Hipot Tester Market Outlook:

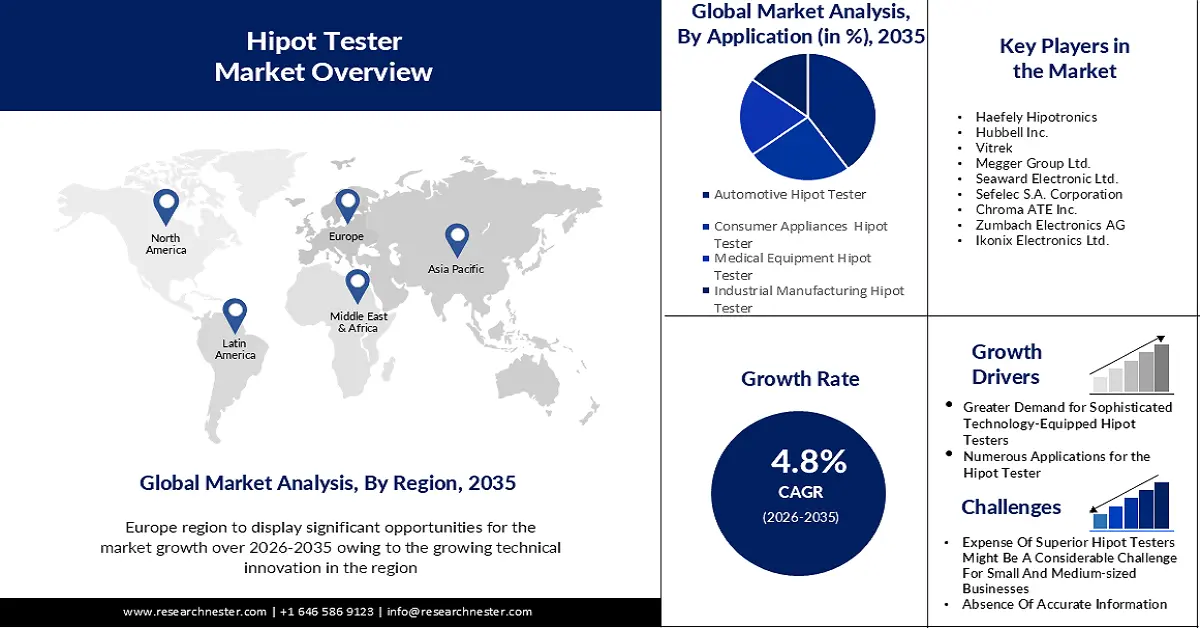

Hipot Tester Market size was over USD 94.49 million in 2025 and is poised to exceed USD 151.01 million by 2035, growing at over 4.8% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of hipot tester is estimated at USD 98.57 million.

The market is expanding due to the increased need for safety in the automotive and laboratory production sectors. Hipot tester has a broad range of applications, which is driving up demand for the product globally. In 2021, there was a 3% year-over-year growth in the production of motor cars, with around 80 million vehicles produced worldwide.

In addition to these, there is a growing need for precise and effective testing equipment as enterprises automate more of their operations. Advanced features like remote control and automated test sequences are becoming more and more common in hotpot testers. Businesses that have automated at least one process do so in roughly 66% of cases. While 50% of firms expect to automate all repetitive processes, the remaining 80% are planning to accelerate process automation

Key Hipot Tester Market Insights Summary:

Regional Highlights:

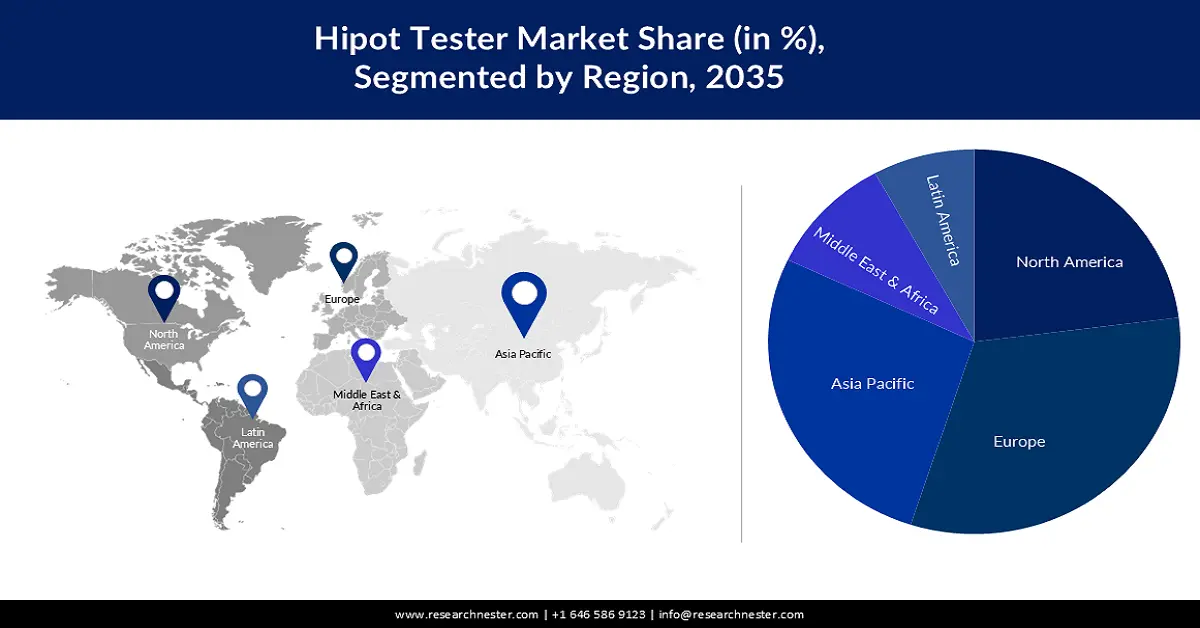

- Europe hipot tester market will secure over 32% share by 2035, driven by increased use of underground high-voltage power cables.

- Asia Pacific market will achieve a 27% share by 2035, attributed to infrastructure expansion in China and India requiring high transmission voltage.

Segment Insights:

- The dc hipot tester segment in the hipot tester market is projected to attain a 55% share by 2035, fueled by advantages like non-destructive testing and energy savings.

- The automotive hipot tester segment in the hipot tester market is projected to hold a 40% share by 2035, driven by increased demand for automotive products and regulatory safety standards.

Key Growth Trends:

- Government Spending on Hipot Testing and Other Safety Gear Has Increased

- Greater Demand for Sophisticated Technology-Equipped Hipot Testers

Major Challenges:

- High Initial Investments

Key Players: Haefely Hipotronics, Hubbell Inc., Vitrek, Megger Group Ltd., Seaward Electronic Ltd., Sefelec S.A. Corporation, Chroma ATE Inc., Zumbach Electronics AG, Ikonix Electronics Ltd..

Global Hipot Tester Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 94.49 million

- 2026 Market Size: USD 98.57 million

- Projected Market Size: USD 151.01 million by 2035

- Growth Forecasts: 4.8% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: Europe (32% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, China, Germany, Japan, United Kingdom

- Emerging Countries: China, India, South Korea, Brazil, Mexico

Last updated on : 16 September, 2025

Hipot Tester Market Growth Drivers and Challenges:

Growth Drivers

-

Government Spending on Hipot Testing and Other Safety Gear Has Increased- The government's growing investments in Hipot testers and safety devices, together with the growing cooperation between Hipot tester producers and laboratories and industries, are driving the growth of the market. The market for hipot testers is also being significantly impacted by the increased concern over electrical safety equipment. The most important safety test is the Hipot test, which, when passed, typically protects users against electrical hazards when using a product in daily life. All design and production terminals can now fulfill safety standards after passing a comprehensive Hipot test. The hipot tester market is mostly driven by rising government financing and investments, as well as industry and electronic device preventative measures. In 2020, there were 126 fatalities related to exposure to electricity, however, during the previous ten years, the number of fatalities had remained flat at 150. Exposure to electricity fatalities has dropped from 8% in 1980 to 3% in 2020 as a percentage of all workplace fatalities.

-

Numerous Applications for the Hipot Tester- Hipot Testers are used in many different applications. They are used to verify that safety circuits in wire harnesses and custom cable assemblies are functioning properly and to make sure that manufactured appliances, transformers, PCBs, and electric motors have enough electrical insulation. The market is expanding as a result of this.

-

Greater Demand for Sophisticated Technology-Equipped Hipot Testers- One of the main factors propelling market expansion is the increasing demand for technologically sophisticated Hipot tester systems for better tester performance. To obtain more accurate results, devices must perform better during testing. As a result, there is a growing need for sophisticated technological Hipot testers. This element is a significant market driver as well. The market requires advancements such as a more compact form, ease of use, and an affordable instrument at a reasonable price. Any business entering the hipot tester market with a product meeting this standard will have more room to grow.

Challenges

-

High Initial Investments- The expense of superior hipot testers might be a considerable challenge for small and medium-sized businesses or organizations with constrained financial resources. Some firms could be discouraged from adopting advanced testers due to the initial investments necessary.

-

Many producers don't realize how important safety is. The primary factor impeding the market is the absence of accurate information regarding the significance of Hipot testing.

-

Preparing the Hipot Tester with more accuracy for minor leaks is becoming a major challenge for the hipot tester market, as some testers are less accurate in identifying leaks.

Hipot Tester Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

4.8% |

|

Base Year Market Size (2025) |

USD 94.49 million |

|

Forecast Year Market Size (2035) |

USD 151.01 million |

|

Regional Scope |

|

Hipot Tester Market Segmentation:

Application Segment Analysis

Based on application, the automotive hipot tester market is attributed to hold the largest revenue share of about 40% during the forecast period. The factors contributing to the growth of this market sector are the rise in demand for automotive products, as well as regulations and safety standards. The requirement from several independent and official product clearance bodies for this test to be conducted and for records to be kept for each product design and production has led to an increase in the industrial manufacturing market. Ground bond testing, dielectric breakdown, leakage current, and insulation resistance are critical components of electrical safety testing for medical equipment. The medical equipment hipot tester segment of the Market has grown as a result of these causes. In 2022, the car manufacturing sector brought in about 2.52 trillion dollars in sales.

Product Type Segment Analysis

The DC hipot tester market is expected to hold the largest revenue share of about 55% during the forecast period. A DC hipot tester can typically be used in place of an AC hipot tester. Compared to an AC hipot tester, a DC hipot tester has an advantage. Even with the high test voltage, there isn't much energy that can be released as an arc. Arcs from a properly executed DC Hipot test are therefore non-destructive. It is possible to do the test at a much lower current level, saving energy and reducing the risk to the test operator. The DC Hipot tester is the sole option for some circuit components, such as diodes and capacitors with greater capacitance values.

Our in-depth analysis of the global hipot tester market includes the following segments:

|

Type |

|

|

Product Type |

|

|

Application |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

Hipot Tester Market Regional Analysis:

European Market Insights

Hipot tester market in the Europe region is anticipated to hold the largest market share of about 32% during the forecast period. Growing technical innovation is fueling market expansion in Europe. Subterranean electrical cable lines with a voltage rating of at least 220 KV are now the mainstay of Europe's power transmission network. In contrast to overhead transmission lines, connectivity, and reliability should improve as high-voltage cables buried beneath Europe replace the current overhead lines.

APAC Market Insights

Hipot tester market in the Asia Pacific region is attributed to holding the second largest market share with about 27% during the forecast period. The growth of the market in this region is owing to the presence of two developing economies, China and India, which will back the call for higher transmission voltage to improve capacity. The most attractive market is Asia-Pacific, where there is a constant demand for Hipot tester equipment. Throughout the projection period, China and India are probably going to be the market leaders in the Asia-Pacific region.

Hipot Tester Market Players:

- B2 Electronics

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- Haefely Hipotronics

- Hubbell Inc.

- Vitrek

- Megger Group Ltd.

- Seaward Electronic Ltd.

- Sefelec S.A. Corporation

- Chroma ATE Inc.

- Zumbach Electronics AG

- Ikonix Electronics Ltd.

Recent Developments

- January 2024: The IoT and AI Chip Test Solutions Featured by Chroma ATE Meet the Growing Need for Edge Computing. High-performance computing is becoming more and more in demand as generative AI gains traction. This further increases the need for edge system parts and associated applications, all of which have strict testing specifications. A leading company in the power test and measurement sector, Chroma ATE has established itself in the increasingly important field of semiconductor component testing. In response to the ever-increasing testing requirements of both local and foreign clients, Chroma recently held the Chroma ATE Semiconductor Test Seminar in Hsinchu, Taiwan, one of the leading tech hubs in Asia.

- January 2018: Brewster, New York. The 100-kV HVT-DI Series AC hipot testers, which the company describes as the contemporary digital solution to AC field-testing of bucket trucks, aerial platforms, vacuum interrupters, breakers, switchgear, and other electrical apparatus, have been released by Haefely Hipotronics, a developer and provider of high-voltage test systems and measuring devices. Every model comes with a bonnet, a section for portable digital controls, an input line wire, connecting cables, and a ground lead.

- Report ID: 5634

- Published Date: Sep 16, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Hipot Tester Market Report Scope

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.