Hoist and Elevator Motors Market Outlook:

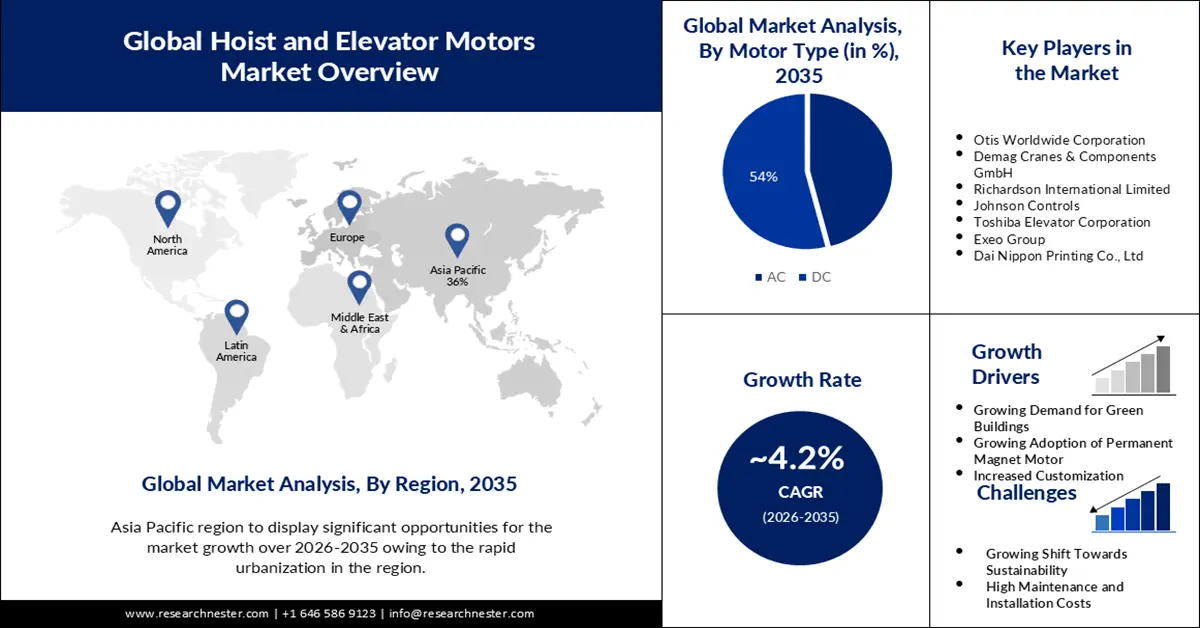

Hoist and Elevator Motors Market size was over USD 103.3 billion in 2025 and is anticipated to cross USD 155.88 billion by 2035, growing at more than 4.2% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hoist and elevator motors is assessed at USD 107.2 billion.

The need for hoist and elevator motors that work with cutting-edge elevator systems is being driven by the emergence of smart buildings and the Internet of Things (IoT). The IoT-enabled smart buildings were predicted to generate 44.81 billion dollars in sales by 2020. Elevators can now operate faster, safer, more energy-efficient, and with more control and security due to these motors. Elevator motor manufacturers are extensively investing in the development of improved safety features to minimize accidents and boost the reliability of passenger elevator motors. Smart elevators are becoming more and more common in contemporary structures because they provide improved dependability, comfort, and energy economy. These elevators make use of advanced data analytics, sensors, and motor control technologies.

Furthermore, vertical transit options including moving walkways, escalators, and elevators are in greater demand as urbanization grows. The need for hoist and elevator motors that can manage large loads, run smoothly and silently, and have cutting-edge safety features is being driven by this trend. Also, these hoists are frequently used in the industrial, material handling, and construction industries because of their superior mechanical performance and ability to precisely raise large weights.

Key Hoist and Elevator Motors Market Insights Summary:

Regional Highlights:

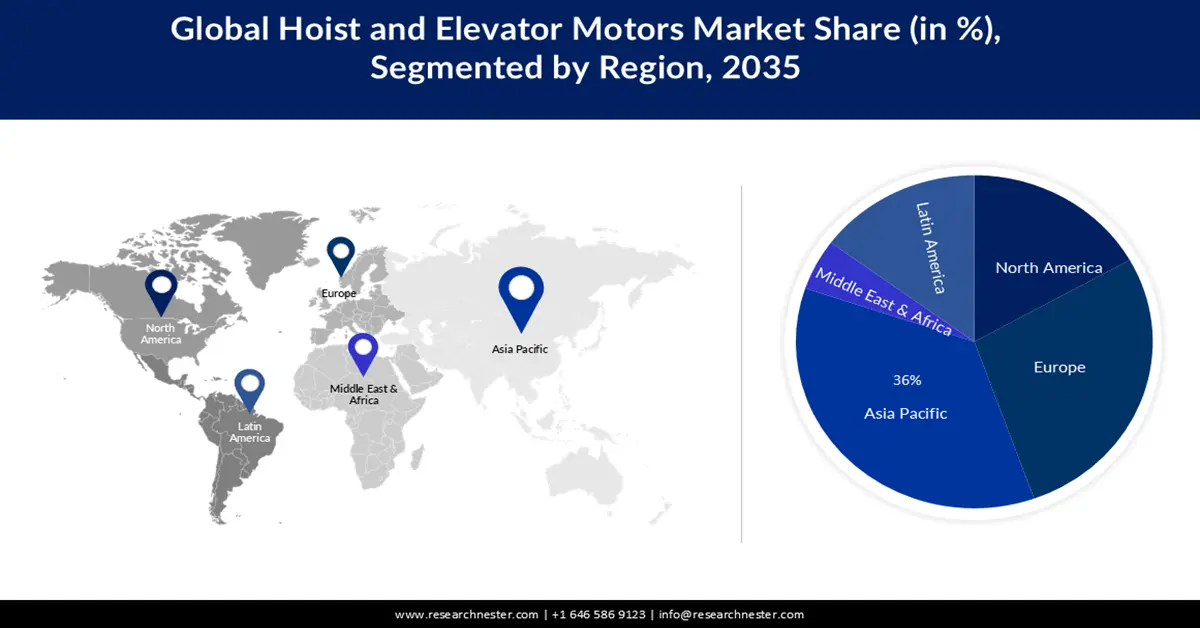

- By 2035, the Asia Pacific region is anticipated to command a 36% share of the hoist and elevator motors market, supported by rapid urbanization and rising construction activities.

- Europe is projected to secure a 28% share by 2035, bolstered by accelerating demand for energy-efficient elevator system upgrades.

Segment Insights:

- By 2035, the PMDC motors segment in the hoist and elevator motors market is expected to capture a 45% share, propelled by the increasing use of power tools.

- The residential segment is set to attain a 43% share by 2035, underpinned by the expanding installation of elevators across high-density housing developments.

Key Growth Trends:

- Growing Demand for Green Buildings

- Increasing Adoption of Permanent Magnet Motors

Major Challenges:

- Growing Shift Towards Sustainability

- Higher Installation and Maintenance Costs may Hinder the Growth of the Market

Key Players: ABB Corporation, Otis Worldwide Corporation, Demag Cranes & Components GmbH, Richardson International Limited, Johnson Controls, Toshiba Elevator Corporation, Exeo Group, Dai Nippon Printing Co., Ltd, Hitachi Co. Ltd., Panasonic Corporation.

Global Hoist and Elevator Motors Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 103.3 billion

- 2026 Market Size: USD 107.2 billion

- Projected Market Size: USD 155.88 billion by 2035

- Growth Forecasts: 4.2%

Key Regional Dynamics:

- Largest Region: Asia Pacific (36% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, South Korea

- Emerging Countries: India, Brazil, Mexico, Indonesia, United Arab Emirates

Last updated on : 27 November, 2025

Hoist and Elevator Motors Market - Growth Drivers and Challenges

Growth Drivers

-

Growing Demand for Green Buildings - There is a growing need for green buildings that use energy-efficient technologies, such as elevators and hoist motors, as awareness of the effects of climate change rises. Manufacturers who can provide motors with lower emissions and energy consumption will be in a good position to profit from this trend. The need for elevator motors is growing quickly in developing countries like India, China, and Southeast Asia because of the surge in infrastructure development, urbanization, and demand for high-power elevator motors in both residential and commercial buildings. In addition, makers of elevator motors are seeing profitable opportunities in the hoist and elevator motors market due to the growing need for modernization and repair of antiquated lift systems.

-

Increasing Adoption of Permanent Magnet Motors - In the market for hoist and elevator motors, permanent magnet motors are becoming more and more popular because of their great efficiency, small size, and low maintenance needs. Consequently, producers are adding more and more of these motors to their range of products. The strongest traction motor type that is currently offered for sale is the permanent magnet motor. As a result, permanent magnet motor adoption is anticipated to rise across a range of industries due to the growing need for motors with improved operating efficiency. Furthermore, these motors are being considered for usage in HVAC systems by the commercial and residential sectors. As per a report, by 2025, the HVAC sector is predicted to expand by 11.6% with annual increases in global temperatures.

- Increase in Customization and Personalization - Customization and personalization are becoming more and more important in the hoist and elevator motors market, as manufacturers provide a greater array of features and alternatives to cater to the individual requirements of their clients. For instance, geared traction motors are frequently tailored to meet the unique load and speed specifications of a building. These motors are made to move elevators smoothly and effectively. Recently, Siemens has been consolidating its operations in the domains of medium-voltage converters, motor spindles, geared motors, and low-to-high voltage motors under this moniker. The portfolio comprises a wide range of service products in addition to creative solutions and digitization.

Challenges

-

Growing Shift Towards Sustainability – The growing need for ecologically friendly and energy-efficient technologies is one of the main obstacles. Manufacturers must create motors with lower energy consumption and lower carbon emissions as consumer attitudes and legislation move towards sustainability. Therefore, this factor may hinder the growth of the hoist and elevator motors market.

-

Higher Installation and Maintenance Costs may Hinder the Growth of the Market

- Stringent Regulations and Compliance Standards in the Construction and Elevator Industries may Hamper the Market Growth

Hoist and Elevator Motors Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Year |

2026-2035 |

|

CAGR |

4.2% |

|

Base Year Market Size (2025) |

USD 103.3 billion |

|

Forecast Year Market Size (2035) |

USD 155.88 billion |

|

Regional Scope |

|

Hoist and Elevator Motors Market Segmentation:

Motor Type Segment Analysis

Hoist and elevator motors market for PMDC motors is expected to hold a share of 45% by the end of 2035. In the industry, permanent DC motors have gained popularity ever since induction motors were phased out. DC motors have a few benefits, including their small size, convenience of use, and self-contained operation. PMDC motors have a small form factor, great efficiency, and significant power and torque output. Because they are widely utilized in many different applications, they may also be interfaced with batteries with ease. Also, they are helpful in many new sectors and applications, like power tools because of their tiny size and battery-operated nature. Therefore, the growing use of power tools will also accelerate the growth of the hoist and elevator motors market. For instance, worldwide, more than 271 million commercial power tool units were consumed in 2020. It was predicted that the numbers will continue to rise, surpassing 384.6 million units by 2027. PMDC motors are utilized in many different parts of cars, such as windows and blowers for air conditioning and heating systems, as well as in personal computer drives and discs.

End-use Segment Analysis

Hoist and Elevator motors market for residential segment is poised to hold a share of 43% by the end of 2035. Residential complexes and structures are in greater demand, particularly in metropolitan locations where space is at a premium. Vertical dwelling options, such as apartment complexes and high-rise buildings, are growing increasingly popular as cities get denser with population. Convenience and accessibility are also becoming increasingly important in residential settings. Residents can move between levels easily and effectively with the help of elevators, especially if they are carrying large or awkward objects. Due to the rising construction of elevators in residential structures, there is a greater need for elevator motors and hoists. Technological developments have also reduced the cost and simplified the installation of elevators and hoists in residential situations. As a result, these factors are contributing to the growth of the residential segment.

Our in-depth analysis of the global hoist and elevator motors market includes the following segments:

|

Motor Type |

|

|

Output Power |

|

|

End-use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hoist and Elevator Motors Market - Regional Analysis

APAC Market Insights

Hoist and elevator motors market in Asia Pacific is poised to hold a share of 36% during the forecast period. The growth can be attributed to the rapid urbanization and a rise in building & construction activities in the region. Moreover, the surge in demand for high-rise buildings, an increase in the adoption of advanced technologies, and a rise in demand for energy-efficient elevator systems are contributing to the growth of the hoist and elevator motors market. In addition, nations like China, India, and Japan have experienced significant economic expansion, raising their standards of life and creating more discretionary income. The promotion of the use of elevators and hoists is also greatly aided by local infrastructure development projects and government efforts. These programs seek to promote sustainable development, increase accessibility, and improve urban mobility, which will benefit the hospitality and elevator motor industries.

European Market Insights

European hoist and elevator motors market is expected to hold a share of 28% during the projected period. Europe has a significant number of aging buildings that require modernization and renovation. As per a report, from 2021 to 2026, the building rehabilitation in Europe is anticipated to expand by 55.6 billion U.S. Dollars. As a result, there is a growing demand for elevator installations and upgrades to improve accessibility and comply with safety regulations. Also, the European Union has implemented directives and regulations that promote energy efficiency and sustainability in buildings. This has led to an increased focus on energy-efficient elevator systems, driving the demand for hoist and elevator motors in the region.

Hoist and Elevator Motors Market Players:

- ABB Corporation

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Otis Worldwide Corporation

- Demag Cranes & Components GmbH

- Richardson International Limited

- Johnson Controls

Recent Developments

- ABB announced the release of ABB AbilityTM NGX Hoist Control, a worldwide control system that maximizes hoist operations' performance and safety for mining businesses. Expanding upon ABB's dependable and validated previous iterations of hoist control systems, it offers smaller businesses unprecedented levels of dependability, adaptability, and user-friendliness for new or renovated projects. By standardizing control systems, it can also assist larger businesses in cutting expenses and increasing efficiency.

- Otis Worldwide Corporation (NYSE: OTIS) announced at the 6th China International Import Expo (CIIE) the launch of the 515NPE public escalator and its next-generation smart elevator system, the Otis Gen360TM digital elevator. The goal of both products is to improve the traveler experience by making urban travel safer and more seamless.

- Report ID: 5579

- Published Date: Nov 27, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hoist and Elevator Motors Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.