High Volume Dispensing Systems Market Outlook:

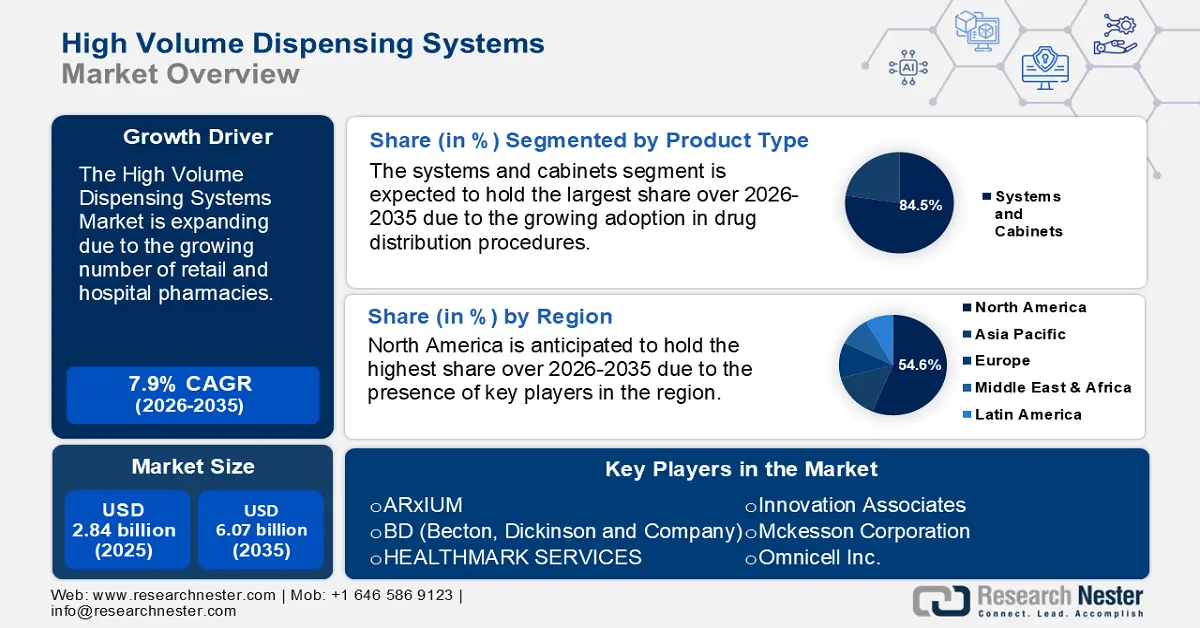

High Volume Dispensing Systems Market size was over USD 2.84 billion in 2025 and is poised to exceed USD 6.07 billion by 2035, witnessing over 7.9% CAGR during the forecast period i.e., between 2026-2035. In the year 2026, the industry size of high volume dispensing systems is estimated at USD 3.04 billion.

The high volume dispensing systems market is primarily driven by the surging number of retail and hospital pharmacies. The Journal of the American Pharmacies Association stated that in 2022 there were 61,715 pharmacies in the U.S. As new pharmacies open and established ones expand, the demand for efficient, high-capacity dispensing solutions grows. This demand directly responds to the population's growing healthcare needs, necessitating the adoption of cutting-edge dispensing technologies by more pharmacies.

Moreover, there is an increase in the elderly demographic that leads to higher incidences of chronic diseases, further necessitating efficient medication management. According to the World Health Organization (WHO) by 2030, one in every six people will be 60 or older. The proportion of the population aged 60 and up will rise from 1 billion in 2020 to 1.4 billion. By 2050, the global population of persons aged 60 and up will double (2.1 billion). The number of people aged 80 and older is anticipated to triple between 2020 and 2050, reaching 426 million. Also, the growing prevalence of conditions such as diabetes, hypertension, and cancer require streamlined dispensing processes to ensure adherence and accuracy.

Key High Volume Dispensing Systems Market Insights Summary:

Regional Highlights:

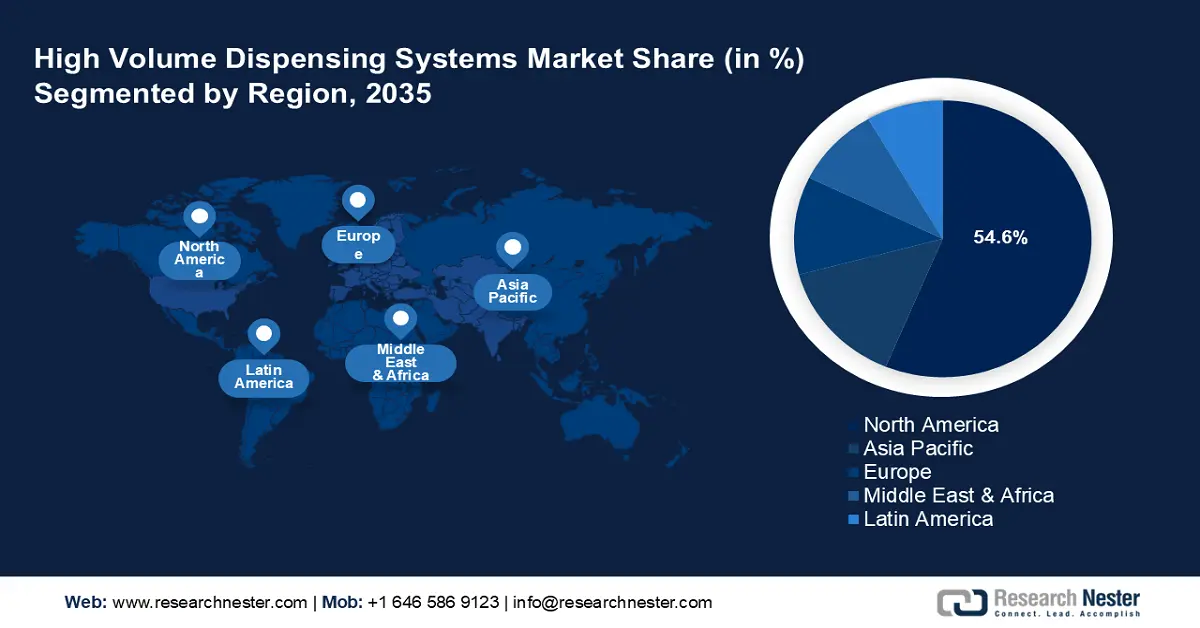

- North America holds a 54.6% share in the High Volume Dispensing Systems Market, driven by presence of major players and rapid technology improvements, solidifying its leadership through 2026–2035.

- The Asia Pacific high volume dispensing systems market is poised for huge growth by 2035, attributed to growing prescriptions and initiatives to upgrade healthcare systems.

Segment Insights:

- The Retail Pharmacy segment is projected to hold a notable 50% share of the High Volume Dispensing Systems Market by 2035, driven by high prescription volumes and efficient inventory management needs.

- The Systems and Cabinets segment is expected to achieve an 84.5% share by 2035, propelled by automation of drug dispensing and real-time inventory tracking benefits.

Key Growth Trends:

- Increased adoption of pharmacy automation systems and software

- Growing integration of advanced technologies

Major Challenges:

- Need for customization

- Need for regular maintenance

- Key Players: ARxIUM, BD (Becton, Dickinson and Company), HEALTHMARK SERVICES, Innovation Associates, Mckesson Corporation, Omnicell Inc., RxSafe, LLC, ScriptPro LLC, Swisslog Healthcare, Synapxe Pte Ltd.

Global High Volume Dispensing Systems Market Forecast and Regional Outlook:

Market Size & Growth Projections:

- 2025 Market Size: USD 2.84 billion

- 2026 Market Size: USD 3.04 billion

- Projected Market Size: USD 6.07 billion by 2035

- Growth Forecasts: 7.9% CAGR (2026-2035)

Key Regional Dynamics:

- Largest Region: North America (54.6% Share by 2035)

- Fastest Growing Region: Asia Pacific

- Dominating Countries: United States, Germany, Japan, United Kingdom, France

- Emerging Countries: China, India, Brazil, Mexico, Turkey

Last updated on : 14 August, 2025

High Volume Dispensing Systems Market Growth Drivers and Challenges:

Growth Drivers

- Increased adoption of pharmacy automation systems and software: Pharmacies can maintain minimum human interaction and real-time stock and inventory management with automated systems. While tracking stock is an essential aspect of pharmacy work, it may be a time-consuming and tiresome task. These days, pharmacies can assign this work to robotic systems and concentrate more on patient care by using automated inventory management systems. Also, there’s a growing shift towards AI and robotics for drug discovery, computer programs, and automated workflow systems, driving the market growth.

AI can be applied in retail pharmacy settings through partnerships in telemedicine, inventory management, and chatbots that simulate interactions between patients and pharmacists similarly in hospital pharmacies it is used for barcode scanning, automated drug tracking and dispensing, and injectable medicine preparation. The surging need for pharmaceutical drugs due to growing non-communicable diseases has led to an increase in the prevalence of pharmacy automation technology. The WHO stated that noncommunicable diseases (NCDs) account for 41 million annual deaths worldwide, or 74% of all fatalities. - Growing integration of advanced technologies: The use of sophisticated technology such as barcode scanning and Radio Frequency Identification (RFID) in these dispensing devices improves the accuracy and safety of drug distribution. By enabling thorough tracking and verification at each dispensing stage, these technologies greatly limit the possibility of errors, ensuring patients receive the correct prescriptions and dosages, hence boosting the sector's expansion.

- Surging government funding: Government often provides grants for R&D to foster innovation in dispensing technologies, encouraging companies to develop more efficient and advanced systems. Funding for infrastructure projects can drive demand for high volume dispensing systems.For instance, the Government of India launched the Pharmaceutical Technology Upgradation Assistance Scheme (PTUAS) to provide interest subvention to eligible Small and Medium scale pharma units with GMP-compliant manufacturing facilities. The aim is to upgrade their manufacturing and infrastructure technology. The government had allocated USD 1.71 billion for 2018-2020 to benefit SMEs.

Challenges

- Need for customization: The demand for customization to meet certain industrial requirements is one of the major challenges that may limit the widespread adoption of high volume dispensing systems Dispensing requirements vary per business, and creating specialized solutions might take a lot of time and resources. Furthermore, the elevated financial investment required to implement these technologies could discourage small and medium-sized businesses from adopting them, especially in regions with low financial resources or the absence of government backing for industrial automation.

- Need for regular maintenance: The adoption of high volume dispensing is hampered by the increased need for routine maintenance and service to maintain precise and dependable performance. These procedures are expensive and time-consuming, and they often result in downtime and decreased production.

High Volume Dispensing Systems Market Size and Forecast:

| Report Attribute | Details |

|---|---|

|

Base Year |

2025 |

|

Forecast Period |

2026-2035 |

|

CAGR |

7.9% |

|

Base Year Market Size (2025) |

USD 2.84 billion |

|

Forecast Year Market Size (2035) |

USD 6.07 billion |

|

Regional Scope |

|

High Volume Dispensing Systems Market Segmentation:

Product Type (Systems and Cabinets, Software)

The systems and cabinets segment will capture 84.5% high volume dispensing systems market share by 2035. Cabinets and high-volume dispensing systems are essential for improving the effectiveness of drug distribution procedures. By automating the processes of drug sorting, counting, and packaging, these systems significantly reduce the time and effort required for manual dispensing. This automation is useful in situations where pharmacies deal with loads of prescriptions daily.

These systems also have sophisticated inventory management features. They provide pharmacies with accurate inventory data to maximize their stock levels by tracking drug usage in real-time. Pharmacies can proactively manage their inventory and reduce the risk of stockouts and waste by using automated warnings for low inventory and approaching medicine expirations.

End use (Retail Pharmacy, Hospital Pharmacy, Long-term Care Pharmacy)

The retail pharmacy segment in the high volume dispensing systems market is poised to garner a notable share of 50% during the forecast period. Retail pharmacies prioritize accuracy and efficiency since they handle a large volume of prescriptions every day. High-volume dispensing systems reduce the time and labor typically required for manual dispensing by streamlining sorting, counting, and packaging. Retail pharmacies are better prepared to manage the flood of prescriptions due to this technology.

Furthermore, retail pharmacies must have efficient inventory management to prevent stockouts and surplus inventory. High-volume dispensing systems provide automated restocking, real-time inventory tracking, and alarms for running out of medication. These features ensure that necessary pharmaceuticals are always available and help pharmacies maintain ideal inventory levels by reducing waste.

Our in-depth analysis of the high volume dispensing systems market includes the following segments:

|

Product Type |

|

|

End use |

|

Vishnu Nair

Head - Global Business DevelopmentCustomize this report to your requirements — connect with our consultant for personalized insights and options.

High Volume Dispensing Systems Market Regional Analysis:

North America Market Statistics

High volume dispensing systems market in North America is anticipated to hold the largest share of 54.6% by the end of 2035. The market growth can be attributed to the presence of major players, established healthcare infrastructure, rapid technology improvements, and early adoption of such cabinets and software by hospitals and pharmacies in this region. Furthermore, the aging population and rising incidence of chronic illnesses also make it necessary to manage large prescription volumes efficiently, driving the market's expansion. For instance, in 2020, the number of elderly population reached 55.8 million, or 16.8% of the total population of the U.S.

The emphasis on patient safety and regulatory compliance within the U.S. healthcare system has led to an increased adoption of automated dispensing systems. These systems play a crucial role in ensuring accurate medication distribution, reducing medication errors, and improving overall patient care. Moreover, continuous technical innovation and a strong emphasis on enhancing pharmacy operations benefit the U.S. market.

The market growth is fueled by Canada’s well-established healthcare infrastructure and supportive government policies for healthcare automation and technological improvements. For instance, in July 2024, the government introduced the Connected Care for Canadians Act, Bill C-72. With the help of this Act, patients will be able to securely access their health data, empowering them to make better decisions and receive better care from Canadian healthcare providers.

APAC Market Analysis

Asia Pacific will encounter huge growth in the high volume dispensing systems market during the forecast period. The main drivers of the regional market expansion are the growing number of prescriptions, the rising number of licensed pharmacists, and ongoing initiatives to upgrade the healthcare system. In 2020, there were about 321,982 pharmacists in Japan. Medication inventory is expected to increase in the next years due to rising healthcare costs, an increase in the number of dispensing errors, and an increase in the burden of disease.

Furthermore, the Government of China’s emphasis on hospital bed counts reflects the country's growing healthcare system and the possibility of a rise in the use of high volume dispensing systems. The government implemented an ambitious plan, the National Plan of Health Care Service System (2015–2020), to improve the development of hospital bed supply, with a specific target of obtaining 6 hospital beds per 1000 population by 2020.

The need for effective systems and software to handle and dispense huge volumes of pharmaceutical inventory has increased in India due to the growth of retail and e-pharmacies. There were 50 e-pharmacies in India and industry estimates for 2019 have it at USD 0.5 billion, or two to three percent of all pharmacy sales in India. By 2025, the industry is projected to have grown at a compound annual growth rate of 44% to reach USD 4.5 billion.

Key High Volume Dispensing Systems Market Players:

- ARxIUM

- Company Overview

- Business Strategy

- Key Product Offerings

- Financial Performance

- Key Performance Indicators

- Risk Analysis

- Recent Development

- Regional Presence

- SWOT Analysis

- BD (Becton, Dickinson and Company)

- HEALTHMARK SERVICES

- Innovation Associates

- Mckesson Corporation

- Omnicell Inc.

- RxSafe, LLC

- ScriptPro LLC

- Swisslog Healthcare

- Synapxe Pte Ltd

Several well-established and up-and-coming companies in the high volume dispensing systems market provide a wide range of goods worldwide. Competing variables among market players include product quality, innovation, customer service, regulatory compliance, and price strategies.

Recent Developments

- In March 2024, a leading worldwide provider of medical technology, BD (Becton, Dickinson and Company), released findings from a study assessing the effects of automating dispensing cabinets and setting up an off-site long-term care pharmacy in assisted living facilities.

- In October 2023, Innovation Associates, a company that offers an integrated Pharmacy Fulfillment Platform for retail, health systems, and government pharmacies, launched two new advanced robotics systems that will expand the capabilities of its centralized fulfillment solutions and solutions tailored to pharmacies of various sizes.

- Report ID: 6554

- Published Date: Aug 14, 2025

- Report Format: PDF, PPT

- Explore a preview of key market trends and insights

- Review sample data tables and segment breakdowns

- Experience the quality of our visual data representations

- Evaluate our report structure and research methodology

- Get a glimpse of competitive landscape analysis

- Understand how regional forecasts are presented

- Assess the depth of company profiling and benchmarking

- Preview how actionable insights can support your strategy

Explore real data and analysis

Frequently Asked Questions (FAQ)

Free Sample includes current and historical market size, growth trends, regional charts & tables, company profiles, segment-wise forecasts, and more.

Connect with our Expert

Copyright @ 2026 Research Nester. All Rights Reserved.