Home Improvement Market Outlook:

Home Improvement Market size was valued at USD 828.8 billion in 2025 and is likely to cross USD 1.29 trillion by 2035, registering more than 4.5% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of home improvement is assessed at USD 862.37 billion.

The global home improvement market is growing due to several factors, including rising consumer spending on house upgrades, rapid urbanization, and a rise in the availability of products and services for home renovation. As per the statistics of World Bank; approximately 4.4 billion people, or 56% of the world's population, live in cities. By 2050, over seven out of ten people will live in cities as a result of this trend, with the urban population predicted to have more than doubled from its current level.

Key Home Improvement Market Insights Summary:

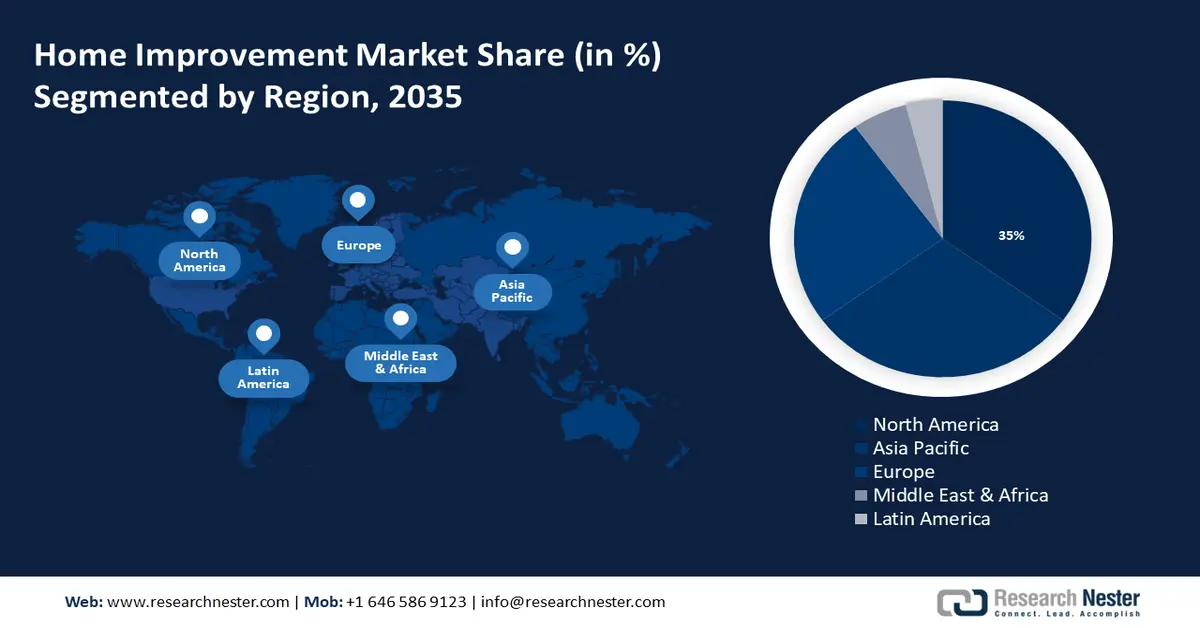

Regional Highlights:

- North America home improvement market will secure over 35% share by 2035, attributed to rising demand for eco-friendly and aesthetic remodeling solutions.

- Asia Pacific market will exhibit huge CAGR during 2026-2035, driven by rural development and increased government investment in housing.

Segment Insights:

- The diy segment in the home improvement market is expected to capture a 60% share by 2035, driven by rising online retail and consumer preference for self-service projects.

- The kitchen & bathroom improvements segment in the home improvement market is anticipated to capture a 30% share by 2035, driven by the integration of smart home technology and changing design trends.

Key Growth Trends:

- Rising number of homeowners making renovation investments

- Rising mortgage and interest rates fueling the need for home renovation

Major Challenges:

- Expensive prices for high-quality materials

- Changing industry trends quickly could impede market expansion

Key Players: Home Depot, Lowe's, Ferguson Enterprises, LLC, Masco Corporation, The Sherwin-Williams Company, Watsco, Inc., Dreamstyle Remodeling, Inc., DuPont.

Global Home Improvement Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 828.8 billion

- 2026 Market Size: USD 862.37 billion

- Projected Market Size: USD 1.29 trillion by 2035

- Growth Forecasts: 4.5% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (35% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Indonesia

Last updated on : 17 September, 2025

Home Improvement Market Growth Drivers and Challenges:

Growth Drivers

- Rising number of homeowners making renovation investments - The rise in house improvement and remodeling expenditures among homeowners, driven by changing needs and desires for unique living environments. This trend has been further accelerated by the pandemic, as more people have stayed at home and improved their living spaces.

Furthermore, the home improvement market demand has been greatly increased by the expanding do-it-yourself (DIY) culture, which is made possible by a variety of home renovation items and simple access to internet tutorials. Approximately 3 out of 4 homeowners do it themselves. Approximately 50% of do-it-yourselfers work on exterior home improvement projects.

- Rising mortgage and interest rates fueling the need for home renovation - With the real estate industry growing at an exponential rate, housing has become a major global concern. Rising global mortgage and interest rates are a direct consequence of rising inflation, making property ownership even more challenging.

Consumers are choosing low-cost home repair projects that update their homes with the newest trends in order to avoid spending more on new homes and to avoid paying high borrowing rates. According to data from the home improvement industry, customers are expected to spend more money than they have in the past on house improvements in the upcoming years. In 2018, data on residential housing mortgage loans was recorded at 25,750.000 RMB bn.

- Startups taking advantage of new funding to grow their home renovation companies - Renovation and home remodeling have gained popularity worldwide as people's standards of living rise and they have more money to spend on these upgrades. A thriving market for home renovation has drawn numerous new businesses looking to provide cutting-edge products and services for customers.

Belgian bank insurer KBC spearheaded the investment in Setle, a start-up company that recently disclosed raising about USD 15 million. Real estate agents and potential buyers can almost immediately obtain a reasonable estimate for sustainable improvements from the start-up.

Challenges

- Expensive prices for high-quality materials - The high cost of labor, high-quality materials, and cutting-edge technologies is one of the primary market barriers that prevents some consumers from affording home remodeling projects. Consumer spending on remodeling and renovations is also influenced by real estate industry swings and economic concerns, which can be a limitation during economic downturns. Regulatory obstacles, such zoning laws and building rules, can make projects more complex and expensive, which hinders the expansion of the home improvement market.

- Changing industry trends quickly could impede market expansion - The quickly evolving trends in the home renovation business are predicted to pose a challenge to the growth of the global home improvement market. Home improvement service providers need to make sure that their workers are trained in the newest home improvement requirements when new styles, patterns, and technologies are brought to the market. The rate of market growth may be further impeded by limited access to skilled professions.

Home Improvement Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.5% |

|

Base Year Market Size (2025) |

USD 828.8 billion |

|

Forecast Year Market Size (2035) |

USD 1.29 trillion |

|

Regional Scope |

|

Home Improvement Market Segmentation:

Project Segment Analysis

DIY segment is anticipated to account for home improvement market share of around 60% by 2035. The increasing growth of online retail sales channels has led to a strong demand for do-it-yourself home improvement solutions. Given that consumers are increasingly choosing convenient shopping options and that 59.5% of the world's population has access to the internet, it makes sense that global retail e-commerce sales are predicted to reach USD 365.05 trillion by 2021. Because do-it-yourself projects are more economical, offer a sense of accomplishment, and allow for customization, most customers opt for them. These projects are solely involving end users; no other stakeholders are engaged. Psychological benefits that encourage social engagement, the acquisition of multiple skills, great flexibility, and economical resource utilization will drive the home improvement market's growth.

End Use Segment Analysis

In home improvement market, kitchen & bathroom improvements segment is projected to capture revenue share of over 30% by 2035. Increasingly, homeowners are investing in kitchen and bathroom renovations due to changing design trends, technology advancements, and the possibility of capital gains. Homeowners usually spend money updating and renovating their kitchens and bathrooms.

These products are dominant because of consumer desires for chic and contemporary living areas. The growing integration of technology into houses is expected to propel the rise of smart home goods. This covers security systems, thermostats, smart lighting, and other home automation products. The Internet of Things (IoT) is fueling the growing trend of smart homes, which in turn is driving demand for smart home renovation goods.

Our in-depth analysis of the home improvement market includes the following segments:

|

Project |

|

|

End Use |

|

|

Resident |

|

|

Distribution Channel |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Home Improvement Market Regional Analysis:

North America Market Insights

North America industry is likely to hold largest revenue share of 35% by 2035. The market demand is being driven by growing client demands for aesthetically beautiful and environmentally friendly products for remodeling projects. In 2021, the US spent more than USD 86 billion on green construction projects.

The United States' rapidly expanding residential building sector and rapidly increasing population will be key factors in the home improvement market's growth. The population of the United States makes up 4.23% of the entire world's population.

APAC Market Insights

The APAC region will also encounter huge growth for the home improvement market during the forecast period. The extensive rural population development in rising Asian nations is the cause of the greater growth rate. While simultaneously supporting advancements in rural housing structures, the regional governments are devoting significant resources to the region's ongoing urbanization. According to UN Habitat’s data, Asia's urban population is predicted to increase by 50% by 2050, adding 1.2 billion new residents.

The growing Chinese population is driving up demand for both functional and esthetic improvements in homes. 52 percent of Chinese respondents, by slim margin, said they did not anticipate any changes in the upcoming six months.

Growing e-commerce is propelling the home improvement market in Japan. Online shopping is more convenient than traditional brick-and-mortar stores because it allows customers to use their mobile devices to make purchases while at home or on the go. The amount that people spent on online fashion purchases in 2023 was estimated to be around 31.9 billion dollars.

Regional expansion is anticipated to be driven by the rising number of solar panel installation projects and the rising demand for do-it-yourself home repair projects in Korea. In South Korea, between 2018 and 2023, 2020 had about 4,120 megawatts of installed solar power generator capacity the largest amount ever installed in a single year.

Home Improvement Market Players:

- GREAT DAY IMPROVEMENTS, LLC

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Home Depot

- Lowe's

- Ferguson Enterprises, LLC

- Masco Corporation

- The Sherwin-Williams Company

- Watsco, Inc.

- Dreamstyle Remodeling, Inc.

- DuPont

- Henkel AG & Co. KGaA

The dynamic competitive climate of the home improvement sector is characterized by the fierce competition among major competitors striving for market share through strategic initiatives and a wide range of product offerings. Prominent industry participants, including both international firms and regional players, are actively engaged in product innovation, network expansion, and strategic collaborations.

Recent Developments

- The Home Depot®, the largest home improvement retailer in the world sent the official agreement to acquire International Designs Group (IDG). IDG runs several businesses with a focus on design, including Construction Resources. Prominent distributor of surfaces, appliances, and architectural specialty products, Construction Resources serves professional contractors working on multi-family, residential home building, remodeling, and renovation projects.

- Great Day Improvements, LLC is a leading direct-to-consumer home remodeling company in the industry. It recently added K-Designers, a remodeling contractor based in California, to its family of brands. K-Designers specializes in curb appeal, including siding, windows, patios, doors, and bathroom remodeling services. With its present portfolio of businesses, Great Day Improvements has continued its organic growth, adding more than 40 locations so far in 2023. Great Day Improvements' entry into the California renovation market, made possible by the strategic acquisition of K-Designers, bolsters the company's position in the Western United States and sustains its upward growth trajectory.

- Report ID: 6089

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Home Improvement Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.