Home Healthcare Market Outlook:

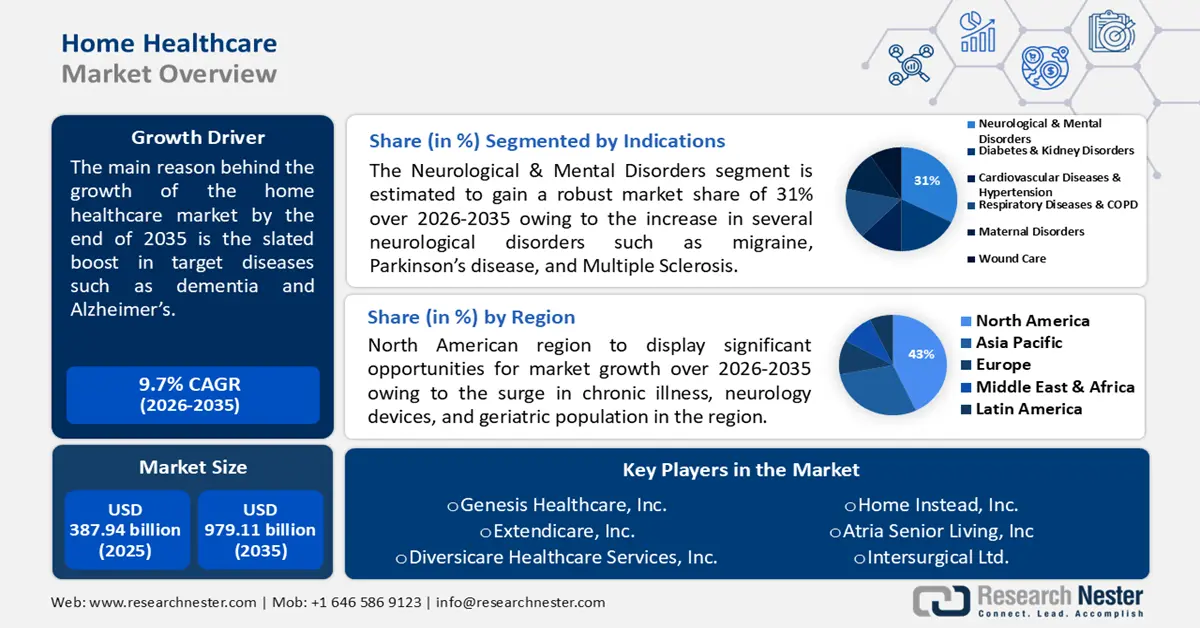

Home Healthcare Market size was valued at USD 387.94 billion in 2025 and is expected to reach USD 979.11 billion by 2035, expanding at around 9.7% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of home healthcare is evaluated at USD 421.81 billion.

This boost is anticipated by the increased boost in target diseases such as dementia and Alzheimer’s. According to a report by the World Health Organization 2023, there are more than 55 million people who have dementia globally and out of this about 60% live in middle and low-income countries.

Key Home Healthcare Market Insights Summary:

Regional Highlights:

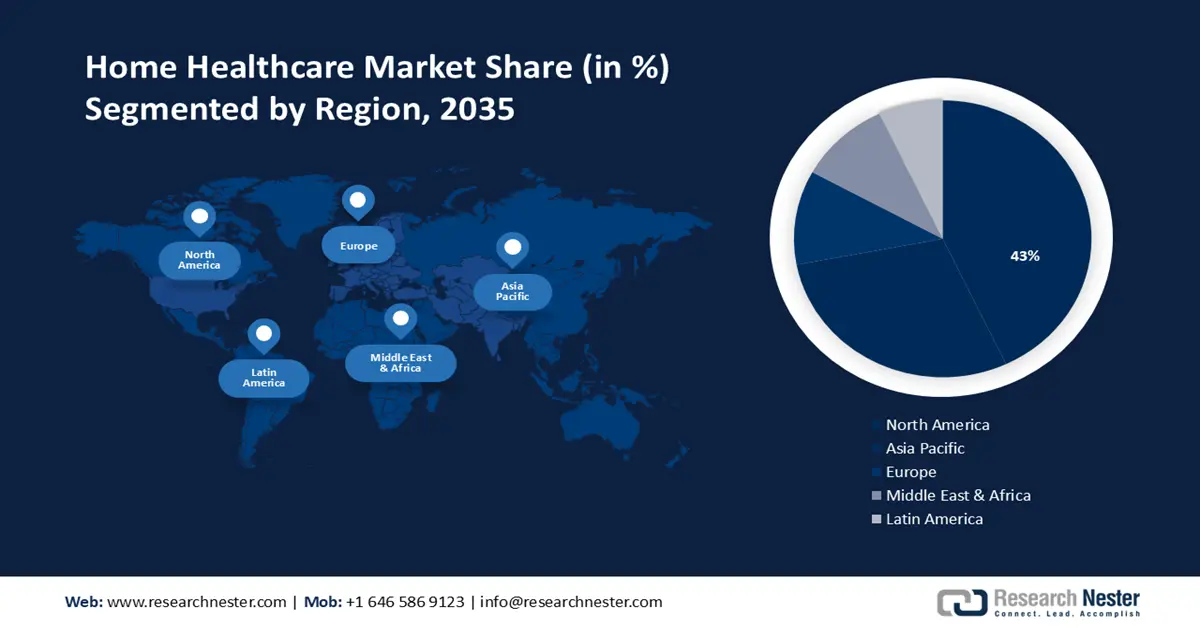

- North America home healthcare market achieves a 43% share by 2035, driven by chronic illness prevalence and aging population boosting home healthcare needs.

Segment Insights:

- The neurological & mental disorders segment in the home healthcare market is expected to see substantial growth till 2035, driven by the rising prevalence of neurological conditions worldwide.

Key Growth Trends:

- Increasing awareness of HaH services

- Rise in elderly population

Major Challenges:

- Lack of trained and qualified home workers

- Limited insurance coverage

Key Players: Abbott, Addus Homecare, Brookdale Senior Living Solutions, Genesis Healthcare, Inc., Extendicare, Inc., Diversicare Healthcare Services, Inc., Home Instead, Inc., Atria Senior Living, Inc., Intersurgical Ltd., and other.

Global Home Healthcare Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 387.94 billion

- 2026 Market Size: USD 421.81 billion

- Projected Market Size: USD 979.11 billion by 2035

- Growth Forecasts: 9.7% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (43% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, China

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 17 September, 2025

Home Healthcare Market Growth Drivers and Challenges:

Growth Drivers

- Increasing awareness of HaH services - The increasing awareness of hospital at-home programs is increasing, due to the increase in bed-ridden patients. According to a survey conducted by the National Library of Medicine in 2022, about 55% of the participants were not aware about HaH services, while 88% of these participants were willing to accept them.

- Rise in elderly population - The older population who highly requires HaH services. According to a report by the World Health Organization in 2022, the population of people over 60 years was estimated to be 1 billion in 2020 and is predicted to cross about 1.4 billion by 2050.

- Increase in the geriatric population - The need for healthcare support for their health issues and needs is increasing along with the increasing demand for healthcare, there is also a greater focus on providing more personalized and better care to elderly patients. According to a report by WHO in 2023, about 4 in 10 patients are harmed in primary and ambulatory settings, while up to 80% (23.6–85%) of this harm can be avoided.

- Rising infections - There is an increase in infectious diseases, based on a report by the World Health Organization (WHO) in 2022, Healthcare-associated infections (HAIs) affect 5 to 10% of patients in developed countries.

Challenges

- Lack of trained and qualified home workers - There is a high demand for skilled home healthcare workers in the home healthcare industry, due to which several home healthcare firms are being turned down. Many home healthcare providers have started training programs for upskilling their work, but it would take ample time to take the lead.

- Limited insurance coverage - for home healthcare, there are several insurance coverages in North America, but they are limited to a few home healthcare organizations that have received certification from Medicare. Equipment that is used for rehabilitation, remote monitoring, telemetry, and multi-parameter monitoring is not covered by insurance.

Home Healthcare Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

9.7% |

|

Base Year Market Size (2025) |

USD 387.94 billion |

|

Forecast Year Market Size (2035) |

USD 979.11 billion |

|

Regional Scope |

|

Home Healthcare Market Segmentation:

Indications Segment Analysis

The neurological & mental disorders segment in home healthcare market is estimated to witness a tremendous growth rate with a share of 31% driven by the increasing prevalence of several neurological disorders such as migraine, Parkinson’s disease, multiple sclerosis, and many more. According to a report by the World Health Organization 2024, a new study by Lancet Neurology estimated that there are more than 3 billion people globally who are suffering from neurological disorders. It is predicted that 1 out of 3 people is affected by this condition.

Component Segment Analysis

The therapeutic segment in home healthcare market is projected to hold the highest influencing segment under the component of home healthcare industry devices. The reason behind this impact is projected by the increase in several conditions, such as respiratory problems, sleep issues, and renal diseases.

According to the European Commission, about 6.7% of all deaths were credited to respiratory systems in 2020. This is a reason behind the increasing awareness regarding healthcare and the usage of several devices such as defibrillators, ventricular assist systems, infusion pumps, pacemakers, and many more.

According to the National Institutes of Health report for 2021, from 2012 to 2018, there has been an increase in public awareness regarding the knowledge of how to use automated external defibrillators (AED), which grew from 4.7% to 20.8%.

Our in-depth analysis of the global market includes the following segments:

|

Indication |

|

|

Product |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Home Healthcare Market Regional Analysis:

North American Market Insights

North America industry is likely to dominate majority revenue share of 43% by 2035. The landscape's substantial growth in the region is expected credited to the surge in chronic illness, and neurology devices, coupled with the geriatric population in this region. According to a report by the Centers for Disease Control and Prevention 2020, more than 51.8% of US adults suffer from 1 chronic condition, and more than 27% are predicted to have multiple chronic conditions.

An increase in healthcare spending in the United States would act as a key growth driver for this market. According to the American Medical Association 2024, U.S. health spending increased by 4% in 2022.

More than 10% of Canadians suffer from neurological disorders, according to a report by the National Institutes of Health 2020, based on Canada’s National Population Health Study about neurological conditions.

APAC Market Insights

The Asia Pacific region will also encounter a huge influence on the home healthcare market demand during the forecast period and will account for the second position attributed to the increasing aging population. According to the Census 2022, the older population in APAC is expected to be about 20% higher than the total population of the U.S. population.

The growing demand for better medical devices in China is slated to increase. According to a report, China’s medical devices industry is expected to set a share of about USD 36 billion in 2024.

In Japan there is an increase in healthcare expenditures which will increase the market size expansion of the home healthcare sector. According to the Organization for Economic Cooperation and Development (OECD) 2021, there was an increase of about 5.8% of Japan’s GDP is used for health expenditure.

Home Healthcare Market Players:

- Amedisys

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Abbott

- Addus Homecare

- Brookdale Senior Living Solutions

- Genesis Healthcare, Inc.

- Extendicare, Inc.

- Diversicare Healthcare Services, Inc.

- Home Instead, Inc.

- Atria Senior Living, Inc

- Intersurgical Ltd.

The home healthcare market is predicted that the top five companies would occupy about 20%. Most of these companies are continuously collaborating, expanding, making agreements, and joining ventures for the growth of this revenue share and are estimated to be the major key players in this landscape.

Recent Developments

- Amedisys- collaborated with Optum, which has specialized in providing several health services. Amedisys provides top-notch personalized home health services along with home care services and has performed more than 11 million annual visits to patient homes.

- Abbott- announced that the U.S. Food and Drug Administration (FDA) has approved the expansion of the indication for the company's CardioMEMS HF System for supporting the care of several people suffering from heart failure.

- Report ID: 6138

- Published Date: Sep 17, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Home Healthcare Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.