ECG Equipment and Management Systems Market Outlook:

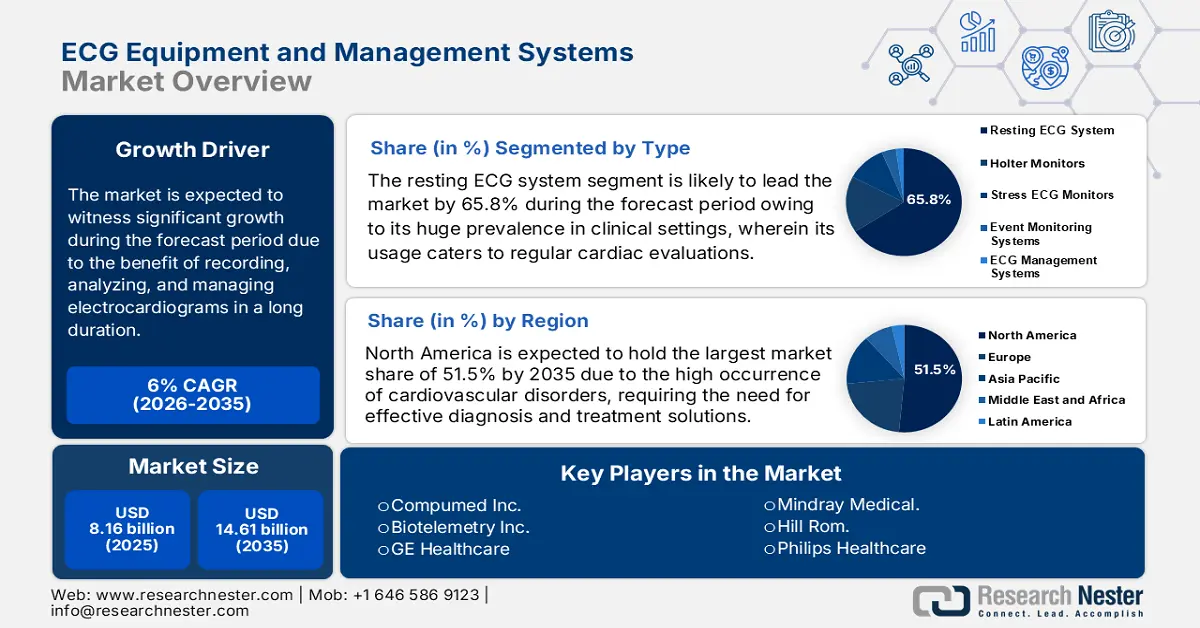

ECG Equipment and Management Systems Market size was over USD 8.16 billion in 2025 and is poised to exceed USD 14.61 billion by 2035, witnessing over 6% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of ECG equipment and management systems is estimated at USD 8.6 billion.

The utilization of ECG equipment and management systems is highly attributed to the upsurge in the worldwide aging population and risks associated with lifestyle choices. According to the October 2024 WHO report, the proportion of the global population of over 60 years of age will almost double from 12% in 2015 to 22% in 2050. Therefore, with the increase in this particular category of population, it is expected that heart diseases will also increase in the upcoming years. For instance, as per the October 2024 CDC report, almost 805,000 people in the U.S. suffer from heart attacks, thereby increasing the need for and upliftment of the market nationwide.

The ECG equipment and management systems market demand effectively depends upon the provision of video displays which play a major role in monitoring the heart, especially in the form of a wavelength that includes heart rhythm, rate, and other parameters. Therefore, there is a huge demand for these devices globally due to which there is continuous export and import internationally. According to the 2023 OEC report, the global trading valuation of video displays is USD 70.8 billion with China as the top exporter at USD 22.4 billion and the United States as the top importer at USD 17.3 billion. Additionally, the product's complexity is 0.1, and is the 54th most traded product across nations, thereby driving market expansion.

Country-wise Visual Displays Export/Import

|

Countries |

Export |

Import |

|

Mexico |

USD 12.7 billion |

USD 2.8 billion |

|

Vietnam |

USD 4.6 billion |

- |

|

Poland |

USD 3.8 billion |

- |

|

Slovakia |

USD 2.9 billion |

- |

|

Germany |

- |

USD 3.4 billion |

|

United Kingdom |

- |

USD 3.2 billion |

|

France |

- |

USD 2.8 billion |

Source: OEC 2023

Key ECG Equipment and Management Systems Market Insights Summary:

Regional Highlights:

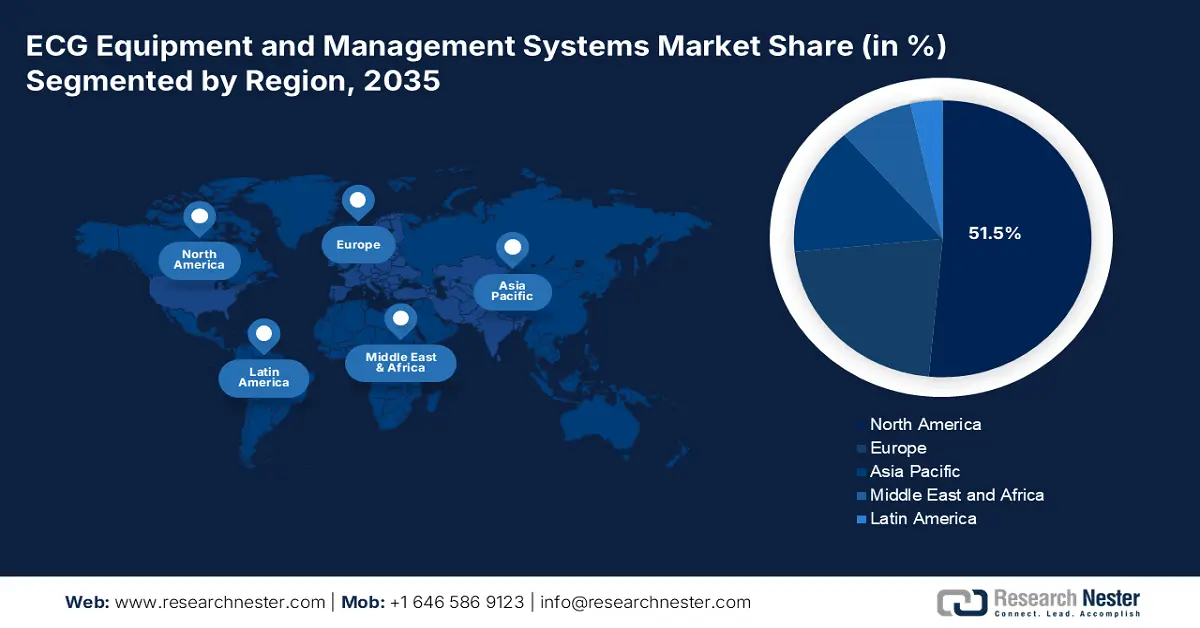

- North America leads the ECG Equipment and Management Systems Market with a 51.5% share, propelled by the high frequency of cardiac failure and increasing demand for ECG systems, sustaining growth through 2026–2035.

- Asia Pacific's ECG Equipment and Management Systems Market is projected to grow rapidly from 2026–2035, fueled by aging population and increased cardiovascular risks in the region.

Segment Insights:

- The Resting ECG System segment is projected to capture 65.8% market share by 2035, fueled by new product launches such as CE-marked home use resting ECG systems.

Key Growth Trends:

- Expansion in medical expenditure

- Rising incidence of cardiovascular disease

Major Challenges:

- Prevalence of cybersecurity issues

- Strict regulatory compliance

- Key Players: Biotelemetry Inc., GE Healthcare, Mindray Medical, Hill Rom, Philips Healthcare.

Global ECG Equipment and Management Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 8.16 billion

- 2026 Market Size: USD 8.6 billion

- Projected Market Size: USD 14.61 billion by 2035

- Growth Forecasts: 6% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (51.5% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Japan, Germany, United Kingdom

- Emerging Countries: China, India, Japan, South Korea, Singapore

Last updated on : 12 August, 2025

ECG Equipment and Management Systems Market Growth Drivers and Challenges:

Growth Drivers

- Expansion in medical expenditure: There is the provision of increased spending by both public and private industries to elevate the infrastructure of the healthcare sector globally, thus a driving factor for the ECG equipment and management systems market. For instance, as per the October 2024 CMS report, the national health expenditure (NHE) in the U.S. grew by 7.5%, expanding to USD 4.9 trillion in 2023, accounting for 17.6% of the gross domestic product (GDP). This increased expenditure inspires the adoption of innovative technologies that progress patient care and diagnostic accurateness such as AI-driven ECG analysis, wireless monitoring systems, and portable ECG devices.

- Rising incidence of cardiovascular disease: An effective and most prominent factor for the expansion of the ECG equipment and management systems market is the upsurged occurrence of cardiovascular disorders. According to the 2025 WHO report, approximately 17.9 million deaths take place every year due to this illness, especially targeting the age group of over 70 years internationally. With cardiovascular disorders becoming progressively common worldwide, there is a cumulative necessity for urbane ECG equipment and management systems. These contribute to patient results and efficient early diagnosis, monitoring, and treatment of diverse cardiac complications.

Challenges

- Prevalence of cybersecurity issues: ECG equipment and management systems possess the ability to collect and store sensitive data of patients. Illegal access or fissures may disclose private health evidence, trespassing patient confidentiality and raising the possibility of individuality theft or other despicable behavior. The ECG equipment and management systems market is connected to superior hospitals and healthcare systems. Besides, cybercrime can compromise not only the ECG systems but also additional related medical devices and patient records if these systems are not adequately protected.

- Strict regulatory compliance: The presence of stringent policies to keep control regarding the functionality of ECG systems usually results in delayed time when it comes to approvals. Due to this, the latest management systems launched by organizations face hindrances regarding their entry into the market. At present, the incidences of heart disorders have increased rapidly and it has become a top priority for healthcare providers to combat this condition. But, with delayed regulatory structures, there is a huge gap in the provision of evaluation, thereby restraining the growth of the ECG equipment and management systems market globally.

ECG Equipment and Management Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

6% |

|

Base Year Market Size (2025) |

USD 8.16 billion |

|

Forecast Year Market Size (2035) |

USD 14.61 billion |

|

Regional Scope |

|

ECG Equipment and Management Systems Market Segmentation:

Type (Resting ECG System, Holter Monitors, Stress ECG Monitors, Event Monitoring Systems, ECG Management Systems)

In ECG equipment and management systems market, resting ECG system segment is poised to capture revenue share of over 65.8% by 2035. These devices are useful for capturing the heart's electrical motion when the patient is at rest, ensuring vital insights into heart health, and pointing out any anomalies. In June 2020, QT Medical received the CE Mark for home use 12-lead ECG. In addition, the organization has also received ISO 13485:2016 certification as a manufacturer of high-quality medical devices by conforming to strict guidelines and high-standard QMS practices. Therefore, the launch of such products is highly driving the segment's growth globally.

End Use (Hospitals & Clinics, Ambulatory Facilities)

Based on end use, the hospitals & clinics segment in the ECG equipment and management systems market is projected to grow at a considerable rate during the forecast period. The segment plays a pivotal role in the uptake and application of ECG systems and devices for cardiovascular disease diagnosis, treatment, and patient monitoring. According to an article published in August 2024, the Mayo Clinic provides minimally invasive surgery for the heart valve, placement of ventricular assist device, and the replacement of transcatheter aortic valve. These treatments are possible with the availability of expert surgeons, cardiologists, and other health professionals, thus uplifting the segment.

Our in-depth analysis of the global ECG equipment and management systems market includes the following segments:

|

Type |

|

|

End Use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

ECG Equipment and Management Systems Market Regional Analysis:

North America Market Analysis

In ECG equipment and management systems market, North America’s region is predicted to hold more than 51.5% revenue share by 2035. The high frequency of cardiac failure in the region has prompted the increasing demand for effective diagnosis and treatment which is possible with the utilization of ECG equipment. In addition, the increasing need for ECG management systems caters to the incorporation of ECG systems with EHRs for more effective data management and improved patient outcomes, thus uplifting the market within the region.

The ECG equipment and management systems market in the U.S. is positively gaining more exposure based on the availability of administrative organizations to provide approval and clearance of newly launched ECG technologies. For instance, in December 2024, HeartBeam, Inc. received the U.S. FDA approval and the 510(k) clearance of the HeartBeam system for complete arrhythmia evaluation. Besides, with its original design, the HeartBeam device is the first of its kind to receive FDA clearance, and owing to its highly reliable ECG system with a credit card-sized form factor and cable-free design, it records heart signals from three separate directions for heart health information.

The ECG equipment and management systems market in Canada is witnessing growth owing to the provision of investment by the government to implement digital tools and online medical services. In May 2022, the Government of Canada funded USD 5 million to support a new national research network that will emphasize refining the prevention, diagnosis, treatment, and care of heart failure across the country. Simultaneously, as per the 2023 pre-budget consultation published by the Canada Cardiovascular Society, there was the provision of USD 700,000 per year for more than 5 years by the federal government to ensure appropriate treatment facilities for patients, thus driving market demand.

APAC Market Statistics

The Asia Pacific ECG equipment and management systems market is registered to be the fastest-growing region during the forecast timeline. Factors such as modified lifestyles, an aging population, and a surge in risks associated with rare disorders are effectively driving the market growth in the region. As per the January 2020 article published by NLM, the elderly population in the region over 65 years of age is poised to increase from 7.4% to 10.9% by 2030. Additionally, over 54% of the global population resides in the region which constitutes an increased risk of heart failure. Therefore, there is a huge demand for ECG equipment and management systems in this region.

The ECG equipment and management systems market in India is subjected to enhancement owing to the presence of both single-channel machines as well as advanced 12-channel systems, launched by manufacturers. Additionally, international organizations are initiating the establishment of manufacturing facilities in the country to drive market demand. For instance, in April 2022, Wipro GE Healthcare proclaimed the launch of its latest manufacturing facility in Bengaluru, India, under the government’s Production Linked Incentive (PLI) Scheme. This new plant is associated with the National Agenda of Atmanirbhar Bharat to boost local manufacturing of medical devices and systems in India, thereby amplifying the market.

The ECG equipment and management systems market in China is undergoing growth, driven by increasing demand for home healthcare, telemedicine, and cardiovascular care. According to the October 2022 article published by the International Journal of Medical Informatics, 74.05 of healthcare professionals preferred the implementation of telemedicine at least once a week, and even recommended it to their patients. Therefore, this ensures remote patient monitoring, especially the ones with cardiac disorders, which is effectively driving the demand for wireless ECG systems in the country.

Key ECG Equipment and Management Systems Market Players:

- Compumed Inc.

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Biotelemetry Inc.

- GE Healthcare.

- Mindray Medical.

- Hill Rom.

- Philips Healthcare

- Schiller AG.

- Spacelabs Healthcare

- DocGo Inc.

- SHL Telemedicine

- AliveCor

- Mecsia

Key companies are converging on enhancing their customer base to achieve a modest edge in the ECG equipment and management systems market. Therefore, organizations are taking numerous tactical initiatives such as mergers and acquisitions, and partnerships with other major companies. For instance, in November 2024, Mecsia announced the acquisition of Glasgow and Warrington-based ECG Facilities Services, a trusted partner in facilities and technical services management.

The purpose of this planned acquisition will further strengthen Mecsia’s growth trajectory, enhance its regional capabilities, and expand its service offerings to clients across the UK. In addition, the acquisition of ECG fortifies Mecsia’s position as a nationwide technical services provider and enlarges the group to 1,200 people with a combined turnover of £200 million (USD 258.3 million. Therefore, with such a development, the market is constituted to expand across all nations with the objective to aid heart diseases.

Here's the list of some key players in ECG equipment and management systems:

Recent Developments

- In December 2024, DocGo Inc. announced an extended partnership with SHL Telemedicine to integrate the SmartHeart transportable 12-lead ECG device across DocGo mobile healthcare units.

- In June 2024, AliveCor stated the U.S. FDA clearance and commercial launch of KAI 12L AI technology and the Kardia 12L ECG system. These are the world’s first AI that can detect life-threatening cardiac conditions, including heart attacks, using a reduced leadset.

- Report ID: 7423

- Published Date: Aug 12, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

ECG Equipment and Management Systems Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.