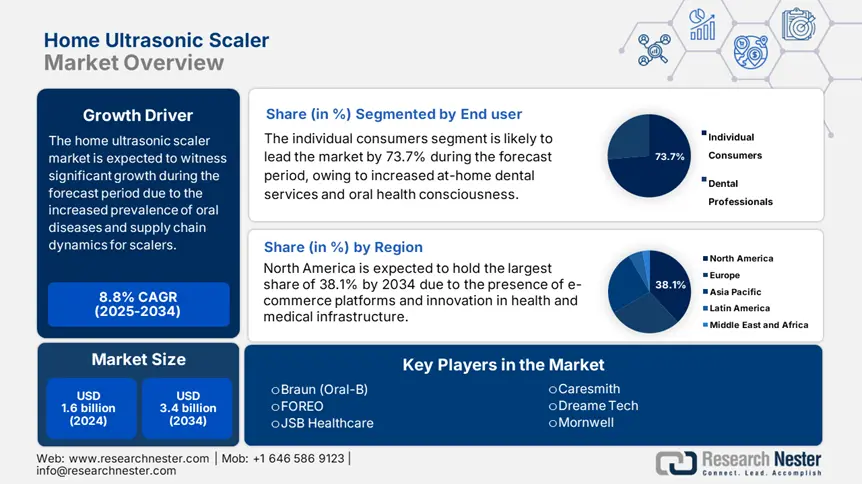

Home Ultrasonic Scaler Market size was valued at USD 1.6 billion in 2024 and is poised to reach USD 3.4 billion by the end of 2034, registering around 8.8% CAGR during the forecast period i.e., between 2025-2034. In 2025, the industry size of home ultrasonic scaler is assessed at USD 1.9 billion.

The international patient pool in the home ultrasonic scaler market is gradually expanding, and in this regard, the World Health Organization (WHO) in 2022 reported that almost 3.7 billion people are affected by oral disorders, which include periodontal and undiagnosed caries conditions. The increasing prevalence is fueling the requirement for remote dental-care solutions, such as ultrasonic scalers. Besides, the supply chain facility for these medical devices depends on precise and engineered components, including lithium-ion batteries, stainless steel tips, and piezoelectric ceramics. These are initially sourced from Japan, which is 20% of the global supply, followed by Germany with 24%, and China with 44%, thereby suitable for uplifting the market.

Moreover, based on the economic standpoint, the producer price index (PPI) has increased to 4.5% year-over-year (YoY) for home ultrasonic scalers as of 2023, which is positively influenced by a surge in expenses for rare-earth metals, along with limited semiconductors. Likewise, the consumer price index (CPI) has also risen to 6.3% for such devices, which has reflected high retail markups as well as logistic expenditure. Besides, investments in research, development, and deployment (RDD) are strong, with the National Institutes of Health (NIH) initiating a provision of USD 325 million as of 2023. This allocation has been made for dental technology advancement, which includes miniaturized ultrasonic devices, thus bolstering the overall home ultrasonic scaler market demand.

Home Ultrasonic Scaler Market - Growth Drivers and Challenges

Growth Drivers

- Customer out-of-pocket expenses: Cost-effectiveness is the key implementation aspect, with consumers in the U.S. spending approximately USD 88 yearly on average ultrasonic scalers without insurance-based coverage services. Besides, almost 65% of users in France depend on private insurance reimbursements, thereby highlighting the importance of payer policies. Meanwhile, the aspect of price sensitivity is acute in developing nations, such as India, where the USD 55 to USD 150 price range has captured only 8.2% of eligible patients. However, to cater to this, brands, including Xiaomi, have unveiled sub-USD 60 models and gained at least 20% of the home ultrasonic scaler market in Asia.

- Product advancement and corporate initiatives: Market leaders are incorporating cost-effective technology, along with telehealth implementations, to fuel the home ultrasonic scaler market growth internationally. For instance, in 2024, Philips collaborated with tele-dentistry platforms and enhanced integration by an estimated 27% among home patients. Besides, advancements, such as AI-driven brushing analytics as well as modular designs, are considered part of sustainability trends. Therefore, all these circumstances are effectively responsible for uplifting the market across different nations.

Challenges

- Acceptance obstacles and administrative delays: The existence of the medical device acceptance process has appeared to be increasingly prolonged, with administrative organizations integrating stricter requirements. For instance, according to the 2024 FDA report, the 510(k) backlog has expanded the U.S.-based approval duration to more than a year. These delays have significant effects, including limited market entry, shortened patent-protected sale opportunities, and augmented development expenses. Besides, the administrative environment has become challenging for progressive features, such as artificial intelligence (AI) connectivity or diagnostics, which frequently fall into device classifications, thus negatively impacting the market.

- Disparities in accessibility and patient affordability: The aspect of cost is the initial barrier to the wide-range adoption of the home ultrasonic scaler market, thereby developing international inequities. For instance, the public health system in Brazil expanded coverage for only 5.5% of scaler expenses, thus leaving the majority of patients to pay from out-of-pocket. Meanwhile, the situation in India is even more challenging, wherein an estimated 90% of rural households are unable to afford medical devices priced between USD 55 to USD 150, thus causing a hindrance in the market upliftment.

Home Ultrasonic Scaler Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2024 |

|

Forecast Year |

2025-2034 |

|

CAGR |

8.8% |

|

Base Year Market Size (2024) |

USD 1.6 billion |

|

Forecast Year Market Size (2034) |

USD 3.4 billion |

|

Regional Scope |

|

Home Ultrasonic Scaler Market Segmentation:

End user Segment Analysis

The individual consumers segment is projected to hold the largest share of 73.7% in the home ultrasonic scaler market by the end of 2034. The segment’s growth is effectively attributed to the preference for remote dental care, along with a rise in oral health awareness. In addition, an increase in periodontal disorder rates and aging demographics are also responsible for fueling the segment’s demand, especially for user-friendly and cordless models, which range from USD 60 to USD 165. Besides, e-commerce platforms, including Rakuten and Amazon, both combinedly achieved 75% of sales by providing discounts and convenience to potential customers, thus suitable for the segment’s upliftment.

Distribution Channel Segment Analysis

The online segment in the home ultrasonic scaler market is expected to hold the second-largest share of 68.7% during the forecast timeline. The segment’s upliftment is fueled by direct-to-consumer (DTC) strategies, competitive pricing, and convenience. Besides, e-commerce platforms, including Alibaba, Amazon, and Rakuten, account for approximately 80% of online purchases by providing at least 20% to 25% discounts in comparison to offline retailers. This sudden transition to digitalization has been escalated by social media marketing, with brands incorporating influencer-based campaigns to gain an estimated 35% increase in conversion rates, thereby denoting a positive impact on the segment.

Our in-depth analysis of the global market includes the following segments:

|

Segment |

Subsegments |

|

End user |

|

|

Distribution Channel |

|

|

Technology |

|

|

Price Range |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Home Ultrasonic Scaler Market - Regional Analysis

North America Market Insights

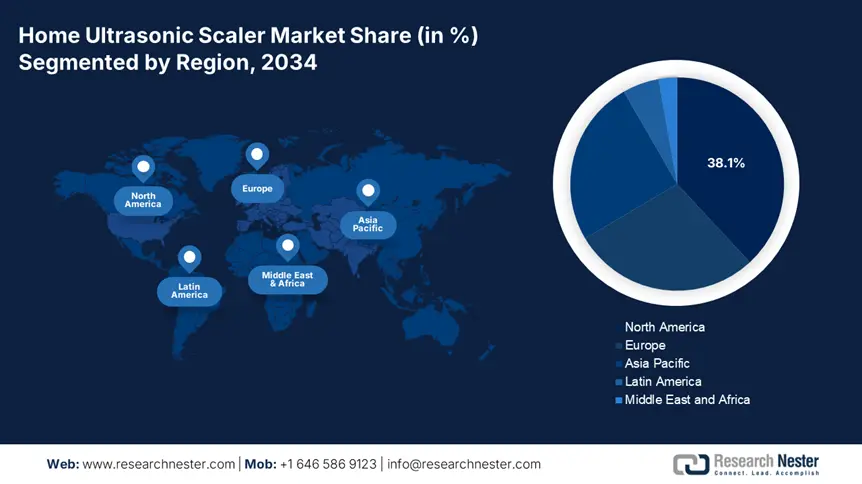

North America in the home ultrasonic scaler market is anticipated to be the dominant region with the largest share of 38.1% by the end of 2034. The market’s growth in the region is effectively fueled by an increase in oral health and medical awareness, as well as progression in healthcare infrastructure. Additionally, the region has reflected a 7.7% growth rate, with increased demand in the U.S., constituting at least 32.8% of the regional share, along with a surge in the market adoption in Canada, with a 6.5% share. Besides, an expansion in both Medicaid and Medicare coverage, dominance in e-commerce platforms, and an upsurge in the aging population are other notable drivers, suitable for the market expansion in the region.

The U.S. home ultrasonic scaler market is gaining increased traction by grabbing approximately the majority of the region’s share, which is highly driven by an increase in Medicare spending of USD 820 million as of 2024, along with advancements in DTC. In addition, AI-based scalers, constituting 27% of the market share, and Amazon sales, catering to almost 82% of online purchases, are readily dominating the market’s upliftment in the country. However, Medicaid exclusions as well as counterfeit challenges exist in the country, which is limiting the market development, but with the presence of the FDA’s fast-track acceptance pathways, there is a huge opportunity for the market in the country.

The home ultrasonic scaler market in Canada is also significantly growing at a rate of 7.1%, which is effectively driven by telehealth implementation and provincially based investments. For instance, Ontario’s provision of USD 130 million has been suitable for boosting the market in the country. Besides these factors, Health Canada has effectively prioritized affordable oral care services and solutions, particularly for developing nations and low and middle-income patients. Meanwhile, the aspect of import dependency on China for raw materials is creating a gap in the country’s market growth.

North America Home Ultrasonic Scaler Market: Trade & Supply Chain Facilities (2021-2025)

|

Category |

2021 |

2023 |

2025 |

Key Trends |

|

Import Sources |

China (65%), Germany (25%) |

China (60%), Mexico (30%) |

Mexico (45%), Vietnam (35%) |

Shift from China due to tariffs & diversification |

|

Domestic Production |

4 major U.S. plants |

6 plants (+3 new in Texas, Ohio) |

8 plants (+Canada’s 1st in Ontario) |

USD 230 million invested in automation |

|

Tariffs & Trade Policies |

27% on China-based imports |

15.5% on select components |

10.7% under USMCA renewal |

Localization incentives in Canada |

|

Key Logistics Hubs |

Los Angeles, Chicago |

Laredo (Mexico border), Toronto |

Atlanta, Montreal |

Nearshoring to Mexico reduces lead times by 30.7% |

|

Supply Chain Disruptions |

8.5-week delays (COVID backlog) |

4.5-week delays (chip shortage) |

2.5-week delays (AI forecasting) |

Blockchain adoption for real-time tracking |

APAC Market Insights

Asia Pacific in the home ultrasonic scaler market is expected to be the fastest-growing region with a share of 25.2% by the end of the forecast duration. The market’s exposure in the region is attributed to the existence of government strategies and an increase in oral health solutions. China is dominating the region with an increase in volume sales, along with India demonstrating continuous growth with administrative bodies. In addition, Malaysia and South Korea are not far behind with tele-dentistry implementations, particularly in 25% of urban households. The region, as a whole, comprises cost-effective medical devices, due to which the market is expanding steadily.

The market in China is projected to account for approximately 47.5% of the region’s share during the forecast period, fueled by government-specific cost-effective initiatives and mass production facilities. The NMPA has reported that almost 1.9 million patients incorporated home-based scalers as of 2023, with regional brands, such as Xiaomi, achieving 70% of the sub-USD 150 segment. Besides, in 2024, domestic subsidies, with a valuation of USD 155 million, aimed to bolster the market accessibility in rural areas. Meanwhile, AI-specific medical devices are also gaining increased traction in urban regions, with almost 35% in premium sales.

The home ultrasonic scaler market in India is also growing, with a growth rate of 15%, and is anticipated to garner 18% of the regional share during the forecast timeline. The presence of the government-oriented Ayushman Bharat scheme subsidizes scales for 55 million low-income households, which is readily driving the market in the country. Besides, manufacturers in the country are focused on sub-USD 55 models, while e-commerce platforms, such as Amazon and Flipkart, are also fueling at least 78% of sales. However, dentists' skepticism, as well as counterfeit products, are limiting the market adoption.

Europe Market Insights

Europe is expected to hold a considerable home ultrasonic scaler market share of 28.4% by the end of the forecast timeline, owing to the presence of innovative healthcare systems and a rise in aging populations. Germany is leading the region with a surge in yearly spending and public insurance coverage. This is followed by the UK, subject to the provision of the NHS budget for preventive oral devices. France is close behind and readily prioritizes AI-driven medical devices, which are suitable for uplifting the overall market in the region. Besides, the €2.8 billion Health Fund in the region has escalated R&D, thereby suitable for market expansion.

The home ultrasonic scaler market in Germany is readily dominating the region, with an expected share of 35.2% during the forecast period, which is fueled by precision manufacturing and the existence of strong public insurance coverage. Besides, the country’s €4.3 billion market size has reflected an increase in the market adoption among the population aged over 65 years of age. Meanwhile, localized production has met almost 65% of the demand, thereby diminishing dependency on imports. The aspect of tele-dentistry incorporation, as well as sustainability-based designs, are two other notable trends that are also skyrocketing the market exposure in the country.

UK is anticipated to hold at least 25.5% of the region’s home ultrasonic scaler market, which is driven by the presence of DTC subscription models and the NHS fund for preventive care. Additionally, e-commerce is also driving approximately 72.5% of sales, which is one of the most effective factors for increasing the market’s traction in the country. Besides, the existence of tele-dentistry collaborations and partnerships among organizations are deliberately augmenting in rural locations, which is suitable for successfully uplifting the market growth in the country.

European Government Funding & Policy Snapshot (2021–2025)

|

Country |

Policy/Initiative |

Launch Year |

Funding/Impact |

Key Focus |

|

France |

Innovative Dental Tech Fund |

2021 |

€215 million for AI/scaler R&D |

AI integration, reimbursement |

|

Preventive Oral Care Subsidy |

2023 |

Covers 32% of device costs |

Elderly/low-income access |

|

|

Italy |

Medical Device Tax Credit |

2022 |

15.7% tax rebate for manufacturers |

Local production boost |

|

Tele-dentistry Pilot Program |

2024 |

€56 million for rural telehealth |

Remote patient monitoring |

|

|

Spain |

Public Dental Health Expansion |

2021 |

€128 million for preventive devices |

Reduce out-of-pocket spending |

|

Anti-Counterfeit Task Force |

2025 |

€12 million budget |

Combat fake devices (20.5% market) |

Key Home Ultrasonic Scaler Market Players:

- Philips Sonicare

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Waterpik (Colgate-Palmolive)

- Xiaomi

- Braun (Oral-B)

- Quip

- FOREO

- JSB Healthcare

- Mornwell

- MEGAHEALTH

- Caresmith

- Wellous

- Dreame Tech

- Soocas

- URSmile

- Jisulife

The global home ultrasonic scaler market is extremely fragmented, with the presence of organizations, including Panasonic, Waterpik, and Philips, collectively accounting for a share of 65% of the international revenue. In addition, these key players have integrated a few strategies, such as administrative partnerships, subscription models, cost-effectiveness, and AI implementation. For instance, as per the 2024 FDA report, Panasonic and Philips are leading with real-time plague detection. Meanwhile, JSB Healthcare and Xiaomi have readily targeted developing economies with sub-USD 60 models, thereby suitable for market development.

Here is a list of key players operating in the global market:Below are the areas covered for each company in the market:

Recent Developments

- In May 2024, Waterpik, Inc. declared a successful merger with Colgate’s Renewal Division to implement water-flossing technology into ultrasonic scalers and developed the Hydro-Sonic Fusion line.

- In March 2024, Philips Sonicare unveiled the Sonicare 9900 Prestige after achieving the FDA clearance for AI-driven plaque mapping, and further featured real-time coaching through a companion application.

- Report ID: 7940

- Published Date: Jul 25, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Home Ultrasonic Scaler Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert